Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Table of Contents

Signup bonus:

Capital One has just launched online applications for its new Capital One Venture X Business Card.

You will earn 150,000 bonus miles after spending $30,000 in the first 3 months. As you earn at least 2 miles per dollar spent, that’s a total of 210,000 miles after spending $30,000.

Note that Spark Cash Plus cardholders are unable to apply for Venture X Business. However, existing cardholders of other Spark cards are eligible to apply. If you do close your Spark Cash Plus card, you will become eligible for the Venture X Business Card.

Don’t have that kind of spending? The consumer Capital One Venture X Rewards Credit Card offers 75,000 bonus miles for opening the card and spending $4,000 in 3 months. As you earn at least 2 miles per dollar spent, that’s a total of 83,000 miles after spending $4,000. Read more here.

The consumer and business Venture X cards are very similar, however there are some key differences as described below.

Annual fee:

$395

Credit reporting:

Unlike most other Capital One cards besides the Spark Cash card, this card does not report spending on your personal credit report, so a high utilization rate of your credit line will not hurt your credit score.

It also means that it won’t hurt your Chase 5/24 count.

Charge Card with no preset spend limit:

This is a charge card has no preset spend limit. It is a pay in full card with no APR as your balance is due in full monthly.

It can be easier to make big purchases with this card than with traditional credit cards that have a hard credit limit.

Annual travel credit:

Receive a $300 annual travel credit every cardmembership year for all travel booked through the Capital One Travel portal, where you can book flights, hotels, and car rentals. Those credits can be applied multiple times until you spend $300.

The credits now discount the price at the time of booking and if you maximize this credit, this card’s effective annual fee is just $95.

Anniversary bonus:

Cardholders will get an anniversary bonus of 10,000 miles every year that they have the card. Those miles are worth $100 towards travel or gift cards, but they can also be transferred into 10K airline miles where they can be much more valuable. At a value of 1.5 cents per airline mile, that’s like another $150 back every card anniversary.

Between the $300 annual travel credit and the 10,000 mile anniversary bonus, the annual rewards are worth more than the card’s annual fee!

¿Por Qué No Los Dos? (Yes, You Can Get Both)

As this card is easily profitable to open for the signup bonus and then keep open for the annual card anniversary bonuses, it’s a no brainer to open a Venture X Business Card in addition to a Venture X Card.

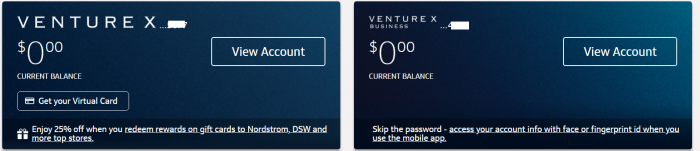

I have the Venture X and just got approved the Venture X Business as well!

It showed up immediately in my account as well after clicking on online setup:

Global Entry/Pre-Check Fee Refund:

It costs $78 to apply for a 5 year TSA Pre-Check membership which makes flying pleasant again. Shorter lines, no need to remove your shoes, belt, jacket, or hat. You can keep your laptop and small liquids inside your carry-on. And you go through a good old fashioned metal detector instead of assuming the position in the body scanner. If you charge it on your card the fee will be refunded.

It costs $100 to apply for a 5 year Global Entry membership which lets you bypass the customs line. If you have Global Entry you also get TSA Pre-Check for free.

If you charge it on your card the fee will be refunded. You can get refunded for this charge once every 4 years.

You can read more about the differences in this post.

My whole family has Global Entry and it sure makes traveling a whole lot easier!

Capital One Lounge and Capital One Landing Access:

Capital One now operates lounges in Dallas/DFW’s terminal D near gate 22 and in Washington DC/IAD, located just beyond the airport’s TSA PreCheck, between the East and West Security Checkpoints.

I loved being able to shower, use the prayer and relaxation rooms, try out the Peleton, and enjoy free snacks and premium beer and cocktails while connecting in DFW.

New lounges will be added soon in Denver and Las Vegas and Capital One Landing locations will be added soon in LaGuardia and Washington/DCA.

