Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Update, 5/2: Starting today, cardholders now get 25% back as a statement credit on premium drink purchases made in United Clubs.

This highest offer ever ends Wednesday.

Originally posted on 3/22:

Earn 120,000 Bonus Miles For Spending $6,000 On The United Club Infinite Card

Table of Contents

Limited time signup bonus

From today through 5/4/22, you can earn 120,000 bonus miles for opening a United Club℠ Infinite Card and spending $6,000 within 3 months.

The United cards have some of the best perks for travelers out of all the airline cards, making them a must have for anyone flying on United. All of these United cards offer expanded saver award availability, an incredible perk that no other airline card offers!

While United miles are not as valuable as they used to be, they no longer expire and there are advantages to using miles over cash or bank points.

When you use cash or bank points you won’t get benefits like free bags for using your United card, whereas with miles you can put the taxes on your credit card to get those benefits.

Plus, you can cancel award tickets for free 30+ days before your flight and get back all of your miles and taxes. As there are free date changes at any time before departure, that effectively means you can always cancel and get back your miles. That’s a huge peace of mind that is hard to calculate and accurately value when comparing the value of a mileage ticket to a cash ticket.

Annual fee

This card has a hefty $525 annual fee, though that’s cheaper than even top-tier United elite members pay for a Club membership, which is included with the card.

Pay yourself back for the annual fee:

You can redeem United miles to pay yourself back for the annual fee at a rate that can vary between 1 or 1.5 cents per mile, depending on your account.

That means you can get this card with no fee for the first year, and still get an effective signup bonus of 67,500-85,000 miles depending on your offer, with a club membership and awesome United travel benefits!

You have 90 days from when the fee is billed to pay yourself back and you can do so even after paying the annual fee.

You can use existing United miles, miles earned from the card’s signup bonus, or you can transfer points from Ultimate Rewards to United to pay back the annual fee.

Welcome bonus terms

- You can receive the bonus on this card if you haven’t received a bonus on a United Club Or United Club Infinite consumer card in the past 24 months and don’t currently have a United Club/Club Infinite Consumer card.

- You can receive the bonus on this card even if you got a United Explorer, Quest, Gateway, or United business card in the past 24 months or currently have one of those cards.

Comparison to previous offer

This card was previously offering 80K bonus miles. The previous highest ever offer was 100K bonus miles.

5/24

Typically, Chase cards are be subject to 5/24 restrictions, meaning that you are not likely to be approved if you have been approved for 5 or more consumer credit cards in the past 24 months. Note that the Chase system automatically counts cards like authorized user cards and store cards as cards that count towards 5/24, but if you explain to Chase that those cards are merely authorized user cards or store cards they can manually approve you for a new card.

However there have been many reports of 5/24 rules being waived for co-brand consumer cards like these.

You can check your credit report for free at the federally authorized annualcreditreport.com to check how many accounts are shows as being open in the past 24 months.

United Club membership

Cardholders get a full United Club membership. You can bring your entire family, or you and 2 guests, to enter over 1,000 United and partner lounges and Star Alliance lounges worldwide when flying United or Star Alliance airlines.

Club membership normally costs $650 per year.

Free Checked And Carry-On Baggage

This card allows the primary cardholder and another passenger on the same record locator to bring 2 free bags worldwide on United, even in basic economy.

This card also allows the primary cardholder and all passengers on the same record locator to bring a free carry-on bag on United, even in basic economy.

- If 2 people bring 2 bags each on a domestic trip in economy, that would normally cost $280 round-trip prepaid or $320 at the airport, but it will be free with the United Club card!

- If 2 people bring 2 bags each on an international trip in economy, that would normally cost $400 round-trip, but it will be free with the United Club card!

- If 2 people bring 2 bags each on an international trip in basic economy, that would normally cost $680 round-trip, but it will be free with the United Club card!

IHG Elite Status And Credit

Cardholders receive IHG Platinum elite status, which gives free internet, 50% bonus points, upgrades, welcome amenity, late checkout, and more.

Plus that status will mean that your IHG points will never expire!

Additionally, cardholders will get a $75 credit to spend at any IHG hotel worldwide in 2022.

