Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Update: DEAD!

Originally posted on 11/7/19:

Table of Contents

Limited time signup bonus

For a limited time, you can earn 40,000 bonus miles for opening a Chase United Explorer card and spending $2,000 within 3 months plus you can earn another 25,000 bonus miles for spending another $8,000 within 6 months.

That means you’ll have at least 75,000 miles if you spend $10K in 6 months.

Note you can also earn up to 100,000 miles on the United Explorer Business Card. You can read more about that card here.

Annual fee

The $95 annual fee is waived for the first year with this offer.

Welcome bonus terms

You can receive the bonus on this card if you haven’t received a bonus on a United Explorer Consumer card in the past 24 months and don’t currently have a United Explorer Consumer card.

You can receive the bonus on this card even if you got a United business card in the past 24 months or currently have a United business card.

5/24

All Chase cards are now subject to 5/24 restrictions. That means it will be hard to get approved if you have been approved for 5 or more consumer credit cards in the past 24 months. Read more about that here.

Card benefits

United has added new features to the United Explorer card this year:

- It now earns 2 miles per dollar on hotels and dining as well as on United purchases.

- Cardholders get Global Entry/Pre-Check for free.

- Cardholders get a 25% rebate on inflight WiFi, food, and drink purchases.

United miles also no longer expire and close-in award fees are being eliminated on 11/15.

The card continues to offer benefits like:

- A free checked bag for the cardholder and a companion, even on basic economy fares.

- A free carry-on bag for the cardholder and companions, even on basic economy fares.

- Priority boarding for the cardholder and companions, even on basic economy fares.

- 2 free United Club passes every year for being a cardmember.

- Primary rental car CDW insurance in every country.

- No foreign exchange fees.

- Exclusive cardmember access to auctions that allow you to use your miles for once-in-a-lifetime experiences. A few years ago I used 25K miles for 4 field box seats to an Indians game along with the right to run onto the field before the top of the 7th inning and swipe 2nd base right off the field. Nobody could believe it as I walked around the ballpark with 2nd base. I even got it signed after the game by the Indians wining pitcher that night, who was equally shocked that I actually had 2nd base.

- Cardholders with United elite status get free upgrades on coach award tickets on upgrade eligible routes.

- If you spend $25K on the card in 2019 it waives the requirement to spend $3K on United flights to get Silver status, $6K on United flights to get Gold status, and $9K on United flights to get Platinum status. You only need to fly the 25K, 50K, or 75K miles like in the good old days.

- Starting in 2020 you can earn 500 PQPs for spending $12K annually or 1,000 PQPs for spending $24K annually. Learn more about the new PQP system in this post.

Expanded award ticket availability

The reason this card is the best airline card you can get isn’t for the spending benefits, it’s for the perks. And they are awesome.

The reason this is my favorite airline card is that the United card is the only airline card that offers expanded award ticket availability.

This increases the value of your miles significantly and in turn makes the Chase Quadfecta/Quinfecta spending strategy even more valuable.

Cardholders have access to expanded saver coach award availability (XN class), last seat standard coach award availability (YN class), and last seat standard business/first class award availability (JN class).

It’s not just slightly expanded. There is a world of difference between the availability that cardholders can access and the availability for non-cardholders.

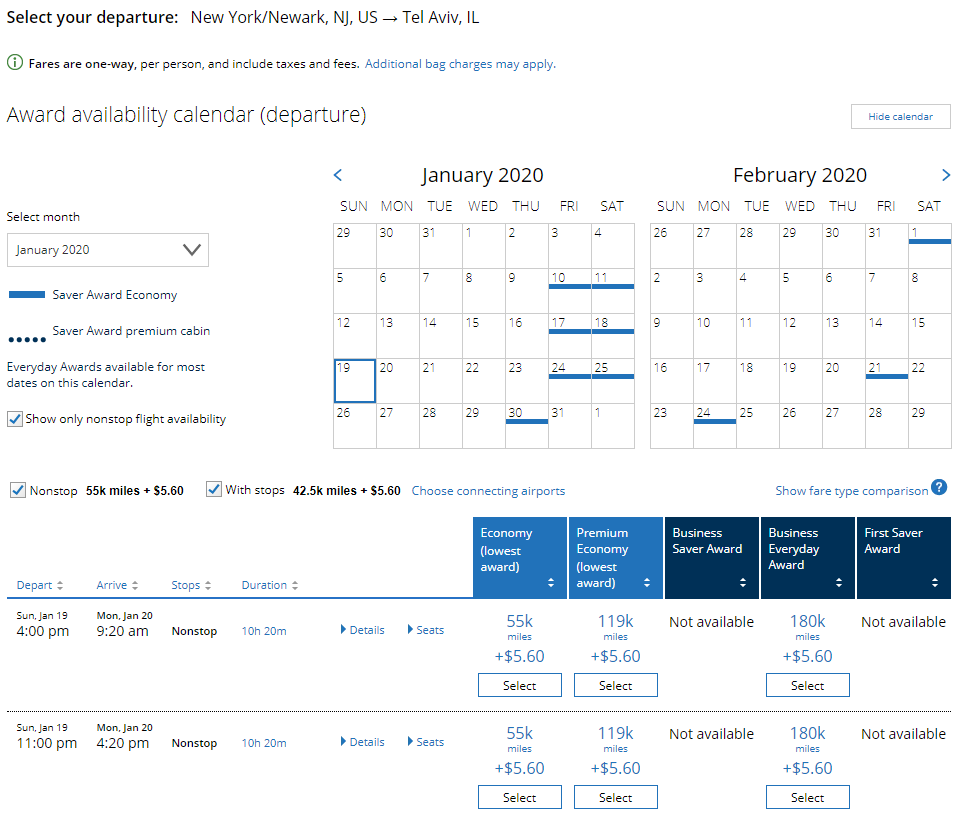

Availability calendar for non-cardholders:

