Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Citi Rewards+® Card: 15K Points, 0% APR, And Incredible For Small Purchases+ThankYou Redemption Rebates

Table of Contents

Signup bonus

You’ll earn 15,000 points for spending $1,000 in 3 months on a new Citi Rewards+® Card

Plus if you’re approved by 5/31, you’ll get an additional 3 months to complete the $1,000 of spending, for a total of 6 months to earn the signup bonus!

Annual fee

$0.

Signup bonus rules

- You can receive the bonus on this card if you haven’t received a bonus or closed a consumer Citi ThankYou card in the past 24 months.

- Citi allows applications for 1 card every 8 days and 2 cards every 2 months. Business cards are limited to once every 3 months. Add a few extra days in between applications to be safe.

Card earnings

- Round up to the nearest 10 points on all purchases. If you spend $1, you’ll earn 10 points! If you make a $0.50 Amazon balance reload you’ll also earn 10 points, which is equal to earning 20 points per dollar spent!

- Earn 2 Points per $1 spent at supermarkets and gas stations for the first $6,000 per year.

- Earn 1 points per dollar elsewhere, rounded up to the nearest 10 points per transaction.

Redemptions and 10% redemption rebate

Cardholders get a 10% points rebate when you redeem points, up to a 10K points rebate per year. That means if you redeem 15K points for a $150 gift card good for hundreds of different stores, you’ll get a rebate of 1.5K points.

Having a ThankYou card also makes you eligible for Citi Offers on Amazon.

This card can’t transfer points into miles, except for JetBlue at a 5:4 ratio. That means if you transfer 10K points to JetBlue you’ll get 8,000 TrueBlue points and you’ll get a rebate of 1,000 points, which can be transferred to JetBlue once again with another 10% rebate.

However if you also have a Citi Premier® Card you’ll get a 10% rebate on points transferred to miles or on points used for paid airfare with a 25% bonus. More on that below.

Citi also allows you to transfer points other members.

Zero APR on purchases and balance transfers

- Get 0% intro APR on purchases for 15 months from date of account opening

- Get 0% intro APR on balance transfers for 15 months from date of the first transfer.

- Balance transfers need to be completed in the first 4 months of account opening.

- There is a balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater.

Virtual card numbers

While Citi co-branded cards like their AA cards no longer offer virtual card numbers, their ThankYou cards like Rewards+ still do.

With a virtual card number you can set a dollar limit and/or expiration date to generate a one-time use credit card number so that you don’t keep getting charged for subscriptions or have your real card number stolen, among myriad other potential uses.

Point transfer options with Citi Premier® Card

If you also have a Citi Premier® Card , you can transfer points into miles or you can redeem points for paid travel at a value of 1.25 cents per point.

Alternatively, you can upgrade your Rewards+ card to Premier in order to make a mileage transfer.

- Citi mileage transfer partners now include:

-

- Aeromexico (Skyteam): 1K:1K

- Air France/KLM Flying Blue (Skyteam): 1K:1K

- Avianca Lifemiles (Star Alliance): 1K:1K

- Cathay Pacific Asia Miles (OneWorld): 1K:1K

- Emirates: 1K:1K

- Etihad: 1K:1K

- EVA (Star Alliance): 1K:1K

- Garuda Indonesia (Skyteam): 1K:1K

- JetPrivilege: 1K:1K

- JetBlue: 1K:1K

- Malaysia (OneWorld): 1K:1K

- Qantas (OneWorld): 1K:1K

- Qatar (OneWorld): 1K:1K

- Singapore (Star Alliance): 1K:1K

- Thai (Star Alliance): 1K:1K

- Turkish (Star Alliance): 1K:1K

- Virgin Atlantic: 1K:1K

-

Plus you’ll get a 10% points rebate with a Rewards+ Card!

For example you can transfer miles to Turkish Airlines to fly from the US to Tel Aviv on United for just 28.8K points in coach after the 10% rebate:

