Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Marriott shook up their card lineup last week and the big winner was…a card that isn’t even currently offered.

The JPMorgan Ritz-Carlton Card now offers an incredible value.

It has a hefty $450 annual fee, but here’s what you get for that:

- An anniversary free night that is now valid up to 85K points. Previously this card received a 50K free night certificate. You can also top it up with up to 15K points, for rooms that go for up to 100K points per night.

- A $300 annual airline fee credit. This credit is a lot more flexible that the AMEX airline fee credit. It’s good for any airline in the world. You can use it for seat upgrades, bag fees, lounges, and any other fee. To get credit, you just call or send an SM to Chase with a request. I’ve never been denied reimbursement for a fee.

- A Priority Pass membership that allows you to bring unlimited free guests into lounges. While AMEX limits you to traditional lounges, this also works for airport bars, restaurants, stores, massage spas, minute suites, and much more. For example in Cleveland I can use it at The Club lounge or for a $28/person credit at Bar Symon. With unlimited free guests, I can receive pretty much all of the snacks and drinks to stay or to go that I could ever want.

- Additional card users are free and they also receive a Priority Pass membership that allows you to bring unlimited free guests into lounges!

- Global Entry/TSA PreCheck/NEXUS credit

- Return Protection, up to $500/item and $1,000/year.

- Roadside Assistance, free up to 4 times per year.

- Primary Car Rental CDW Coverage worldwide.

- Emergency Medical and Dental when traveling.

- Trip Delay Reimbursement

- Baggage Insurance, extended warranty, and purchase protection

- Trip Cancellation and Interruption Insurance

- 3 annual Ritz-Carlton Club Level Upgrade Certs On Paid Stays

- $100 property credit at Ritz-Carlton, Ritz-Carlton Reserve or S. Regis when you book using special rate for a 2+ nights.

- Gold elite status, plus earn Platinum with $75K spend.

- Complimentary premium in-room internet.

- Visa Infinite benefits, like a 3 year Ship membership.

If you use the $300 airline fee credit, your effective annual fee for all the other benefits is just $150!

Alas, the card no longer offers the $100 airfare discount, but that’s still a lot of benefits for that fee.