Venture X Business cardholders get unlimited free entry and can bring 2 guests for free. You need to have a departing or connecting flight within 3 hours to use the lounge.

Unfortunately, unlike with the consumer Capital One Venture X Rewards Credit Card, additional cardmembers don’t receive free entry.

Lounge access for Capital One Venture Rewards Credit Card and Capital One Spark Miles for Business cardholders is $45 per person per visit. Those cardholders also get 2 free visits per year. Lounge access for everyone else is $65 per visit. Kids under 2 are free.

Lounges feature grab and go food with to-go bags for your flight, fully stocked bars with local beers and craft cocktails, coffee bars, work zones, exercise rooms with Peloton bikes and yoga mats, nursing rooms, kids rooms, soundproof relaxation rooms, luggage lockers, multi-faith prayer rooms, and shower suites!

Enhanced Priority Pass Membership:

Venture X Business cardholders get a complimentary Priority Pass lounge membership. Priority Pass lounge membership allows you to bring 2 guests with you into over 1,300 airport lounges.

Best of all, while consumer Capital One Venture X Consumer Cardholders do not receive Priority Pass retail airport offers with a per person credit, Venture X Business cardholders do receive this credit via its enhanced Priority Pass membership!

In Cleveland, that means getting a $28 per person credit every time you stop at Bar Symon. With 2 guests, you can load up on $84 of free snacks and drinks, and they’re happy to pack it up to go.

In many airports, you can take advantage of massage chairs and spa service at Be Relax Spa, at gaming lounges, or at other restaurants and shops with free spending credits. You can find non-lounge and lounge offerings via the Priority Pass website.

Having access to Priority Pass retail airport offers adds a ton of value to this card offering!

Card earnings:

- 2 miles per dollar everywhere.

- 5 miles per dollar on flights booked via Capital One Travel, plus get a refund if Hopper by Capital One Travel says to buy a flight and the prices goes down within 10 days. Cardholders can also freeze the price of select flights for up to 14 days!

- 10 miles per dollar on hotels and rental cars booked via Capital One Travel.

- There are no foreign transaction fees.

Spend Threshold:

You’ll need to spend $30,000 on this card within 3 months for 150K bonus miles.

You can pay your federal taxes for a 1.82% fee. If you overpay your taxes you can request a refund or apply it to your next year’s taxes. If you paid $98,213 in taxes you would pay $1,787 in fees and earn 500,000 miles!

My local natural gas company allows me to prepay up to $1,000 on a credit card for a $1.65 flat fee. That’s a great way to earn miles and help meet a spend threshold. My electricity supplier allows me to pay with a credit card for free as long as I am enrolled in autopay.

See this post for more ideas on meeting a credit card spend threshold.

Excellent MLB Redemptions

Capital One cardholders have access to exclusive tickets to special events such as All-Star Week, the MLB Postseason, and the World Series presented by Capital One.

Plus, you can redeem just 5,000 miles (or $40 cash back) for ultra-premium MLB seats in every ballpark, for every game. There are 4 tickets available for every game at that rate. The best time to buy is when each month’s games go live, which are posted here.

I have gone to games with amazing seats in NYC, DC, LA, Anaheim, Cincinnati, Cleveland, Dallas, Houston, Pittsburgh, San Diego, and San Francisco, and hope to go to many more to complete my 30 ballpark tour using my Capital One miles at an excellent value!

Getting $200 seats for 5,000 miles is a great deal!

Premier collection hotel access

Venture X Cardholders have access to The Premier Collection of hotels.

Those hotels will qualify for the card’s $300 travel credit and 10x points per dollar, plus you’ll get a $100 experience during your stay, breakfast for 2, free WiFi, upgrades, early check-in, late checkout, and you will earn standard elite credit, elite benefits, and hotel points.

Flight booking perks

Cardholders get access to airfare perks like the ability to get free price drop credits, get alerted about price drops, and the ability to pay a nominal fee to freeze airfare prices or get a refund on airfare for any reason.

Discounted travel offers are also available for Venture X cardholders.

