Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Chase Sapphire Reserve®® card took the miles and credit card world by storm when it was introduced in 2016. People love the card and 90% of cardholders kept it for a second year!

But its less flashy sibling, the Chase Sapphire Preferred® Card, is no slouch.

While the Sapphire Reserve’s $450 annual fee looks daunting at first glance, the effective annual fee is actually just $55 more than Chase Sapphire Preferred® Card’s $95 annual fee. That’s due to the $300 annual travel credit on the Sapphire Reserve that automatically refunds up to $300 in annual airfare, car rentals, hotels, cruises, Airbnb, subways, trains, taxis, Uber, tolls, parking, and even UberEats food delivery. Here are just some of the items that qualify for the credit. It’s not hard at all to take advantage of the $300 credit (you can always get travel gift cards if you didn’t spend the full amount) so the effective annual fee is actually $150.

Having one card or the other is practically a requirement to maximize your miles, but there’s no reason to have both cards. Which card is right for you? Is Sapphire Reserve worth the extra $55 over Chase Sapphire Preferred® Card?

Here’s a comparison chart that illustrates their strengths and weaknesses.

| Chase Sapphire Preferred® Card | Sapphire Reserve | |

|---|---|---|

| Signup bonus | 50K points for spending $4,000 in 3 months, plus 5K points for adding an additional user | 50K points for spending $4,000 in 3 months |

| Annual Fee | $0 for the first year, then $95 | $450 |

| Allows you to transfer Chase points from any card to airline miles | Yes | Yes |

| Value of points towards paid airfare, hotels, car rentals, cruises, and activities | 1.25 cents | 1.5 cents |

| Additional Cardholder Fee | $0 | $75 |

| Annual Travel Credit (Airfare, hotels, car rentals, Uber, etc) | $0 | $300 |

| Points earned on travel (Airfare, hotels, car rentals, Uber, etc) | 2 per dollar | 3 per dollar |

| Points earned on dining | 2 per dollar | 3 per dollar |

| Priority Pass membership | None | Primary and secondary cardholders can bring themselves and 2 free guests into a lounge |

| $100 Global Entry/Pre-Check Fee Refund | None | Once every 4 years for Primary cardholder |

| Foreign transaction fee | None | None |

| Worldwide Car Rental CDW Coverage | Primary coverage | Primary coverage |

| Roadside Assistance | Available for a $59.95 charge | Free battery boost, flat tire service, 2 gallons of fuel delivery, towing, or lockout assistance |

| Purchase Protection for items damaged or stolen within 120 days | $500 per item | $10,000 per item |

| Extended Warranty Protection | 1 extra year for items up to $10,000 | 1 extra year for items up to $10,000 |

| Trip Cancellation/Trip Interruption Insurance | $10,000 per trip or $20,000 per trip with multiple travelers | $10,000 per trip or $20,000 per trip with multiple travelers |

| Return Protection | None. | $500/item up to $1,000/year |

| Lost Luggage Insurance | $3,000 per person per trip (limit of $500 per person for jewelry, watches, and electronics) | $3,000 per person per trip (limit of $500 per person for jewelry, watches, and electronics) |

| Trip Delay Reimbursement | $500 per person for reasonable expenses (Hotel, food, toiletries, medicine, etc) required for delays more than 12 hours. | $500 per person for reasonable expenses (Hotel, food, medicine, etc) required for delays more than 6 hours. |

| Baggage Delay Reimbursement | $100 per day per person (max of 5 days) for essential items needed (Clothing, toiletries, cell phone charger, etc) required for delays more than 6 hours. | $100 per day per person (max of 5 days) for essential items needed (Clothing, toiletries, cell phone charger, etc) required for delays more than 6 hours. |

| Travel Accident Insurance | $500,000 per person | $1,000,000 per person |

| Emergency Evacuation and Transportation due to injury or illness on a trip | None | $100,000 for trips between 5-60 days, more than 100 miles from your home |

| Repatriation of Remains Insurance | None | $1,000 for a coffin and to return your body to your home country if you die on a vacation |

| Emergency Medical and Dental Benefit | None | $2,500 for medical expenses on trips between 5-60 days, more than 100 miles from your home |

You can view the full details about the Sapphire Reserve’s protections here and Chase Sapphire Preferred® Card’s protections here.

