Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Update: Offer expired!

Originally posted on 11/15/18:

For a limited time, you can earn 40,000 bonus miles for opening a Chase United Explorer card and spending $2,000 within 3 months plus you can earn another 25,000 bonus miles for spending another $8,000 within 6 months.

That means you’ll have at least 75,000 miles if you spend $10K in 6 months.

The $95 annual fee is also waived for the first year with this offer.

You can receive the bonus on this card if you haven’t received a bonus on this card in the past 24 months and don’t currently have this card.

This card is subject to 5/24 restrictions.

United has added new features to their credit card this year:

- It now earns 2 miles per dollar on hotels and dining as well as on United purchases.

- Cardholders get Global Entry/Pre-Check for free.

- Cardholders get a 25% rebate on inflight WiFi, food, and drink purchases.

The card continues to offer benefits like:

- A free checked bag for the cardholder and a companion, even on basic economy fares.

- A free carry-on bag for the cardholder and companions, even on basic economy fares.

- Priority boarding for the cardholder and companions, even on basic economy fares.

- 2 free United Club passes every year for being a cardmember.

- Miles that will never expire as long as you are a United cardholder, even if you don’t have any activity.

- Primary rental car CDW insurance in every country.

- No foreign exchange fees.

- Exclusive cardmember access to auctions that allow you to use your miles for once-in-a-lifetime experiences. A few years ago I used 25K miles for 4 field box seats to an Indians game along with the right to run onto the field before the top of the 7th inning and swipe 2nd base right off the field. Nobody could believe it as I walked around the ballpark with 2nd base. I even got it signed after the game by the Indians wining pitcher that night, Justin Masterson, who was equally shocked that I actually had 2nd base.

- Cardholders with United elite status get free upgrades on coach award tickets on upgrade eligible routes.

- If you spend $25K/year on the card it waives the requirement to spend $3K on United flights to get Silver status, $6K on United flights to get Gold status, and $9K on United flights to get Platinum status. You only need to fly the 25K, 50K, or 75K miles like in the good old days.

The reason this card is the best airline card you can get isn’t for the spending benefits, it’s for the perks. And they are awesome.

The reason this is my favorite airline card is that the United card is the only airline card that offers expanded award ticket availability.

This increases the value of your miles significantly and in turn makes the Chase Quadfecta/Quinfecta spending strategy even more valuable.

Cardholders have access to expanded saver coach award availability (XN class), last seat standard coach award availability (YN class), and last seat standard business/first class award availability (JN class).

It’s not just slightly expanded. There is a world of difference between the availability that cardholders can access and the availability for non-cardholders.

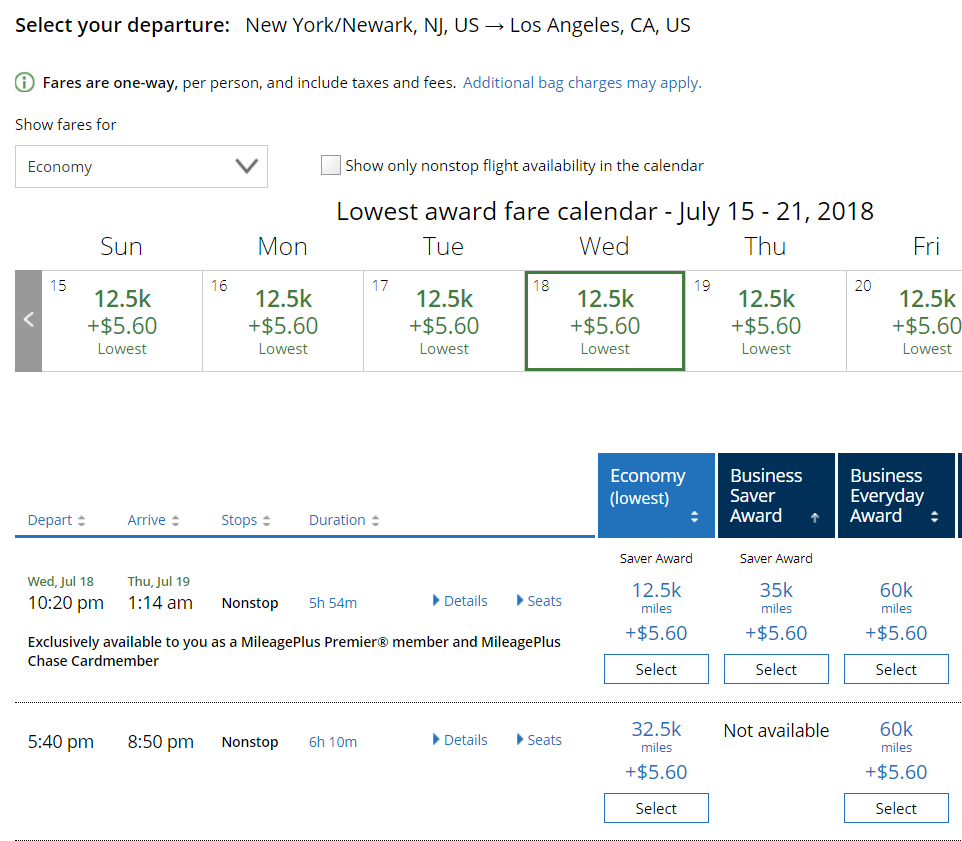

Availability calendar for non-cardholders:

Availability calendar for cardholders:

Let’s say you want to fly from Newark to Tel Aviv from August 25-September 10:

If you’re a cardholder and are logged in on United, you’ll pay 85K miles:

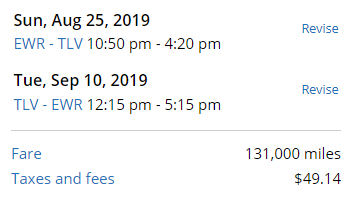

If you’re not a cardholder you’ll pay 131K miles for the same flights:

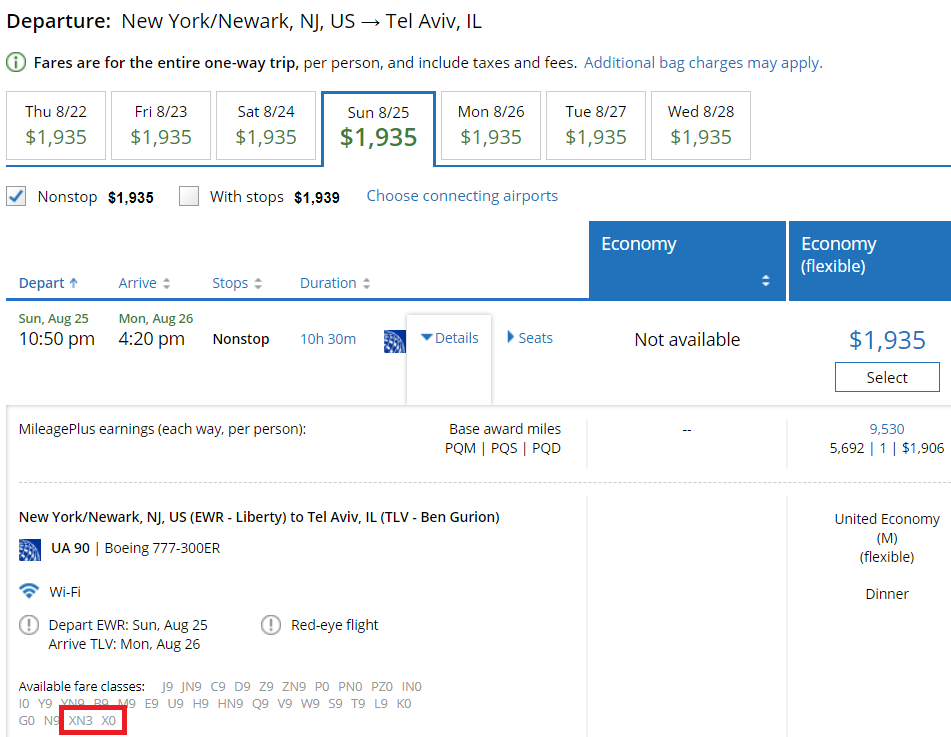

If you have read the United Expert Mode post, you know that’s because United is willing to sell 3 saver award seats in XN class to cardholders (XN9), but there are no seats in X class for saver award for non-cardholders on those flights (X0):

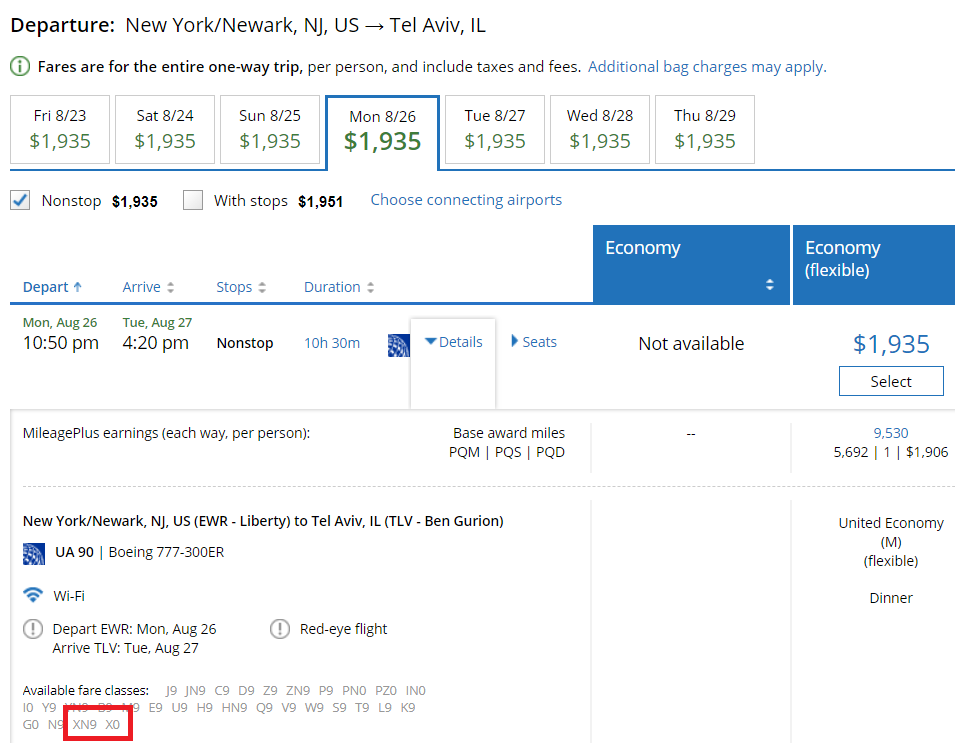

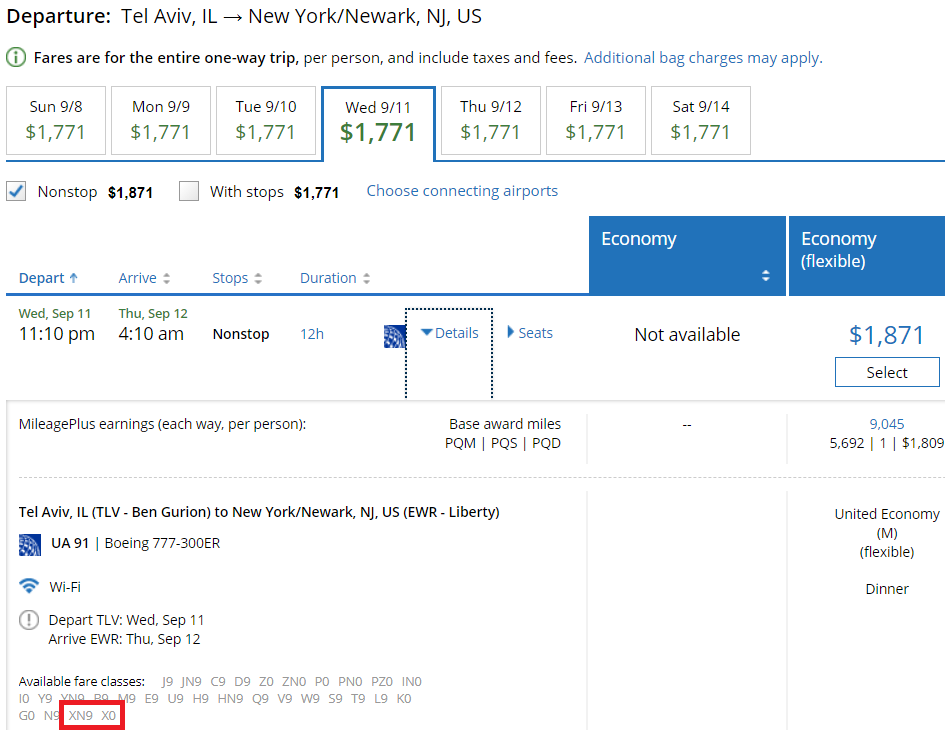

On the return flight United is willing to sell 5 saver award seats in XN class to cardholders (XN5), but there are no seats in X class for saver award for non-cardholders on those flights (X0):

Need more seats?

