Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Update, 08/17: I had no problem cancelling my subscription online tonight. I just logged in, went to my subscriptions, and clicked to cancel it. It offered to lower the price to $12.95/month but I declined and got an email confirming the cancellation.

———————————————————————————–

Originally posted on 08/13:

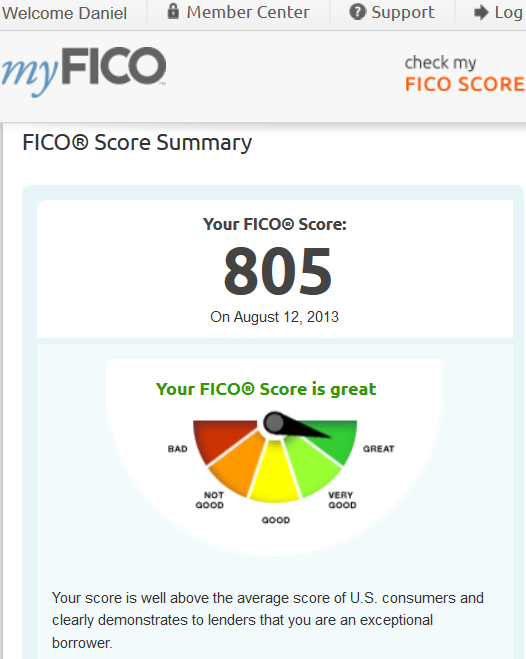

You can check your Equifax FICO score for free from MyFico.

You do have to cancel the service within 10 days in order not to be billed for the service. Checking your own score has no effect on your credit score.

They also sell Transunion and Experian FICO scores but I’m too cheap to actually pay for my score. 99.9% of other scores that you find online are FAKOs or fake scores that are practically meaningless.

I’ll admit that most people’s Equifax FICO score will be somewhat higher than their Transunion and Experian FICO scores, though I don’t think it’s worth spending ~$40 to find out exactly what that difference is. Nor do I think the difference will be that significant in most cases.

My 805 FICO score goes to prove that with proper credit usage and strategies you can rack up millions of miles and have a rock-star score. I may have hundreds of cards on my report but stories about that being bad for your credit score are just fables.

-I pay off nearly my entire bill before the statement closes so that owe just a few dollars or nothing when the statement comes in the mail.

-I never miss a payment.

-I’m careful that accounts that I’m an authorized user on (that my parents set up years ago for my benefit) are also barely utilizing their credit lines.

-If I have purchases that I need more time to pay off I use business cards that don’t report credit utilization to the credit bureaus.

-I apply for cards using 2/3/4BM methods that limit the number of credit pulls you get for multiple card applications from the same bank using multiple browsers at the same time.

-I avoid Capital One like the plague due to them slamming you with 3 credit pulls for one card.

-I don’t worry about the effects of closing a card as closed cards stay on my report and help my average account age for 10 years after they’re closed. Once 10 years go by I’ll have other cards to take their place.

-I do try to salvage and transfer credit lines before closing a card as those disappear when a card is closed.

-I took out a car loan and paid it off early to take advantage of financing rebates and to add another type of loan account to my credit profile.

So, what’s your FICO score? You can see what DDF members reported in this thread.

![[Final Days To Transfer Before Emirates Transfer Pause, 1 Month Left For Alaska Transfers] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Final Hours!] Rare Bonus: Earn Up To $300 With A CIT Bank Platinum Savings Account!](https://i.dansdeals.com/wp-content/uploads/2025/03/04163028/WhatsApp-Image-2025-03-04-at-4.30.19-PM-595x150.jpeg)

![[Final Days To Transfer Before Emirates Transfer Pause, 1 Month Left For Alaska Transfers] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

107 Comments On "What’s Your FICO Score?"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

The link for a 10 day trial doesn’t work. Any other link?

@sol:

Works for me.

What is Considered a good credit score

@Joey: 680-720 is good. 720+ is considered excellent.

@dan It says i need top call to verify identity- is that a pain?

@Sol works for me 2!

@Dude notice how the picture has a meter?!!!

@Dan if i used the MYFico trial a few years back and then cancelled, can I do this again?

i did it and forgot to cancel with in 10 days. so called them and they said i have to pay for three months min before i can cancel. thats 45 bucks

@dan whats the advantage to paying off most of your bill before the statement comes? is that so it doesnt look like you are utilizing that much of your credit limit? they only look at the final statement?

Dan

Yes – I pay off the card before the statement close date.

What % should I leave as outstanding balance so they see that I am using and paying off the card?