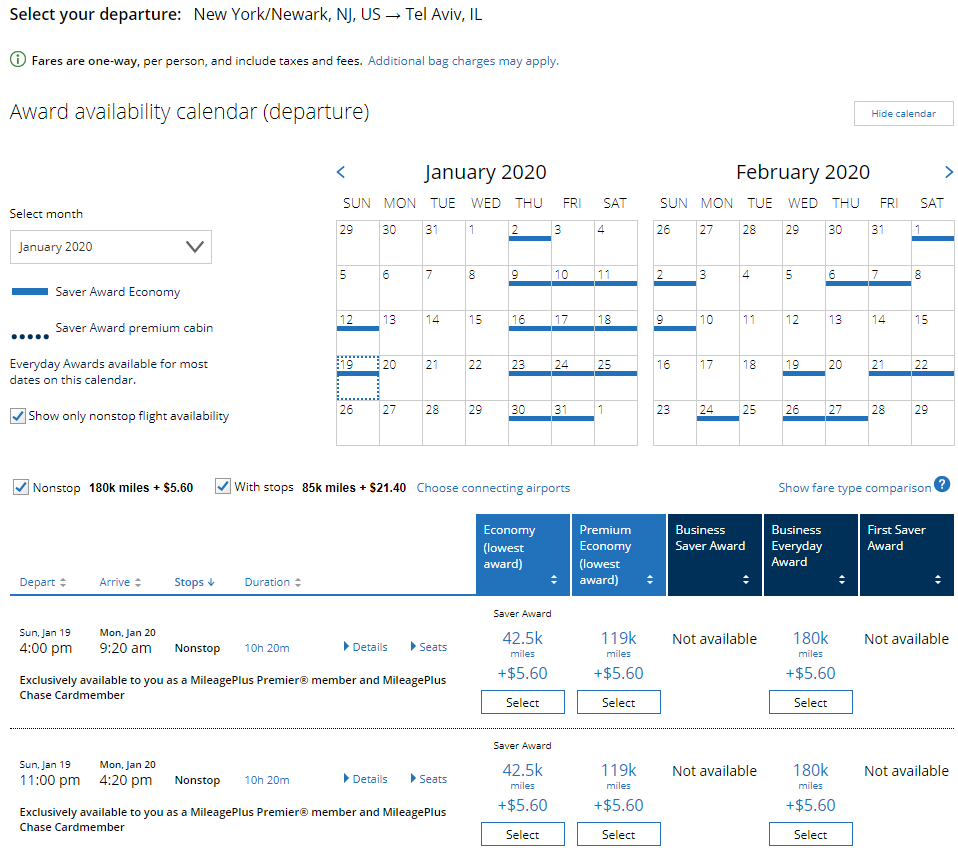

Availability calendar for cardholders:

Read more about this in the United Expert Mode post.

This availability differential applies to all domestic and international routes and makes it crucial to be a United cardholders.

Expanded Plan B availability

As you have better access to saver coach awards you’ll also have better ability to do Plan B awards.

Plan B allows you to redeem for saver business class awards when there’s only saver coach available! Read more about Plan B in this post.

No airline besides United offers a Plan B style award redemption.

Discounted awards for cardholders

United runs promotions offering discounts on award flights for cardholders.

They have offered these discounts for travel to Tahiti, Ski destinations, Hawaii, Mexico, The Caribbean, and more.

New 5K Saver Awards

United recently introduced new lower cost saver awards starting at just 5K miles:

I went about compiling a list of all award rates on all of United’s flights to/from NYC and here’s where I found one-way saver awards for less than the normal rate:

- Atlanta, Chicago, Fort Lauderdale, Montreal, Myrtle Beach, Orlando, Toronto: 5K

- Asheville, Norfolk, Richmond, Washington DC: 5.5K

- Burlington, Portland/PWM: 6K

- Knoxville, Savannah, Syracuse: 9K

- Buffalo, Charleston, Charlotte, Cleveland, Grand Rapids, Rochester: 9.5K

- Houston: 10.5K

- Denver, Minneapolis, New Orleans: 11K

- Miami, West Palm Beach: 11.5K

- Dallas, Madison, Nashville, Seattle: 12K

Short haul routes to/from NYC where I only found the regular 10K saver rate:Akron, Albany, Bangor, Boston, Detroit, Greensboro, Greenville, Halifax, Hilton Head, Indianapolis, Louisville, Nantucket, Pittsburgh, Presque Isle, Providence, Quebec City, Raleigh, South Bend, Traverse City

Long haul routes to/from NYC where I only found the regular 12.5K saver rate: Austin, Bentonville, Bozeman, Fort Myers, Jacksonville, Jackson Hole, Kansas City, Key West, Las Vegas, Los Angeles, Memphis, Milwaukee, Montrose, Orange County, Palm Springs, Pensacola, Phoenix, Portland/PDX, Rapid City, S. Louis, Sacramento, Salt Lake City, San Antonio, San Diego, San Francisco, Sarasota, Steamboat Springs, Tampa, Vail, Vancouver

The advantage of United MileagePlus

In general I’m a big fan of United miles as they’re part of the Star Alliance, which has the best award availability of any airline alliance.