Travel a day later, from August 26 -September 11, and you can see that United has at least 9 saver awards (XN9) for cardholders in each direction, but there are no seats in X class for saver award for non-cardholders on those flights (X0):

This availability differential applies to all domestic and international routes and makes it crucial to be a United cardholders.

As you have better access to saver coach awards you’ll also have better ability to do Plan B awards. Plan B allows you to redeem for saver business and first class awards when there’s only saver coach available. Read more about Plan B in this post.

No airline besides United offers a Plan B redemption.

In general I’m a big fan of United miles as they’re part of the Star Alliance, which has the best award availability of any airline alliance.

Best of all, United never charges any fuel surcharges. Other airlines like American collect massive fuel surcharges to fly on British Airways. Delta charges fuel surcharges to fly on some partners and if you originate in Europe and other regions. United will never collect a fuel surcharge and they have access to awards on 36 partner airlines which means better availability on more awards.

A short-haul United domestic award under 700 miles in distance is just 10,000 miles. That’s more than the BA 7.5K short-haul, but availability is much better, it allows for a longer flight distance, and you are allowed to have connections for the same rate, something that BA doesn’t allow.

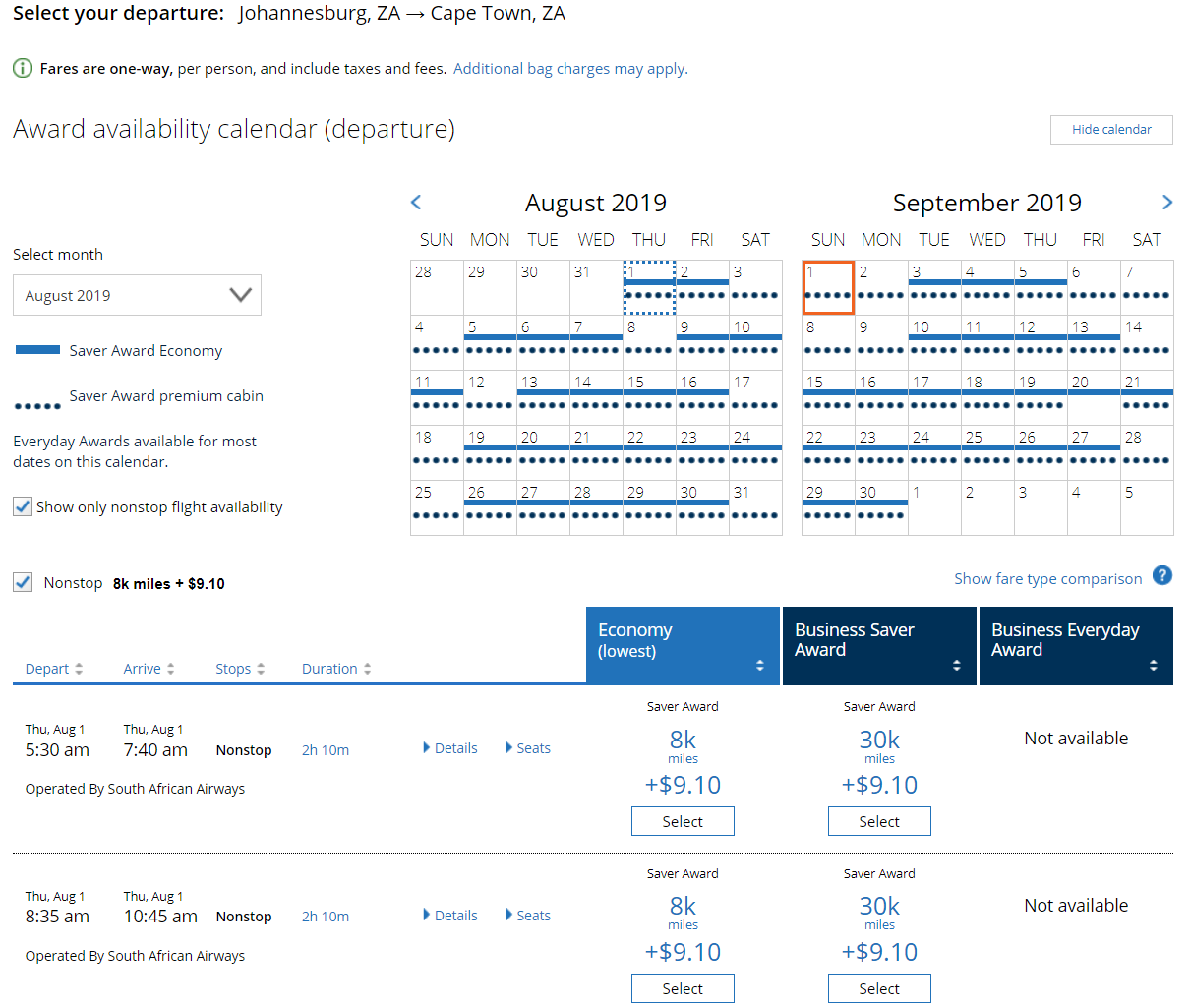

Short-haul nonstop flights within any region outside of the US are just 8K miles:

United is also the only major US carrier that caps the mileage rate for standard awards at a reasonable rate.

