Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Update: The Chase World Of Hyatt Business Credit Card 75K intro bonus will end today at 4:59pm EDT!

Here is a comparison chart of the Hyatt consumer and Hyatt business card:

Originally posted on 10/7/21:

Earn 75,000 Bonus Points With The Brand New Chase World Of Hyatt Business Card!

Table of Contents

World Of Hyatt Business Card Intro Signup Bonus

Signup for the brand new Chase World Of Hyatt Business Credit Card and earn 75,000 bonus points for spending $7,500 in 3 months. Plus cardmembers who apply by 12/31/21 will receive a complimentary one-year Headspace subscription. The Headspace subscription must be redeemed by Dec. 31, 2022.

World Of Hyatt Business Card Annual fee

$199

Previous cardholders

- This is a brand new card, so everyone will be eligible for this bonus.

- You can get the bonus on this card even if you currently have the consumer World Of Hyatt Card.

5/24

Typically, Chase cards are be subject to 5/24 restrictions, meaning that you are not likely to be approved if you have been approved for 5 or more consumer credit cards in the past 24 months. Note that the Chase system automatically counts cards like authorized user cards and store cards as cards that count towards 5/24, but if you explain to Chase that those cards are merely authorized user cards or store cards they can manually approve you for a new card.

However there have been many reports of 5/24 rules being waived for co-brand consumer cards. Post a comment if you’re over 5/24 and are approved for this card!

You can check your credit report for free at the federally authorized annualcreditreport.com to check how many accounts are shows as being open in the past 24 months.

It’s important to note that business cards from most banks, including Chase business cards, do not get added to your 5/24 count of recently opened cards. That’s because business cards from most banks don’t show up on your personal credit report and the 5/24 count is based off of your personal credit report. That means that applying for these cards won’t “hurt” your 5/24 count.

Annual Hyatt Credit

Cardholders will get a $50 statement credit when spending $50 or more at any Hyatt property worldwide, starting when they open their card and valid up to two times each anniversary year.

Most Hyatt hotels sell gift cards, so even if you don’t have Hyatt stays, you should always be able to just walk into any Hyatt and purchase 2 $50 gift cards in separate transactions to trigger a $100 statement credit. That lowers the effective annual fee to just $99.

Elite status for all cardholders and for 5 employees

The card gives Discoverist status, which gives free premium internet, 10% bonus points at Hyatt hotels, free bottled water daily at Hyatt hotels, and 2PM late checkout.

You can also gift 5 company employees with Discoverist status.

World Of Hyatt Business Card earnings

- 4 points per dollar at Hyatt hotels.

- 2 points per dollar for fitness club and gym memberships.

- 2 points per dollar in your top 3 quarterly categories through 12/31/22 from the following categories (Effective 1/1/23, earn 2 points per dollar in your top 2 quarterly categories). No registration is required and there is no category earning cap.

- Dining

- Airline tickets purchased directly with the airline

- Car rental agencies

- Local transit and commuting

- Gas stations

- Internet, cable and phone services

- Social media and search engine advertising

- Shipping

- 1 point per dollar elsewhere.

The last of the valuable hotel point currencies and waived resort fees

After the Starwood merger, most hotel points are now worth less than 1 cent each. I value Hilton and IHG points at about 0.45 cents, and Marriott points at about 0.65 cents each. I’d value Hyatt points at about 1.55 cents each, making them by the far the most valuable hotel points.

While chains like Marriott tack on massive resort fees and destination fees onto award nights, an awesome feature of the Hyatt program is that they waive resort and destination fees on award nights.

Faster Path To Hyatt Elite Status

Hyatt elite status works by calendar year. For example, if you earn enough elite qualifying nights from a combination of paid stays, award stays, and credit card spending in 2022, your status will last until 2/28/24.

The card gives 5 elite night credits towards elite status with every $10,000 that you spend.

That compares favorably compared to the 2 elite night credits for every $5,000 offered by the consumer card, though the consumer card offers 5 nights just for having the card, something the business card does not offer.

Paid and award stays at Hyatt hotels combine with night credits earned with the credit card.

- Discoverist status requires 10 elite qualifying nights. This status is free for World Of Hyatt cardholders.