In short, assuming you’ll use the $300 travel credit, the extra $55/year of Sapphire Reserve over Chase Sapphire Preferred® Card gets you:

- Priority Pass lounge membership with access to over 1,000 lounges with unlimited guests

- I’ve used this to access the Art & Lounge in Newark, where they have kosher food and wine, without even needing a boarding pass! The lounge is located in Newark Terminal B before security.

- Triple points on dining and travel

- Combined with the travel protections this card offers, it’s a no-brainer to put all travel charges on the Sapphire Reserve.

- Global Entry/Pre-Check membership

- Makes flying domestically and internationally so much easier and less stressful!

- Roadside assistance

- I’ve taken advantage of this several times for assistance when my car got stuck or the battery needed a jump.

- Trip delay reimbursement starting from a 6 hour delay

- Medical coverage and evacuation coverage while traveling

- 120 days of Purchase protection for items up to $10,000

- The ability to redeem all of your Chase points at a value of 1.5 cents each for travel, including airfare, car rentals, hotels, and activities. That makes the 50K signup bonus alone worth a minimum of $750.

- This means you can use just 3.1K points to fly one-way from NYC to Florida:

7.5K points to fly one-way coast to coast:

29K points round-trip from NYC to Rome:

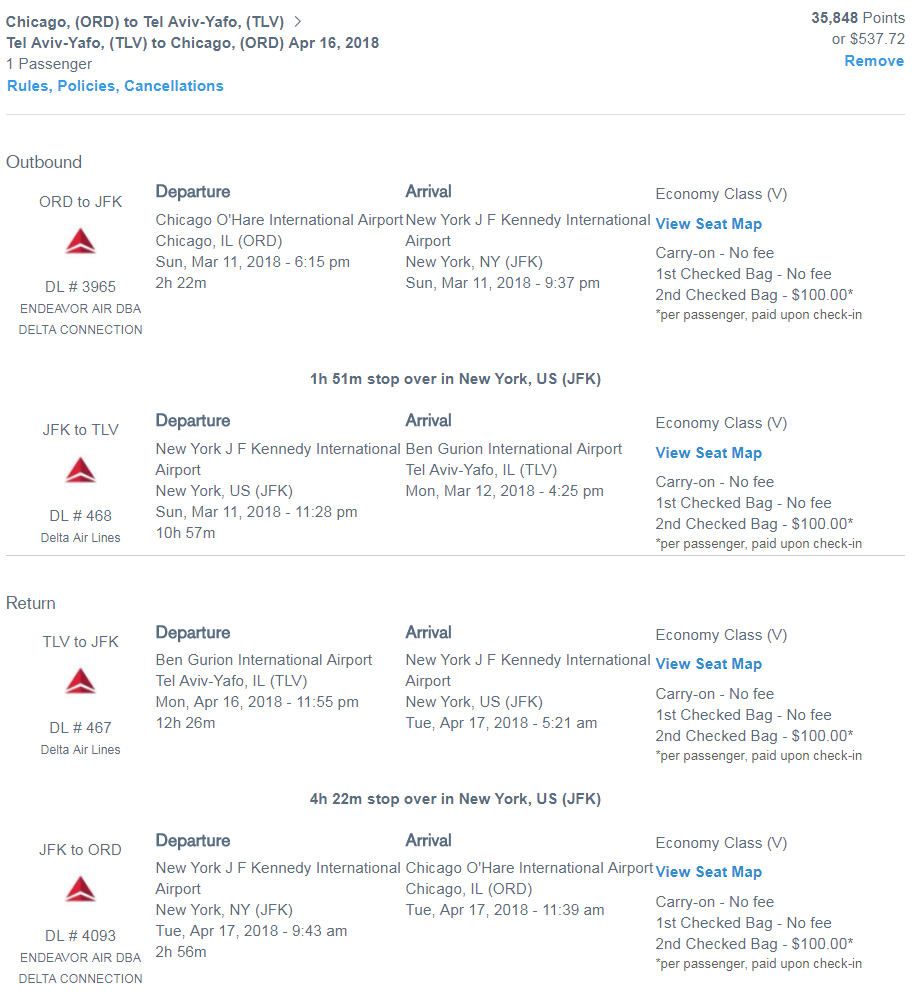

Or 35.8K points to fly round-trip from Boston or Chicago to Israel:

I’d say that those benefits make the Sapphire Reserve a no-brainer, but share your thoughts in the comments and vote below:

![[Cardholders Register For 11 Bonus Points Per Dollar] Hyatt Launches Under Canvas National Park Glamping Partnership](https://i.dansdeals.com/wp-content/uploads/2024/07/26004607/Outdoor_Dining_Area_licjda-267x150.jpg)

Leave a Reply

154 Comments On "Should You Have A Chase Sapphire Reserve® Or Chase Sapphire Preferred® Card? View The Full Comparison Chart And Vote In The Poll!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Triple points on dining and travel

Combined with the travel protections this card offers, it’s a no-brainer to put all travel charges on the Sapphire Reserve

Global Entry/Pre-Check membership

Makes flying domestically and internationally so much easier and less stressful!

