DansDeals will receive compensation if you are approved for a credit card via a link in this post. Terms apply to American Express benefits and offers, visit americanexpress.com to learn more.

Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Update: This offer ends today, the offer is currently only for existing AMEX members with a personal or business credit card!

Open An AMEX Business Checking Account And Earn 60,000 Membership Rewards Points

If you open your first AMEX business checking account by 1/3/23, you’ll earn 60,000 AMEX points if you also:

- Deposit at least $5,000 into the account within 20 days of account opening.

- Maintain a balance of at least $5,000 in the account for 60 days, starting from the date that you initially have at least $5,000 in the account.

- Complete 10 transactions within 60 days of account opening, including mobile deposits, and electronic/online transactions, ACH, Wire, and Bill Payments made to or from your account.

You can share a login between your AMEX credit cards and your checking account, though it will force you to enable 2 factor authentication to login to your account.

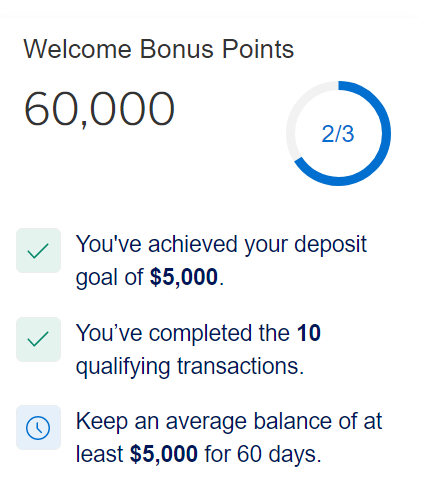

You can easily track your progress towards earning the bonus in your account dashboard. Funding the account with 10 ACH pulls from another bank counted to meet the 10 transaction requirement:

It’s worth noting that the system won’t allow 2 users to open up a business account for the same Tax-ID number, but you can open a business account under your social security number as a sole-proprietorship. I was instantly approved using a Tax-ID number and my wife was instantly approved as a sole-proprietor, though some people are being asked to send in proof of a business to open the account. You can try sending in your Driver’s License if you are asked to send in proof of your sole-proprietorship.

There are no monthly account fees, ACH fees, or incoming wire fees. You can withdraw month via ACH or via MoneyPass ATM with no fees.

You’ll only earn a 1.3% APY, but even with a 4% account, you would only earn about $32 on a $5,000 balance for 60 days, so earning 60,000 points is a no-brainer. 60K points is enough for $600 in flights. If you have an AMEX Business Gold Card those 60K points are good for $798 of flights and it you have an AMEX Business Platinum Card those 60K points are good for $924 of flights!

Will you signup for this checking account limited time offer?

![[Lawyer From Previous Lufthansa Antisemitic Incident Will Represent Passengers From This Week’s Incident] Deja-Vu: Lufthansa Accused Of Antisemitism Again](https://i.dansdeals.com/wp-content/uploads/2019/01/24205620/lh-373x150.jpg)

![[Cancellation Updates, Arkia Adds Athens Connection] Here Are The Current And Next Available Flights To Israel On More Than 40 Airlines!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Now Including Size 3] Pack Of 25-34 Huggies Size 4 Or 5 Snug & Dry Diapers For $6.49-$6.99 From Amazon Huggies Size 4 Diapers, Snug & Dry Baby Diapers, Size 4 (22-37 lbs), 30 Count, Packaging May Vary](https://i.dansdeals.com/wp-content/uploads/2025/04/25160302/huggiessize4diaperssnugdrybabydiaperssize422-37lbs30-150x150.jpg)

![[AMEX Explains Upcoming Points Transfer Pause To Emirates] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

138 Comments On "Ends Today! Existing AMEX Members: Open An AMEX Business Checking Account And Earn 60,000 Membership Rewards Points"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Worth noting AMEX will not match you to this offer if you have opened this account under the lower offer.

Right, AMEX hasn’t matched any offers in years.

I got the 20,000 point offer for a business account and they matched the 30,000 offer when I called them after the bonus increased.

Wow, nice!

Anyone else try for this one yet?

I got a 30k offer and they would not match

Got 30k, called to match said they are very limited when they can match. Like only within a few days. and even then its not the full 30k

Dan, do you know anything about the Checking / Savings ?

