DansDeals will receive compensation if you are approved for a credit card via a link in this post. Terms apply to American Express benefits and offers, visit americanexpress.com to learn more.

Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

On Wednesday, the Wall Street Journal wrote an article titled “The Best Frequent-Flier Awards Programs of 2019.”

On Thursday, the Wall Street Journal wrote an article titled “Sapphire Reserve Strains JPMorgan’s Ties With United Airlines”

You can try opening those links in an incognito browser to read the articles.

The criterion in the first article for what determines the best mileage program is far from what I would use. They calculated the percentage of domestic flights available for 25K or fewer miles and came up with this:

Personally I care more about coach availability within a week of a flight or premium cabin availability in general as those are where airline miles can become insanely valuable. Anyone can buy an advance purchase domestic ticket for relatively cheap, so the miles in that case aren’t as valuable.

The author then talks to the head of United MileagePlus,

While international business-class awards can be very difficult to score, Mr. Covey says United is focusing on award seats in the economy cabin. Even frequent fliers with big mileage-account balances often want to take family and friends on trips with their miles. They’re liable to look for three and four coach seats rather than a business-class ticket that may cost three or four times as much as a coach seat.

In November, United will do away with its award chart completely. “The constraints of the award chart didn’t really match supply and demand,” Mr. Covey says.

With all due respect Mr. Covey, the reason people with high mileage balances are liable to look for 4 coach seats instead of business class is because airlines have made it increasingly difficult to find business saver awards. That is the case even close to the flight when airlines know they won’t sell all of the seats.

United’s award charts had no real constraints. They could have kept the charts, increased the cost of everyday awards, and had frequent award sales below the saver level when they felt like stimulating more demand.

Instead they plan on killing their award charts in November, which means they can devalue without warning. It’s nothing more than spitting in the face of your customer.

The 2nd article is more interesting.

The article quotes a Chase card user by the name of Al Sanzari, who used to have a Chase United Explorer card and a Chase Sapphire Reserve® card. He cancelled the United card as he said,

“There wasn’t anything the United card was doing for me that the Chase Sapphire Reserve® couldn’t.”

If he was a DansDeals reader he would know that is far from the truth. The United card actually has some pretty sweet benefits. Non-elites get access to elite level expanded saver and last seat everyday award availability, free carry-on bags on basic economy fares, free checked bags, free priority boarding, and more. Elites get access to upgrades on award tickets. And everyone gets free clubs passes, Global Entry/Pre-Check, plus 25% off in-flight WiFi, food, and drinks.

Thanks to expanded award availability, your Chase Ultimate Rewards points are far more valuable if you also have a United card, which is why I included it in my Killer Combo/Quinfecta post.

However it’s excusable that Mr. Sanzari didn’t know that as both Chase and United do a terrible job marketing those benefits.

The Sapphire Reserve is not a be all and end all card. In fact Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card both do a great job allowing you to earn bonus points on travel while giving you the ability to transfer Chase points into miles. Plus they both have richer signup bonuses than Sapphire Reserve and have lower annual fees. No annual fee cards like Ink Unlimited and Freedom Unlimited earn 50% more points on everyday purchases than the Sapphire Reserve, while no annual fee cards like Ink Cash and Freedom earn a whopping 5 points per dollar in valuable categories. You’ll want one of the premium cards for transferring points into miles, but they are not great everyday cards.

“United executives have told JPMorgan they believe the Sapphire Reserve card is competing directly with the airline’s cards and siphoning off customer spending, according to people familiar with the matter. While the deal lasts for another six years, according to people familiar with the matter,

United President Scott Kirby has said publicly that the airline has had tough conversations about the JPMorgan partnership and wants to get more money out of it.

The airline has asked JPMorgan to pay it more for miles, among other things, according to people familiar with the conversations. JPMorgan, meanwhile, insists the cards aren’t direct competitors and believes the airline should be doing more to earn traveler loyalty, the people said.”

So United has 6 more years on its deal and wants to renegotiate. Sounds like they hired an NFL agent. In the end, Chase is correct here, United keeps on devaluing their miles and can’t figure out why they’re having a hard time competing with Sapphire Reserve. Could they possibly be this clueless?