Be aware that you have to call to cancel. You cannot cancel online and if you don’t cancel the free trial you will automatically get charged 14.95 a month.

@Dang!:

You should be able to.

@servme:

That’s why Citi Virtual Card Numbers was created

@marc:

Correct.

@JP:

A few dollars is fine.

im at 787

so you dont want to wait until your statement comes out to pay it all, but you dont want to pay it all beforehand either? i guess just leave a few dollars behind

dan is there any point in keeping it open for 10 days?

why wont someone just cancel immediately after?

you can call any mortgage broker or lender and they will run your credit report for you for free or you can get a free report at http://www.annualcreditreport.com

Thanks.

Just keep in mind that you must call (and wait on the line…)to cancel subscription.

Hey dan I see that it is saying i only have 2 inquires in the past year both from chase… I should have at least 1 from Amex… I live in maryland, and the report is from equifax, any info you can give me as to why? THANKS!

@Lender:

-If a broker pulls your score it will count as a hard pull which will cost you points.

-AnnualCreditReport.com does not give you a score.

@SrulyP:

They pull from Experian.

@Chezky: Are you sure about that?

I cancelled online and got a confirmation email that my account has been cancelled. Are you telling me I need to call as well?

I am curios after all your inquiries how great your credit is. (Don’t mind the personal….)

800 is mine

I noticed that last bit at the end about taking out a car loan and paying it back early… Care to elaborate?

Never mind. I read the forum.

I recommend http://www.AnnualCreditReport.com it’s free from one or all three agencies. No signing up for anything It is a soft pull as well.

@Ya:

No, of course not.

@My08701:

Huh? It’s right in the post!

@Jack:

You can often get deals for financing a car. You can take a high interest rate and get more cash off up front.

Then just pay it off right away

I’m a car dealership’s worst nightmare.

@My08701:

As I already said, they don’t give you your score.

@Ya: how did you cacel online? when i hit “cancel” they gave me a number to call.

@Dan

I’ve been on hold trying to cancel for over 30 minutes.

When I clicked “Cancel Subscription” on the webdsite, it said that I need to call to cancel.

Does anyone know how I can cancel without out waiting so long, or have another number to call? I called 1-888-577-5978.

i recently used the trial a few months ago, and they said I cant sign up again for this promotion. How do i get around this block? it goes according to SSN

@david

@ya

It took 33 minutes on hold and 5 minutes on the phone with them to cancel.

just sat on phone for 15 minutes to cancel

I just tried searching the forums, but didn’t find such an extensive explanation for why closing a card doesn’t hurt your credit. Dan, you explained in the post that it helps his “average account age for 10 years after they’re closed”. What does this mean? Also, are there any other negatives of closing a consumer card?

Thanks!

@joey

may be because as long as his credit is transferred to another CC he technically doesn’t hurt his CS

getting the call customer service when i try to cancel online. deal killer for me. what a PITA

Can I use the email form to ask them to cancel the trial?

I used a Citibank virtual card number, do you think I even need to cancel if they can’t bill me anyway?

@chaim

as dan has mentioned he uses a VCN therefore he never cancels because they cant bill him anyways

@TRYING TO CANCEL:

I got through in less than a minute and canceling it took less than a minute, but only because they offered me a lower monthly payment of $9.95.

If anyone would like to keep this service I’d suggest requesting a cancellation so that you’d pay less for the service.

This service looks like it might be comparable to lifelock. Does anyone have any idea if they’re better, the same, or not as good?

just for the records; Not true dan! There could be a HUGE dufference between the 3 scores (alk fico of course). Thanks n keep it up

@nomas:

Of course there could be, namely when you are late with payments and it’s not reported to all 3 bureaus.

But in most cases there won’t be a massive difference.

Dan, how do you have 805 even with proper credit usage, aren’t you always a week or 2 after a hard pull ?

@Tim:

That’s why I said my Equifax score would be higher than EX/TU.

@Dan: Dan,if any other bank is pulling a different bureau than Capitol one & also only pulling one score,the fact that Capitol one has pulled the other two also won’t affect it as the new bank only sees one…unless using freezing to force the use of a different agency ,no?

@voldemort:

Say you’re in a state where AMEX pulls from EX, Chase pulls from TU, and Citi pulls from EQ.

How exactly does Crap1 pulling from all 3 not effect you??

@Dan:

Amex just sent me a letter that they’re lowering my credit line based on my FICO of 709. I need to finance a car in the immediate future. What are my prospects for getting a good rate through Honda or the low-APR financing institutions? Any suggestions on what I can do to ‘quickly’ bring up my score by at least 11 points? Thanks!