Currently with Ally – considering switching

CIT bank

Just as a fyi, you can NOT open a business checking account if you have/had the Amex rewards checking account, the personal version of the business account

You will have to use 2 factor every time you log in going fwd?

That has been my experience. Not sure what happens if you close down the checking account though.

Was only required for the first time.

chttted with them they sad they are working on making a seprate login for the banking so u do not need 2 step

No mention of the 1099 that will be sure to issue?

Any DPs on that?

1099 guaranteed.

1cpp?

Yes.

Is that a 1099 for the bonus points or for the interest you’ll earn?

You got one?

can make multiple ACH transfers in a day so can do $4900 and then 9 $10 to finish all requirements on day 1. i believe they need to be 5 minutes apart

I did 10 ACHs in various numbers totalling $5K back to back. No need to wait unless it’s a duplicate funding amount.

Is ACH considered a “deposit” for the purposes of this promo?

so any scheduled transfer from external bank acct is counted towards 10 transactions? can i do as low as $5 ten times? Thanks!!

Can I open 10 business accounts using ten different EIN’s but same SSN?

“If you open your first AMEX business checking account…”

I successfully got 3 x $300 and 1 x 20,000 points over the last six months for opening 4 separate business accounts with the same SSN but different tax ID. I did need to change up my contact details like email in order for the system to let the application go through.

@Everythingjosh Were you able to link both checking accounts to your regular Amex login or you created a separate login for each one?

Separate

Is there a hard pull on this?

Just opened it as SP, thanks!

I have one other account with them, a Personal Platinum Credit Card which I would like to closes down any day. Would I lose my points earned on that CC or will it transfer to this new Checkings account I just opened? Also is there bonuses and transferrable like it is now?

You can open a no annual fee card like Blue Business Plus to keep your points alive and transferrable.

But will this checking account alone hold my point balance alive being that they would have a way to give me the points without me having any ‘point cards’

Excellent question. …

FWIW…chatted with a rep and he/she said your credit card MR account will be different from your checking MR account, so you’d need to make sure you link the 2 accounts and then you’d be fine if you canceled that MR-earning account as those points would go into you checking MR account. One AMEX rep’s opinion. lol

Not something anyone has wanted to test.

Did anyone that opened account and didn’t link it to the same login did their point balance from the credit card show up

Do I need EIN or Social S is ok to open account? Thanks

Read the post?

Can I set Zelle to work with this ?

If you have a business, but not an amex MR biz card can you get this and connect it to your personal MR account?

And how would it work to actually use these points if it gets approved under a business, but without those cards.

Will this be taxable?

Yes.

What documents can I upload as proof of business if I am a sole proprietor (and don’t have Articles of Organization)? The application is requiring me to upload something…

Try uploading your driver’s license?

Keep us posted.

I uploaded my DL and SS card and was approved. Thanks!

Nice!

I do not currently need 2fv to log in. Also, the verification deposits from linking my checking account counted as transaction. Both the deposits and subsequent withdrawals.

Dan any advice

You’re almost done!

Now that you’ve submitted your application, please provide us with additional information so we can complete our review.

File size can not exceed 10MB per file (30MB in total)

Copies or images are acceptable in the following formats:

PDF, DOCX, DOC, GIF, JPG, PNG, PPT, BMP, RTF, XLS

Please complete the 4506-C form

anyone answer you on this?

i got the same thing

Approved!

I am having trouble setting up the shared login, any advise?

Only works if you have a Amex card?

If i dont have any amex cards it seems i can only waitlist is that correct

Mine says Application is pending review… Yikes what did I do wrong

Is there a reconsideration number or something

Thanks for the reminder on this and the extra tips. First time I tried this I came to the biz documents they wanted and figured my sole prop wouldn’t work and gave up. But now I just tried your DL upload suggestion and approved immediately. Thanks for the 60,000 mile bonus!

Congrats!

Can I open up using my EIN number and also a second account using my SSN?

where is the tracker? i am not seeing it

Do you actually have to run a business to be eligible to open this account? Can you open one for yourself as a business owner and another one for a spouse who isn’t employed and isn’t running a business?

Will Amex send 1099-INT form?

Can I open two biz checking accounts for 2 businesses under my SSN, to double dip this offer?