I’ve long advised banking “Hybrid points” over locking yourself into airline miles and hotel points. In other words the Sapphire Reserve offers the ability to redeem directly for paid travel at a value of 1.5 cents each (multiplied by 1.5-5 points per dollar earned means a return of 2.25%-7.5% at the minimum) and it offers the ability to obtain even more value by instantly transferring points into a variety of airline miles and hotel points. Or you can even cash out the points at 1 cent each if you so desire.

I’m not sure how United doesn’t understand this, but they keep on proving again and again exactly why you should NOT use their card or any airline card. The United card is worth holding onto for its benefits, but there’s no good reason to use the card over other cards that earn more points per dollar spent and more critically, allow you to keep the points as a hybrid currency so that they are not devalued.

Unmentioned in the article is that United’s $95/year Explorer card isn’t trying to compete with Sapphire Reserve. United’s premium card is their Club card which matches the Sapphire Reserve’s $450 annual fee. However United has obliterated the benefits on that card and continue to make new cuts to their clubs, such as getting rid of showers, eliminating all newspapers in the clubs as of this week, and restricting access to United ticket-holders as of November. The card earns 2 points per dollar on United flights versus 3 on Chase Sapphire Preferred® Card and doesn’t include the protections that Sapphire Reserve provides.

“When the bank launched Sapphire Reserve in 2016, applications for the United cards slowed, according to people familiar with the matter.”

True, the Sapphire Reserve card launched in August 2016 and United thinks the slowdowns in card applications were caused by it. I don’t think it’s fair to blame everything on Sapphire Reserve. After all, Chase Sapphire Preferred® Card has been around for years and also offered more compelling spend benefits while retaining hybrid points.

A more likely culprit is tougher underwriting standards by Chase. For example 5/24 rules were implemented on United cards in May 2016 and surely slowed down the number of new Chase cards that people could open during the same time period as the Sapphire Reserve launch and those rules continue until today.

If anything, United should be lobbying Chase to lift 5/24 rules off of their cards. At the bare minimum, Chase should allow the option for someone to get approved for a card they want and agree to forgo the signup bonus if they are over 5/24 or received the bonus on a card within the past 24 or 48 months based on the card’s bonus rules. AMEX currently has an eligibility popup when you apply for a card and there’s no reason that Chase can’t have the same type of popup asking if you want to proceed without a signup bonus.

“JPMorgan pays United for the miles cardholders accrue. The airline gets paid before customers book flights, and a portion of the miles is never redeemed. United also gets a cut of the swipe fees merchants pay when customers use the cards…

…Sapphire Reserve points are worth 50% more when used to book travel, making the card particularly attractive to frequent travelers who aren’t loyal to a particular airline.

The perks on airline cards have been enhanced in recent years to better compete with banks’ premium offerings. Some United and American Airlines cards, for example, added 2 miles per dollar spent at restaurants last year.”

If United wants to sell more miles, devaluing their program and getting rid of award charts is not the answer. And their cards are setup today are simply not worth spending on. Adding 2 points for dining is laughable when that merely matches Chase Sapphire Preferred® Card (let alone the 3 points offered by Sapphire Reserve) while those points have the advantage of being hybrid points that aren’t subject to be devalued into oblivion by United. If you want United miles you can transfer them there on demand, but there’s zero reason to bank them there.

“Citigroup wants its customers to be able to transfer American miles to its Prestige credit card, according to people familiar with the matter. American hasn’t historically allowed for that.”

That’s fine American. You can lock down your miles for people spending money on your weak credit card offerings and I’ll keep ignoring your miles as there’s no chance that I trust you not to devalue them. I’ll accumulate miles from signup bonuses and that’s about it. Or you can make more money by allowing Premier and Prestige cards to transfer to AA miles as I’d be happy to transfer miles over for a specific redemption.

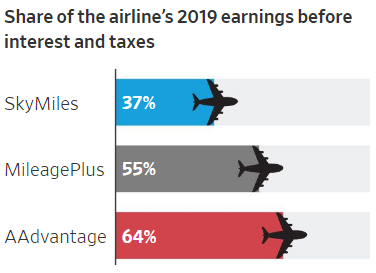

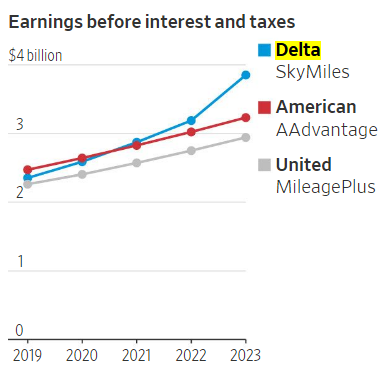

This graphic is pretty incredible. Airlines are becoming flying credit card marketing companies, making billions of dollars on selling miles to the banks:

Earnings from mileage sales are fairly close for the 3 big airlines in 2019 and fall in order of how big each airline is, with American as the largest airline, followed Delta and then United. Delta however project their revenues from mileage sales to skyrocket due to a new deal they inked with AMEX:

I’m sure some will ask how Delta is able to serially devalue their program and still make that kind of money on selling miles. However they have several things going for them:

- AMEX doesn’t have a 5/24 rule, so anyone can signup for a Delta card when they want to.

- They have a more robust card portfolio, with Blue, Gold, Platinum, and Reserve levels of consumer and business cards.

- They offer more reasons to use their cards, including the ability to earn elite status from hitting spending thresholds.

- They recently signed a new more lucrative deal with AMEX, which is possible because they hold a whopping 21% of AMEX lending after AMEX lost the Costco and JetBlue co-brand cards. They gave Delta an incredible amount of leverage in negotiations.

- They are the best operated big airline in the US, which gives them more leverage to sell their cards. Their share of earnings from mileage sales is actually much lower than AA and United, though that’s because they run their airline better than AA and United.

- Delta runs valuable flash sales in Premium and Business class. They seem to actually get what people want, it was enough to make me take a trip to Amsterdam, something I didn’t think would be possible with Delta “Skypesos” in the past.

It’s worth noting that you don’t hear Delta complaining about cards like the no annual fee AMEX Blue Business Plus Credit Card that earns 2 points per dollar spent everywhere and can be used as Hybrid points (with a 35% rebate on paid airfare if you also have the AMEX Business Platinum card) or transferred into Delta or other miles on demand should you need them.

Consumers are slow to react to changes, but Sapphire Reserve proves they know a good deal when they see one.

I believe that cashback cards and banks offering hybrid points are going to continue to steal market share away from airline cards and that’s a good thing. Airlines make billions on their mileage programs and they think they can keep devaluing the programs without the public noticing. But there are more options now than ever and until airlines come up with a way to entice me to spend on their credit card, I’ll keep banking hybrid points and advising others to do the same.

Later this year Qantas will introduce elite benefits based solely on how many miles you accumulate from non-flying activity. Hopefully US airlines are paying attention as that would be a good reason to start spending on airline cards, if they make it more rewarding than earning hybrid points.

However based on United’s clueless responses to the first article, I don’t think they’ll realize that they are actively causing some of the problems that they complain about in the 2nd article.

What is your current credit card spending strategy?

![[Ends Tomorrow!] Transfer Citi Points To Avianca Lifemiles And Get A 25% Transfer Bonus; Save On United Awards](https://i.dansdeals.com/wp-content/uploads/2018/04/05130208/avianca-lifemiles-1176-1024x557-276x150.jpg)

![[Now In Effect] Brazil Will Require Tourist Visas Again](https://i.dansdeals.com/wp-content/uploads/2019/01/21120824/DSC01281a-225x150.jpg)

![[Ends Tonight] United Cardholder Sale: Save On Awards To Latin America](https://i.dansdeals.com/wp-content/uploads/2017/07/13170120/United-Airlines1-267x150.jpg)

Leave a Reply

75 Comments On "My Thoughts On 2 Fascinating Mileage And Credit Card Articles In The Wall Street Journal And What Chase And United Can Do To Fix Their Problems"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

What is the future of the expanded saver award availability in a post-award chart world? Will there still be a saver mileage tier?

Lots of questions. Not many answers.

What happens when they take away an award chart?

Can’t I still look at the day I want to travel and see the available options?

The price will be what they say it is that day. You can’t save up for an award and know what it should cost.

Even now you can’t do that …. What with saver availability being so flighty ( pun intended)

hybrid points it is!

Make those airlines cry

Excellent Analysis. I have to ask, though, since you sometimes get the direct ear of the marketing department, can’t you ask these questions of United? Or like any direct commentary do you have to guard your questions so as not to accidentally offend them? Is it like walking on eggshells if you get the opportunity to have a real-time talk?

I don’t have anyone’s ear like that. I once met the head of United co-branded cards but he just said they’re very comfortable with their offerings.