@Yitz:

Pay off all your credit card bills before the statements close.

bottom line, can you cancel the subscription online or only over the phone????

how is student loans effect the credit score, 300,000$ in student loan (which I am trying to consolidate) no default no late payment all credit cards paid before the bill is out..

do you have a guide on student loans and their effects on the score?

@Dan: That’s a pretty tall order for me at this moment

I’m looking at specials going on now from Honda, but the fine print requires a minimum 720 score to qualify.

Btw, Amex pulled my FICO score from Experian.

Whats the deal with paying off Amex cards before it closes?

And is there a difference between charge cards and regular cards?

I got a free 30 day trail from experian

credit.com updates your score once a month for free,any info on that?

@jack6941: For me it worked online, I got a cancellation confirmation a minute later to my email.

Others are saying it did not work for them. Seems to be YMMV

It made me call. I got through in less than a minute and was on the phone for 1 minute. Thanks Dan!

how do you cancel online?

it brought me to a phone number and thats all

@Ya: @Ya: where on the site did you find a place to cancel?

but cap1 spark-cash gives u 2% CASH back on everything. barclays 2% only helps if you have travel spend>

I see you spoke about authorized users have a very long questions feel free to answer then or anybody else about this interesting scenario Dan or whoever I my friend had never doesn’t have any credit cards so I put him as an AU under my name on a Chase credit card and I have no idea how but he got American Express offer for 50,000 points to my house to my address my question is when applying which address does he use mine or his

Now in my house we got a lot if cc flying and some money owed to Amex

What is your response

659TU and was approved for spg

instantly!!!

for both spg+prg

Never used citi virtual #.

Do you make one and set it to only work for one day, meileh they can’t charge you down the line?

@Eli:

I was able to cancel online

I used mint credit Moniter. They have a 16 day free trial and they give you 3 bureau credit scores, and a detailed report as to how they got to that score. Pretty cool. I hope it’s real… My score is average-good. 1 reason they say my score is lower is because there were 6 credit pulls in the last 12 months, why is that a problem???

@Efraim:

It’s 100% fake.

If you want the real scores get them from MyFico, 99% of the stuff out there is fake.

@dan, why do you think so?? They even listed exactly who pulled my credit report, and it was all accurate info. How do they get that?? And they asked pretty legit questions in order to obtain my score…. Additionally will it hurt my score if I try fiko, even thought I used mint?…

@efraim:

I don’t think so, I know so.

The report is fine but the score is a fake. I can also generate a fake score for you if you would like.

Feel free to ask them yourself if it is your FICO score.

Checking your own score doesn’t hurt your score. That’s true whether you check your fake or real score.

they wouldn’t allow me to cancel on line. I had to call up to cancel. my score? 775

when i tried to cancel right after signing up i got the “call this number” thing. so i waited 3 days and then it let me do it online.

Thanks Dan, i’ll try FIco then, we’ll see the score difference….

@tolch use his legal address. btw an offer in the mail doesnt have anything to do with getting approved for a cc. its only an offer to receive x amount if approved. good luck

I got an email from myfico that my score went down from 791 to 783 for a 1 dollar purchase on a kohls card. How could that be ? (It’s a good thing I didn’t spend $100.)

837 here. Interestingly enough tho it said that my score was this because I don’t have enough ” credit experience “. Huh?

@yide

I would guess it’s bec it heavily affected your utilization ratio.

How much credit line do you have on that card? and what’s your overall credit limit bet all your cards?

I canceled online 20 minutes after I signed up

my score is 806

Steve, my credit line on that card is 2000 dollars. How does 1 dollar affect anything ??

Servme

Ye but he has no credit in his house his parents have no credit in his house he has credit through chase through mr as in au that the prob I just nervous about him he getting denied

@yide its prob bec you never use that card. always pay personal cards in full before statements close

@Yitz:

@Yitz: try to lower your debt per cc to under 50% of ur credit limit, or under 25% (if u can)

is creditkarma also fake it has been quoted in wall street journal and ny times?

What are 2/3/4BM methods?

@Shlomo: Thanks Shlomo. Part of the problem is however that Amex just cut my credit limit by over 80 percent on one card. Talk about getting drastic!

758

Dan,

In the report it rated me as NOT GOOD for amount of new credit cuz I signed up for Chase SP 2 months ago. Otherwise everything else in the report is pretty solid (GREAT payment history, VERY GOOD amount of debt, and GOOD length of credit history). How much longer should I wait before signing up for another card (I wanna get Chase BA before the offer expires)?