- Discoverist status gives 10% bonus points on stays, free premium in-room internet, free bottled water, preferred room upgrades, elite checkin, 2pm late checkout, and bonus AA miles on stays.

- Explorist status requires 30 elite qualifying nights.

- Explorist status gives 20% bonus points on stays, free premium in-room internet, free bottled water, room upgrades, elite checkin, 2pm late checkout, guaranteed hotel availability 72 hours in advance, and bonus AA miles on stays. There isn’t a big difference between Discoverist and Explorist.

- Globalist status requires 60 elite qualifying nights.

- Gloablist status gives 30% bonus points on stays, waived resort fees on all stays, waived parking fees on award stays, club access or free breakfast, free premium in-room internet, free bottled water, suite upgrades at checkin, elite checkin, 4pm late checkout, guaranteed hotel availability 48 hours in advance, and bonus AA miles on stays.

- Globalists can also book a “guest of honor award” to allow another person to be treated to all Globalist benefits for an award stay when using the Globalist member’s points.

- Many Hyatt hotels will also buy Globalists free kosher breakfast where available. I’ve taken advantage of free kosher breakfast in Buenos Aires, Cleveland, Hawaii, Los Angeles, Melbourne, New York, Paris, Sydney, and many more.

Thanks to earning Hyatt Globalist status, I was also given top-tier American Executive Platinum status! Hyatt elites also get perks and challenges to earn AA status.

Hyatt Milestone Tiers

Hyatt also offers great bonuses for hitting tiers of elite qualifying nights in a calendar year:

- Earn 20 elite qualifying nights and you’ll get 2 club lounge awards that are valid for club access for the duration of your Hyatt stay.

- Earn 30 elite qualifying nights and you’ll get 2 more club lounge awards, and a free night at category 1-4 hotels.

- Earn 40 elite qualifying nights and you’ll get a $100 Hyatt gift card or 5,000 bonus points.

- Earn 50 elite qualifying nights and you’ll get 2 confirmed suite upgrades that are each valid on paid or award stays of up to 7 nights.

- Earn 60 elite qualifying nights and you’ll get 2 more confirmed suite upgrades on paid or award stays, a Hyatt concierge to take care of your every Hyatt need via email or private phone line, and a free night at category 1-7 hotels.

- For every additional 10 elite qualifying nights you’ll get another confirmed suite upgrade or 10,000 Hyatt points.

Award Rebates For Big Spenders

If you spend $50,000 on your World of Hyatt Business Card during a calendar year, in addition to earning 25 elite qualifying nights, you will immediately be eligible for a 10% rebate on the rest of your Hyatt redemptions for the remainder of the year. You can get a rebate of up to 20,000 points per calendar year on up to 200,000 redeemed points. The rebate will apply to stays that were booked before you spend $50,000, as long as the stay is completed after you spend $50,000.

You will get an email when you complete the $50,000 of spending and Chase will have a tracker so that you know how close you are to hitting the $50,000 annual spend threshold.

Increased Promotions And Rebates For Cardholders

Hyatt often offers increased point offers for cardholders staying at Hyatt hotels.

Hyatt also often offers point rebates on awards to cardholders. If you spend over $50K in a calendar year then you can stack your 10% rebate with the general rebate that Hyatt offers to cardholders.

Waived Requirements For Hyatt Leverage

Businesses can sign up for Hyatt Leverage to receive up to 15% off standard paid hotel stays. You’ll get a code and the discount will show up in search results:

The Leverage program requires that you have 50 company stays in the prior year to continue using the program, but the stay requirement is waived for World of Hyatt Business cardholders.

Card Benefits

- Complimentary roadside dispatch

- Primary rental car collision damage waiver

- Extended warranty protection

- Purchase protection

- Trip cancellation/travel interruption insurance

- Travel and emergency assistance services

- No fee for employee business cards

- No foreign transaction fees

Point transferability

Hyatt points can be transferred between members without limits, free of charge.

You can also transfer points from Chase Ultimate Rewards to Hyatt instantly at a 1:1 ratio. This is a much better value than Chase Ultimate Rewards transfers to IHG and Marriott as Hyatt points are far more valuable than IHG or Marriott points.