Absolutely fabulous article! So well thought out. Agree 100% especially the part about Citi and AA “…I’ll keep ignoring your miles as there’s no chance that I trust you not to devalue them.” Well said.

(Just one small favor, next time save such a great read for a regular weekday, not an erev Shabbos! But thanks a bunch anyway!)

Thanks.

You can always come back and read DD after Shabbos

isn’t the DD trade marked to dunkin, I hope you don’t get sued

Aren’t they just D now

That’s what I’m doing now for the comments

Would you say getting and spending on Delta Amex is worthwhile you don’t seem to advise that much

Not unless you need elite status. Blue Business Plus earns 2 miles per dollar everywhere!

Is Blue Business Pkus better than Chase Ink Business Cash card?

My everyday spending goes to my amex blue business then transferred to Delta if I need delta miles.

I currently have around 127K moles I my acct. Mostly because if sign up bonus.

What can/should I do with them? I basically only fly business to Israel once a year & I just took advantage of the amex/quantas/elal deal. In general saver awards on that route isn’t great for premium. Any ideas what to do.

I do have quite a bit of ultimate rewards but how can I combine the miles to that?

127K in which account?

In the united mileage.

Dan you should write as a consultant for the Wallstreet Journal!

At least for their travel articles…

Feel free to suggest it to them.

The article finishes Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and David Benoit at david.benoit@wsj.com

Send them a link

You really should reach out to those reporters. You have no idea how much influence the WSJ has on corporations. They really listen when the WSJ digs in. I know this first hand.

you would be a good lawyer!

But I like working from home

from Qsuites

Amazing article, I’m sure many airline exec. got a link to this article in their inbox and hopefully it’ll open their eyes a bit.

Dan- Your knowledge on credit card points and miles is second to none. Not everyone who is smart and has a tremendous amount of knowledge is a good teacher. You have a way of making it very clear for the reader to understand. Much appreciated!

Q: Does Chase have a “maximum” for the amount of cards you can have? I have 3 UR Personal, 2 UR Business, 1 hotel, and 1 airline card with them. 7 total. I have a great relationship with them as I use them for banking as well and don’t want to ruin it. Would you refrain from signing up for another card or two if not in 5/24?

Sorry about the long post but your opinion would be greatly appreciated!

There is no max. I have more than a dozen!

Banking with Chase doesn’t increase your relationship status – it can possibly easily kill it. Read DDF for more on this.

Can you please share a link? Thanks!

Banking in and of itself can certainly help. Risky banking can certainly hurt.

I’ll second that , I used to have like 6 cards and was doing well w points and then I think I cashed a $25 check via mobile app and it Sisyphus for some reason and I cashed it again in atm … and I suspect it was the reason for me getting a closure letter for my bank a month later … followed by a closure letter for my credit Cards 2 months after that ….. they sent me a letter saying they are ending their relationship with me… no explanation.. and I was never able to shed light on it ever since … Dan if you have any thoughts I would greatly appreciate it…. but any way guys be careful w chase , you don’t have to do something intentionally wrong , anything that raises a flag will get you cut off for life

the bottom line is delta devalued their miles and still are raking it in from their mileage program

It’s a fair argument, which is why I discussed that in the post.

Someone should’ve told Al Sanzari that’s there’s no reason to close the card, he could’ve downgraded to the no annual fee Milage Plus card and still get expanded availability.

They actually do take away the expanded availability, but it stays for quite a while after you downgrade.

I think that one has no expanded availability.

Correct.

I sign up to collect airlines miles sign up bonus but all my spending are going to my amex blue business/chase freedom/Barclays arrival plus (everyday), ink business (Office depot/Staples), Chase Sapphire reserve (dining). I don’t spend a dime on any of the airline credit cards I have.

Freedom Unlimited for everyday I hope

Sounds like a good strategy.

Yes I went from the regular Freedom to the unlimited.

Excellent article!

Thanks!

An utterly savage and entirely deserved evisceration of both United and American. Well done.

Thanks

Hi. Is there any way to contest the 5/24 in opening another business card from chase or any other bank?

Sure. Call reconsideration.

the article says that the airlines share in the swipe fees for transactions on their card

do they also share in the annual fees meaning does the airline get a benefit if i have the card even if i never spend on it

They do share annual fees as well.

