Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

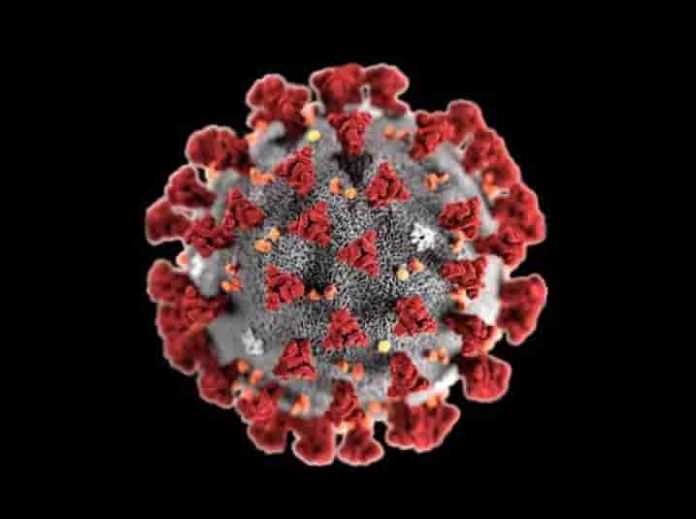

President Trump has signed the $2.2 Trillion Coronavirus Stimulus Bill/CARES Act into law.

Here are some of the things that will do:

- Stimulus checks, up to $1,200 per adult and $500 per child as described in this post. Those will be sent out within the next 3 weeks.

- Unemployed benefits of $600 per week for up to 4 months, on top of state benefits. Also extends unemployment payments from 26 to 39 weeks. These will not only cover regular employees, but also gig economy and other self-employed workers who lose work due to coronavirus! This will run through 12/31/20.

- Many banks, credit cards, and companies are allowing payment deferrals without interest or penalties for consumers who ask for them. The new law won’t allow negative marks on your credit report due to taking advantage of these programs.

- Small businesses can apply for an emergency grant of up to $10,000.

- The SBA will distribute $350 billion in forgivable loans, up to $10MM per small business equal to 250% of an employer’s average monthly payroll, on favorable terms with no collateral needed. To qualify, a company must make a good faith certification that they need the loan based on current economic conditions. The entire principal of the loan can be forgiven based on keeping employees on payroll through the end of June and the forgiven amount will not be considered income. If you receive the $10,000 grant you would have that amount deducted from your loan forgiveness.

- Businesses with existing SBA loans can defer paying for up to 6 months without interest or penalties.

- Businesses with a 50% quarterly drop in gross receipts compared to past years can get a refundable tax credit for half the wages paid to employees, up to $10,000/employee as long as they keep paying wages and health benefits. Small businesses that take advantage of this will not be eligible for the SBA forgivable loans.

- Suspend federal student loan payments through September 30 without interest or penalties. Employers can also provide up to $5,250 in tax-free student loan repayment benefits.

- Employers and self-employed individuals can defer the 6.2% social security tax with half of the deferred amount owed by 12/31/21 and half by 12/31/22.

- Additional funding for food stamps, child nutrition, and food banks.

- $100 billion payments to hospitals for lost revenue and additional payments for treating patients with coronavirus.

- $16 billion for equipment like ventilators and masks.

- $500 billion of loans for businesses and state and local governments.

- Airlines will get bailed out in exchange for limits on stock buyback for the next year, executive compensation, and retaining employees and airports served.

- Money for the national guard, farmers, schools, distilleries making hand sanitizer, defense, post office, and research for developing coronavirus medicine and vaccines.

Which of these items will you benefit from?

