Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Update, 1/25/23: These offers will end around 3:59pm ET today. Apply now if you want to take advantage of them!

Update, 11/10/22: These offers are alive again!

- United Gateway℠ Card, Earn 30,000 miles.

- United℠ Explorer Card, Earn 60,000 miles.

- United Quest℠ Card, Earn 80,000 miles.

- United Club℠ Infinite Card, Earn 100,000 miles.

- Chase United Business Card, Earn 75,000 miles.

- Chase United Business Club Card (Click on apply now to reach this card application), Earn 75,000 miles.

Table of Contents

United card offers

United has limited time offers available on their credit cards. The United cards have some of the best perks for travelers out of all the airline cards, making them a must have for anyone flying on United. All of these United cards offer expanded saver award availability, an incredible perk that no other airline card offers! Plus you can pay yourself back for the annual fee at an excellent value of 1.5 cents per mile!

While United miles are not as valuable as they used to be, they no longer expire and there are advantages to using miles over cash or bank points.

When you use cash or bank points you won’t get benefits like free bags for using your United card, whereas with miles you can put the taxes on your credit card to get those benefits.

Plus, you can cancel award tickets for free and get back all of your miles and taxes. That’s a huge peace of mind that is hard to calculate and accurately value when comparing the value of a mileage ticket to a cash ticket.

- United Gateway℠ Card

- Earn 30,000 bonus miles after spending $1,000 in the first 3 months of card membership, plus 12 months 0% APR on purchases.

- This card previously offered 20,000 bonus miles.

- No annual fee.

- Earn 2 miles per dollar on United purchases, gas stations, transit and commuting, including ride share services, taxicabs, train tickets, tolls, and mass transit.

- 1 year free DoorDash membership.

- $10 monthly GoPuff credit through 12/31/23.

- United℠ Explorer Card

- Earn 60,000 bonus miles after spending $3,000 in the first 3 months of card membership.

- $0 intro annual fee, then $95. You can currently redeem 6,600 United miles to pay for the card’s annual fee thanks to a value of 1.5 cents per mile towards refunding the annual fee!

- Earn 2 miles per dollar on hotels and dining as well as on United purchases.

- Cardholders get Global Entry/PreCheck/NEXUS for free.

- A free checked bag worldwide for the cardholder and a companion, even on basic economy fares.

- A free carry-on bag for the cardholder and companions, even on basic economy fares.

- Priority boarding for the cardholder and companions, even on basic economy fares.

- The ability to use online checkin and get a boarding pass in advance on basic economy fares. United does not allow online checkin on basic economy fares unless you have elite status or a United card with free bags.

- 2 free United Club passes every year for being a cardmember.

- Primary rental car CDW insurance in every country.

- Cardholders with United elite status get free upgrades on coach award tickets on upgrade eligible routes for the cardholder with status and a companion!

- If you spend $12K/year on the card it will give you 500 PQPs and if you spend $24K/year you’ll get 1,000 PQPs. PQPs from multiple cards can stack together up to 15,000 PQPs, enough for Platinum status.

- 1 year free DoorDash membership.

- $10 monthly GoPuff credit through 12/31/23.

- United Quest℠ Card

- Earn 80,000 bonus miles after you spend $5,000 on purchases in the first 3 months of card membership.

- $250 annual fee. You can currently redeem 16,667 United miles to pay for the card’s annual fee thanks to a value of 1.5 cents per mile towards refunding the annual fee!

- Earn 3 miles per dollar on United purchases.

- Earn 2 miles per dollar on travel, dining, and streaming

- Cardholders get Global Entry/PreCheck/NEXUS for free.

- Get a rebate up to $125 every cardmembership year, equal to the amount spent on United tickets, upgrades, seat assignment fees, WiFi, inflight food and beverages, baggage fees, or other United charges. This will also work for United Travel Bank funding valid for future United flights with a minimum 5 year validity!

- Get a rebate of 5,000 miles, up to 2 times per cardmembership year starting with your first card anniversary, for a total of up to 10,000 miles per year, when the primary cardholder flies on an award that includes at least 1 United flight segment. You’ll get the 5,000 mile rebate even if the award cost less than 5,000 miles! You’ll want to redeem 2 one-way awards as those will each trigger a 5,000 mile rebate.

- 2 free checked bags worldwide for the cardholder and a companion, even on basic economy fares. A value of up to $680 round-trip!

- A free carry-on bag for the cardholder and companions, even on basic economy fares.

- Priority boarding for the cardholder and companions, even on basic economy fares.

- The ability to use online checkin and get a boarding pass in advance on basic economy fares. United does not allow online checkin on basic economy fares unless you have elite status or a United card with free bags.

- Primary rental car CDW insurance in every country.

- Cardholders with United elite status get free upgrades on coach award tickets on upgrade eligible routes for the cardholder with status and a companion!