Best of all, United never charges any fuel surcharges. Other airlines like American collect massive fuel surcharges to fly on British Airways. Delta charges fuel surcharges to fly on some partners and if you originate in Europe and other regions. United will never collect a fuel surcharge and they have access to awards on 36 partner airlines which means better availability on more awards.

A short-haul United domestic award under 700 miles in distance is just 10,000 miles. That’s more than the BA 7.5K short-haul, but availability is much better, it allows for a longer flight distance, and you are allowed to have connections for the same rate, something that BA doesn’t allow.

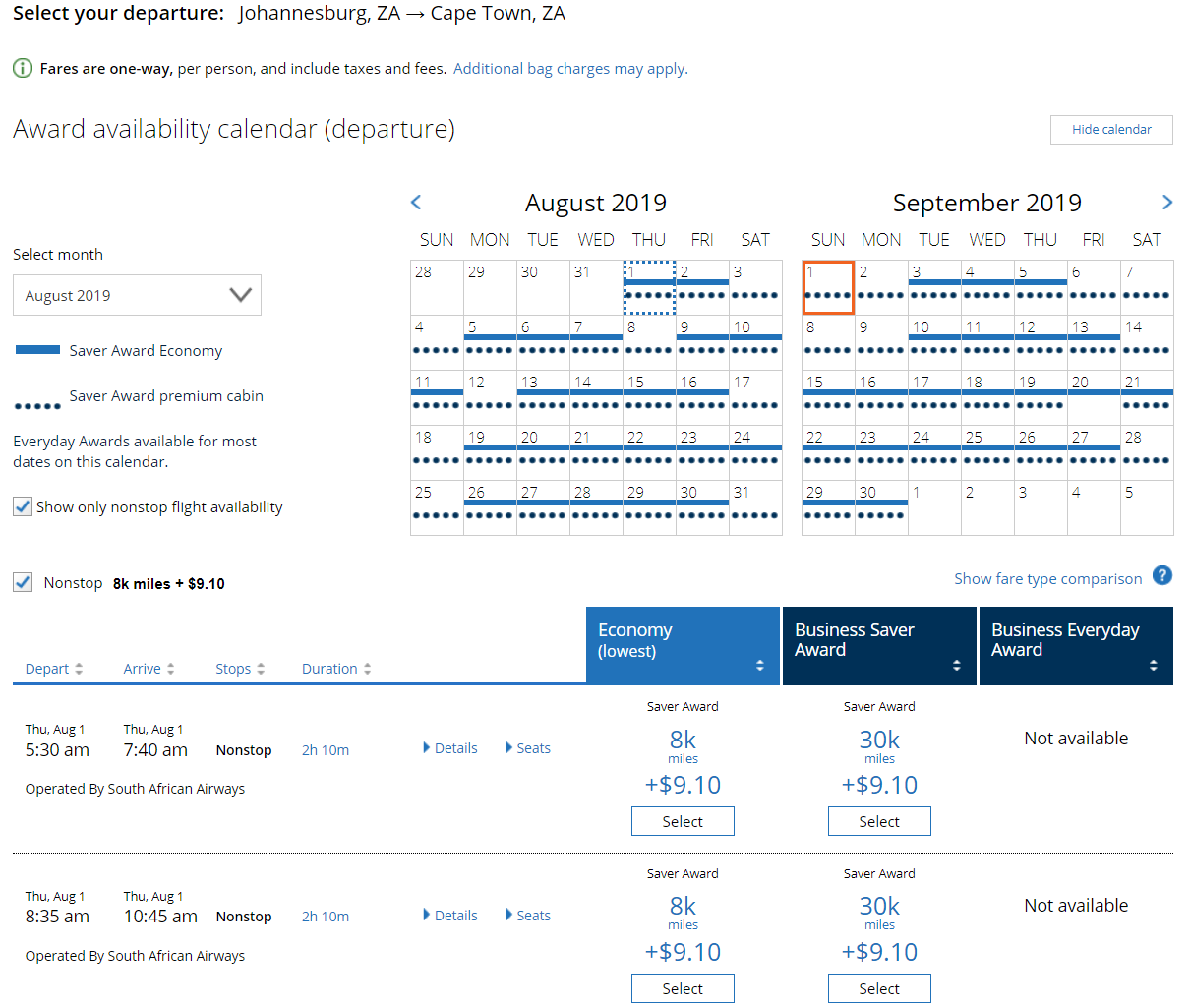

Short-haul nonstop flights within any region outside of the US are just 8K miles:

United is also the only major US carrier that caps the mileage rate for standard awards at a reasonable rate.