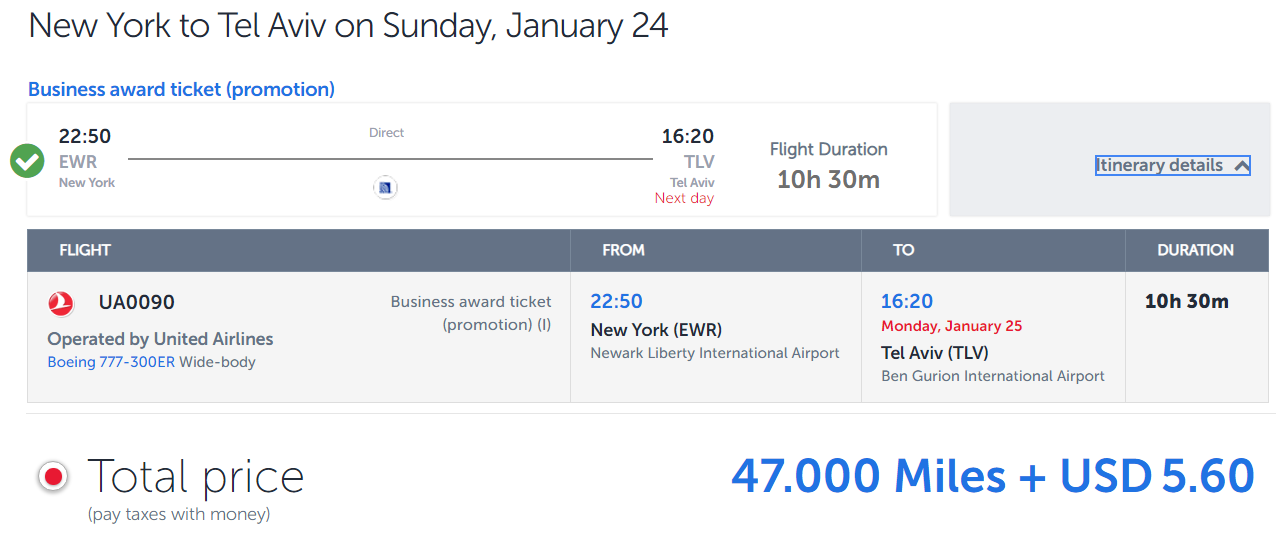

Or 42.3K points in Polaris business class after the 10% rebate:

United award availability is unprecedented, even for next year.

There are lots of other bargains after the 10% points rebate:

- Fly one-way anywhere in the US, including Hawaii, Alaska, Puerto Rico, and USVI, for just 6,750 points in coach or 11,250 points in business class on United with no fuel surcharges.

- Fly one-way anywhere to Canada or Mexico for just 9K points in coach or 13,500 points in business class on United with no fuel surcharges.

- Fly one-way to Europe for 40.5K points in business class on United with no fuel surcharges.

Do you have a Citi Rewards+® Card?

Leave a Reply

40 Comments On "Citi Rewards+® Card: 15K Points, No Annual Fee, 0% APR, And Incredible For Small Purchases+ThankYou Redemption Rebates"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

“Round up to the nearest 10 points on all purchases. If you spend $1, you’ll earn 10 points! If you make a $0.50 Amazon balance reload you’ll also earn 10 points, which is equal to earning 20 points per dollar spent!”

What are the chances of a shutdown if I keep doing this to rack up points?

People do it. I haven’t heard of shutdowns.

@Dan. You know that shutdowns will happen eventually.

Considering that people have been doing it successfully for years, I don’t know that.

We of course don’t know. But, the last time a bank offered something similar- the Freedom 10 points per transaction- people who hit it hard got shut down after a couple months.

And people have been doing this for years…and Citi isn’t Chase.

Just tried 20x 0.50 reloads in a day lol will update if Citi says anything

Since the typical interchange fee for a MasterCard credit card is $0.10 + nearly 2% of the charged amount, if Citi’s real cost of 1 TYP = 1 cent, they are breaking even on a charge of even $0.01. So, presumably from their perspective if someone is going to take the time to make a bunch of $0.01 charges, no real loss to them and no reason to chase down these “penny players.”

So you have any idea if they will approve me when my credit score is only “fair”?

till when can you redeem points at 1.25 for airfare?

As of April 10, 2021, points redeemed for travel through the ThankYou® Travel Center will no longer get 25% more value as compared to gift cards.

What is the best citi sign-up bonus to do and then downgrade to this card? Premier?

I have the premier and the rewards+ when I go to transfer points I don’t see any rebate

You get the rebate shortly after you redeem or transfer points.

Is there anyway to see a previous rebate I got

I made a couple of transfers and I didn’t get the rebate, then I combined all my TY accounts into one account and then on transfers that were done afterwards I received the bonus.

“You can receive the bonus on this card if you haven’t received a bonus or closed a consumer Citi ThankYou card in the past 24 months.”

However: “Citi allows applications for 1 card every 8 days and 2 cards every 2 months.”

If I’ve received a bonus for the Premier, will I not receive a bonus for the Rewards+ Within 24 months? (And then the second card within 2 months would be bonus-less?)

Thanks!

Same question

Is there a foreign transaction fee?

Looks like the minimum gift card now on Amazon is $1.00 not 0.50 anymore

.50 works for me.

So isnt better to first apply for premier card to get the 60k first if you have eligible slot under citi rules?

is it possible to transfer points from one Thank you account to a different account holder name

Yes.

they keep offering me to switch my Citi preferred card to the rewards plus. Any reason I shouldn’t. I don’t want a new hard pull now

The 10% rebate is up to 100k points per year. Not 10k

You can get up to 10K points rebated (on 100K points redeemed).

Do they charge foreign fees?

Yes, 3%.

If you upgrade your card to the Premier card to transfer to miles, you wont get the 10% rebate since you wont have the rewards+ card anymore. Is that correct?

Correct, you would need both cards open.

Between my wife and I, we have 3 Citi cards. If I convert hers into the double cash and I have the rewards+ and premier, is that essentially getting the trifecta? Or is her double cash rewards not transferrable to my premier miles account?

How would this card compare to the citi double cash on a can back level?

Just got this card a week ago. How can I get the signup bonus?

Pretty sure you need to combine your Thank You accounts in order to get the rebate for other cards

0% interest for 15 months. What is it after 15 months?

@dan I have a citi simplicity card that i opened to do a balance transfer a while ago i recently called in to have it closed and they offered me to switch to any other card i would like with no credit pull …wondering if this card would be worth it without the signup bonus or should i rather get the double cash? thanks

does this card include international travel insurance?

you can move points to Prestige for transfer?

You can combine your accounts so the points all total into one pot like American Express