- Earn 500 PQPs towards elite status for every $12K/year spent annually on the card, up to 6,000 PQPs for $144K/year spending. PQPs from multiple cards can stack together up to 15,000 PQPs, enough for Platinum status.

- 1 year free DoorDash membership.

- $10 monthly GoPuff credit through 12/31/23.

- United Club℠ Infinite Card

- Earn 100,000 bonus miles after spending $5,000 in the first 3 months of card membership.

- This card previously offered an annual fee waiver with no bonus miles.

- This card has a hefty $525 annual fee, though that’s cheaper than even top-tier United elite members pay for a Club membership, which is included with the card. You can currently redeem 35,000 United miles to pay for the card’s annual fee thanks to a value of 1.5 cents per mile towards refunding the annual fee!

- Full United Club membership: Cardholders get a full United Club membership. You can bring your entire family, or you and 2 guests, to enter over 1,000 United and partner lounges and Star Alliance lounges worldwide when flying United or Star Alliance airlines. Club membership normally costs $650 per year.

- 4 miles per dollar on United purchases, including tickets, upgrades, WiFi, inflight food and drinks.

- 2 miles per dollar on all other travel and dining and 1 mile per dollar elsewhere.

- Cardholders get Global Entry/PreCheck/NEXUS for free.

- 2 free checked bags worldwide for the cardholder and a companion, even on basic economy fares. A value of up to $680 round-trip!

- IHG Platinum elite status which gives free internet, 50% bonus points, upgrades, welcome amenity, late checkout, and more. Plus your IHG points will never expire if you have status.

- $75 IHG hotel credit for use in 2022.

- Avis President’s Club Status.

- Instant discount on select United awards: Cardholders get a 10% instant discount on saver awards within the US48 and Canada. This applies to X class (saver awards available to everyone) and XN class (expanded saver awards available only for United cardholders) flights.

- Signup for CLEAR and get 10,000 miles: Cardholders who enroll in CLEAR will get 10,000 bonus miles if they enroll by 6/30/22. You will also be able to enroll in CLEAR for $109. You must provide your MileagePlus account number here when you sign up for CLEAR to get the discount price and bonus miles. Allow 4-6 weeks after the sign-up for miles to post to your account.

- Cardholders with United elite status get free upgrades on coach award tickets on upgrade eligible routes for the cardholder with status and a companion!

- A free carry-on bag for the cardholder and companions, even on basic economy fares.

- Premier Access: Priority check-in, security screening, boarding, and baggage handling privileges.

- 3 free years of Shipt for free deliveries from Target stores and more.

- The ability to use online checkin and get a boarding pass in advance on basic economy fares. United does not allow online checkin on basic economy fares unless you have elite status or a United card with free bags.

- Primary rental car CDW insurance in every country.

- Earn 500 PQPs towards elite status for every $12K/year spent annually on the card, up to 8,000 PQPs for $192K/year spending. PQPs from multiple cards can stack together up to 15,000 PQPs, enough for Platinum status.

- 1 year free DoorDash membership.

- $10 monthly GoPuff credit through 12/31/23.

- Chase United Business Card

- Earn 75,000 bonus miles after spending $5,000 in the first 3 months of card membership.

- $0 intro annual fee, then $95. You can currently redeem 6,600 United miles to pay for the card’s annual fee thanks to a value of 1.5 cents per mile towards refunding the annual fee!

- A free checked bag worldwide for the cardholder and a companion, even on basic economy fares.

- 2 miles per dollar on United, restaurants, gas stations, office supply stores, local transit, taxis, tolls, mass transit, and ride share services.

- 5,000 bonus miles every card anniversary if you have this United business card and any United consumer card.

- $100 annual statement credit if you make 7 United purchases of $100 or more on the card.

- 25% statement credit for food, beverage, and WiFi purchases on United flights.

- A free carry-on bag for the cardholder and companions, even on basic economy fares.

- Priority boarding for the cardholder and companions, even on basic economy fares.

- The ability to use online checkin and get a boarding pass in advance on basic economy fares. United does not allow online checkin on basic economy fares unless you have elite status or a United card with free bags.

- 2 free United Club passes every year for being a cardmember.

- Primary rental car CDW insurance in the US when renting for business purposes and in every other country for any rental purpose.

- Cardholders with United elite status get free upgrades on coach award tickets on upgrade eligible routes for the cardholder with status and a companion!

- If you spend $12K/year on the card it will give you 500 PQPs and if you spend $24K/year you’ll get 1,000 PQPs. PQPs from multiple cards can stack together up to 15,000 PQPs, enough for Platinum status.

- 1 year free DoorDash membership.

- $10 monthly GoPuff credit through 12/31/23.

- Chase United Business Club Card (Click on apply now to reach this card application)

- Earn 75,000 bonus miles after spending $5,000 in the first 3 months of card membership.

- This card previously offered 50,000 bonus miles.