For example the last time there was a limited time offer on this card I checked on award space from NYC to LA:

American charged 82.5K-97.5K miles with their variable standard award pricing:

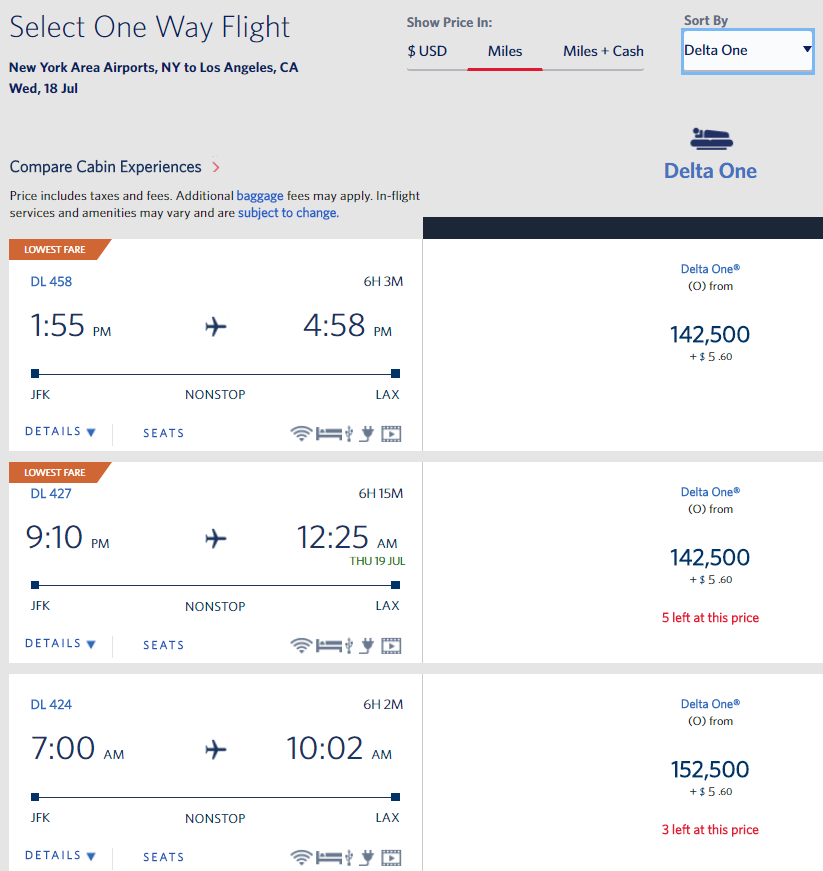

Delta charged 142.5K-152.5K miles with their variable standard award pricing:

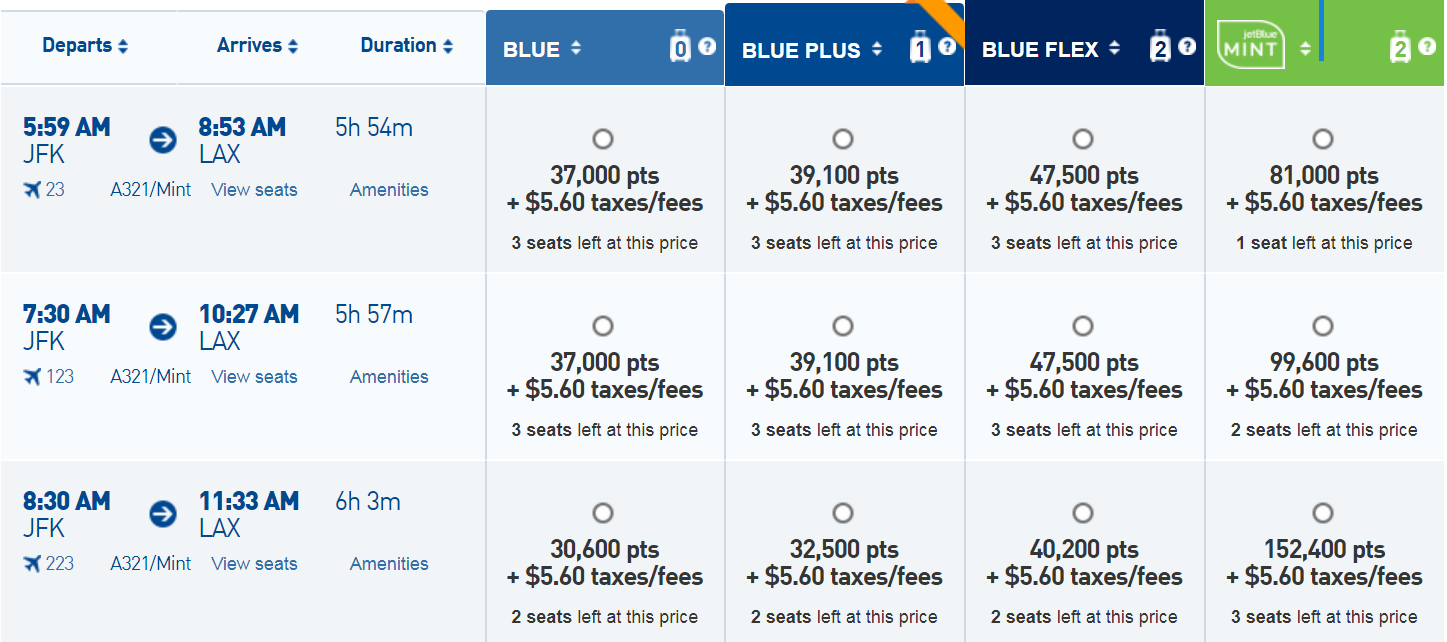

All JetBlue award pricing is variable and they wanted 81K-152.4K miles:

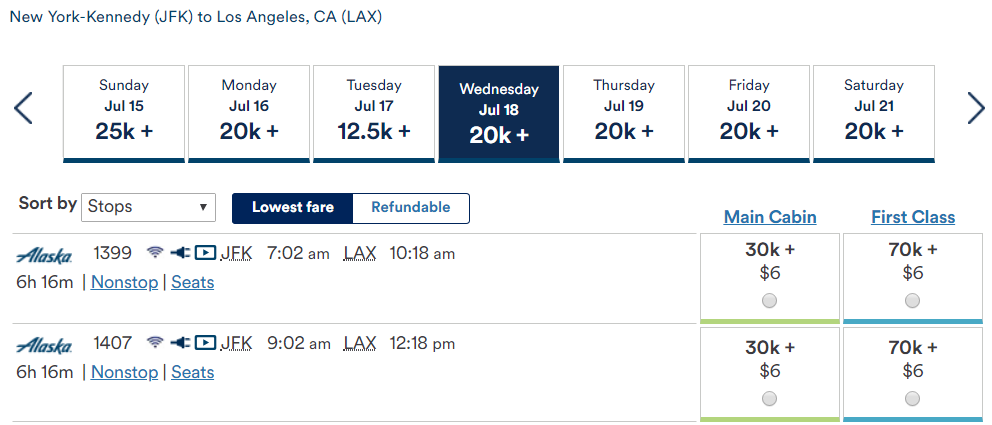

Alaska is the only airline flying nonstop between NYC and LAX without lie-flat seating in business class and they wanted 70K miles:

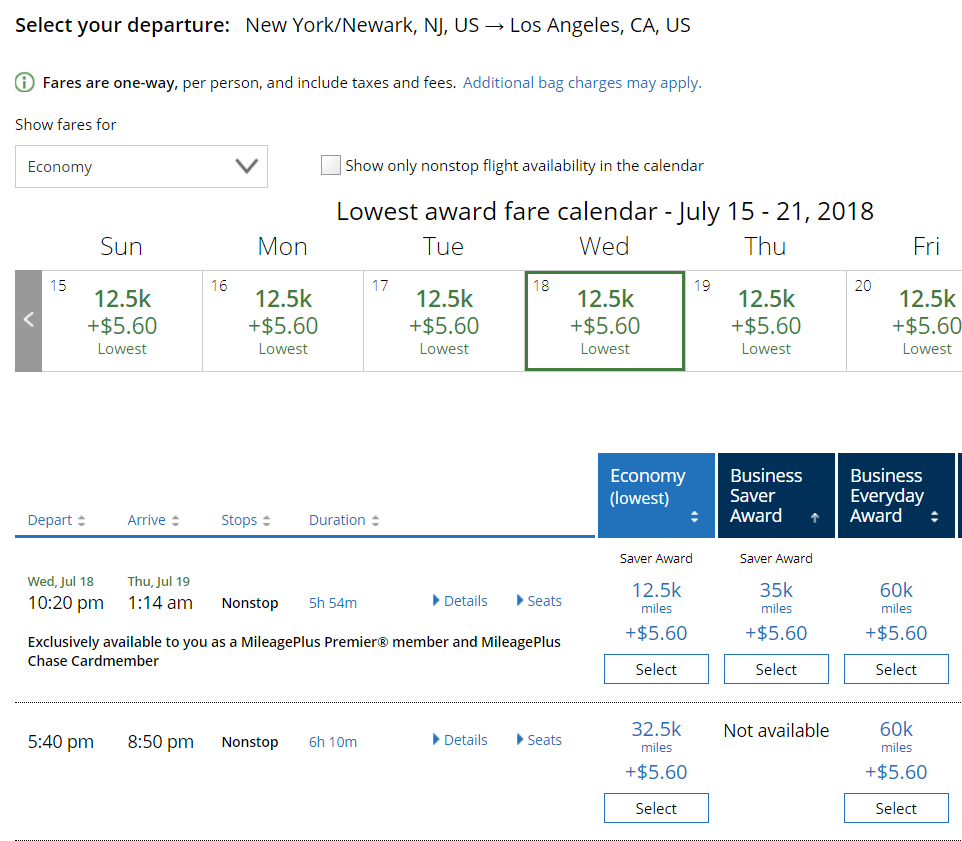

With United there was a saver award for 32.5K. Those come and go, but the standard awards on United are just 50K-60K on this route. That’s significantly less than other airlines. Best of all, cardholders can book a standard award even if it’s the last coach or business seat on the plane:

Excursionist Perk

While American and Delta have eliminated free stopovers, United continues to offer a free excursionist perk as described in this post. Just use the multi-city award search on United.com to piece it together.