For example the last time there was a limited time offer on this card I checked on award space from NYC to LA:

American charged 82.5K-97.5K miles with their variable standard award pricing:

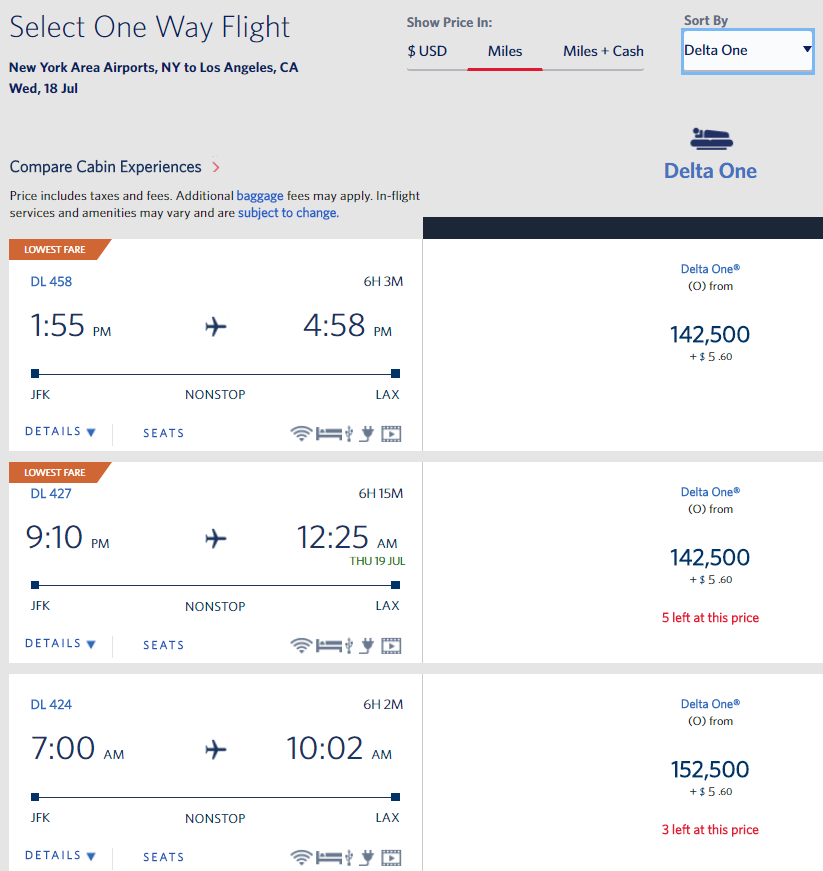

Delta charged 142.5K-152.5K miles with their variable standard award pricing:

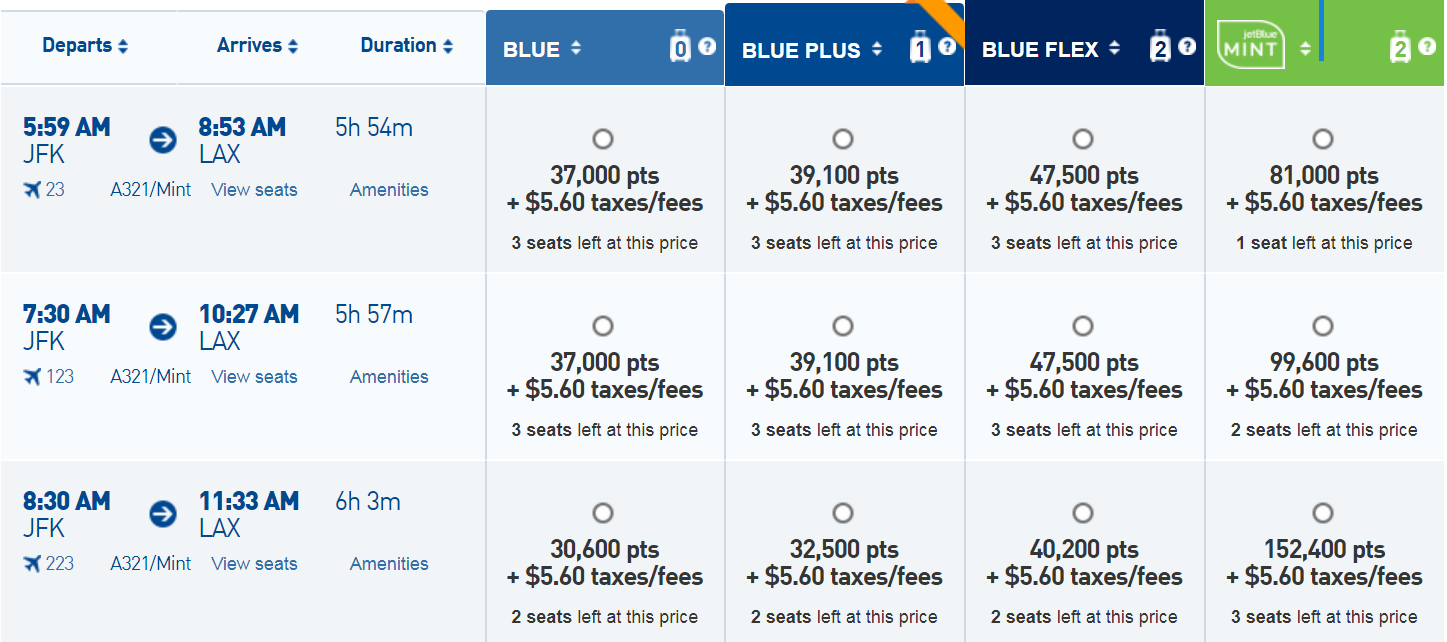

All JetBlue award pricing is variable and they wanted 81K-152.4K miles:

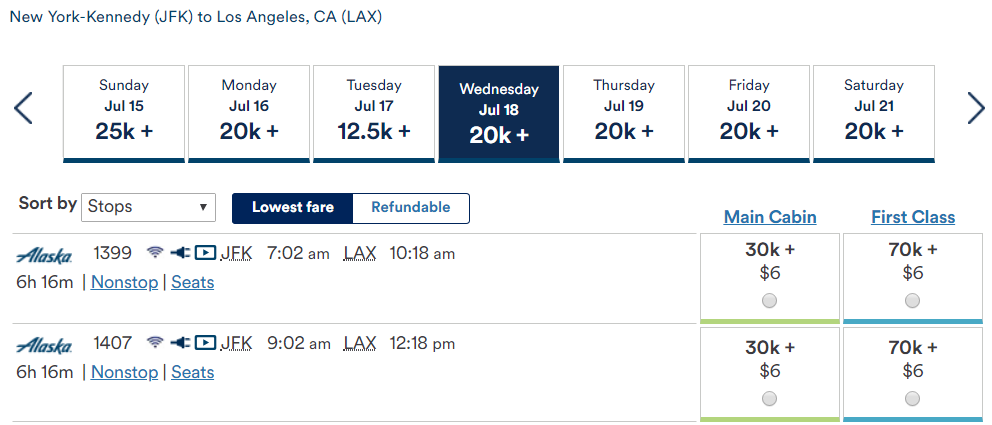

Alaska is the only airline flying nonstop between NYC and LAX without lie-flat seating in business class and they wanted 70K miles:

With United there was a saver award for 32.5K. Those come and go, but the standard awards on United are just 50K-60K on this route. That’s significantly less than other airlines. Best of all, cardholders can book a standard award even if it’s the last coach or business seat on the plane:

While American and Delta have eliminated free stopovers, United continues to offer a free excursionist perk as described in this post. Just use the multi-city award search on United.com to piece it together.

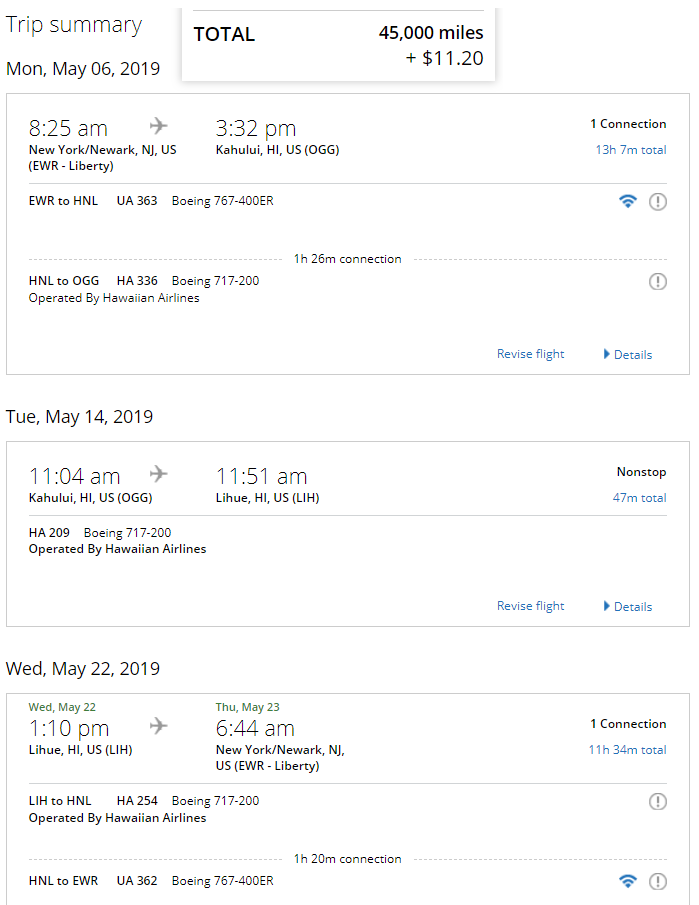

A round-trip to 2 Hawaiian Islands is just 45,000 miles round-trip thanks to the free excursionist perk:

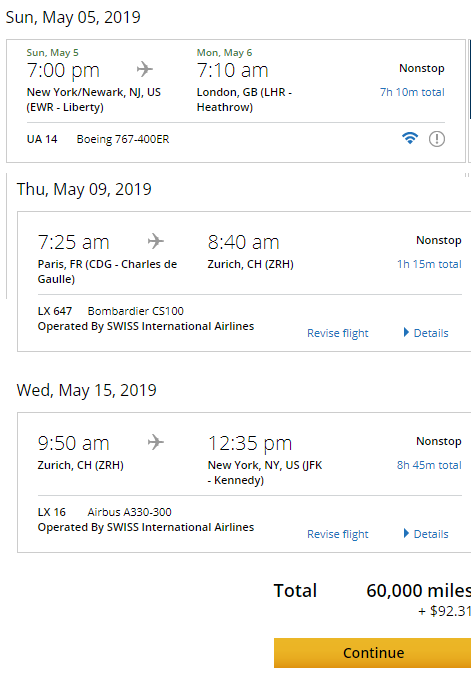

A round-trip ticket to 2 European or South American cities is just 60,000 miles round-trip thanks to the free excursionist perk:

A flight to 2 of my favorite cities in Asia, Hong Kong and Chiang Mai, Thailand is 80K miles thanks to the perk:

You’re even allowed a free open jaw in addition to the perk to really maximize your travel. For example this itinerary includes travel to London, Paris, and Zurich. You can take a train or use 4.5K BA Avios to get from London to Paris to fill the hole in the open jaw:

Of course the free stopover isn’t just useful from the US.

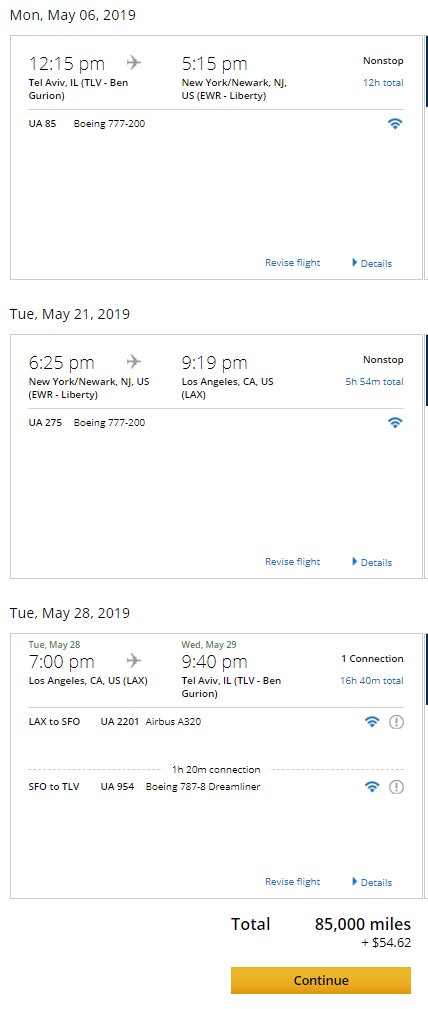

You can stopover in NYC and LA when flying from Tel Aviv to the US:

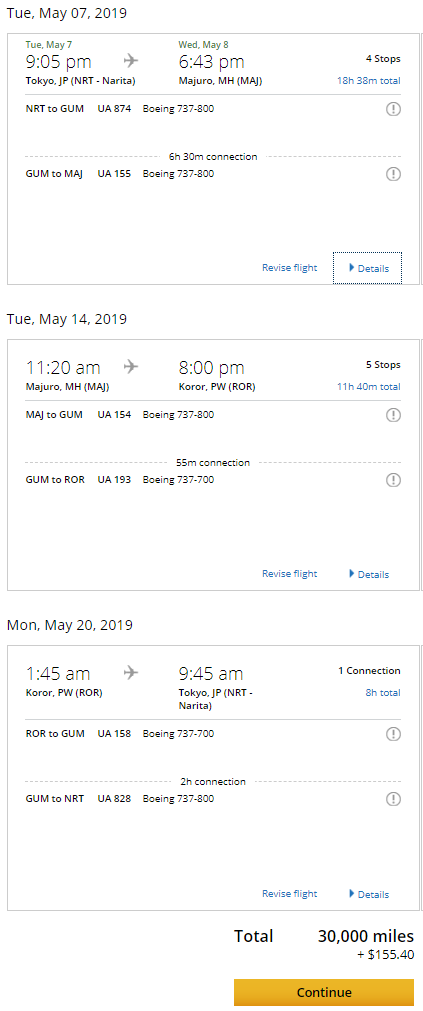

If you find yourself in Japan you can fly on the island hopper to 2 cities in Micronesia (I’ve been hankering to get back to Palau since the moment I left) for 30K miles:

United has dozens of partner airlines which means lots of great award opportunities. It can be worth checking for award space on partner sites like ANA or Aeroplan.com to search for award availability and then call United to book if you don’t see availability on United.

Partners airlines include:

- ANA

- Adria Airlines

- Aegean Airlines

- Aer Lingus

- Air Canada

- Air China

- Air Dolomiti

- Air India

- Air New Zealand

- Aeromar

- Asiana Airlines

- Austrian Airlines

- Avianca Airlines

- Azul Brazilian Airlines

- Brussels Airlines

- Cape Air

- Copa Airlines

- Croatia Airlines

- EVA Air

- Edelweiss

- Egyptair

- Ethiopian Airlines

- Eurowings

- Germanwings

- Hawaiian Airlines

- Island Air

- Juneyao Airlines

- LOT Polish

- Lufthansa

- Scandinavian Airlines

- Shenzhen Airlines

- Silver Airways

- Singapore

- South African Airways

- Swiss International Airlines

- TAP Portugal

- THAI

- Turkish Airlines

Are you a United cardholder?

![[United And Air Baltic Will Resume Tel Aviv Flights Next Week] Here Are The Current And Next Available Flights To Israel On More Than 40 Airlines!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Update: AA And Delta Match United’s Solo Passenger Surcharges] Forget Hidden City Ticketing, Have You Tried Hidden Passenger Ticketing?](https://i.dansdeals.com/wp-content/uploads/2017/09/03174721/United-Airlines1-768x432-267x150.jpg)

![[Updated With Comments From Both Airlines] JetBlue And United Launch Blue Sky Partnership!](https://i.dansdeals.com/wp-content/uploads/2025/05/29085514/United-JetBlueAnnouncementHeroPhoto-267x150.jpg)

![[Final Days To Transfer Before Emirates Transfer Pause, 1 Month Left For Alaska Transfers] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

158 Comments On "1 Hour Left! Earn Up To 65,000 Miles On My Favorite Airline Credit Card; How To Take Advantage Of United’s Most Generous Awards"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

@dan if i got a private offer of 50,000 points will i also get the bonus 25,000 after spending anothe 8,000 $ ?

No.

So in my case i am better off not using the private offer.

Indeed.

Just got this.

We need to review your request a little longer. We will let you know of our decision as soon as possible.

Any offers for a United business card?

The public offer for the business card is 50K for spending $3K in 3 months.

You can get that by clicking on the link in the post, clicking apply now, and scrolling to the bottom of the application page to where it says “Rewards for You and Your Business,” and click on the United Business card.

if i have the card already, opened it 6 years ago anyway to take advantage?

You won’t get approved if you currently have the card. You can however downgrade the existing card.

Downgrade to what? Do I call customer service to do that? How long should I wait after downgrade to apply? Thanks, thanks, thanks.

if I sign up for this card under my wife name (since im way over 5/24) can I use my United account number under the application that way all the points and benefits would feed my account?

@dan pls answer tnx.

I’ve never tried that with Chase.

does it work with other carriers?

Is this business or personal?

At the very end you write “Click Here to get more details on this card and compare to other business travel cards!”

Thanks for correcting. I was hoping it’s a business card. I gotta be very picky which personal cards I get bc of 5/24

The public offer for the business card is 50K for spending $3K in 3 months.

You can get that by clicking on the link in the post, clicking apply now, and scrolling to the bottom of the application page to where it says “Rewards for You and Your Business,” and click on the United Business card.

Is this available for business cards as well?

Can you please post a link?

The public offer for the business card is 50K for spending $3K in 3 months.

You can get that by clicking on the link in the post, clicking apply now, and scrolling to the bottom of the application page to where it says “Rewards for You and Your Business,” and click on the United Business card.

Dan- if I just got approved (5 min ago) for the card how long will it take for me to have expanded awards? I was in the process of booking a flight on united then I saw your post so I got the card

It can take several days.

You’ll know it’s active when the expiration date in your United account changes to “Expiration waived.”

@dan i got approved bh tnx. I got the card but i still doesn’t say expiration waived still says date.

Give it a week or 2.

