Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Chase Freedom Flex and Freedom are excellent no annual fee cards thanks to their quarterly 5% categories. While the rewards are marketed as 5% cash back, you’ll actually get 5 Ultimate Rewards points per dollar spent which can be worth much more than 5% cash.

If you max out the $1,500 in bonus spending per quarter you will earn at least 30,000 Ultimate Rewards points over the course of a year (7,500 points per quarter at 5 points per dollar spent). My wife and I have 8 Freedom cards, which makes it all the more lucrative!

You can register now and start spending on the Chase Freedom Q3 5% categories which will be valid 7/1-9/30 at:

- EV Charging

- Gas stations

- This includes most 7-Eleven stores and gas stations that sell gift cards for other stores as well. My local GetGo gas stations earn sweet rewards on gift card purchases, making this quarter even more lucrative.

- Select Live Entertainment

- Includes in-person entertainment such as major sporting events, zoos and aquariums, concerts, theatrical productions, museums, tourist attractions and exhibits, amusement parks, circuses, carnivals, bands, and entertainers. Ticket agencies selling on behalf of the entertainment venue are included.

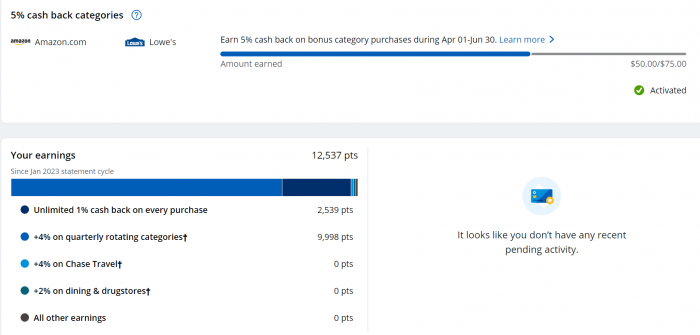

You can check your current 5% earnings here by clicking on “Your Dashboard.”

The Freedom spending tracker has also been updated:

And as DansDeals reader Eluzer K points out in his screenshot below, it now shows pending bonus points as well as earned bonus points. I wish it also stated what you spent and have left to spend, but you can just multiply the rewards earned and remaining rewards by 20 to figure that out. In other words, if you earned $50 out of $75, that would be $1,000 out of $1,500 in quarterly spending.

You can currently earn a $200 signup bonus in the form of 20,000 Ultimate Rewards points for spending $500 and 5 points per dollar on up to $12K of spending at grocery stores for 1 year on the Freedom Flex Mastercard. Plus you’ll earn 3 points per dollar on drugstore and dining purchases and 5 points per dollar on all Travel purchased through the Chase Ultimate Rewards portal.

While Chase Freedom Flex is a great card for the bonus categories, it’s not a great card for everyday spending. However, the Chase Freedom Unlimited® card also has no annual fee and earns 3 points per dollar on up to $20,000 of spending during your first 12 months. Plus it’s excellent for everyday spending thanks to 1.5 points per dollar that can be earned everywhere with no limit, though it doesn’t have rotating 5x categories. Read more about the Freedom Unlimited card here.

The no annual fee business version of Freedom Unlimited is the Ink Business Unlimited® Credit Card Card, which offers $900 in the form of 90,000 Chase Ultimate Rewards points after spending $6,000 within 3 months plus 1.5 points per dollar spent. Read more about the Ink Unlimited card here.

Freedom, Freedom Unlimited, and Ink Unlimited alone can’t transfer points into much more lucrative airline or hotel miles, but if you or your spouse has an Ink Business Preferred® Credit Card, Sapphire Reserve, or Chase Sapphire Preferred® Card, then you can transfer points from Freedom to one of those cards and from there to your favorite travel currency. Those cards also allow you to redeem your points for paid travel or other select consumer categories and business categories at a value of 1.25 or 1.5 cents per point. The Freedom, Freedom Unlimited, or Ink Unlimited card can also keep your points alive for free if you do close one of those premium cards.

The value of the points will be based on where you use them, but if you use those points for a trip worth where they are worth 2 cents each then you’ll have effectively earned 10% back on those “5 point categories.” The sky is the limit of the value of airline miles as they aren’t tied to the cost of a ticket. That’s good for people in the know and bad for those who are not. 1 mile can be worth 0.25 cents or it can be worth 25 cents, it all just depends on how you use them!

Where will you make your Q3 purchases?

![[3 Liter Water Bottles For $1.34] 24 Pack Of Pure Life Purified 8oz Water Bottles Now Just $3.08-$3.44 From Amazon! Pure Life, Purified Water, 8 Fl Oz, Plastic Bottled Water, 24 Pack](https://i.dansdeals.com/wp-content/uploads/2024/07/02225249/purelifepurifiedwater8flozplasticbottledwater24pack-150x150.jpg)

Leave a Reply

5 Comments On "Chase Freedom’s Q3 5x Bonus Categories Are Live"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

I’ve been to 4 different 7-eleven stores in North Florida area and they all told me I can’t buy the Visa gift cards with a credit card. I know I’ve done it once in the past. I’m not sure if it’s a new policy. Anyone know other options?

Does this include 7 elevens that don’t sell gas?

Was it changed to gas stations and grocery stores?

As per an email this morning “earn a total of 5% cash back at gas stations and grocery stores”

Does the “Gas station” category include auto mechanic work?