Pending review… 3 to 5 days for a answer… Should I cancel the application or wait it out

Got the same, then got approval email within an hour.

do you need a amex cc to get the points?

also is the a credit pull if you open the account?

If I used to have this account and closed it about 6 months ago am I eligible for the bonus

I called amex to ask what to upload if I don’t have biz docs & they said I can just upload a blank doc. Did that & instantly approved.

Can I open 2 accounts for 2 different business under the same login?

Do you have to be US citizen? or just having a SSN works?

Thank you. I got instantly approved for the Sole Proprietor business account and no documents have been requested.

PSA: do NOT put down your business as real estate or investment. You will be declined instantly and can not re apply again under a different industry. When called up they said they don’t approve such businesses.

Got approved instantly bh!

Thanks Dan for posting about this, I hadn’t heard about this at all and would’ve missed out on an easy 60k points

Seems like you now need an Amex Business Credit Card before you can open a checking account.

I dont have any American Express cards or accounts, how can I skip the waitlist as it doesnt allow me to apply

How do I open a second business account (Sole Pro)? When I hit apply, it automatically adds a second account under the first account I opened (LLC.)

Applied and it said oops something went wrong, please contact support

Any idea if its just a technical issue or something else?

I received the offer via email it states clearly they will issue a 1099 . How does it still make sense?

If they 1099 you $600 for 60K points and you pay a 35% marginal tax rate, it will cost you $210 in taxes.

Still a bargain for 60K points that are worth $600-$900.

I applied but got notice in the mail to upload some documents – which I do not have… How should I proceed to get this offer?

Did you do SSN sole-prop or EIN?

Which documents?

ssn, followed all the instructions, they want business structure and tax docs etc…

“You can try sending in your Driver’s License if you are asked to send in proof of your sole-proprietorship.”

I did that but still says pending

I read the post, I applied, they said they are reviewing, i then got a email to upload documents, I uploaded my drivers license, nothing changed, I then got a letter in the mail requesting same info as email –

I do not want to lose out on this offer, anything to do?

I just got off the phone with them, they said again over the phone what was said in the mailings –

“We need to verify critical information. Please complete the 4506-C form (Request for Tax Transcripts) which will allow us to retrieve your personal tax transcripts.”

I just told them to cancel the application. Should I apply now again??

Don’t leave us hanging…

What would you do in my scenario?

Thank you

Not sure what you’re hoping to hear.

Sounds like you need to give that if that’s what they are saying they need from you for whatever reason.

I cancelled that application. If I apply again you think they would request that same info?

Is there a credit pull?

No

Don’t think so.

It is only a checking account.

I just signed up and was approved instantly and I didn’t get a notification from my credit monitors of an hard inquiry. (I did get multiple emails of a hard inquiry posting on my credit report instantly, after applying for the Chase ink credit card last week)

The Welcome Bonus may be taxable income to you and may be reported on IRS Form 1099. You are responsible for any federal or state taxes resulting from the offer. Please consult your tax advisor if you have questions about the tax treatment of the Welcome Offer.

Do I need to have a business to open this account?

To get this offer do you have to have MR type of Amex card or any Amex card like a blue cash rewards amex card? (Or miles amex card?)

can i open an amex credit card today and then apply for this?

hi

is there a point in having this account besides the 60k points?

“Please complete the 4506-C form” I opened for a C corp and they are asking for a personal 4506 form. When I called in they answered it’s to confirm identity. Can anyone explain this, or figure a workaround?

I had the same thing so I just pulled my application. They said they send the form to the IRS. Idk anything about taxes and such but didn’t seem worth the risk.

able to open 2 for same person but different business – 1 under SS and 1 under EIN?

Please note, non profits are not eligible for this.

They just asked me to fill out a 4506-C form.

This means a FR. Not happy and not worth the risk for doing this application.

I got the same, are you sure it is a FR? Would it help to cancel the application?

i assume so. probably not.

Over the phone they stated it’s only for verification. The rep claimed that if I send in a a bank statement together with the 4506 they won’t send it out to the IRS. Go figure if you can rely on that..

Thanks for the DP. I was referring to a FR = financial review by Amex, not the IRS.

If you don’t send in the form 4506-C there won’t be any review, and I assume the application will be denied and automatically canceled.

If one just has the blue cash rewards card, is he eligible for this offer?

do I have to currently have a amex card with the amex points or a amex Bonvoy card is good as well?