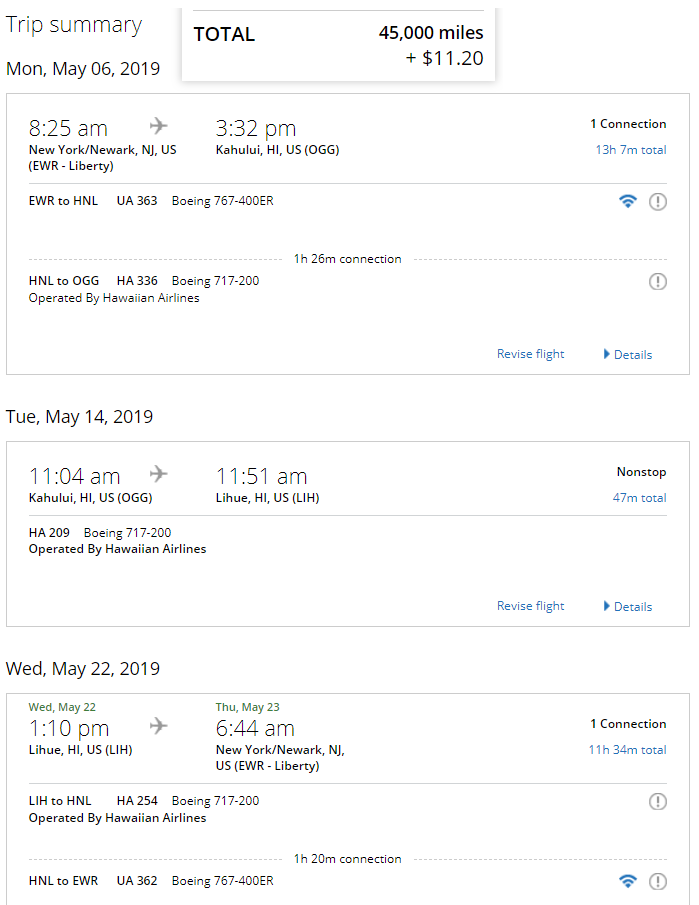

A round-trip to 2 Hawaiian Islands is just 45,000 miles round-trip thanks to the free excursionist perk:

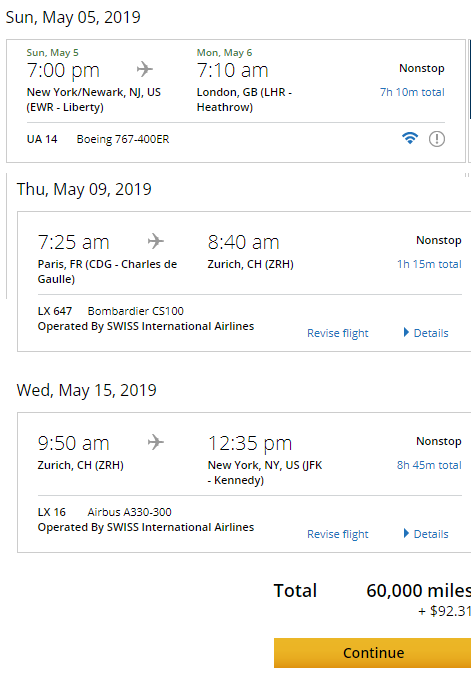

A round-trip ticket to 2 European or South American cities is just 60,000 miles round-trip thanks to the free excursionist perk:

A flight to 2 of my favorite cities in Asia, Hong Kong and Chiang Mai, Thailand is 80K miles thanks to the perk:

You’re even allowed a free open jaw in addition to the perk to really maximize your travel. For example this itinerary includes travel to London, Paris, and Zurich. You can take a train or use 4.5K BA Avios to get from London to Paris to fill the hole in the open jaw:

Of course the free stopover isn’t just useful from the US.

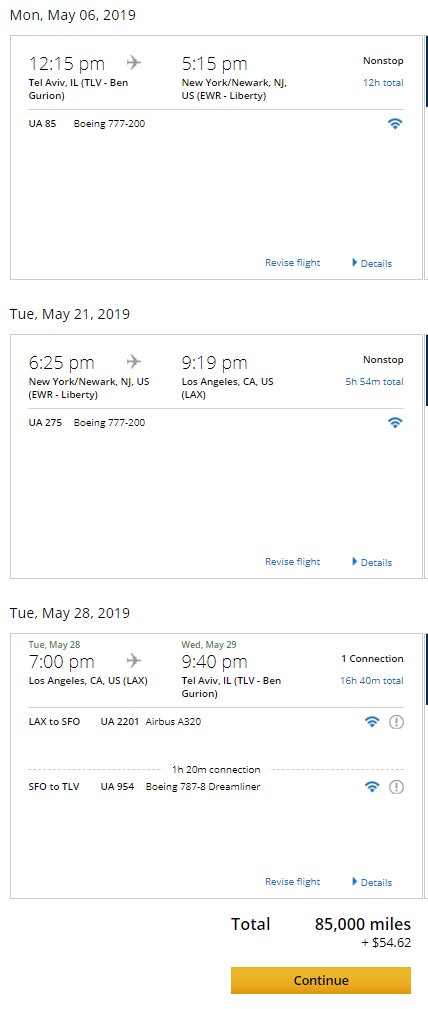

You can stopover in NYC and LA when flying from Tel Aviv to the US:

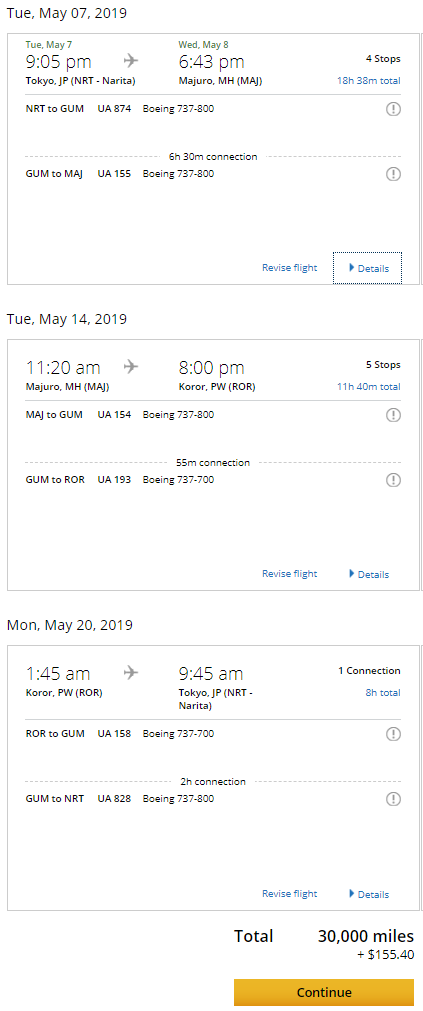

If you find yourself in Japan you can fly on the island hopper to 2 cities in Micronesia (I’ve been hankering to get back to Palau since the moment I left) for 30K miles:

Partner airlines

United has dozens of partner airlines which means lots of great award opportunities. It can be worth checking for award space on partner sites like ANA or Aeroplan.com to search for award availability and then call United to book if you don’t see availability on United.

Partners airlines include:

- ANA

- Aegean Airlines

- Aer Lingus

- Air Canada

- Air China

- Air Dolomiti

- Air India

- Air New Zealand

- Aeromar

- Asiana Airlines

- Austrian Airlines

- Avianca Airlines

- Azul Brazilian Airlines

- Brussels Airlines

- Cape Air

- Copa Airlines

- Croatia Airlines

- EVA Air

- Edelweiss

- Egyptair

- Ethiopian Airlines

- Eurowings

- Germanwings

- Hawaiian Airlines

- Island Air

- Juneyao Airlines

- LOT Polish

- Lufthansa

- Scandinavian Airlines

- Shenzhen Airlines

- Silver Airways

- Singapore

- South African Airways

- Swiss International Airlines

- TAP Portugal

- THAI

- Turkish Airlines

Will you signup for a United card?

![[Citi-Emirates Transfers Will Be Devalued] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Global Entry Reimbursement Information Corrected] WOW! United Massively Overhauls Credit Card Program And Lounge Access; The Good, The Bad, And The Ugly](https://i.dansdeals.com/wp-content/uploads/2017/09/03174721/United-Airlines1-768x432-267x150.jpg)

![[Citi-Emirates Transfers Will Be Devalued] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

83 Comments On "Earn Up To 65,000 Miles On My Favorite Airline Credit Card"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Can I get this offer if I already have a united explorer credit card that my husband is primary on?

Yes.

Xn for partners too?

No, just on United.

Are there any Chase cards are not subject to 5/24

Not that I know of.

Wish I could get the card. The cancelled my 6 cards in June! Hope much longer do I need to wait?

Did they tell you the reason?

They didn’t but after reading your forums I figured it out. I had 25K limit on card and I wanted to use it for $40K purchase so I called up Chase and spoke to agent who told me I could prepay and then with credit balance I could buy for $40K. Long story, sent them 50K (was going out of country so wanted to pay future statement before leaving) so had credit balance of 50K and made 40K purchase leaving me credit balance of $10K. Two weeks later they cancelled all cards and told me cancelling because usage higher than usual and, therefore, I was risk. Told them they owed ME $10K and that I had over an 835 credit score. Also told them that their agent said it was ok and to listen to tape. Spoke after to supervisor then someone at executive office! Zip! Worse part was I lost my grandfathered Presidential Plus card!

Yup…

https://www.dansdeals.com/credit-cards/avoid-credit-cards-closed-red-flags-trigger-financial-reviews-adverse-action-shutdowns/

Dan, on that link, you list, “Depositing excessive cash or money orders into a checking account.” I have some money orders ~$200 each from GCs that want to deposit. Can you please help define “Excessive”: 5 such money orders? 10?

Don’t do it into a Chase account.

So, I should deposit the money orders into another bank account, then what would be best to do: withdraw cash or request a check and then deposit into Chase account?

Dan, can you please answer, thanks.

Do an ACH transfer to Chase.

Thanks. Just curious, why is cash/check deposit more suspicious than ACH given that anyone can open another account at a bank and transfer the funds?

Dan, can you please answer, thanks.

Because it is.

Thanks, really appreciate the help. If ur depositing 5 money orders into another non-Chase bank and then transferring it out to Chase, wouldn’t that also raise suspicion. It seems the idea of buying GCs and then money orders is not too practical. Any advice?

It does not. Nor do I understand why you continue to question what I’ve already told you multiple times.

Sorry for the confusion Dan. I was referring to suspicion at the non-Chase bank, not the Chase bank i.e. wouldn’t they want to know why there are 5 money orders into account then transfer out. Really learned a lot, thanks again for learning how to bank.

Most banks don’t care. Chase does.

Either way, not a big deal to get shut down by a bank where you don’t have a credit card.

Thanks again! And how soon between Chase business CC apps is safe before applying again?

Dan, I think it would be really beneficial to the community if you do a post on cashing out the money orders because I’m sure a lot of people are not aware to avoid depositing cash/check into Chase. Also would BillPay for a Chase CC be ok? thanks again!

Instead of the transfer, can I just pay the Chase CC from the other non-Chase bank?

How about just 2 money orders?

About 5/24

All chase are also beeing counted as part of the 5

I remember the was some card that didn’t get listed on your 5.

Business cards aren’t counted as part of 5/24, but you need to be under 5/24 to get one.

If you have the United card and want to book an award travel flight, will you have to pay the additional $75 fee besides the points if your flight is within the week?

That fee is being eliminated on 11/15.