Stay In 5, 10, Or 15, 20, Or 25 Hyatt Brands And Earn Free Nights

Hyatt’s 26 brands include:

- Hyatt

- Hyatt Regency

- Grand Hyatt

- Hyatt Place

- Hyatt Residence Club

- Hyatt House

- Park Hyatt

- Hyatt Centric

- Ziva

- Zilara

- Miraval

- UrCove

- Andaz

- Alila

- Caption by Hyatt

- Thompson

- Unbound Collection

- Destination Hotels

- joie de vivre

- Alua

- Secrets

- Dreams

- Breathless

- Zoëtry

- Sunscape

- Vivid

Stay at any 5 brands over the life of your account and you’ll earn a free category 1-4 night. Earn another free night when you hit 10 or 15 brands!

Business card info

This is a business card, but you may already have a business that needs a card to keep track of expenses. For example if your name is Joe Smith and you sell items online, or if you have any other side business and want a credit card to better keep track of business expenditures you can open a business credit card for “Joe Smith” as the business. You don’t need to file any messy government paperwork to be allowed to do that. Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field.

If you have business paperwork you can apply under your business name. Otherwise, it’s critical to just write your own name as the business name if you are just applying for your own small business as a Sole Proprietorship that doesn’t have any business paperwork. You can then send in bills in your own name for verification.

Another benefit of a business card is that it doesn’t report spending on your personal credit report. When you spend money on personal cards your credit score will be hurt even if you pay your bill on time. A whopping 30% of your credit score is based on credit utilization. You can pay off your card bill before your statement is generated to avoid that, but that takes effort and laying out money well before you have to. Additionally it’s good to have the statement close with a couple dollars to show the card is active and being paid every month. On an business cards from banks like AMEX and Chase it’s just not reported, so you can wait until the money is due without it having a negative effect on your score. That also means if you close the card, it won’t have an effect on your credit score.

Here is the Hyatt award chart and how many free nights you can earn with the card

Here is the Hyatt award chart for standard hotels:

And here is the Hyatt award chart for all-inclusive brands:

Hyatt has added the ability to book suites with points online.

You’ll need 35-45K points for a category 8 SLH hotel like the Park Hyatt Paris, Sydney, Tokyo, Norman Tel Aviv or Canaves Oia Suites Santorini where paid rates can cost up to $1,500/night. View category 8 hotels here.

You’ll need 25-35K points for category 7 hotel like Park Hyatt Maldives where paid rates can cost up to $1,500/night. It’s also valid for SLH hotels like the Ca’ Sagredo Hotel in Venice, which is just half a mile from Gam Gam and Chabad of Venice, where there are delicious meals to be had on weekdays and Shabbos. View category 7 hotels here.

You’ll need 21-29K points in a category 6 hotel like the American Colony Hotel Jerusalem, Andaz Amsterdam, Grand Hyatt Kauai, Park Hyatt Chicago, Park Hyatt Vienna, Hyatt Huntington Beach, Park Hyatt Aviara, Andaz Mayakoba, Park Hyatt Abu Dhabi, Hyatt Regency Maui, Park Hyatt Buenos Aires, Park Hyatt Toronto, or Andaz 5th Ave, where paid rates can cost up to $1,400/night. View category 6 hotels here.

You’ll need 20K points for a category 5 hotel like The Confidante Miami Beach, Grand Hyatt Baha Mar Bahamas, Grand Hyatt Seattle, or the Park Hyatt Melbourne, where paid rates can cost up to $800/night. View category 5 hotels here.

You’ll need 15K points or an anniversary night in a category 4 hotel like the Grand Hyatt Washington DC, Hyatt Centric Center City Philadelphia, Hyatt Place Long Island City / New York City, MGM Grand Las Vegas, Hyatt Regency Boston Harbor, Hyatt Regency Amsterdam, Hyatt Regency Paris Étoile, Hyatt Regency Hong Kong, Grand Hyatt Dubai, Grand Hyatt Seoul, Grand Hyatt Melbourne, Hyatt Regency Tokyo, Hyatt Regency Sydney, Hyatt Regency Hong Kong, Altstadt Vienna, Akyra Manor Chiang Mai, or the Grand Hyatt Taipei, where paid rates can cost up to $700/night. View category 4 hotels here.