![[Lawyer From Previous Lufthansa Antisemitic Incident Will Represent Passengers From This Week’s Incident] Deja-Vu: Lufthansa Accused Of Antisemitism Again](https://i.dansdeals.com/wp-content/uploads/2019/01/24205620/lh-373x150.jpg)

![[Cancellation Updates, Arkia Adds Athens Connection] Here Are The Current And Next Available Flights To Israel On More Than 40 Airlines!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Now Including Size 3] Pack Of 25-34 Huggies Size 4 Or 5 Snug & Dry Diapers For $6.49-$6.99 From Amazon Huggies Size 4 Diapers, Snug & Dry Baby Diapers, Size 4 (22-37 lbs), 30 Count, Packaging May Vary](https://i.dansdeals.com/wp-content/uploads/2025/04/25160302/huggiessize4diaperssnugdrybabydiaperssize422-37lbs30-150x150.jpg)

![[AMEX Explains Upcoming Points Transfer Pause To Emirates] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

61 Comments On "President Trump Has Signed The $2.2 Trillion Coronavirus Stimulus Bill Into Law; Here Is What You Need To Know About The Benefits"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Is there something in the stimulus for mortgage forbearance or deferment?

Uch, before it was 6 months for student loans, now two months! That would have saved me an extra $10,000!!!

Sorry about that, it will allow payment deferrals through 9/30!

I have a $4.3MM 7a SBA loan and just saved myself $30K a month! i wonder if they will charge my account interest on the principal during the payment deferment period

Should be no

The ultimate Dans Deal?

+1

@Dan which items will you benefit from?

I will not benefit, I receive social security! Not complaining!

My wife is a schoold based, but independent (contracted through an agency) speech therapist, so she’s self-employed. Due to school closures she is not able to work and therefore has lost all income. I’m sure this is fairly common, does anyone know how she is to file for the unemployment benefits (that I believe are not normally made avaiable to self-employed workers)?

I could Be wrong but I think it’s the same way you apply regularly. Just answer the questions they ask on the regular unemployment site

Thanks. Here is what I found today on labor.ny.gov under the FAQs for COVID-19

I am self-employed or an independent contractor. Am I eligible for Unemployment Insurance?

Currently, most self-employed individuals and independent contractors working in New York State are not authorized to obtain unemployment insurance benefits. However, in certain situations, the President of the United States may authorize Disaster Unemployment Assistance (DUA), a federally funded program that provides unemployment insurance benefits to individuals who have lost work or income in disaster areas even if they don’t usually qualify for unemployment insurance. Self-employed workers and independent contractors would be covered by DUA.

On March 16, the Governor submitted a request asking the President to authorize DUA in light of impacts COVID-19 is having on New York State. That request is still pending with the President.

What about SSI benefits? Do people on social security get money?

People on Social Security are eligible for the $1,200 per adult benefit. However, it is subject to income phase out beginning at $75,000 for individuals and $150,000 for married filing jointly.

I am receiving ssi monthly but I haven’t received 1200 what shall I do?

How can I apply for the small business grant?

What will happen to those that are on public service loan forgiveness program for their student loans? You need to make 120 consecutive payments….

It counts for purposes of the 120 month period even though no payments are made. Make sure you cancel scheduled payments

What does this mean? My wife is on a student loan income based repayment plan also needs to make 120 consecutive payments. Does she not need to pay them now? I am confused. Thank you.

Does this mean that it is too late for our airline petition thingy?

First of all I want to thank you Dan for disseminating and filtering down all the good and the bad information. You really do so much for so many people with your posts. I personally have benefited greatly. I don’t see the stimulus package having anything about rent

I worked in 2019 and the company i worked for Filed state taxes for me but my self didnt file for tax return, will i receive this money from the government?

Probably not, but you can still file for 2019 until July 15. File now. You may be entitled to an EITC and get money back.

Anyone know what happens with the $500 per child if you are divorced and you switch off filing the kid as a dependent. I claimed for 2018 but already filed my 2019 return where my ex is claiming child

if she claimed for 2019, its mean that she have them. so the 500 that she will get for YOUR kids, will be the best thing for your kids.

Lol yeah, women frivolously divorcing is “best for the kids” yet again.

I don’t know if this has anything to do with taxes or tax returns.

i heard payment may be by direct deposit based on past tax return(s) on file. what if i changed that bank to another? how would i update with irs?

Thank you President Eisenhower!

Don’t forget to give maaser on the amount you get. We need to help people that are struggling now

BH now I’ll be able to afford to make Pesach for the first time. Yeshu’as Hashem keheref ayin!

And thank you Trump!