Is there anyway, if one gets the popup from AMEX explaining non-eligibility for sign-up bonus, to still get it after applying through Recon?

Next recession I think airlines will drastically increase the value proposition. Flights are being sold for cash or insane amounts of miles. So while Airlines complain now, there’s no real impetus for them to take real action on the value proposition front until they’re desperate for cash. IIRC AA sold those lifetime tickets during recessionary times. IINM many of the benefits that are now disappearing were enticements implemented around the last recession.

Very thoughtful and informative article.

One comment however.

The supposed benefit of expanded award availability is a marketing gimmick of United that we all fall for.

It’s just another way to keep cardholders when these saver awards should already be available for all. I don’t see this as really expanded, because without it availability is truly pathetic. So they are offering mediocre availability and then calling it a perk.

United saver availability without the card is still better than what the competition offers.

With the card it is significantly better.

I cancelled my Chase Club card earlier this month, and replaced it with Sapphire Preferred. As you note, UA has eviscerated the Club card benefit.

I haven’t seen saver availability drop for the routes I monitor. Then again, when it’s bad to begin with…..

Dan, Great analysis. I’m glad the mainstream press is finally picking up on the lunacy of airlines that continue to devalue their loyalty programs and expect consumers not to be able to read between the lines. Why doesn’t United follow what Hyatt did to combat the reserve by offering 4 miles/$ and basic status plus, as you mentioned the ability to earn higher status or more lounge passes through spend?

I’m a little confused. If Chase is paying United fr each mile earned by credit card users, then wouldn’t it be in United’s best interest to make earning potential on the card as high as possible ? So to say it is laughable that United would only offer 2x on dining (matching the preferred and 1 less than the reserve) would mean that Chase is likely not willing to offer more than that, as United would be happy to have the user earn more miles as Chase pays for them. I must be missing something.

United has to find a way to compete. I suggested offering elite qualifying miles as Delta does or making an elite level based on spending as Qantas is planning on doing. Southwest offers the companion pass for spending on their cards.

Dan,

Any chance u have some connections with other star alliance partners? Any way they can pressure united to keep a uniform award chart. With the new system, all other mileage programs lose their value tremendously. Once united raises from 12.5k, even to just 13k, it automatically prevents those award tickets from being available to other mileage partner programs

Dan, you keep on saying freedom unlimited is the best card to use for everyday spending as you get 1.5. shouldn’t the best card be the amex blue business as you get 2 per dollar?

1.5 transferred to the Reserve account books travel at 1.5 per point. Total = 2.25 per $ spend

Blue business gives 2 points and used with amex business platinum is worth 35% more…..

35 with your airline of choice, no?

You can change the airline of your choice by chatting.

Good for all airlines in business/first.

1. Freedom unlimited combined with Sapphire Reserve gives you 2.25 cents per dollar spent when redeeming through Chase for travel.

2. Not everyone has a business, and officially one isn’t supposed to use a business card for personal spending.

What I don’t understand is Freedom Unlimited is 1.5 and SR is 1.0. Do they figure bigger spenders are not the target market for the card. Many years ago before 2% cards and when points were 1-1 airline or points I was offered AMEX black. When I heard it was 1 point per dollar spent I said forget it. If that card was 2/1 I would have gotten it. Back in those days the extra points would have been worth a few grand in costs for me.

Same reason why AMEX Blue Business offers 2x while Platinum offers 1x. They don’t want to give away the farm to everyone, they make you work for it.

Doesn’t the United card have an additional advantage in that it offers primary rental car insurance , rather than secondary? Thanks for your insights

Sapphire Preferred and Reserve are primary as well.

Mostly agree on your conclusions. Chase used to lead the CC world for some years, but now getting edged by Amex, and Citi is still well behind the game of those two. But recent cut in benefits on Citi and some other MasterCard benefits showing the trend for banks to cut expenses where they feel they can (without loosing too much customers). But just like greedy airline CEOs, with despicable award charts or lack of it, banks are wrong by not counting the consequences of their bad behavior toward loyal customers. Annual fee paid for benefits – no valuable benefits means not many consumers are gonna keep paying fees – total lose for banks. Simple economics that bank CEOs don’t comprehend. But the free market with balance itself.

Erica Johnson, Chase Executive Office, Chase-United Loyalty, Customer Relations

1-888-214-7712 x 6548050

What are hybrid points?