If you also have the Amex Platinum card, the above isn’t necessarily true? So is It still worth the extra $55/year?

AMEX Platinum doesn’t have the travel protections that this card comes with, so that becomes a difficult decision, but in most cases I think that Sapphire Reserve will make more sense.

Global Entry membership can be used for family members as well.

Don’t forget PP has guest limits on the Plat card, although it has Sky club access, and Centurion lounges.

Is it worth losing the 2 extra points per dollar on airfare for the protections that you hope you will never need? I recently booked 7 tickets to Israel on the Personal Platinum card and didn’t use my CSR. The bonus 25k MR points was a sweet reward….

Good question.

The first thing you need to do is value the points. Personally I value Chase points higher than AMEX points as I prefer the Chase partners (United, Hyatt, etc) over AMEX. Plus AMEX charges a fee for mileage transfers to domestic airlines. And with Chase I can get a 1.5 value for all travel, which I can’t get with AMEX.

So let’s assume a value of 1.8 for Chase and 1.4 for AMEX. That means airfare on AMEX gets a 7% rebate and on Chase gets a 5.4% rebate. Of course those numbers can vary based on how you redeem your points. And even with that “value” I still find myself using Chase points far more often than AMEX MR points as they’re more versatile.

Essentially you would be paying 1.6% of the cost of the airfare for trip delay, baggage delay, trip cancellation, medical coverage, etc. that Chase will cover and that AMEX won’t.

My guess is that in the long-run that bet will pay off for Chase, but it will vary based on what trip you’re taking.

But it’s an interesting question. Would like to hear what others with both cards do.

On mileage tickets putting the taxes on Sapphire Reserve over AMEX Plat is a no-brainer.

I am “up” around 2000 dollars this year from the travel protection with the prestige

I did the same mistake by paying with Amex Platinum for $1500 ticket.. but due to my wife medical emergency i would able to travel and would able to reimburse my ticket amount with doctor’s letter.. if i would have used my csr would have got my full money back…

“Global Entry membership can be used for family members as well.” How so?

Also, the Platinum allows you to add unlimited Gold cardholders who all can receive the Global Entry benefit free, as opposed to CSR, where it’s $75 for an AU. Still, I like my reserve better than my Plat.. and ALOT better than my preferred!!

Sam’s and Costco offer the 3% travel and dining so that really is not a factor.

3 Chase points are worth much more than 3%.

Just completed a family jaunt to S Africa (thank you Dan / Air Canada) via Canada, Europe. A lot of flying = a lot of Priority Pass Lounges. Invaluable benefit. That along makes the CSR the clear winner.

Nice!

No brainer, the reserve. If you factor in the $300 reimbursement, its essentially costing you $55 more. with the extra bonus points and other perks with the card, its a lock…Reserve it is!

I called Chase and they said only 1 guest is allowed with a priority pass holder. I later had a layover in Abu Dhabi and my mom was allowed in with me. The receptionist made an “exception” for my daughter who just turned 2 the same day and said kids under 2 are free. Anyone over age 2 would have to pay full price. Only 1 guest is allowed with the priority pass holder. Please clarify?

Speaking from experience, you were misinformed.

You can bring in as many guests as you want, just swipe your Priority Pass card and you won’t be charged.

According to priority pass website every location has different rules regarding how many people can come with you

Same here. Iv’e let in many guest with me in many airport lounges. Never had an issue.

That’s not true. Whoever’s traveling it with you is able to enter the lounge with you. I just took my 7 kids into the lounge in Paris without charge.

A few months ago I took my family of 7 to the lounge in WAW on the going and again on the coming. Receptionist said she was charging my card for like 4 guests or something like that. Made no difference to me what she did to my PP card because she let all of us in.