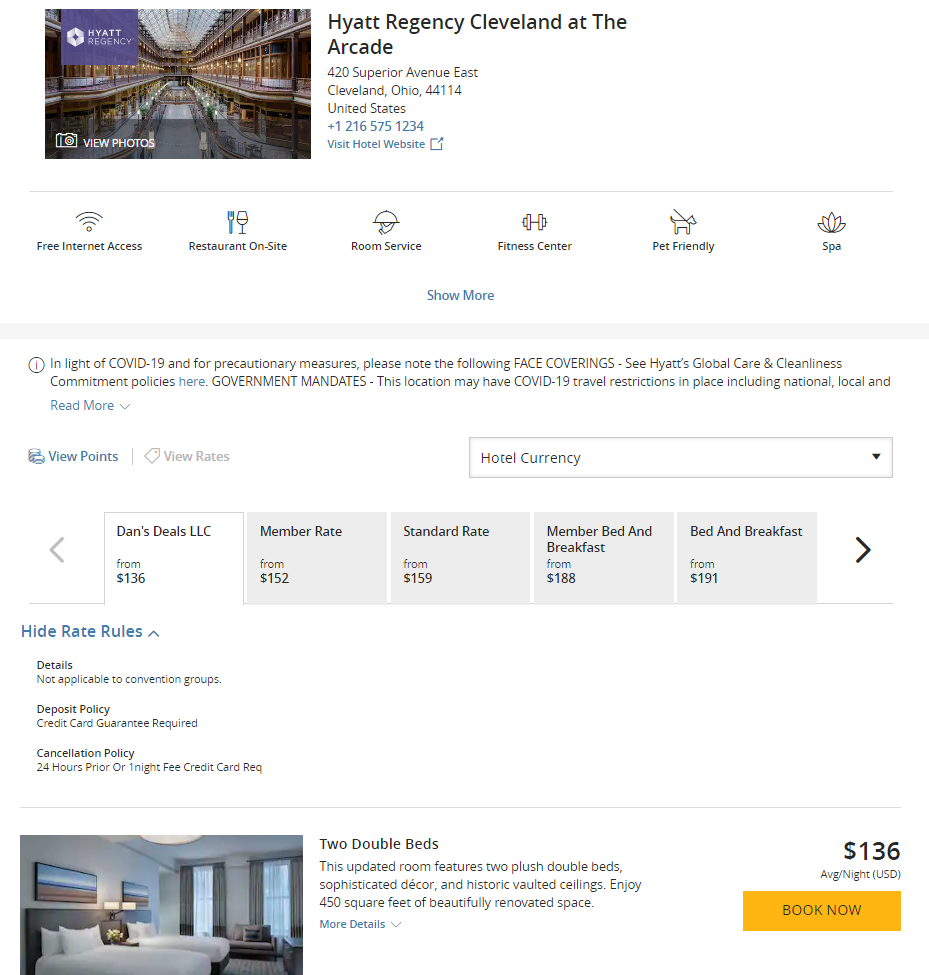

You’ll need 12K points in category 3 hotels like the Hyatt Regency JFK Airport at Resorts World New York, Hyatt Regency Toronto, Grand Hyatt Denver, Hyatt House Anchorage, Hyatt Regency Cleveland at The Arcade, Hyatt Regency Morristown, Grand Hyatt Atlanta, Hyatt House across from Universal Orlando Resort, Hyatt Regency Phoenix, Hyatt Palm Springs, Hyatt House Los Angeles/El Segundo, Hyatt Place LaGuardia Airport, Hyatt Place Niagara Falls, Hyatt House Austin/Downtown, Hyatt Place Waikiki Beach Honolulu, Hyatt Regency Casablanca, Hyatt House Fort Lauderdale Airport & Cruise Port, Park Hyatt Mendoza, or the Grand Hyatt Rio de Janeiro, where paid rates can cost up to $500/night. View category 3 hotels here. These hotels are eligible for the anniversary free nights as well.

You’ll need 8K points in category 2 hotels like the Hyatt Place Cleveland/Legacy Village (the only hotel within walking distance of the local Jewish community), Hyatt Place San Diego/Vista-Carlsbad, Hyatt Place Pittsburgh South/Meadows Racetrack & Casino, Hyatt Regency O’Hare, Hyatt Regency Johannesburg, where paid rates can cost up to $400/night. View category 2 hotels here. These hotels are eligible for the anniversary free nights as well.