How do I take advantage of the Federal Unemployment benefit? I got laid off for 2 weeks should be back to work fairly soon though…

File with your state, the additional money will be added to the state payment.

What happens if I had a baby in 2019 but still didn’t file taxes?

You can get the credit when you file.

So glad that the Dems fought to increase the unemployment benefits and increase the direct payments to individuals. I hope this can help enough people through this tough financial time.

Dems only fought to have vote by mail and bail out their donors.only think about themselves

Dems have done nothing, they want money for global warming rubbish.

They almost blocked whole thing.

How do you apply for the unemployment benefits? If you live in NYC is it the same as regular unemployment??

Should be the same.

Will Americans living outside the USA who file tax returns, also get the $

Will U.S. citizens living abroad get a payment?

Yes, as long as they meet the income requirements and have a Social Security number.

Yes.

Question:

I am not eligible based on my 2018 returns

I will be eligible based on my 2019 returns

I haven’t filed my 2019 returns yet.

Do I need to rush to file my 2019 returns before they make the calculations?

Or can I later file my 2019 returns and AOD for adjustment

The question is because since it’s technically based on 2020 returns and they are just using what’s available now to help ppl now, they may say if when they made the calculations all they had was my 2018 returns and I wasn’t eligible, I have to wait to see my returns in 2020 to ask for an adjustment, (which I don’t know yet if I’ll be eligible)

Small businesses can apply for an emergency grant of up to $10,000, anybody has more info on this? What’s considered a small business and how to apply?

TIA

So, my situation is is that I would get the whole payment if it’s based on 2018 return, but less than half if it’s based on 2019 or 2020. The problem is, I haven’t filed EITHER my 2018 OR my 2019 return. Is there still time to file the 2018 return now, and have it count for determining the payment? I fear that because I can’t e-file it and I will have to mail it, it will take weeks to get processed and the IRS will be sending the checks out before then. Or, as long as the postmark is before the “determination date” (which we don’t yet know when that will be but hopefully after tomorrow), will I later- once my 2018 return is processed- be able to claim the payment based on it, even after they sent most of the checks out? Or will they then tell me, at this point it will be based on your 2020 income? Seems like there’s a lot of things unclear about the timing rules here, hope someone would know. Thanks!

The bill makes a new deduction available — and not just for 2020 — for up to $300 in annual charitable contributions. It’s available only to people who don’t itemize their deductions, and you calculate this new one by subtracting the amount you give from your gross income.

When trying to apply for unemployment, I know many who have got down to around 3/4 of the application, only to get error messages so they were unable to finish. This has happened repeatedly so no application was ever able to get properly submitted.

Any ideas of why this is so?

Thanks and stay safe and healthy!

You must use internet explorer browser.

In confused with the NYS Paid leave law. Is my employer supposed to pay me? Do this means I can’t file unemployment?

@Dan, thanks for all your research on this and for bringing it out in a very clear, understandable way. Keep it up!

just spoke to SBA

they said you can get a loan up to max 2 million

where did you get the info regarding getting 250% of your monthly average payroll up to 10 million?

on the us chamber of commerce website you can find all the info uschamber.com/co

here is the details of all the loan programs available so far

https://www.uschamber.com/sites/default/files/023595_comm_corona_virus_smallbiz_loan_final_revised.pdf

I’m a BMG single bochur (22 years old. Dependant). Do I get any money? I’ve never worked and never filed any taxes.

How so I sign up for the stimulus checks and sign up for Unemployed benefits of $600 per week for up to 4 months for self-employed workers who lose work due to coronavirus?

Does the forgiveness of loans aply to student loans also?

Does everyone qualify for the stimulus checks?

Thank you Mr. Presedent!

My fiancé and I are not married. So he could only claim son as dependent. I have been a stay at home mom for 3 1/2 years. Do I get the 1200 as well, since I have no income?

I got my stimulus check but it only counted myself and my husband. We didn’t get anything for my now 8 month old (he was 5 months at the end of December). Shouldn’t we have gotten $500 for a child under 16?

Iam on SOCIAL security disability and I get the exspress card from social security ! And never filed taxes ! Will my stimulus pay go on my card !