- This card has a hefty $450 annual fee, though that’s cheaper than even top-tier United elite members pay for a Club membership, which is included with the card. You can currently redeem 30,000 United miles to pay for the card’s annual fee thanks to a value of 1.5 cents per mile towards refunding the annual fee!

- Full United Club membership: Cardholders get a full United Club membership. You can bring your entire family, or you and 2 guests, to enter over 1,000 United and partner lounges and Star Alliance lounges worldwide when flying United or Star Alliance airlines. Club membership normally costs $650 per year.

- Earn 1.5 miles per dollar everywhere and 2 miles per dollar on United purchases.

- 2 free checked bags worldwide for the cardholder and a companion, even on basic economy fares. A value of up to $680 round-trip!

- A free carry-on bag for the cardholder and companions, even on basic economy fares.

- Premier Access: Priority check-in, security screening, boarding, and baggage handling privileges.

- Avis President’s Club Status.

- The ability to use online checkin and get a boarding pass in advance on basic economy fares. United does not allow online checkin on basic economy fares unless you have elite status or a United card with free bags.

- Cardholders with United elite status get free upgrades on coach award tickets on upgrade eligible routes for the cardholder with status and a companion!

- If you spend $12K/year on the card it will give you 500 PQPs and if you spend $24K/year you’ll get 1,000 PQPs. PQPs from multiple cards can stack together up to 15,000 PQPs, enough for Platinum status.

- 1 year free DoorDash membership.

- $10 monthly GoPuff credit through 12/31/23.

Comparison chart

Welcome bonus terms

You can receive the bonus on each of these cards if you haven’t received a bonus on the same exact card in the past 24 months and don’t currently have the same exact card.

If you do have the exact same card you can change to another United card, wait 3-4 days, and apply for that card again.

5/24

While all Chase cards are typically subject to 5/24 restrictions, there have been many reports of that not being enforced for United consumer cards. If you apply for a United card and are over 5/24, please let us know what happens!

In general, 5/24 means that you won’t be approved for a Chase card if you have been approved for 5 or more consumer credit cards in the past 24 months. Read more about that here.

Spend Threshold

You can pay your federal taxes for a 1.87% fee. If you overpay your taxes you can request a refund or apply it to your next year’s taxes.

My local natural gas company allows me to prepay up to $1,000 on a credit card for a $1.65 flat fee. That’s a great way to earn miles and help meet a spend threshold. My electricity supplier allows me to pay with a credit card for free as long as I am enrolled in autopay.

See this post for more ideas on meeting a credit card spend threshold.

Card convertibility

You can change a consumer card between all 4 United consumer card products:

- United Gateway℠ Card (No annual fee)

- Chase United Explorer card ($99 annual fee)

- Chase United Quest card ($250 annual fee)

- United Club℠ Infinite Card ($525 annual fee)

You can change a business card between both United business card products:

- Chase United Business Card ($99 annual fee)

- Chase United Business Club Card ($450 annual fee)

Pay yourself back for the annual fee

You can redeem United miles to pay yourself back for the annual fee at a rate of 1.5 cents per mile!

You can pay back all or part of the annual fee at that rate.

You have 90 days from when the fee is billed to pay yourself back and you can do so even after paying the annual fee.

You can use miles from the card’s signup bonus or you can transfer points from Ultimate Rewards to United to pay back the annual fee.

Card benefits

In addition to the benefits listed above, all 6 cards offer:

- No foreign exchange fees.

- A 25% rebate on inflight WiFi, food, and drink purchases.

- Exclusive cardmember access to auctions that allow you to use your miles for once-in-a-lifetime experiences. A few years ago I used 25K miles for 4 field box seats to an Indians game along with the right to run onto the field before the top of the 7th inning and swipe 2nd base right off the field. Nobody could believe it as I walked around the ballpark with 2nd base. I even got it signed after the game by the Indians wining pitcher that night, Justin Masterson, who was equally shocked that I actually had 2nd base.

- United miles never expire, even if you close your card.

- Trip Cancellation / Trip Interruption Insurance

- Extended Warranty Protection

- Purchase Protection

United Cards As Part Of A Chase Quinfecta Strategy

All of the United cards have unique benefits, so which should you get?

That depends on which benefits you value and how much they would cost you otherwise.

It’s worth noting that you can get the signup bonus for each United card as long as you didn’t get the bonus for that exact card within the past 24 months and don’t currently have that exact card.

If you have a United consumer card you can change to any currently offered United consumer card and if you have a United business card you can change to any currently offered United business card. After waiting 3-4 days you can apply for that card again.

It certainly makes sense to have a United card on top of a Chase Quinfecta strategy as just having the card makes your points more valuable. That consists of:

- Sapphire Reserve or Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card for mileage transfers and bonus value on points.

- A no-fee Freedom Unlimited or Ink Unlimited for 1.5 points per dollar everywhere.