Instant discount on select United awards

Cardholders get a 10% instant discount on saver awards within the US48 and Canada. This applies to X class (saver awards available to everyone) and XN class (expanded saver awards available only for United cardholders) flights.

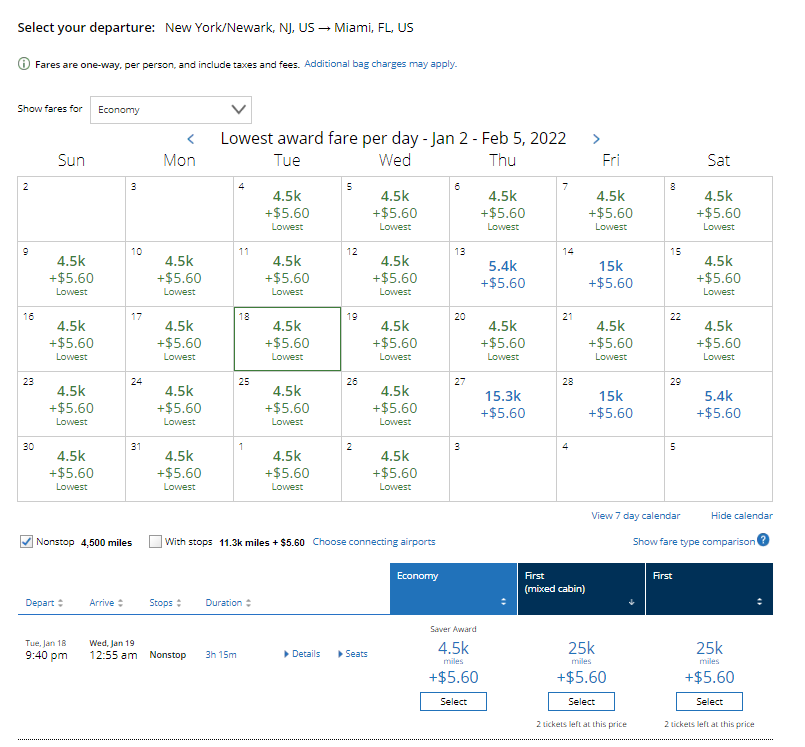

For example a flight from Newark to Chicago or Miami will be 4.5K miles after the discount:

A flight from Newark to Toronto will be 7.5K miles after the discount:

A flight from Newark to Los Angeles will be 9.1K miles after the discount:

Global Entry/Pre-Check Fee Refund:

It costs $85 to apply for a 5 year TSA Pre-Check membership which makes flying pleasant again. Shorter lines, no need to remove your shoes, belt, jacket, or hat. You can keep your laptop and small liquids inside your carry-on. And you go through a good old fashioned metal detector instead of assuming the position in the body scanner. If you charge it on your card the fee will be refunded.

It costs $100 to apply for a 5 year Global Entry membership which lets you bypass the customs line. If you have Global Entry you also get TSA Pre-Check for free.

If you charge it on your card the fee will be refunded. You can get refunded for this charge once every 4 years.

You can read more more about the differences in this post.

My whole family has Global Entry and it sure makes traveling a whole lot easier!

Upgrades for Premier members and a companion on award tickets

Most United cards offer Premier members the ability to get complimentary upgrades on eligible flights when using miles for an economy award.

With the Club Infinite card, Premier members will also have the ability to get complimentary upgrades with a companion on eligible flights when using miles for an economy award.

Card earnings

- 4 miles per dollar on United purchases, including tickets, upgrades, WiFi, inflight food and drinks.

- 2 miles per dollar on all other travel and dining

- 1 mile per dollar elsewhere.

- There are no foreign transaction fees.

Spend Threshold:

You’ll need to spend $6,000 on this card within 3 months for 120K bonus miles.

You can pay your federal taxes for a 1.87% fee. If you overpay your taxes you can request a refund or apply it to your next year’s taxes.

My local natural gas company allows me to prepay up to $1,000 on a credit card for a $1.65 flat fee. That’s a great way to earn miles and help meet a spend threshold. My electricity supplier allows me to pay with a credit card for free as long as I am enrolled in autopay.

See this post for more ideas on meeting a credit card spend threshold.