If you travel at all, then yup. No brainer. When I first got it, I thought that priority pass was just a luxury perk. It’s definitely not absolutely necessary, but it really makes a difference when traveling. Really makes you feel like a mensch. I was so grateful to have it when my ElAl flight last winter got delayed overnight and then finally cancel. Getting stuck in the airport overnight was a whole lot more decent in the Dan lounge rather than being at the gate for 8 hours!!!

Lounge access is huge when there are irregular flight operations.

I tried signing up last year when there was a 100K bonus but was turned down because of the 5/24 rule.

What would you say is likelihood of another increased sign up bonus of 75k or higher?

The 100K hasn’t been offered since the intro offer. It’s been 50K since then.

I don’t think it’s likely to return, Chase took a big hit handing out all of those miles, especially since they’re worth at least 1.5 cents each for Sapphire Reserve cardholders.

Recent numbers (90% retention specifically) didn’t make you think otherwise?

The retention numbers are great, but that doesn’t mean they’re going to give away the house again. It will take a very long time to make a profit on this card from people who got a 100K signup bonus during the intro offer.

They’re doing just fine offering 50K on the card…

With the trip cancelation if the airline cancelled the trip due to airport strike in Rome and had to buy a new ticket for more expensive would they reimburse me for the difference thanx for all your info on saving money.

I’d suggest calling Chase to discuss the fine print.

I thought you could have one or the other? If one has the CSR, can you get the CSP sign up bonus too?

They used to allow you to open both, but now they won’t approve you if you have the other open.

You can however downgrade either of them to Freedom or Freedom Unlimited and then apply for either card.

So if I downgrade my preferred and then apply for the reserve I will get another 50k bonus?

As long as you didn’t apply for a Sapphire card in the past 24 months.

Thanks Dan,

I wanted to share my experience on this issue.

I have had the Preferred for about 22 months. I called Chase to upgrade to Reserve. The phone rep advised me to sign up for the CSR as a new applicant to receive the 50k bonus and not to upgrade (APPARENTLY SOME CHASE REPS ARE SERIOUSLY MISINFORMED). I applied for CSR and was declined because I have the Preferred.

Per a supervisor, I was told that I could cancel the Preferred and apply again for the Reserve in April (being 24 months since I opened the Preferred). Any idea if I will be declined again because of my recent failed application?

The problem with this chase card charges me over 24% interest all my other chase cards r much less

If you’re paying interest then you shouldn’t be using mileage cards. Go get a 0% card.

I just wanted to let you know, you can’t fund Disney accounts anymore as the Disney Vacation Account was closed down by Disney last year. It was a great thing while it lasted.

Shame, thanks.

are additional users $75 per card per year on reserved?

Officially, though if you don’t care about lounge access you can cancel the additional card and not have to pay the $75. The credit card itself for charging will still work but it won’t get lounge access.

I need additional cards for wife and kids so won’t that cost $225 extra regardless of lounge access? Thanks

Then what I told you to do will work.

that might be YMMV as i just returned from an international trip and used the lounge at 3-4 diff airports using my spouses card. none of them seemed to care, they just scanned my boarding pass and PP and let me in. Again YMMV of course but worth trying if folks don’t have an AU card.

my son fell overseas last summer and broke a leg, i had to make an emergency operation.

will the CSR reimburse that? is that named accident?

Sure, but there is a 180 day limit on claims.

Up to $2500.

Went to Art & lounge in EWR a few months back – they now require you to show a boarding pass even though it’s before security.

That’s too bad. Any more reports like this?

I was there in July. Did not need a boarding pass.

I was there twice in January no Boarding Pass

Nice!

Just there (Oct. 22). Boarding passes required for entrance, and was told that Kosher food is only available for those with an El Al boarding pass….They are renovating the lounge, and apparently creating a separate walled off area for El Al passengers. Only passengers in that area can access the kosher food.

How does the travel insurance work?

Do i must pay for the trip with the card ? what if i drive to Canada?

Needs be a trip on a common carrier.

“Common Carrier: any land, water, or air conveyance that operates under a valid license to transport passengers for hire and requires purchasing a ticket before travel begins. It does not include taxis, limousine services, commuter rail or bus lines, or rental vehicles.”

I like best the “$1,000 for a coffin and to return your body to your home country if you die on a vacation” option

Morbid, but useful for people who like doing risky activities

how many times per year can this option be used ?

9 if you’re a cat.