Not working for non profits. See below for Amex’s email:

Here’s what happened

After reviewing your application, we couldn’t open an American Express® Business Checking account for you at this time.

Reason(s) for our decision:

We are not currently offering accounts to companies within your industry.

Just got approved as sole proprietor, no documents needed.

THANK YOU, DAN

Is there a hard pull?

Does “ACH” mean zelle too?

Opened successfully. Any idea why by personal Platinum card it says 700,000 points, by my business Platinum it says 350,000 points. And by my checking account that I just opened it says 0 points. It’s all the same login, shouldn’t they be merged as one? Or do they all have different rules on how to use them?

Call AMEX to merge the MR accounts.

can i merge MR from my wifes account into my account which has a platinum ?

My application is under review

Since it will not be opened today does that mean I wont get the offer?

Thanks for the reminder on this, used the link and signed up. Thanks again for all that you do. you wrote “I did 10 ACHs in various numbers totaling $5K back to back.” you need to keep the $5k in the account, why would you empty the account? Can you just do small bill pays to satisfy what they need? Can I pay my AMEX with it? It is on my profile online, I was thinking to just pay in small increments different AMEX cards on the same profile

He meant that he deposited 5k into the account through 10 different transfers totaling that number. You have to keep 5k in the account for 2 months, so by depositing 5k with 10 separate transactions and leaving it there you’re good to go.

does funding account thru zelle work for 10 transactions

Does the offer only work for MR Amex type cards or also miles, blue cash, etc. Amex cards?

have the same Question, Anyone please?

ANyone know how to delete an application? I accidentally mistyped my SSN, and it isn’t letting me edit. I cleared cache and cookies and tried incognito but it isn’t letting me. Chatted with amex but they couldn’t help and said I had to call new accounts team but they are only open until 6 PM ET which means I wont get bonus. Any tips?

removed one card from my online login, set up a new log in, and applied with the new log in. Amex rep was impressed with my creativity lol because the rep was definitely lost as to what to do

I recently cancelled my only Amex cc… I still have the online login, could I apply or do I first need to get a new cc with Amex?

Singed up as a sole-proprietor and uploaded a copy of my drivers license. After submitting they asked for a 4506-C form.

Eastern time?

Just remembered about this promo. Can I still get this deal untill 3am est ?

just checked sounds dead, it shows 30K

For all those wondering, it seems that even non-membership-rewards accounts (i.e. Blue Cash, Cash preferred) ARE targeted for their offer. I was approved instantly with no doc. Request, although I only have the cash preferred.

This also seems to prove that to maintain the MR balance there is no need to keep a MR cc.

thanks for explaining. Can you just do small bill pays to satisfy what they need? Can I pay my AMEX cards with the checking to satisfy the requirements? It is on my profile online, I was thinking to just pay in small increments different AMEX cards on the same profile

I transferred a total of $5100 to my Amex Bus Checking acct (counts as 1st transaction) and then did 9 more transfers of $10 each back to my external checking account. I am showing 10/10 transactions completed on their activity tracker.

Got an immediate decline. Email states:

“We are not currently offering accounts to companies within your industry.”

That is odd, because application submitted for same industry under different name and EIN was approved. I tried calling but they said they can’t reopen application that was a system decline.

got the approval just after midnight so it kicked me to the 30k bonus. Any way to get them to match the 60?

signed up on the 3rd.

Just realized that today may be the last day to deposit the funds.

Initiated a transfer last night (1/21), but the email confirmation said the posting date would be the 24th.

Any ideas?

Did anyone receive the bonus yet ?

After you have completed all the above qualifying criteria, American Express will credit the Membership Rewards points to the Membership Rewards Program Account linked to your American Express® Business Checking account within 8-12 weeks.

Scroll to the bottom of this link for the terms of the 60k membership rewards.

https://www.americanexpress.com/en-us/banking/business/checking-account/welcome-bonus/

I am also waiting for the bonus to be posted this month since all the requirements have been completed. I am assuming the points will show up in the usual place where all my MR points appear when I log-in. The business account comes at the bottom of all my Amex cards and I don’t remember linking any specific credit cards.

Do i need an American Express credit card in order to transfer points to the partners? My 60k bonus just hit but I am having trouble transferring them to the partners.