Card convertibility

You can change between the following card products:

- United Gateway℠ Card (No annual fee)

- Chase United Explorer card ($95 annual fee)

- Chase United Quest card ($250 annual fee)

- United Club℠ Infinite Card ($525 annual fee)

Bonus PQP earnings

While most United cards cap PQP earnings at 1,000 per year, you can earn up to 4,000 per year on this card to help you earn Premier status.

You will earn 500 PQPs per $12,000 spent, so you can earn a maximum of 4,000 PQPs for $96,000 of spending.

You can earn up to 5,000 PQPs per year from card spending across all United cards (grandfathered Presidential Plus PQP earnings are excluded from the 5K cap). Learn more about PQPs here.

Additional cardholder benefits

- Cardholders get a 25% rebate on inflight WiFi, food, and drink purchases.

- Premier Access: Priority check-in, security screening, boarding, and baggage handling privileges, even when flying in basic economy.

- The ability to use online checkin and get a boarding pass in advance on basic economy fares. United does not allow online checkin on basic economy fares unless you have elite status or a United card with free bags.

- This will be a Visa Infinite card, which means it will come with awesome benefits like 3 free years of Shipt for free deliveries from Target stores and more.

- 12 months complimentary Doordash Dashpass.

- $10 monthly GoPuff credit through 12/31/23.

- Primary rental car CDW insurance in every country.

- Trip Cancellation/Trip Interruption Insurance

- Lost Luggage Insurance

- Trip Delay Reimbursement

- Baggage Delay Reimbursement

- Travel Accident Insurance

- Purchase protection for items damaged or stolen within 120 days

- Return protection

- Extended warranty protection

- Exclusive cardmember access to auctions that allow you to use your miles for once-in-a-lifetime experiences. Several years ago I used 25K miles for 4 field box seats to an Indians game along with the right to run onto the field before the top of the 7th inning and swipe 2nd base right off the field. Nobody could believe it as I walked around the ballpark with 2nd base. I even got it signed after the game by the Indians wining pitcher that night, who was equally shocked that I actually had 2nd base.

- United miles never expire, even if you close your card.

Expanded award ticket availability

The reason the United cards are the best airline cards you can get isn’t for the spending benefits, it’s for the perks. And they are awesome.

The United cards are the only airline card that offers expanded award ticket availability.

All 4 of these cards offer this benefit.

This increases the value of your miles significantly and in turn makes the Chase Quadfecta/Quinfecta spending strategy even more valuable.

Cardholders have access to expanded saver coach award availability (XN class), last seat standard coach award availability (YN class), and last seat standard business/first class award availability (JN class).

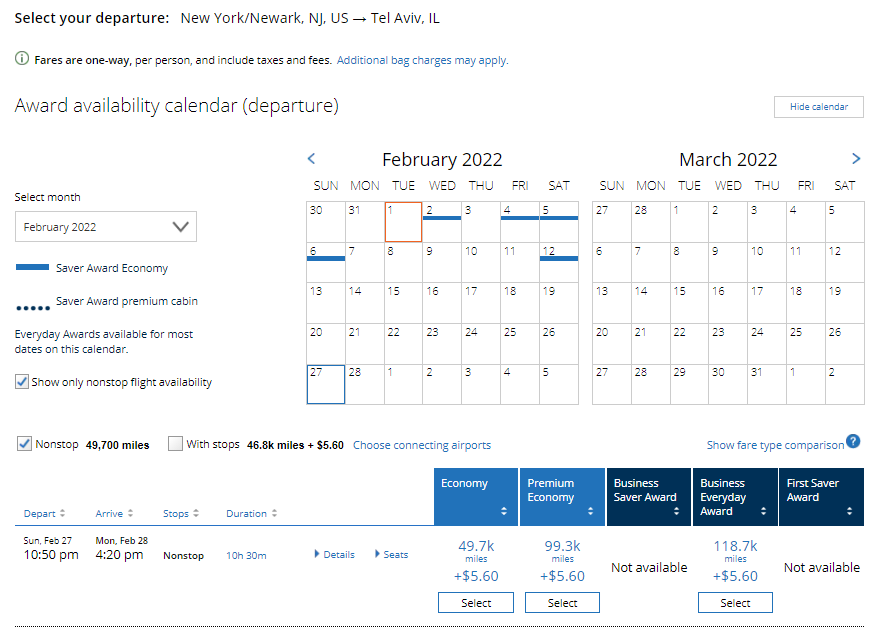

It’s not just slightly expanded. There is a world of difference between the availability that cardholders can access and the availability for non-cardholders.