I recently got a 50K + 5K for AU offer a few months ago. Considering if it’s worth matching to this, but I don’t see the +5K offer for this offer. So questioning if getting an additional 10K miles is worth the spend when i could be spending on CSR or chase freedom. Any wisdom on that?

Depends if you’ll spend that money anyway. If you are, then sure.

I just got the this card about 3 months ago. Any point sending a secure message asking them to match?

What do you have to lose?

Time. Icht hob nisht kein tzeit

if i signed up for this card for the 40,000 promotion a couple months ago, can i still get the 25,000 from this promotion in 6 months from when i opened the card?

also how do you get to 75,000 if you have 40,000+25,000?? maybe another 5,000 for an additional user which will bring you to 70,000??

add 10K points for the $10K spent to trigger bonus

10,000 miles for the $10,000 spent on the card…

Dan, please answer first question thx

Same Q, is there a way to take advantage of the 25,000 if I applied before this offer came out?

@dan If I live in Toronto and generally travel from there are United points useful for me?

Sure, they are partners with Air Canada.

cool, never knew Canadians can get American cards…

can canadians really get this card?

is this offer available also on club card? if not could i take this offer and after receiving bonus upgrade to a club card? since the club is much more valuable

The public offer for the Club card is 50K for spending $3K in 3 months.

You can get that by clicking on the link in the post, clicking apply now, and scrolling to the bottom of the application page to where it says “United Club Membership and More,” and click on the United Club card.

Dan, does the Club Card offer the same availability calendar as well? Also, does the Club card offer “Cardholders with United elite status get free upgrades on coach award tickets on upgrade eligible routes.”

Thanks

Can I get this offer if I have the United Plus card?

I’m not familiar with that card.

Sorry, United MileagePlus Card.

That’s not a card name.

If I downgrade to the no annual fee version after the year is up, which benefits will remain/which will I lose?

I have seen reports that you will keep the expanded availability, but I haven’t personally tried that.

Thanks! Anyone had personal experience with this and care to comment?

Yes, I downgraded and still get the expanded availability message

Me too

Thanks!

“That means you’ll have at least 75,000 miles if you spend $10K in 6 months.“

Doesn’t add up to 65,000miles?

It’s really simple- 40,000 signup bonus spend, 25,000 for additional 8k spent within 6 months= 65,000 But you still need to factor in at least 10,000 miles for the 10k you spent.

i guess i will not receive this offer of 65K on the club card, so my question is could i apply for this one and then upgrade?

Any idea how a Canadian can take advantage of this?

If the foreign exchange is waived would it make sense to get the card while living in Canada and still pay for everything here?

Can a husband and wife transfer points between each other?

Hey dan will you get the 25k extra if u use a refer a friend link?

DOES DAN OR ANYONE KNOW HOW MUCH THE miles can be sold for ?mileage brokers

is this ok for a first card?

Dan- Can you pls answer this?

A. Can a husband and wife transfer miles between each other? Does it pay to take out a 2nd card for my wife if I got one a few months ago? Idk if Chase will match this offer on mine.

B. I assume the CSP is a better spending card.

Hi Dan, whats the best card to use for a domestic rental car?

Chase reserve

amex business gold

chase united explorer

chase business preferred

I need a new credit card for business large spend. What is the difference of using a consumer card strictly for business and a business credit card?

I live in LA and need to travel frequently to Newark with my family. What’s the best credit card for airline miles that I could redeem for tickets?

“If you spend $25K/year on the card it waives the requirement to spend $3K on United flights to get Silver status….

1) Is this true with United Business as well?

2) Will spending 25K waive the need of PQM or PQS? Or I still need to satisfy the PQM or PQS requirements?

So I got the card. If I book a basic economy through chase ultimate rewards using points of my Chase reserve will I still get a free bag and free carry? Also with basic economy and having the card will we be able to choose our seats?

I don’t think so. In the fine print it says that the ticket must be purchased with the card.

whats the minimum credit limit?

Probably $5K.

Hi dan, is the end date 1/8 for applying for the card or for spending the amount? or for both?

Thanks

1/8 is the deadline to apply. The spending dates are in the post based on when you are approved (Chase also allows a little extra time on top of those dates, you can message them for the exact deadlines).

If I spend solely on my chase freedom unlimited does it make sense to get this card and start swiping away or just get the $25k threshold and move back to the freedom unlimited card?

Just until the thresholds.

Should I signup to the personal or business card?

Are there many more benefits with the club card over this one? Besides for club access?

2 checked bags and waived close-in fees.

can kids under 18 apply for this card (or others with generous sign-up bonuses)?

Does anyone know if

Are there other cards that I can apply to at the same time?

(To take advantage of the credit pull)

TIA

Any other Chase card.

https://www.dansdeals.com/credit-cards/ultimate-comparison-chart-chase-ultimate-rewards-cards-supercharge-earnings-creating-killer-quinfecta/

What about non-chase cards?

I was shut down by Chase 🙁

Do you only get the free bag benefits if the ticket was booked with this card or as long as you are a card holder?

With this card you need to book with it.

What about award tickets?

And what if I book a UA flight with SQ etc miles? Will I get the free bag if I use the United Explorer card for the taxes and fees?

How do i get this offer if i have this card that i opened 7 years ago?

My son is 18, has a discover student card, and makes around 2-3k a year from side jobs. Anyway he would be approved for the United card or is it a waste of a pill until he has substantial income in a few years?

I’d include all household income.

Dan, Other than the 65K bonus miles, is there a benefit of having the United Explorer card, if I already have the club card?

-2 miles per dollar on hotels and dining

-Global Entry/Pre-Check for free.

-25% rebate on inflight WiFi, food, and drink purchases.

-2 annual club guest passes

Hi Dan,

If I’m booking a flight on United, is it better to pay with this United Explorer card or the Chase Sapphire Reserve card?

which card offers better benefits/protection

Can these points be transferred to my Chase Ultimate Rewards account?

No

it asks if i want to combine chase credit lines. do i want to do this or not?

I was thinking of getting the chase reserve or Safire card, but now I see this offer with United. What do you think makes sense? Traveling to israel is important to me. Thx.

This question made me laugh

For ppl that spend few hundred thousand a year on the card isint using the United club card better? Besides all the perks it comes with you get 1.5 miles for every dollar spent. The extra .5 per dollar pays the $450 a year fee 10X (the more you spend the more it’s worth it).