Actully want to downgrade ( have the Citi Prestige for lounge access, trip delay, etc.) and am only taking 1 air trip this year. Already have the Freedom and Freedom unlt’d. and had a sapphire preferred up to mid last year. Is the regular Sapphire my best option (have an Ink for business)

Why keep Citi Prestige over this?

What do you do with your Citi points?

Not speaking for James, but

(1) 3 hour baggage/delay insurance, this is better than 6 hours and was simple to use the one time I had to use it.

(2) recon last year gave out a $350 incentive to keep. on top of the $250 credit, the $450 fee is actually -$150 fee.

(3) Singapore is [now more] useful for those of us without UA status. Avianca is a decent transfer as well, 63k one way in business vs 70k on UA to Europe is useful. Also the ~short (Florida to Montana) distant zones are useful intra USA. (7500 per way including connects).

(4) linked to an att+ more card gives 3x on online purchases.

(5) 4th night free benefit.

(6a) if you have an ink+/bold/preferred card, you don’t need CSR for transfers.

(6b) I hold the CSR, and when I can load my ez pass or uber acct to hit the next year the very short period of time before i can downgrade, i think I will.

the two things I see as critical benefits to the CSR that prestige cannot touch.

(1) 1.5 cent per redemption when not transferring. (not a great deal but useable)

(2) 3x on dining and travel. (in the states you can do better with DE gift cards with ink or otherwise, intl’n yes you are losing 1x).

The car rental insurance would also be a CSR reason, but anyone reading this should probably have the united card anyhow (XN), which covers that. And playing huca with UA on the fee waiver is becoming more time consuming. I’ll just use my Singapore points when possible. I have, love, and use UR all the time, but freedom/FU/ink at 1.5-5x really cover that completely for me.

I think that because the golf benefit and AA lounge benefit were dropped, there are probably several years of good retention offers.

#stopbuyingalltheVGCatmyheinens

Singapore charges fuel surcharges besides for travel on UA, good for UA travel though.

I prefer the prestige because I only pay 350 a year on it also only 3 hours for trip delay

Generally true. But you can do cle-ewr (UA) ewr-osl (sas) osl-waw (LOT) without YQ for 27.5k pts. Long-haul lot is $60, but for the connector they don’t charge YQ. Should also have no YQ on the LAX-LHR new zealand flight, and of course on UA. Probably a few other programs out there where YQ is not billed.

If I purchase a mileage ticket with either another cc it airline points but put the $5 of tax on the reserve am I’m fully covered as if it purchased the whole ticket using chase?

Yes.

Doesn’t the entire charge have to be on the CC as they always say ?

So What’s the minimum that have to be to charged on the reserve?

I booked flights using CSR right before downgrading to Freedom Unlimited. What happens with trip insurance type benefits for those flights which will be flown after the downgrade?

Thanks.

I’d assume they are lost, but call Chase to confirm.

Any chance of them increasing sign up reward above the 50k? I feel like an idiot for not taking advantage of the 100k bonus.

https://www.dansdeals.com/credit-cards/chase-sapphire-reserve-sapphire-preferred-view-full-comparison-chart-vote-poll/#comment-1345881

If I buy a ticket for my son or someone do he get the same coverages

Yes.

I have & use the Reserve card.

We’re planning a trip abroad but I have a sick & elderly Mother in Law. If we have to cancel the trip due a sudden problem with her or us – is that covered or do I need an additional travel insurance policy

If it’s for a covered reason than you are covered. See the full benefits guide link that is after the chart in this post.

Amex plat also has it ?Baggage Delay Reimbursement

It does not.

Does the CSR have the benefit of getting you gold membership in Hilton and Marriott/Starwood? Or is that only on the amex plat?

How does the travel insurance work when booking with UR points?

Only AMEX Plat.

It’s covered as well. See the benefits guide or call for details.

Unfortunately my understanding is with the Chase Reserve every extra authorized user costs. On the Chase Sapphire you can have multiple authorized users without an additional charge.

Any way of getting around this?

https://www.dansdeals.com/credit-cards/chase-sapphire-reserve-sapphire-preferred-view-full-comparison-chart-vote-poll/#comment-1345903

I know that this is between the 2 chase cards, but ime, the 120 day rule for stolen or broken purchases are a real pain. (Police report etc, ..)

Amex is a breeze literally every time – all online etc. Benefits that are too complicated and stressful and time consuming are not benefits imo.