If you’re not a United cardholder, there are just 5 dates with saver award space nonstop from Newark-Tel Aviv in February-March:

If you are a United cardholder, there are 31 dates with saver award space nonstop from Newark-Tel Aviv in February-March:

Read more about this in the United Expert Mode post.

This availability differential applies to all domestic and international routes and makes it crucial to be a United cardholders.

Expanded Plan B availability

As you have better access to saver coach awards you’ll also have better ability to do Plan B awards.

Plan B allows you to redeem for saver business class awards when there’s only saver coach available! Read more about Plan B in this post.

No airline besides United offers a Plan B style award redemption.

Discounted awards for cardholders

United runs promotions offering discounts on award flights for cardholders.

They have offered these discounts for travel to Tahiti, Ski destinations, Hawaii, Mexico, The Caribbean, and more.

United Cards As Part Of A Chase Quinfecta Strategy

All of the United cards have unique benefits, so which should you get?

That depends on which benefits you value and how much they would cost you otherwise.

It’s worth noting that you can get the signup bonus for each United card as long as you didn’t get the bonus for that exact card within the past 24 months and don’t currently have that exact card.

If you have a United consumer card you can change to any currently offered United consumer card and if you have a United business card you can change to any currently offered United business card. After waiting 3-4 days you can apply for that card again.

It certainly makes sense to have a United card on top of a Chase Quinfecta strategy as just having the card makes your points more valuable. That consists of:

- Sapphire Reserve or Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card for mileage transfers and bonus value on points.

- A no-fee Freedom Unlimited or Ink Unlimited for 1.5 points per dollar everywhere.

- A no-fee Freedom Flex for 5 points per dollar in rotating categories.

- A no-fee Ink Cash for 5 points per dollar on wireless and office supply stores, including gift cards to stores like Amazon and hundreds more.

- Having a United card on top of the cards above creates a Chase Quinfecta as your United miles (and by extension your Chase points) become more valuable thanks to expanded award availability.

Here is a summary comparing what the currently available United cards have to offer:

- If you just want expanded award availability, go for the no-fee United Gateway Card. However you should get a premium consumer card with a higher signup bonus and downgrade the card after your first year as the higher signup bonus will more than offset the first year’s annual fee. Plus you can redeem miles to directly cover the annual fee and still come out ahead.

- If you also want to be able to get a free bag and bypass onerous basic economy restrictions, go for the United Explorer Card or United Business Card.

- If you will be able to take advantage of the Quest card’s $125 and 10,000 mile rebates, then the United Quest Card will effectively be cheaper than the Explorer card, plus you’ll get 2 free bags to boot!

- If you want United Club access, go for the United Business Club Card (Click on apply now to reach this card application) or if you want a consumer card, the United Club℠ Infinite Card.

- The United Club℠ Infinite Card offers a mega 120K signup bonus along with many valuable and unique card perks.

- Grandfathered cards like the old United Presidential Plus card (good for earning more PQPs towards United elite status) and the old consumer United Club card (similar to the current United Business Club card) can’t be had anymore, so think twice before you close those.

Here Is United’s Hidden Award Chart

United no longer publishes an award chart, but rates for United flights found in their old award chart are still correct.

United does charge a close-in mileage surcharge and they can be found in the chart below. Note that the you’ll want to book travel as 2 one-ways to avoid paying the surcharge on the return leg when it wouldn’t apply when booked separately. However if you do that you would lose your ability to take a free stopover.