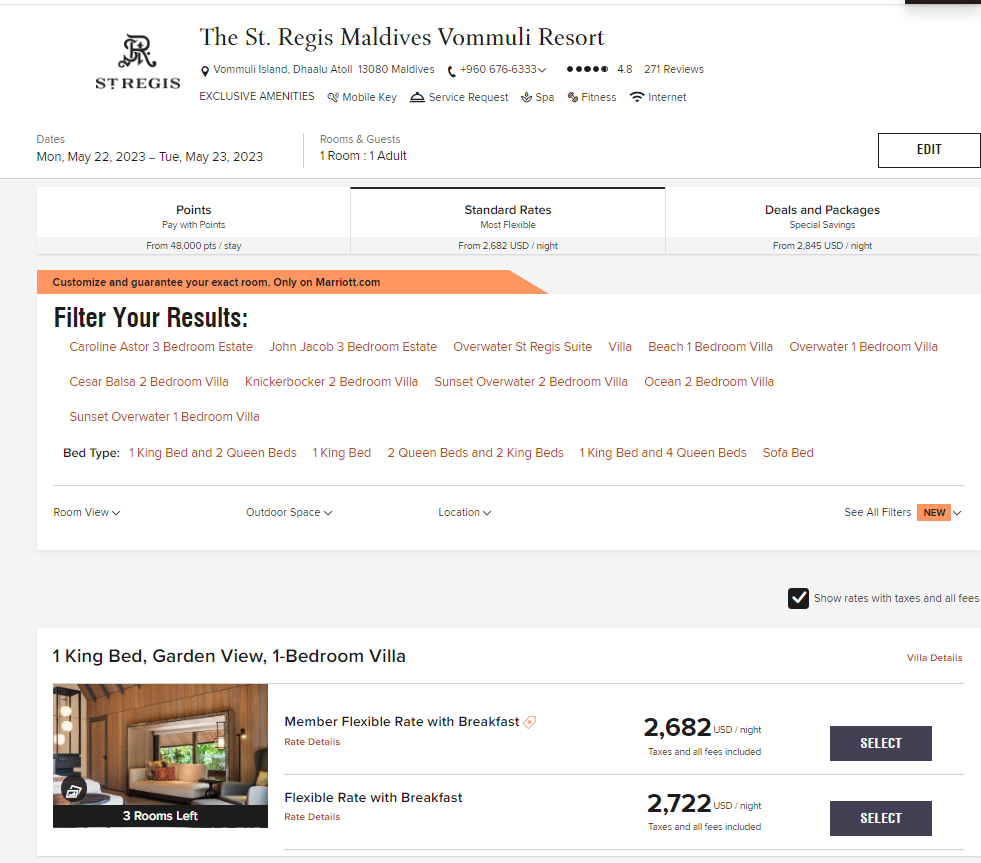

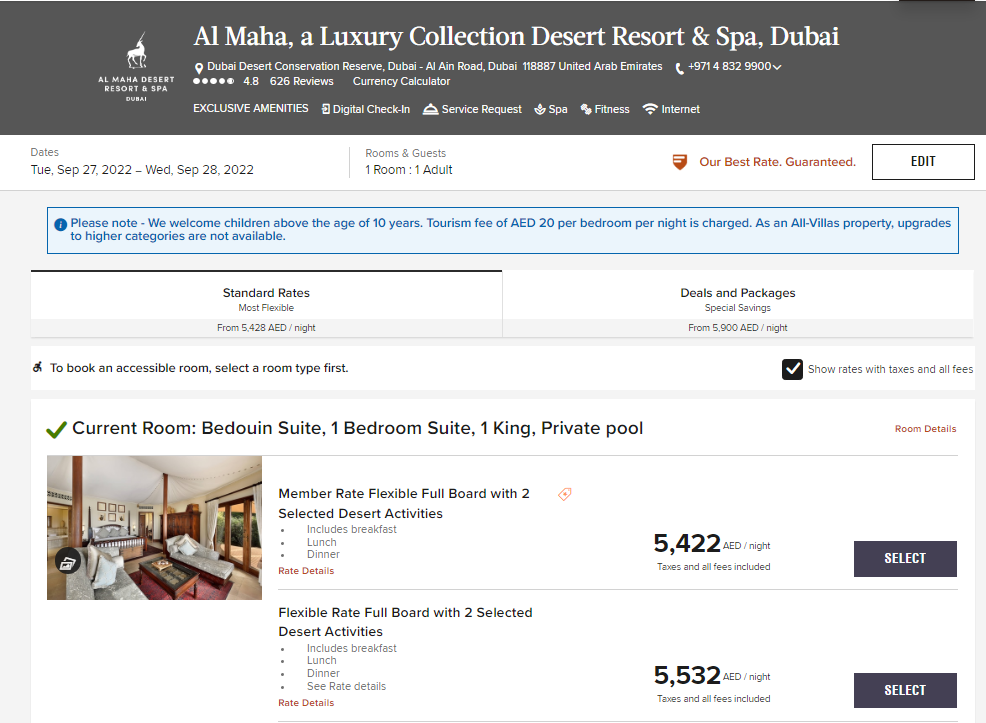

With 85K-100K points, you can stay in a hotel room with a private pool that would otherwise cost thousands of dollars per night!

The one caveat here is you can’t apply for this grandfathered card anymore!

- Luckily, you can still product change to it from these cards that are currently offered:

- Chase Marriott Bold Consumer Card: Earn 60,000 points for spending $2,000 in 3 months, $0 annual fee, no anniversary certificate. Read more here.

- Chase Marriott Boundless Consumer Card: Earn 100,000 points for spending $3,000 in 3 months, $95 annual fee, 35K anniversary certificate. Read more here.

- Chase Marriott Bevy Consumer Card: Earn 125,000 points for spending $4,000 in 3 months, $250 annual fee, no anniversary certificate. Read more here.

The clear winner among those cards is the Chase Marriott Boundless card, with a low annual fee and a valuable free night certificate.

In general, you have to hold onto a card for a year before you can product change, though some reps have allowed people to product change before then.

If you’re a Marriott loyalist, the JPMorgan Ritz Carlton card is now a no-brainer. Will you try to get it?

![[Citi-Emirates Transfers Will Be Devalued] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Global Entry Reimbursement Information Corrected] WOW! United Massively Overhauls Credit Card Program And Lounge Access; The Good, The Bad, And The Ugly](https://i.dansdeals.com/wp-content/uploads/2017/09/03174721/United-Airlines1-768x432-267x150.jpg)

![[Citi-Emirates Transfers Will Be Devalued] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

61 Comments On "Crazy: The Grandfathered JPMorgan Ritz-Carlton Card Now Offers An Incredible Value, Here’s How To Get It!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

probably wont take long till they start killing of some benefits once they get flooded….

Existing FNC issued prior to this announcement is still only 50k redemption, right?

Correct.

How often do I get the tsa precheck credit?

Every 4 years.

This is a chase card?

How does their return protection compare with Amex?

I was wondering about this as well. I have used Ret Prot with CSR, which I assume this will be the same. The big difference compared to Amex is you need to send the item to them! As I recall I needed to pay for shipping cost back as well. I also don’t recall if they cover tax.

So this worked out in the case where I wanted to try a tech item over the $300 Amex covers, and in particular if I received a large amount of reward points through a cashback site to cover the shipping cost.

Ugh, i was hoping the blogsphere wouldn’t push this

If I did a product change to get the Ritz card would that add to my Chase 5/24 status?

No

Can I join Chase Marriott Boundless Consumer Card right now and then product change once I get the card?