- A no-fee Freedom Flex for 5 points per dollar in rotating categories.

- A no-fee Ink Cash for 5 points per dollar on wireless and office supply stores, including gift cards to stores like Amazon and hundreds more.

- Having a United card on top of the cards above creates a Chase Quinfecta as your United miles (and by extension your Chase points) become more valuable thanks to expanded award availability.

Here is a summary comparing what the currently available United cards have to offer:

- If you just want expanded award availability, go for the no-fee United Gateway Card. However you should get a premium consumer card with a higher signup bonus and downgrade the card after your first year as the higher signup bonus will more than offset the first year’s annual fee. Plus you can redeem miles to directly cover the annual fee and still come out ahead.

- If you also want to be able to get a free bag and bypass onerous basic economy restrictions, go for the United Explorer Card or United Business Card.

- If you will be able to take advantage of the Quest card’s $125 and 10,000 mile rebates, then the United Quest Card will effectively be cheaper than the Explorer card, plus you’ll get 2 free bags to boot!

- If you want United Club access, go for the United Club℠ Infinite Card or United Business Club Card

- Grandfathered cards like the old United Presidential Plus card (good for earning more PQPs towards United elite status) and the old consumer United Club card (similar to the current United Business Club card) can’t be had anymore, so think twice before you close those.

Expanded award ticket availability

The reason the United cards are the best airline cards you can get isn’t for the spending benefits, it’s for the perks. And they are awesome.

The United cards are the only airline card that offers expanded award ticket availability.

All 4 of these cards offer this benefit.

This increases the value of your miles significantly and in turn makes the Chase Quadfecta/Quinfecta spending strategy even more valuable.

Cardholders have access to significantly expanded saver coach award availability (XN class), last seat standard coach award availability (YN class), and last seat standard business/first class award availability (JN class).