Partner award rates have gone up and they can be found in the unpublished saver award chart below with one-way rates for flights to/from the mainland US:

| United flights | Partner flights | |

|---|---|---|

| Close-in surcharge within 7 days | 2.5K-3K miles | 1K-3.5K miles |

| Close-in surcharge 8-21 days in advance | 2K-2.5K miles | 1K-3.5K miles |

| Mainland US/Canada | 12.5K Coach 25K Business 35K Premium Business | 14K Coach 27.5K Business |

| Alaska | 17.5K Coach 30K Business 40K Premium Business | 19.5K Coach 33K Business |

| Hawaii | 22.5K Coach 40K Business 50K Premium Business | 25K Coach 44K Business |

| Mexico | 17.5K Coach 30K Business | 19.5K Coach 33K Business |

| Central America | 17.5K Coach 30K Business | 19.5K Coach 33K Business |

| Northern South America | 20K Coach 35K Business | 22K Coach 38.5K Business |

| Southern South America | 30K Coach 60K Business | 33K Coach 66K Business |

| Europe | 30K Coach 60K Business | 33K Coach 77K Business 121K First |

| Africa | 40K Coach 70K Business | 44K Coach 88K Business 143K First |

| Middle East | 42.5K Coach 75K Business | 47K Coach 93.5K Business 154K First |

| Central Asia | 42.5K Coach 75K Business | 47K Coach 93.5K Business 154K First |

| South Asia | 40K Coach 75K Business | 44K Coach 99K Business 154K First |

| North Asia | 35K Coach 70K Business | 38.5K Coach 88K Business 132K First |

| Japan and Oceania | 35K Coach 70K Business | 38.5K Coach 88K Business 121K First |

| Australia and New Zealand | 40K Coach 80K Business | 44K Coach 99K Business 143K First |

Excursionist Perk

While American and Delta have eliminated free stopovers, United continues to offer a free excursionist perk as described in this post. Just use the multi-city award search on United.com to piece it together.

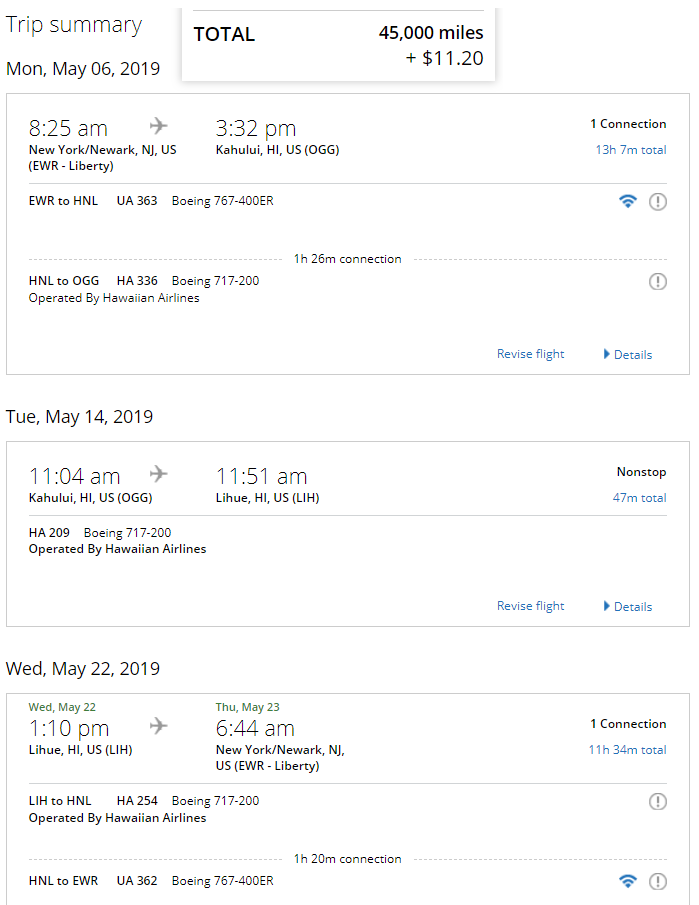

A round-trip to 2 Hawaiian Islands is just 45,000 miles round-trip thanks to the free excursionist perk:

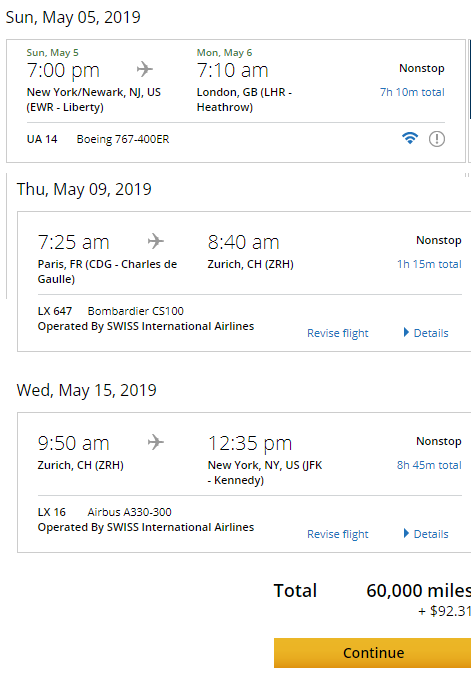

A round-trip ticket to 2 European or South American cities is just 60,000 miles round-trip thanks to the free excursionist perk:

A flight to 2 of my favorite cities in Asia, Hong Kong and Chiang Mai, Thailand is 80K miles thanks to the perk:

You’re even allowed a free open jaw in addition to the perk to really maximize your travel. For example this itinerary includes travel to London, Paris, and Zurich. You can take a train or use 4.5K BA Avios to get from London to Paris to fill the hole in the open jaw:

Of course the free stopover isn’t just useful from the US.

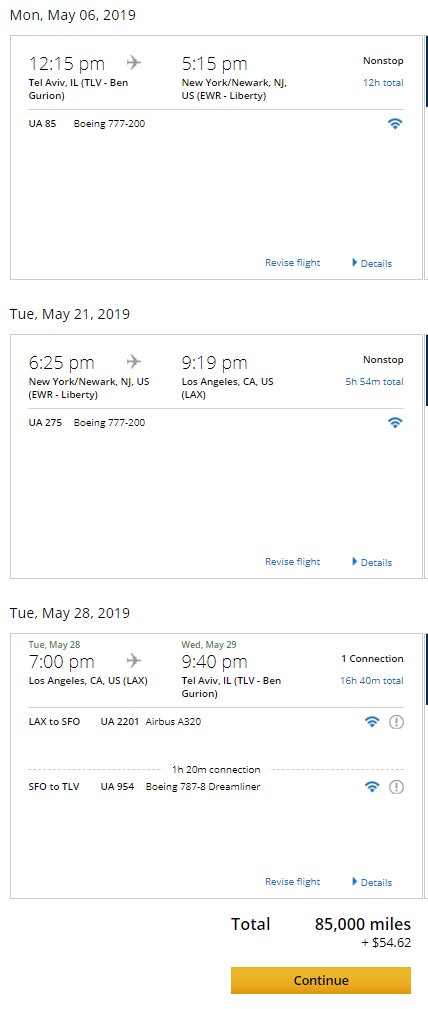

You can stopover in NYC and LA when flying from Tel Aviv to the US:

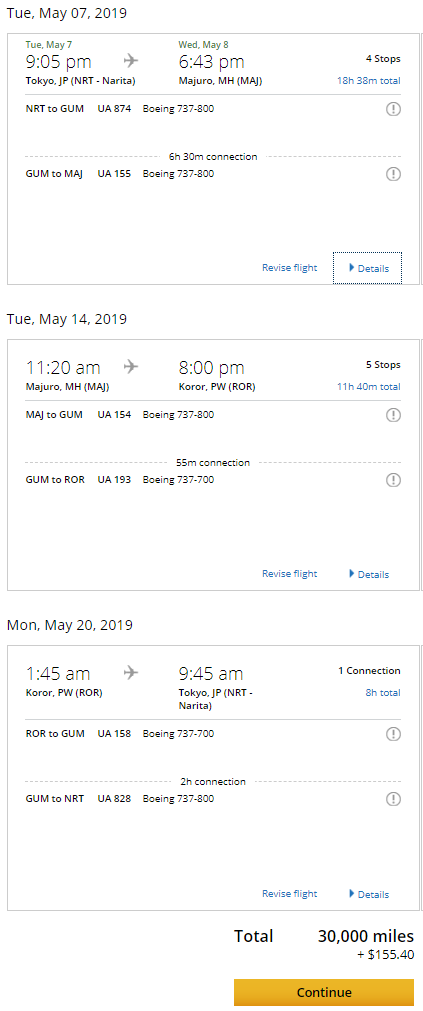

If you find yourself in Japan you can fly on the island hopper to 2 cities in Micronesia (I’ve been hankering to get back to Palau since the moment I left) for 30K miles:

You can also hack the excursionist perk for even more value.