Read the post? “In general, you have to hold onto a card for a year before you can product change, though some reps have allowed people to product change before then.”

can I apply for Chase Marriott Boundless Consumer Card first and then do product change when i get the card? Thanks

How many Ritz cards can you have

Anyone know the minimum credit I need on my card before I change to the ritz one?

Used to be $10k

$10,000 credit line

If I’m currently holding the Amex consumer card (formerly SPG), am I eligible to get any of the chase Marriott cards?

Wondering the same

When is the FNC issued? At the date of your change to the card or your original card anniversary date?

Any tricks how to use the 300 airline credit to pay for actual flights?

just book a flight and do a $300 upgrade which the card will cover and then cancel the flight and you have yourself 300 bucks

My time is worth more than all that nonsense.

So why are you even on this website?

Upgrades are usually non refundable…

just got off the phone. the product change worked for me. lets hope i remember to use all the benefits to get the value, lol

Congrats!

How long did you have your old card?

years. i had two boundless for wife and myself to get the yearly free night. Figured keep one and switch hers to the ritz considering the slew of benefits and better hotel access. Marriot at 35k for a free night really limits the selections. hope ritz has larger group to choose from. stay tuned and thanks dan. shana tova

I’d say switch both for the pair of 85K nights.

I currently have the sapphire reserve and now the ritz. as they r both $450 cards would i be better off to keep these as my staples or switch the reserve for a second ritz ? i know its just your opinion but would like an outsiders thought.

You can’t convert Sapphire to Ritz.

sorry i wasnt clear. i would just cancel the reserve to save the $450 and convert my other boundless to an additional ritz. any pros or cons?

They’re completely different cards and benefits.

For someone that does not have a personal Marriott card neither Amex or Chase. Can he open both on the same day and be eligible for both sign-up bonuses?

Hi, Dan. Gmar chatima tovah. I just product changed successfully. I proactively offered to consolidate credit from another card. The minimum credit line is confirmed to be $10,000.

Is there a limit to how many lounges/food establishements one can visit per airport per day?

Do AUs get their individual PP membership, as in can they bring their own guests even when traveling solo (without primary card member?)

Same question for roadside assistance?

No limit.

Yes.

Yes.

Way too generous to stick around for long

… without meaning to be pessimistic, of course.

If I already have this card in my portfolio, can I product change a boundless to another Ritz so that I can earn two 85k nights annually?

Yes.

Can you apply for two separate cards and then product change both?

Is there a business version of this card?

No

Can someone please explain why St John’s Westin is not available anymore with points? I keep in searching for open dates but it’s not showing up any

It’s a timeshare property under Westin/Sheraton Vacation Club, which is currently in the middle of a merger with Marriott Vacation Club. Between all of the timeshare owners and cash buyers, very little space left.

Can I upgrade my current boundless to the ritz card and then reapply for a new one in a couple of days? I have already had my card for a couple of years.

Yes.

I haver aMarriott boundless card for about 5 month. Tried to call to product change but was told 2 times it’s impossible in the first year. Any tips?

If you upgrade to this, do you get the anniversary night on your previous card’s anniversary date? And when do they charge the $450? Also on that anniversary date?

Same q!

Is the $300 travel credit by calendar year? So if I do the downgrade in December, I can potentially tripledip on that?

Would purchasing united travel bank work to get the 300 credit? Like we do on the amex platinum

I’m struggling to understand this promo. Despite the blog title, it appears that there is no 100K point offer for upgrading my Bonvoy Boundless CC. Correct me if I am wrong.

Also confusing is what the immediate benefits are to doing the upgrade. Can you confirm my assumptions, please?

1. I assume I will be charged a prorated fee, since I paid an annual fee on my Bonvoy in June 2022.

2. I assume I will not get my 85K free night certificate until I pass the next anniversary date. If true, the benefits for the first year are low, considering the high annual fee.

“A Priority Pass membership that allows you to bring unlimited free guests into lounges”

Can anybody confirm if it’s correct? On 01/05/21 I contacted JP Morgan Premier Concierge and confirmed that Ritz-Carlton CC Priority Pass lounge access changed (on 10/1/20) from Unlimited guests to TWO guests. Never tested it if it’s true.

I’ve done more than 2 since then and haven’t been charged. YMMV.

In order to use the $28 bar or restaurant credit, would it need to be one that participates in the PP program? If yes, where can I find a listing of vendors that participate? I have an upcoming trip out of JFK T5 and on the PP website, only a spa comes up for T5. No lounges or food establishements.

?

Just to clarify – correct me if I’m wrong – if you open a new chase marriott card to upgrade to the ritz you will have to wait a FULL YEAR before getting the 85k fna as they are only awarded on your card ANNIVERSARY and the when it was opened it wasn’t a ritz card…

I just upgraded to a Ritz card and there is no mention of Priority Pass under the benefits. Did chase get rid of it?

Call to request it.

i am trying to switch and he is saying no product changes. are people still doing this?

If you use points on a car rental reservation, but use your Ritz card as the card on file when you pick up the vehicle, do you still get the primary insurance with the Ritz Card

Does this still work in 2024?