Is it still possible to apply for both same day when at 5/24 and receive bonus for both?

Tough to get both of these cards, but you can try one of these and another Chase card.

im not sure global pass is relevant any longer if you download mobile pass

Global Entry is in many more airports than mobile passport.

Global Entry also includes Pre-Check.

Dan if I downgrade my reserve to a reg. Sapphire , then I upgrade back to prefered and transfer my points into miles, then I would right away downgrade it again, would that be an issue?

Doable, though Freedom/Freedom Unlimited are better than Sapphire non-preferred.

I tried to use the roadside assistance, they told me it covers up to $50, and that they just raised to price to 69.99, so effectively it’s not free, rather 19.99. unless I’m missing something?

I’ve done towing and jump start and didn’t have to pay a dime.

The truth about chase travel protection for reserve card:

Had family medical emergency

Applied for refund of air fee

Insurace handled by third party who would drag you with more abd more documents needed and after one year of document still not finished

They hope you give up

Anywhere in chase to complain ?

Did you provide what they asked for?

I just got an ink (business) how does it compare to the others?

Very different card offering than these…

I’m coming up on CSR and CSP renewal. CSP offered a $60 retention, bringing the fee down to $35. No retention offered on CSR. That’s a $115 swing and I don’t think the extra point on dining and travel will make it worthwhile to keep the CSR. I already have Priority Pass from the Ritz card.

Retention bonuses vary based on your spending patterns and whether you recently got a retention bonus on another card.

Also you can make the Reserve into a Freedom and then make the Preferred into a Reserve.

Wish I would have known! got stuck on the side of the road with no gas!! and my reserve card in my pocket. good to know for the future.

Most amazing combo is the sapphire and chase business ink

Utilizing gift cards from staples ( now that card cash/PayPal gift card deal-doesn’t work) for many purchases with ink and moving points to the reserve card is amazing value.

Frankly an interesting card for free hotel weekend nights at Hilton group hotels is the Amex ascent since with $15000 in purchases in a calendar year you earn one weekend night and if you earn that night with purchases at restaurant gas stations and supermarkets (six points per dollar) u have a second free night at most Hilton products for $90/year. if u have the platinum card to boot then u have potential for late checkout free breakfast and room upgrade at EG the Waldorf in LA (typically $700 per night without including the tax.) not a bad deal for $90 fee and $15000 in purchases

Does the reg saphire have forex?

Yes.

I have both. My husband uses my Preferred because it’s cheaper than adding him on to my Reserve and easier to see which charges are his.For everything else and when we are together, we use the Reserve.

https://www.dansdeals.com/credit-cards/chase-sapphire-reserve-sapphire-preferred-view-full-comparison-chart-vote-poll/#comment-1345903

I would be eligible for CSR travel benefits like trip delay and lost luggage as long as PART of the trip with this card, correct?

Yes.

Is it worth booking airfare on the Reserve If I also have the airline card and can get free luggage (albeit without the perks)?

Only United requires you to use their card.

oooh! a free coffin!

#TooMuchWinning

Can I apply/get the preferred card for the bonus if I currently have the reserve card and don’t want to let it go? How should I go about it? I believe I also have to wait the 24 mth since getting the last bonus and be within 5/24.

Dan can you please do such a comparison post with the Chase sapphire vs Amex Platinum.

Thank you.

BTW, when I booked some hotel rooms through Chase Sapphire, they weren’t the best prices- my AAA rates were better, and had to book non-refundables to get a decent rate.

Not really a $55 difference as spouse costs extra $75 for card.

https://www.dansdeals.com/credit-cards/chase-sapphire-reserve-sapphire-preferred-view-full-comparison-chart-vote-poll/#comment-1345903

Can a second global entry for a spouse count towards travel expense reimbursement? Any other way of getting a second global entry without getting a second CSR card?

Yes.

how? do I need to call up Chase or can it be done online?

Online, it’s automatic.

I mis-read you; are you saying that chase will re-imburse the global entry for a spouse? or if I spent my travel credit for this year already, then I will have to pay for it?

On the side, do you think 1 hour between an international connection in jfk and a domestic flight is enough time if traveling with a spouse and a 3-month old infant?

It would come off the travel credit if you already got a GE reimbursement.

Don’t want to apply for a CSR for your spouse?

That would mean spending another $100+/year which at the moment we don’t have; nor does she have credit (she never owned a credit card)….also when I first got the card, I requested from chase to send me a duplicate card for free, like you mentioned in one of the posts awhile back about the CSR when it first came out.