You can use the multi-city search to book 2 flights within a single region and then you can book a free one-way within any other region sandwiched in between your flights.

For example if you book a round-trip from Cleveland to Chicago for 6,240 miles you can add in a free Excursionist Perk flight anywhere else in the world in between your flights, such as onboard the United Island Hopper from Palau to Kosrae via Guam, Chuuk, and Pohnpei, a flight that costs $598 or 12.5K miles on its own:

Or if you book a one-way flight from Cleveland to Chicago and then Chicago to Kansas City for 6,240 miles you can add in a free Excursionist Perk flight anywhere else in the world in between your flights, such as Johannesburg to the Seychelles, a flight that costs $473 or 19.5K miles on its own.

Partner airlines

United has dozens of partner airlines which means lots of great award opportunities. It can be worth checking for award space on partner sites like ANA or Aeroplan.com to search for award availability and then call United to book if you don’t see availability on United.

Partners airlines include:

- ANA

- Aegean Airlines

- Aer Lingus

- Air Canada

- Air China

- Air Dolomiti

- Air India

- Air New Zealand

- Aeromar

- Asiana Airlines

- Austrian Airlines

- Avianca Airlines

- Azul Brazilian Airlines

- Brussels Airlines

- Cape Air

- Copa Airlines

- Croatia Airlines

- EVA Air

- Edelweiss

- Egyptair

- Ethiopian Airlines

- Eurowings

- Germanwings

- Hawaiian Airlines

- Island Air

- Juneyao Airlines

- LOT Polish

- Lufthansa

- Scandinavian Airlines

- Shenzhen Airlines

- Silver Airways

- Singapore

- South African Airways

- Swiss International Airlines

- TAP Portugal

- THAI

- Turkish Airlines

Will you signup for a United Club Infinite Card?

![[Cardholders Register For 11 Bonus Points Per Dollar] Hyatt Launches Under Canvas National Park Glamping Partnership](https://i.dansdeals.com/wp-content/uploads/2024/07/26004607/Outdoor_Dining_Area_licjda-267x150.jpg)

Leave a Reply

58 Comments On "[40 Minutes Left!] Highest Offer Ever: Earn 120,000 Miles On The United Club Infinite Card With New Benefits! Club Membership, Discounted Awards, 2 Free Checked Bags Per Passenger, IHG Status+Credit, And More!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Anything i can do if i just completed the SUB for 100,000?

Try sending a secure message asking to be matched.

Who do I send secure message to chase or united? I just signed up few days ago and got the 80k bonus …

Chase, when logged into their site.

What do you mean “depending on your account “?

At my last renewal it was offering 1.5 cents per mile, but someone reported getting 1 cent per mile last month and another said they see 1.5 cents per mile today..

Need some more data points, but it seems to possibly vary between accounts or it changes by the day.

So if I fly Aer Lingus I can get into their lounge with this card?

Another super helpful post! thanks for all the help Dan!

I am planning to fly EWR –> TLV this Summer. I want to build up points – so if I apply for this card now, and spend the 6K needed as soon as I get it, how quickly will I get the bonus points? Also, are there United lounges in TLV? (I am literally just going to get this card for the purpose of this one trip)

there is no united lounge in TLV

There is a Dan Lounge.

If I spend the 6k right away, how quickly do they apply the bonus points?

When the next statement closes.

Can you explain how you can use the points to retroactively pay the annual fee? Won’t the annual fee be due in the first billing cycle, while it may take 3 billing cycle to earn the bonus points.

You can refund the fee for 90 days.

Does this card offer anything worth besides of the signup bonus if I have the venture x?

Yes, completely different set of benefits.

Hi Dan

does this card open you up to more saver award flights than the United quest card?

TIA

No, it’s the same for that.

Hi Dan, thanks for the post. Are the 2 checked bags in addition to the one bag that you get for an international flight (EWR-TLV) or just 1 additional?

2 total bags per person.