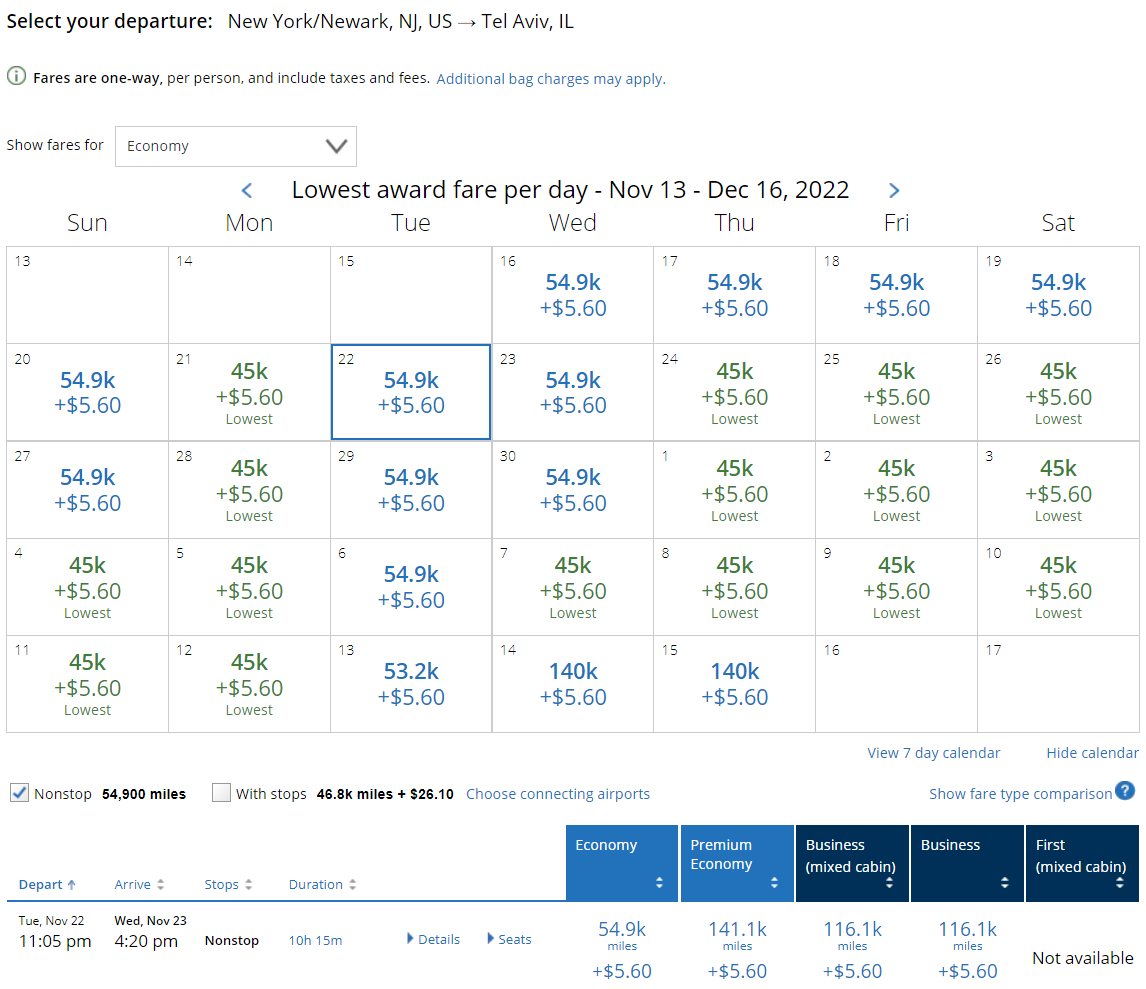

If you’re not a United cardholder, there are no dates with saver award space nonstop from Newark-Tel Aviv in November-December:

If you are a United cardholder, there are many dates with saver award space:

This availability differential applies to all domestic and international routes and makes it crucial to be a United cardholders.

Expanded Plan B availability

As you have better access to saver coach awards you’ll also have better ability to do Plan B awards.

Plan B allows you to redeem for saver business class awards when there’s only saver coach available! Read more about Plan B in this post.

No airline besides United offers a Plan B style award redemption.

Discounted awards for cardholders

United runs promotions offering discounts on award flights for cardholders.

They have offered these discounts for travel to Tahiti, Ski destinations, Hawaii, Mexico, The Caribbean, and more.

Here Is United’s Hidden Award Chart

United no longer publishes an award chart, but rates for United flights found in their old award chart are still correct.

United does charge a close-in mileage surcharge and they can be found in the chart below. Note that the you’ll want to book travel as 2 one-ways to avoid paying the surcharge on the return leg when it wouldn’t apply when booked separately. However if you do that you would lose your ability to take a free stopover.

Partner award rates have gone up and they can be found in the unpublished award chart below with one-way rates for flights to/from the mainland US:

| United flights | Partner flights | |

|---|---|---|

| Close-in surcharge within 7 days | 2.5K-3K miles | 1K-3.5K miles |

| Close-in surcharge 8-21 days in advance | 2K-2.5K miles | 1K-3.5K miles |

| Mainland US/Canada | 12.5K Coach 25K Business 35K Premium Business | 14K Coach 27.5K Business |

| Alaska | 17.5K Coach 30K Business 40K Premium Business | 19.5K Coach 33K Business |

| Hawaii | 22.5K Coach 40K Business 50K Premium Business | 25K Coach 44K Business |

| Mexico | 17.5K Coach 30K Business | 19.5K Coach 33K Business |

| Central America | 17.5K Coach 30K Business | 19.5K Coach 33K Business |

| Northern South America | 20K Coach 35K Business | 22K Coach 38.5K Business |

| Southern South America | 30K Coach 60K Business | 33K Coach 66K Business |

| Europe | 30K Coach 60K Business | 33K Coach 77K Business 121K First |

| Africa | 40K Coach 70K Business | 44K Coach 88K Business 143K First |

| Middle East | 42.5K Coach 75K Business | 47K Coach 93.5K Business 154K First |

| Central Asia | 42.5K Coach 75K Business | 47K Coach 93.5K Business 154K First |

| South Asia | 40K Coach 75K Business | 44K Coach 99K Business 154K First |

| North Asia | 35K Coach 70K Business | 38.5K Coach 88K Business 132K First |

| Japan and Oceania | 35K Coach 70K Business | 38.5K Coach 88K Business 121K First |

| Australia and New Zealand | 40K Coach 80K Business | 44K Coach 99K Business 143K First |

Excursionist Perk

While American and Delta have eliminated free stopovers, United continues to offer a free excursionist perk as described in this post. Just use the multi-city award search on United.com to piece it together.

You can read this post for more about hacking excursionist perks.