Better off earning 1.5 UR points per dollar on Freedom Unlimited than 1.5 United miles per dollar.

https://www.dansdeals.com/credit-cards/ultimate-comparison-chart-chase-ultimate-rewards-cards-supercharge-earnings-creating-killer-quinfecta/

If get the British Airways card and spend 10k, will have 85k Avios. Whats worth more, 75k united or 85k avios?

75 United.

If I already hit the 5/24 card max (I’m not sure if I did or not) ..will i be approved and just not get the bonus? Not approved? And uf approved will I be notified if not eligible for the bonus or only find out after I spend and dont get the points? Thanks

You won’t be approved

If I have the business card already, will I be able to get the personal card?

Sure

Generally how much in advance do you need to book a united miles flight to tlv? If I dont have enough miles to book the entire flight can I pay the rest? Would that be a fee they add on or I would need to purchase the additional miles first? Thanks!

Sorry for the unrelated question.

Does capital one business spark miles transfer to Qantas?

which booking class i need available in biz for the plan B for united biz ?

pz class ?

If I have a free united card (for many years), can I upgrade to this one and get the points bonus?

You won’t get points for upgrading. If you open a new card you will get the points.

To confirm, if I had this card, and downgraded to the free version some years ago, can I reapply for this card now, and receive the incentive bonus here?

Is the expanded award availability only for ua flights or also partners

UA flights.

Hi,

After 12 months what are my options for saving the miles but closing the credit card?

I don’t need cards that have annual fee since I don’t travel much. If you already wrote it in this article please direct me I didn’t see it.

You can downgrade it to a no annual fee United card.

@dan I currently have three Chase cards. Two under one Inc and one under a separate LLC. Getting this would put me at 4/5 max cards that I can have with Chase?

There is no max. I have 14.

So what’s the 5/24 rule?

https://www.dansdeals.com/?s=5%2F24

If my application is pending question is if I still get the sign up bonus upon approval if I only get approved after tomorrow’s deadline?

As long as you apply by then you’re good.

Thanks

Dan

After I get approved for this card, can I transfer my chase freedom points to this card?

No

If you or a spouse has a card that allows mileage transfers.

https://www.dansdeals.com/credit-cards/ultimate-comparison-chart-chase-ultimate-rewards-cards-supercharge-earnings-creating-killer-quinfecta/

just applied. my application is pending, how long until I would get an answer? and how would they notify me, by email? Thanks

You can try calling if you don’t want to wait a week or 2.

hi dan. im pretty new to all this credit cards. can you pls tell me, i wana fly united domesticly. is this united card tht you posted worth for me to open? will i gain much by using miles v $?

Sure, it’s great when tickets are expensive.

Doesn’t the United Club card also give expanded award availability?

Sure, but that has a $450 annual fee.

How much are united miles worth

I have the chase sapphire card – but don’t really do much with it, except pay the $95 fee yearly and get 2% back at restaurants and not pay foreign transaction fees.

Should I cancel it and get this one instead? How do I cancel it without it affecting my credit score? Is there some type of exchange to prevent my score from being affected?

You should read up more on Dansdeals here or on DDF (Dansdeals Forums), you wouldn’t have these questions. You would be getting ALOT more value for your $95 fee and probably wouldn’t be considering shutting it down. When people don’t reply to such comments, it is not cuz they’re ignoring it, it’s just that there’s too much info to pass on in a few lines. I’m just trying to be helpful cu I too was a “beginner” not too long ago 🙂

To best of my knowledge; you cannot “exchange” cards. You can “downgrade” your card to a no fee card, it would not affect your score at all, even closing barely makes a dent in long run. You would need to apply separately for this card to get the bonus. But like I said; if you understood the value in the card you have, you probably wouldn’t be looking to close it.

Ohh, I do get the 20% discount travel and use points on this one.

Question – If I were to only keep one paid credit card, are you suggesting I keep the Sapphire over getting this United card?

Keep the Sapphire

Read this link https://www.dansdeals.com/credit-cards/ultimate-comparison-chart-chase-ultimate-rewards-cards-supercharge-earnings-creating-killer-quinfecta/

Hi Dan, if i add other member to the card, is there a bonus in miles? thanks

No.

If I get the card in my name would I be able to use the Global Entry for my wife? I already have TSA PRE CHECK from another card.

Yes.

I am an authorized user for this card on my husbands account. (He is primary). Can I apply for this card today or am I considered to already have the card even though not primary.

Yes.

Just to clarify you are saying yes I can apply?

Correct.

Also if you are denied for any reason, make sure that you explain that you are only an authorized user and not responsible for that account.

My application is pending. If I don’t get approved I would sign up for the s.w. cards but not sure I can hit both spends…anyone know how long till I hear back?

Try calling Chase?

I just applied last night…was hoping you would say next business day 🙂

Is the expanded award availability from this credit card the same as what people with silver or higher status can book even if they don’t have the Explorer card?

Yes, but elite members need to have a United card in order to get upgraded on award tickets.

do cardholders have better access to saver awards than non-cardholders who are elite 1k?

No, but elite members need to have a United card in order to get upgraded on award tickets.

I have the card already. Thinking of getting the card for my wife. As of now; I don’t have enough value out of having TWO cards to justify the $95 fee and would consider cancelling HER card when the AF kicks in. Would I be able to transfer her miles to my account at that point so they don’t expire??

You can’t transfer her points, but you can downgrade this card to a no- fee United card. Or you can use her points for anyone.

As long as you earn or use 1 mile every 18 months they will never expire.

Thanks

What’s a good business card with 0 apr? Besides chase, Amex gold I have already

I opened this card a 6 months ago and add my wife as an AU, now i checked her credit report and this AU card shows up in her credit report, now can she get now a united card for her self? is this AU counted towards 5/24?

Its still active

Still active via United

Does the united biz card also provide expanded award ticket availability ?

traveling to israel. should i put a car rental (minivan for 1 week) on this united explorer mileage plus card or a chase saphire reserve card?

Do I need to contact Chase to get the extra 25,000 miles? I already spent over $10K. The initial 40000 were deposited to my MP account without any issue