OK thank you very much. And do you get these benefits if I don’t book using the credit card? Meaning is it just some sort of status that is connected to my mileage plus number, or do I need to use the actual credit card in order to receive these benefits?

You need to use the card and have your mileage number attached to get United benefits.

Somebody told me that they have this card and it allows him to check 2 suitcases that weigh up to 70 pounds but I can’t find this perk online. Is this an accurate statement or did he make a mistake and is really just Premier Gold?

Any way to get the card benefits if redeeming United Travel Bank?

I have like $850 from Clear and Amex Platinum, Aspire credit

Put $1 on the card.

This card has primary cdw in all countries from united or because it’s a visa infinite?

The venture x doesn’t work for rentals in Israel.

is the annual fee waived 1st year?

“If 2 people bring 2 bags each on an international trip in basic economy, that would normally cost $680 round-trip, but it will be free with the United Club card!”

Is that really true for an international flight not offering even one checked bag?

“same record locator”

That possible to combine family members who weren’t originally booked togther?

Would it work for a freind and workmate or whomever is flying that same time to be added to your flight locator? What’s the easiest way to add them to the record locator?

Sure, many flights to Europe have that and I’m sure TLV will have that too soon enough.

Not possible to combine. But a friendly agent might agree to waive the fee at checkin.

If I have the gateway card could I still get the sign up bonus?

Yes

How do you see a XN price if you are a United cardholder? Does it happen automatically when you sign in? Because I don’t usually find good rates any time I tried.

Should be automatic unless it doesn’t get linked for some reason.

For the lounge access to work, do you have to have a United flight?

United or Star Alliance.

If paying AF with points, worth getting this over explorer? I won’t really use benefits. Haven’t flown United. Just looking for best SUB to put my reg spend towards.

Already have Cap1 Vx, Amex Plat. Not eligible for Sapphire till Oct.

Any other better card for me to get with good SUB?

I already have the United Club card. If my wife applies for a new card, is there a way to combine the miles, without paying a fee, so when booking we will have one reservation (locator)?

The United web site indicates that the fee will be $1,530 to transfer 100,000 miles to another United account.

No good way to do that, but you can just book one-way from each of your accounts.

Is everyone eligible to redeem the annual fee with points for this card or do you have to specifically receive an offer to do so?

Everyone.

Oh because I just spoke to chase and they told me that it’s only an option in specific offers…

DROPR (Don’t rely on phone reps!)

Lol got it thanks. On the application If I’m a student should I select self employed or other? Also how much income should I write?

Is there any downside to signing up and cancelling after 1 year?

Can I pay for part of my flight with my credit card to get the perks?

For example book on chase.com with my UR and then leave over $10 to pay with my credit card? Will that allow for me to get coverage for a delayed flight? Lost baggage? Canceled flight? Seats, bags.. and etc?

Or does the full ticket amount need to be on the cc?

Not just with this chase united card, would it be the same with the CSR card?

Can I have the UnitedSM Explorer Card and This card?

Yes

I guess DROPR

Is there any benefit in having this card if UA doesnt fly from my city?

(Besides for the signup bonus)

In ‘Additional cardholder benefits’ you wrote:

Premier Access: Priority check-in, security screening, boarding, and baggage handling privileges, even when flying in basic economy.

Is this only for Premier Member with this card, or all card holders get this benefit?

So I’m late…..however I still see the offer, will it work if I apply now?

Applied and approved using your link at 5:40ET. We shall see

Used your link for a spouse card, didn’t say “approved” immediately. In ya’lls experience does it normally require a review?

SO was approved for this about 36 hours after applying.. got email, card now shows up in the CHASE online portal. Is there ANY place on the site to confirm the promotion for 120K miles? Last year when I applied for a United CHASE Quest card for the 100K promo, I could swear that someone on the CHASE site I could see either my progress towards meeting the spend goal, or meeting the requirements for the sign-up bonus? Is there someplace where this can be seen for this promo?

Has anyone else who applied and was approved seen a confirmation of the promotion on their CHASE pages?

Can I use the infinite card to book a united flight through the chase rewards portal and still be eligible for all the benefits (free baggage etc.), or do I have to book it directly with united?

When does the IHG benefit become available? I have this card and it doesn’t show as a benefit.

https://promo.united.com/offers/ihgstatus