If I book a flight now for travel on 11/17, will I be able to call in and get the $75 refunded? Only other option would be avianca I think

No.

too bad, also any idea why I can’t see comments to your posts anymore on telegram or iphone safari browser?

Got approved 1 week ago for base 40k. Will chase match to this new offer?

Message them and ask.

Hi Dan I was approved for this card a few days ago before this offer so I will message them to request a match. I still don’t see expanded availability when searching for award flights. Do you have any idea how long it would take for my MileagePlus account to update to start showing expand availability as a card holder? Thank you!

Can take a week or 2.

Does this card give you an extra free bag if flying international on a ticket which already includes 1 free check in bag?

And can you use the free extra bag perk on a partner airline?

No, but if your international ticket doesn’t come with a bag then you will get a free bag.

United flights only.

What will happen to the expanded award availability benefit with the move to dynamic pricing?

Does United explorer business also give free Global Entry/Pre-Check?

No.

If I had the Explorer card and downgraded it to the no-fee version (which earns 1 mile for every 2 dollars – no other benefits), would I still qualify for the sign up bonus?

I’m at 4/24 right now (already have CSR, Freedom Unlimited, and Freedom) and trying to figure out which card to use my 5th slot on.

Yes.

Don’t want to try for an Ink card?

I actually just got approved a couple weeks ago for the Ink Business Cash but thought that it doesn’t contribute to 5/24 rules? It’s more first foray into business cards so I’m still trying to sort through all the rules.

It doesn’t, but perhaps try for an Ink Preferred while you’re still 4/24?

https://www.dansdeals.com/credit-cards/chase-ink-preferreds-mega-80000-point-signup-bonus-versatility-apply-card-today/

And now their miles don’t expire!

Dan, I would hate to get the card, and then lose the expanded award availability feature when United revamps their program 11/15. Do you think this feature can be lost?

This is a valid question. Dan, why don’t you answer this before pushing this credit card?

You should be clear if a key benefit will soon go away or be diluted!

I wrote in the post,

“Note that United will remove their award charts on 11/15 and the future of the program is up in the air at this point.”

I can’t predict the future.

When does this offer expire?

Does Expanded Plan B availability still exist?

@dan Do Bonus points disappear if you downgrade a card before 12 months? Does it create a “red flag”? In other words is there any problem with opening a card hitting the bonus then downgrading, thereby avoiding 3/4 of the annual fee?

Chase: don’t think so because Dan advised earlier to sign up for ink preferred, then downgrade to avoid AF

AmEx: think so because they are more “strict”

Dan, can you please confirm?

Dan, please?

Why in the world would you downgrade a card that has no fee the first year??

I wasn’t referring to this card specifically. I really want to know about the sapphire cards. Thank you

Please ask non-post related questions on the DansDeals Forums.

Hi Dan, I see you writing a lot about booking on partner airlines, how does that work, do I just search for a flight on their website? They are always so expensive…

Let’s say to Europe, a regular flight is 60k United points, which is way more expensive than a regular cash ticket, do u have an article maybe where u explain this a little?

Dan, if I book a united flight w UR points. Does this card get me a free carry on and checked bag?

While I maintain a U.S. address, I lam a U.S. citizen and live in Israel. Can I still get this card?

But partner airlines like AC will still show only the seats available to non cardholders, correct?

Is there an expiration date (or estimate) on this offer cuz i would wait till 11/15 to see what they do with their points before signing up

Is there any way to avoid the Philippines Call Center?

I took your advice and got the United Explorers Business card a few months ago and just hit the spending to get 50k pts (there’s no way I’m going to spend $25k in 6 months to get the extra 50k points (100k total)). Anyway, since I’m not working on that anymore, can I (should I) get this card and start working on getting these 75k points? Could I have 2 United cards (under the same MileagePlus account)? Would I just let the UEB card go dormant? I don’t want to pay 2 annual fees. I’d rather have 1 active card.

Sure.

Two questions. Delta Platinum and this card, when you close them, to they claw back your points?

Chase doesn’t claw back.

AMEX can claw back if you close/downgrade within 12 months.

I now live in Israel and fly once a year if that. Is it worth it to get this card. I appreciate your constructive input. Thanks

is united miles still the most valuable?

is there any valuable millage card with a no annual fee

Doesn’t show availability when clicking link it says not available anymore

Should be working now. Try incognito if it’s not.

Bought a United ticket to EY with the United card. They would not give us the extra bag free. That was why I bought the ticket with their card. Never again.

You don’t get an extra free bag, you get your first bag free.

Is this the best offer for this card?

Applied for the card before 559 and it’s still “Verifying information”. Says if you refresh or hit back arrow you lose the request. Any suggestions?

I’m not sure how your getting the free stop over when I try the example you posted ewr to LAX than tlv it shows me first 32k points then plus 42.5?

i applied @ 550

still awaiting a response

this is the message im getting

Verifying your information…

Thank you. We’re processing your request and may need more information from you. We appreciate your patience. Please don’t click “Refresh” or the “Back” arrow in your browser window or your request will be lost.

still alive

Will I get the free first bag etc when booking a Basic Economy ticket via Expedia, or must be purchased directly from ua.com?

No difference where you book.

Thanks for the quick response,

One more question, do I need to use the card for the booking?

https://www.dansdeals.com/points-travel/airlines/united/reader-question-use-chase-ultimate-rewards-points-get-united-card-benefits/