I just tried cancelling online and it wont let me. Gave me a phone number and im hold for 20 minutes already

@Shmuel Z:

758 is a top-tier credit score. You will get the best mortgage/car rates with that and get credit cards as well.

Stop worrying

@chaim:

When did you signup?

Hey Dan,

Just wondering… What’s the point of “I pay off nearly my entire bill before the statement closes so that owe just a few dollars or nothing when the statement comes in the mail.”? Don’t you always write that the cc co. may submit the account at any given time during the month, so how does it help to pay early?

best time to call is late at night

@Dan: my score is 758, I had a late payment few years ago for a small amount with Macy’s card because of changing address, I close the I close the account at the time because I was upset with them… I was not really knowing what I was doing then. is the any way remove those late payments? or should I just forget about it?

If they have fixed the website that’s great. I had to call this weekend as the subscriptions page would not load. The young lady couldn’t have been nicer and had me cancelled, with e-mail confirmation, in about 2 minutes. No hard sell, just “Thanks for giving MyFICO a try.”

@avi:

FAKO.

@California Zaidy:

http://www.dansdeals.com/forums/index.php?topic=8028.0

@yankel: Well I got to experience why Dan does this while on my Scorewatch trial last week. My United Chase card, set to autopay the full amount, read a double charge-then credited back to the card-from AirBerlin as a payment and rolled the entire balance ($15G+) over to next month. Chase reported to Equifax and BAM! 10 points gone from my score. I’ll pay attention next time.

Just cancelled online, no problem.

Thanks Dan!

@Rockwall Al: I don’t see how that explains “paying before your statement closes”. If we say that chase might report at any given time, then your paying may not help because they may be reporting the day you had a charge posted, so what has it got to do with the “statement closing”???

@chaim: The same thing is happening to me. I tried twice, going to My Subscriptions – Cancel & I get a pop up box telling me to call a phone # to cancel. They are only open until 6:00 Pacific time so I will have to call tomorrow. I don’t get it!?

P.S. I signed up on August 13.

Called this morning and cancelled. I was offered to keep the subscription for $9.95 per month but declined so they cancelled for me. I asked why some people can cancel online and was told that this is possible only on Sundays. !? Doesn’t seem consistent with what people are saying in this space but that’s what I was told.

I called this morning to inquire if they have a service where I can pay them to bump my score up a couple points. They noted my customer feedback, but politely stated that it is unlikely they will be offering that service LOL

LOL

Used a Citi virtual card number with a $1 limit and didn’t bother to cancel.

Today they cancelled my membership automatically as my card couldn’t be charged

Just reporting that on Sunday you can cancel online w/o a problem. Just canceled 2 accounts.

if you miss the ten days they will BILL YOU FOR THREE MONTHS 14.95 A MONTH . i called them a few times until a rep agreed to refund and cancel . if they say they cant hang up and try again .

Cancelling online said I need to call. I called, 7 minute call and it’s cancelled.

How often can you sign up and cancel?

Dan, please explain what you mean when you wrote

“2/3/4BM methods that limit the number of credit pulls you get for multiple card applications from the same bank using multiple browsers at the same time.”

@DB:

http://www.dansdeals.com/forums/index.php?topic=8028.0

I’ve had credit cards for 10 years and just checked my fico score for the first time today.

Score: 795

Dan, I have a capital one secured mastercard since july 2012, it is my oldest card and pulls up average credit age, but I don’t want to keep this card b/c a) I don’t use it, b) I don’t want to pay yearly fee, and c) I have $700 as deposit that I only get back if I close card. I have about 7 other cards, that I use and get rewards bonuses etc. Should I close this card or look to transfer credit line to another capital one card that has no yearly fees if such a thing exists?

@Dan in your post you mention that you “salvage

and transfer lines before closing a card…” How can I transfer lines of credit?

Dan

Which company is the best most accurate(also cheap) for credit monitoring from all 3 bureaus?

I have signed up now (I didn`t even realize what I`m doing)by “your score and more.com” (I got the link thru coupons mamma which I get emails from them)

after singing up and putting in my phone number like 10 minutes later I start receiving over 20 phone calls from all different interesting numbers telling my wife that I want to apply for a cash loan, I right away cancelled the subscription and coupon mamma, do I have to be scared that I got caught in identity theft? is it related, is this site secure and reliable? (or it just happened now and nothing related) I never received any call like this.

PS I got a fan from your site just a couple months ago and got a nice couple items thru it for good prices.

Thanks

does it still work?

myfico doesn’t have anymore a free trial.