You’ll need 5K points in category 1 hotels like the Hyatt Place Pittsburgh Airport, Hyatt Place Mt. Laurel, Hyatt Place Panama City/Downtown, Park Hyatt Chennai, Hyatt Place Frankfurt Airport, Hyatt Place Amsterdam Airport, Hyatt Place London Heathrow Airport, Grand Hyatt Bali, or the Hyatt Regency Bali, where paid rates can cost up to $300/night. View category 1 hotels here. These hotels are eligible for the anniversary free nights as well.

The Park Hyatt Sydney and Sydney Opera House, as seen from the Sydney Harbour Bridge, January 2011:

Not a bad view from your room!

Dan’s Quick Thoughts

I’m somewhat underwhelmed by this card offering, though perhaps that’s because of how generous the World of Hyatt consumer card offering is. There are no free nights or elite qualifying nights for being a cardholder and the rebate for $50K of spending is capped too low.

The main benefit for this card will be for those who spend their way to top-tier Globalist status. On the World of Hyatt card in a normal year, that requires $140,000 for 56 nights, plus the 5 nights that come with the card to get to Globalist. Of course that number goes down if you spend paid or award nights in Hyatt hotels.

On the World of Hyatt Business card in a normal year, that requires $120,000 for 60 nights to get to Globalist. Or if you have both cards, you would need $110,000 of spending to get 55 nights, plus the 5 nights that come with the consumer card to get to Globalist.

The 75K signup bonus is good, but I’m not sure if the card benefits will justify the annual fee for all except big spenders gunning for Globalist.

It’s worth noting that the Ink Business Cash® Credit Card and Ink Unlimited cards also offer 75K points for $7,500 of spending in 3 months, but those cards have no annual fee.

Will you apply for the World of Hyatt Business Card?

![[Cardholders Register For 11 Bonus Points Per Dollar] Hyatt Launches Under Canvas National Park Glamping Partnership](https://i.dansdeals.com/wp-content/uploads/2024/07/26004607/Outdoor_Dining_Area_licjda-267x150.jpg)

Leave a Reply

18 Comments On "[Less Than 1 Hour Left!] Intro Bonus: Earn 75,000 Bonus Points With The Chase World Of Hyatt Business Card!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Very weak!

Just to confirm, this year this card would let you spend your way to globalist by spending $60k…in a regular year its $120K….but in any case this is the only hyatt card that will give you globalist for spending

Weak in general. But as an introductory offer, pathetic.

For same amount of points just stick to INKs for no annual fee.

“Here is the Hyatt award chart that will go into effect for stays starting in March 2022. Until then, there is just standard award pricing.”

What? Isn’t it happening in a week or so?

Clarified that language, thanks.

mo annual free night ?

For globalists 3 nights at a Cat 6 easily worth $3k plus on the sign up bonus! Awesome!

The fact that you can earn 2x at gas really changes the calculus of the opportunity cost in spending to Globalist. Big plus over the consumer card.

I’d probably spend $15k on the consumer card + $100k on the biz card for globalist status + a cat 1-4 cert. Slightly more efficient (depending on how you value the cert) since you overshoot Globalist by just 1 night rather than 5.

This card is surprisingly underwhelming.

מענין לענין

Any word on the JetBlue card 70000 offer?

Wait for the 100K to return?

Oops..

I applied today..

Should I (can i) cancel?

@Dan

tempting for the bonus and the fact that its a business card won’t impact 5/24.

Question – what do you mean by “These hotels are eligible for the anniversary free nights as well.” Seems the card only has $50×2 credit.. what free night? that would make the card a keeper.

Dan do you suggest waiting for the new offer or getting this one?

Typically, Chase matches better offers on non-Sapphire cards. So better off taking the current offer.

Thanks!

Just in case anyone was wondering, I’m 7/24 and applied for this card recently but was denied due to “too many accounts opened last two years bla bla bla” contrary to 3 months when I was also 7/24 but was approved for a chase card. Sad that the 5/24 loosening seems to be over perhaps

5/24 was loosened on consumer cobrands, but there haven’t been many business DPs