But thanks Dan for all of your chessed that you are doing for everyone! much appreciated

Thanks Dan! I downgraded CSP when I got the CSR for 100k sign up. It’s so valuable to me and definitely worth the extra $55.

When claiming for lost luggage, do you need to go through the airline first/at all? How can the require receipts for everything?

And can I get anything for delayed bags when arrived back home?

Thanks!!

And how does it work if a bag 2 bags are delayed and then 1 is lost? Would you be able to benefit from both protection$$$?

Yes.

csp has double points for catering and csr only 1 point

Catering is no longer a bonus category on either card as far as I know.

What would you say is the most woth it way to redeem your points but not too complicated (I just got the 50,000 promo)

For me having Executive status with National Rental is a big plus!

Reserve- no question!

this one seals the deal:

$1,000 for a coffin and to return your body to your home country if you die on a vacation

The CSP offers ״Primary coverage “ On Car Rentals – preventing any collision claim from going own car insurance – the CSR only offers ״Secondary Coverage״.

I have the CSP, just for 2 months. If I switch to CSR, would I forfeit my first year ($95) free on the CSP?

Yes. Anyway, you can’t get the bonus for the CSR by upgrading, so you should close/downgrade the Preferred and sign up for the Reserve afterwards.

is it possible to have both cards at the same time?

Yes

You can’t currently apply for another card in the Sapphire family if you already possess one. Most people on this forum had both long before that rule, though.

I have both sapphire cards but I’m giving up the preferred because the reserve is by far a better card. With all the benefits, I got back the extra $55 in annual fees many many times. I think it is the best point card available.

Is it easy to get accepted to global entry or do you need to be a frequent flyer to get accepted??

Pretty much anyone who isn’t a criminal will be accepted.

So basically, it’s pretty tough

the amex ascend that offers 10 free visits annually on piority pass does the primary cardholer/ piority pass cardholder have to be the one to check in? or other random people that are unrealted to the primary can use it without him being here? if not can you bring your wife or friends with you into the lounge

No brainer for all travel expenses? If I use an airline card I get free luggage. I use up the $300 travel costs other ways.

is there a United Chase Reserve?I have a UnitedPlus Explorer and use it to qualify for my gold status. I travel exclusively on United to Israel and Florida.

i got the reserve for the 100,000 points (which we used for a trip to israel) and the two travel credits (prepaid ez pass) in the first year then downgraded to the freedom. we don’t plan on doing major travel anytime soon is there a reason for my wife to get the reserve now over the preferred now that they’re both 50k

I got a letter from chase that they going to close my account in 60 days from the letter due to inactivity ; its saying that you may use your card until it closes, BUT USING YOUR CARD WONT KEEP IT OPEN.

can anyone help me about that??

Same thing happened to me. I called Chase and asked them to keep the card open. No problem, they were happy to do so.

Put my chase card into the rainbow room for a wedding in nyc. First time got my triple points for the deposit 30,000 . Next payment $ 60,000 only got 1 point last payment 40,000 again got only 1 point . They said it’s personal services. I really think this is dining. Any recommendations

i saw on chase web site that the sign up bonus for the reserve is only for customers which don’t have any other sapphire card, i do have the sapphire preferred card, do i need to stop it before applying for the reserve card ? or i can just call them to change the same card ? (i have done like that with my amex card, or maybe by chase doesn’t work like that ?)

Hi Dan, Thanks for all your great help I just switched from the preferred to the reserve I thought it would also give me an upgraded status at some of the Rental car companies however I can’t seem to find that on the benefit list just discounts at time of rental. Would you be able to help me with this?

Thanks a lot

hi whats the best way to redeem my case sapphire?i want to go to Israel I have like 70k points?

its a really good card. its well worth it. the rewards are amazing. i would say go with the preferred unless you travel allot or book hotels and the like then reserve is really the better card.

I am just curious, if I get sapphire preferred, canned that travel medical coverage be used for my children? Who are in Yeshivas around the country? Or only for the primary and secondary card holders?

Yes, as long as you book on the card.

Another question, what makes the additional $75 for the additional cardholder worth it? What’s the payout on that one That makes that worth it?

For the lounge membership.

Is the reserve still worth it with the increase to $550 and only getting $300 in travel credit?

TBH I only travel 1 to max 2 times per year between Israel and America.