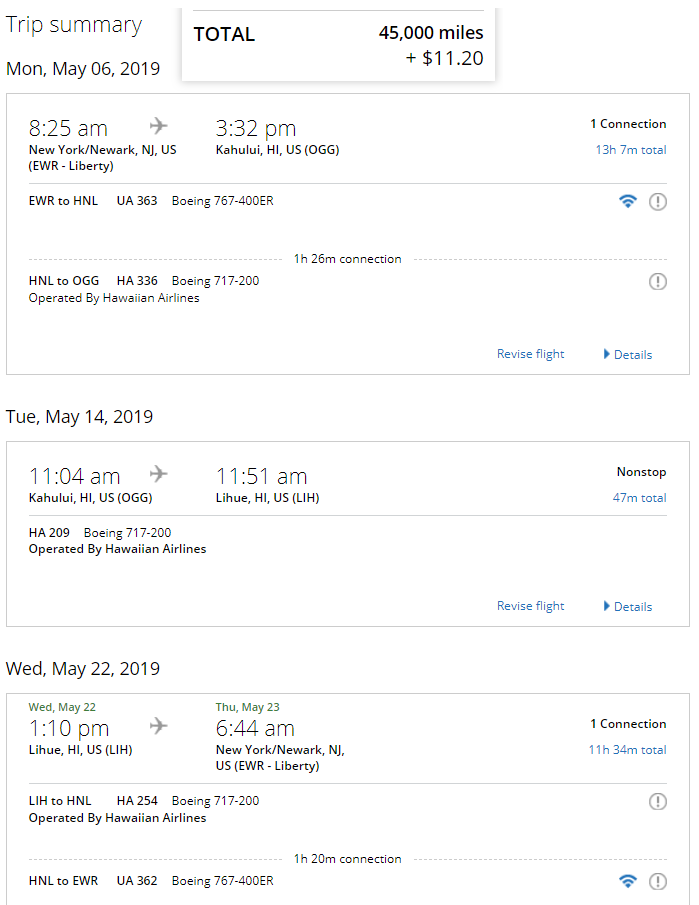

A round-trip to 2 Hawaiian Islands is just 45,000 miles round-trip thanks to the free excursionist perk:

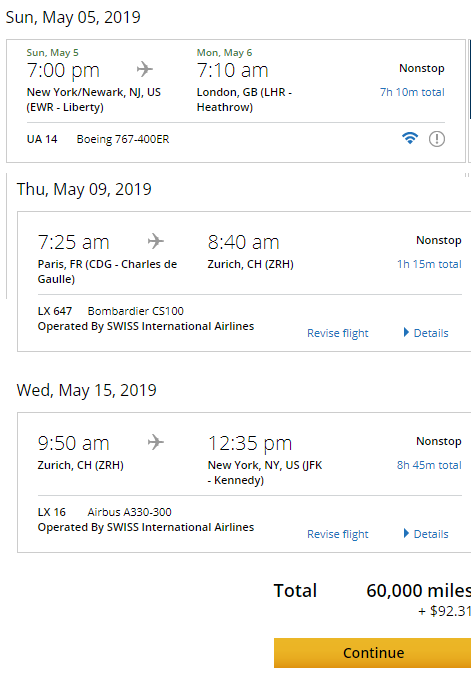

A round-trip ticket to 2 European or South American cities is just 60,000 miles round-trip thanks to the free excursionist perk:

A flight to 2 of my favorite cities in Asia, Hong Kong and Chiang Mai, Thailand is 80K miles thanks to the perk:

You’re even allowed a free open jaw in addition to the perk to really maximize your travel. For example this itinerary includes travel to London, Paris, and Zurich. You can take a train or use 4.5K BA Avios to get from London to Paris to fill the hole in the open jaw:

Of course the free stopover isn’t just useful from the US.

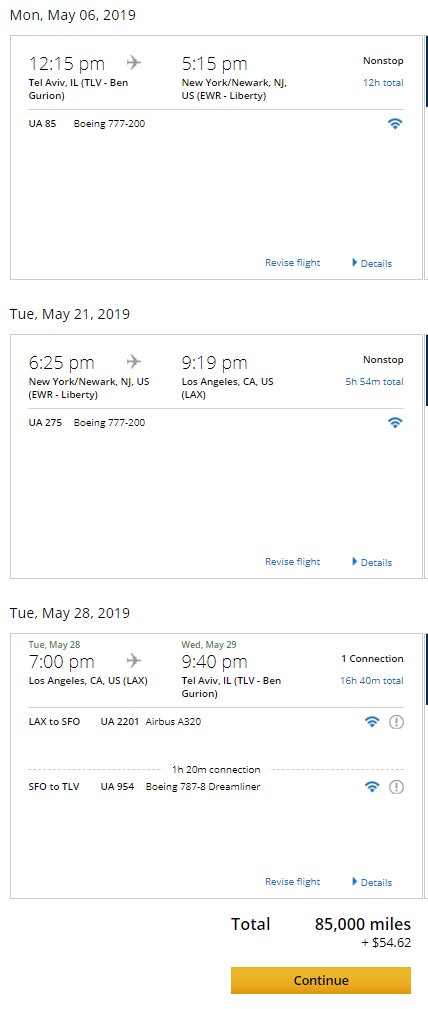

You can stopover in NYC and LA when flying from Tel Aviv to the US:

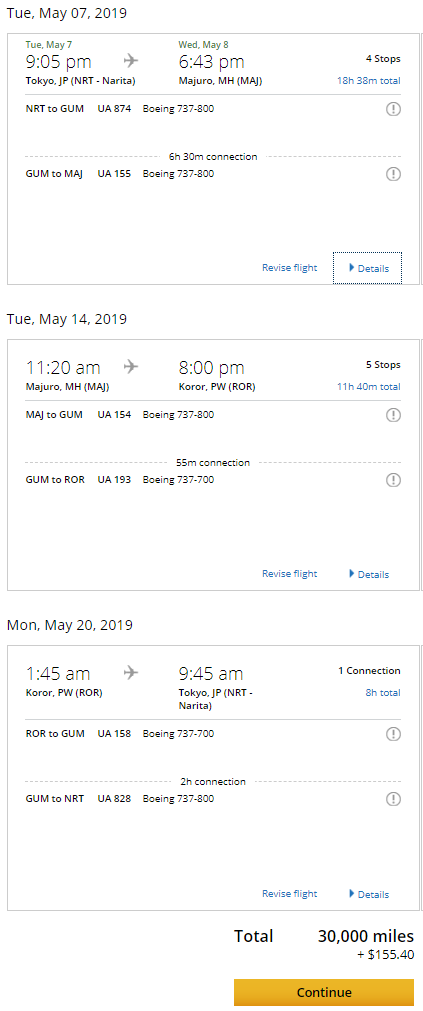

If you find yourself in Japan you can fly on the island hopper to 2 cities in Micronesia (I’ve been hankering to get back to Palau since the moment I left) for 30K miles:

You can also hack the excursionist perk for even more value.

You can use the multi-city search to book 2 flights within a single region and then you can book a free one-way within any other region sandwiched in between your flights.

For example if you book a round-trip from Cleveland to Chicago for 6,240 miles you can add in a free Excursionist Perk flight anywhere else in the world in between your flights, such as onboard the United Island Hopper from Palau to Kosrae via Guam, Chuuk, and Pohnpei, a flight that costs $598 or 12.5K miles on its own:

Or if you book a one-way flight from Cleveland to Chicago and then Chicago to Kansas City for 6,240 miles you can add in a free Excursionist Perk flight anywhere else in the world in between your flights, such as Johannesburg to the Seychelles, a flight that costs $473 or 19.5K miles on its own.

Partner airlines

United has dozens of partner airlines which means lots of great award opportunities. It can be worth checking for award space on partner sites like ANA or Aeroplan.com to search for award availability and then call United to book if you don’t see availability on United.

Partners airlines include:

- ANA

- Aegean Airlines

- Aer Lingus

- Air Canada

- Air China

- Air Dolomiti

- Air India

- Air New Zealand

- Aeromar

- Asiana Airlines

- Austrian Airlines

- Avianca Airlines

- Azul Brazilian Airlines

- Brussels Airlines

- Cape Air

- Copa Airlines

- Croatia Airlines

- EVA Air

- Edelweiss

- Egyptair

- Ethiopian Airlines

- Eurowings

- Germanwings

- Hawaiian Airlines

- Island Air

- Juneyao Airlines

- LOT Polish

- Lufthansa

- Scandinavian Airlines

- Shenzhen Airlines

- Silver Airways

- Singapore

- South African Airways

- Swiss International Airlines

- TAP Portugal

- THAI

- Turkish Airlines

Business card information

Some of these are business cards, but you may already have a business that needs a card to keep track of expenses. For example if your name is Joe Smith and you sell items online, or if you have any other side business and want a credit card to better keep track of business expenditures you can open a business credit card for “Joe Smith” as the business. You don’t need to file any messy government paperwork to be allowed to do that. Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field.

It’s important to just write your own name as the business name if you are just applying for your own small business as a Sole Proprietorship that doesn’t have any business paperwork.

If you’re like me and you run more than one business, you can signup for multiple of the same card for each business to manage each businesses expenses separately.

Business cards from most banks, including Chase business cards, do not get added to your 5/24 count of recently opened cards. That’s because business cards from most banks don’t show up on your personal credit report and the 5/24 count is based off of your personal credit report. That means that applying for Chase business cards won’t “hurt” your 5/24 count.

Another benefit of business cards not reporting on your personal credit report is that when you spend money on personal cards your credit score will be hurt even if you pay your bill on time. A whopping 30% of your credit score is based on credit utilization. You can pay off your card bill before your statement is generated to avoid that, but that takes effort and laying out money well before you have to. Additionally it’s good to have the statement close with a couple dollars to show the card is active and being paid every month. On an business cards from banks like AMEX and Chase it’s just not reported, so you can wait until the money is due without it having a negative effect on your score. That also means if you close the card, it won’t have an effect on your credit score.

Will you signup for one of these cards? Which United cards do you have?

![[Lawyer From Previous Lufthansa Antisemitic Incident Will Represent Passengers From This Week’s Incident] Deja-Vu: Lufthansa Accused Of Antisemitism Again](https://i.dansdeals.com/wp-content/uploads/2019/01/24205620/lh-373x150.jpg)

![[Cancellation Updates, Arkia Adds Athens Connection] Here Are The Current And Next Available Flights To Israel On More Than 40 Airlines!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[AMEX Explains Upcoming Points Transfer Pause To Emirates] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

50 Comments On "2 Hours Left! Earn Up To 100,000 Miles With Bonus Offers On 6 Chase United Cards That Have My Favorite Airline Card Benefit! Plus, Updated Comparison Chart"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

In the Quest card those 5000 mile rebates come in the form of a certificate that expires in a year. I just downgraded because of this

Can you open a new card for every buisness you own? Also, if it’s true, why can’t someone just open 10 buisness cards?

Who said they can’t…

I thought only one social security per account. Do you know if it’s okay to open up buisness cards for every buisness?

Does the quest card bypass 5/25

Can you use the $125 rebate on the Quest card to purchase miles and get the rebate? Can’t find an answer to that anywhere and United hasn’t answered my direct question.

Is “Pay yourself back for the annual fee” a temporary perk ?

It appears to be permanent.

Thank you !

This might sound noob, how do I book partner availability awards with United miles? I am trying to go through Singapore airlines from LAX to DPS. TIA

Is it more worthwhile to book a ticket using one of these cards for the benefits, eg. free bags etc. or one of the Sapphire cards with all the protection they offer?

I currently have the United Quest card. Is it worth upgrading to the United Business Club Card to effectively get the United club lounge and priority check in?

Dan I see you updated roadside assistance the limit for the four services is $50 per incident BTW thanks for all the posts

I just applied for business explorer card. And they did a hard credit pull. I put down sole proprietor. What did I do wrong? I thought they don’t pull for business card applications?

If I got that is wrong does it pay to apply for others in next 24-48 hours or will that hit score too?

Note I had a credit freeze and they emailed me to unfreeze and I did. And then the pull. Using ssn.

Thanks Dan. Still learning.

Applied for the United Explorer Card using your link and was approved . Looking forward to visiting the brand new United Lounge At Newark Liberty Airport using the 2 free United Club passes the come with this card .

Thank you for providing the most comprehensive credit card posts on the internet . I look forward to reading them !

We opened a business card in my husbands name less than 24 months ago (his SS but with the company EIN). If I opened a new business card with the same company EIN but with my SS number can I get the bonus?

One of the best perks is the pay your annual fee with the card!

Two free bags are really international like to Israel?

Yes.

So I used united points to make tix to Israel and I get 2 bags?

How do I request that?

Did you use your Club or Quest card to pay the taxes?

Yes

Then it’s automatic.

Dan, please help me understand how to get a companion pass or give a link to explain how to get a companion pass. Thank you for all the information provided.

Can i pay the annual fee after I get the bonus points (within 3 months) or only if I have enough points prior for the approval?

You can pay it after.

Hi @Dan, I applied for the United Mileage Club plus card and got denied. I only have 1 other chase card (sapphire reserve) for the past 2 years and have paid every bill in full on time. The reason for denial was “

High debt relative to income

•Insufficient installment loan information

•Credit card balances are high compared to the age of the accounts

•Too many revolving accts opened in 1 year compared to all revolving accts”

Anyway I can get approved for this?

Try calling them.

Try moving some of your Sapphire credit to the new card.

Just got a decline for United Club due to 5/24 rule as I am over. Unfortunately they enforce this restriction.

In order to receive the 10K miles for signing up for Clear, can I get the 10K miles even if I get clear for free, as a 1K, or only if there’s a charge on the card?

Sorry don’t know if anyone ever asked before but do additional card holders have the same benefits as the primary card holder when they’re not flying with a primary card holder ie. Free bags/lounges

No

do you have to use the card to book the flight in order to get the free bag, or is it even if you use a different card, as long as you are a cardholder?

You need to use the card

Two questions. 1. If I had one type of card can I get the bonus on a different one? Also, am I understanding properly, if I book a rewards flight, say to Israel, and take a non refundable ticket, can I still cancel and get my miles back?

1. Yes.

2. Yes.

Are there any other Chase cards that will give me PQP, aside from United cards?

No.

As mentioned on a different post, there is a huge number of US citizens with domestic addresses, currently in Israel. We all need to know please if the deals you are offering charge foreign transaction fee. Please make it automatic procedure to include foreign transaction fee information as product information on each card you advertise, including of course, the cards in this post. You and your readers will both gain from this. Thanks so very much!

It’s in the chart

i canceled 3 award flights for medical reasons and i couldn’t cancel it on the website so called and they made me upload a letter and then they only gave me flight credits anything i can do?

Award flights are only with United miles and are refundable.

If you book flights with bank points, those are paid flights which are not refundable.

it was made with united points

HUCA. United miles are fully refundable.

what can i do to get back the points?

Thank you Dan, i Applied for United Quest using your link & got approved B”H, does every additional user on the card get all the benefits that i would get?

& do you have a recent article of how to make the best out of the Quest card?

No, primary only.

Applied for club card and was subject to 5/24

@Dan, are there any united cards, or any airline for that matter, that get me a free 2nd bag internationally?

Quest and Club.