Excellent card benefits:

This will be a World Elite Mastercard with benefits like:

Primary and additional cardholders get benefits like:

- Primary rental car CDW insurance, for rentals primarily for business purposes

- Cell phone insurance, up to $800 per claim if monthly bill is charged to card. $50 deductible applies.

- Price protection, up to $500 per item for price drops within 60 days, up to $2,500 per year.

- Delayed baggage coverage for bags delayed over 4 hours, up to $100 per day for 3 days.

- Rideshare protection for items lost in a rideshare car up to $750 per ride.

- Trip cancellation and interruption insurance, up to $1,500 per trip.

- Extended warranty of 1 extra year, up to $10,000 per item.

- Lost or damaged luggage insurance, up to $1,500.

- Travel medical services coverage, up to $2,500 per person.

- Travel Accident Insurance, up to $1,000,000 per person.

- Purchase protection for items damaged or stolen within 90 days, up to $10,000 per item.

Business vs Consumer card:

The Capital One Venture Rewards Credit Card X Business card and the Spark Cash business card don’t appear on your credit report. That’s good for several reasons.

First of all they won’t count against your 5/24 count for opening new Chase cards. Only cards on your report that have been opened within the past 24 months count for that.

Second, when you spend money on personal cards your credit score will be hurt even if you pay your bill on time. A whopping 30% of your credit score is based on credit utilization. You can pay off your card bill before your statement is generated to avoid that, but that takes effort and laying out money well before you have to. Additionally, it’s good to have the statement close with a couple dollars to show the card is active and being paid every month. On an AMEX business card it’s just not reported, so you can wait until the money is due without it having a negative effect on your score.

Third, if you close a business card it won’t ever have an effect on your score.

You may already have a business that needs a card to keep track of expenses. For example if your name is Joe Smith and you sell items online, or if you have any other side business and want a credit card to better keep track of business expenditures you can open a business credit card for “Joe Smith” as the business. You don’t need to file any messy government paperwork to be allowed to do that.

Just be sure to select “Sole Proprietorship” as the business type and just use your social security number in the Tax Identification Number field

Use points for paid travel reimbursement:

You can redeem your points to pay yourself back for any travel related expenses (airfare, hotels, car rentals, cruises, ride sharing, etc) or book new travel at a value of 1 cent per point. There’s no need to book via any portal, just pay yourself back for part or all of a purchase!

210,000 miles would reimburse $2,100 in free travel!

Airline and hotel transfer partners:

You can transfer points from Capital One into these programs at the following ratios:

- Aer Lingus (1:1 via BA, No alliance)

- Aeromexico (1:1, SkyTeam)

- Air Canada Aeroplan (1:1, Star Alliance)

- Air France/KLM Flying Blue (1:1, SkyTeam)

- Avianca LifeMiles (1:1, Star Alliance)

- British Airways Avios (1:1, OneWorld)

- Cathay Pacific Asia Miles (1:1, OneWorld)

- EVA (2:1.5, Star Alliance)

- Etihad (1:1, No alliance)

- Emirates (1:1, No alliance)

- Finnair (1:1, OneWorld)

- Iberia (1:1 via BA, OneWorld)

- Qantas (1:1, OneWorld)

- Qatar (1:1 via BA, OneWorld)

- Singapore (1:1, Star Alliance)

- TAP Air Portugal (1:1, Star Alliance)

- Turkish Airlines (1:1, Star Alliance)

- Virgin Red/Virgin Atlantic (1:1, No alliance)

- Accor Hotels (2:1)

- Choice Hotels (1:1)

- Hilton Hotels (1:1.5 via Virgin)

- Wyndham Hotels (1:1)

You can also combine miles between Capital One miles cards, transfer cash back into miles, and you can transfer miles to any Capital One cardholder!

A nice perk is that after the 1,000 mile minimum transfer, you only need to transfer points in increments of 100, meaning you have fewer leftover points compared to other bank transfers.

- Air Canada awards start at just 6K miles on United, making for excellent bargains!

- Avianca Lifemiles awards start at just 6.5K miles on United. Or save up for the 194K miles you’ll need for a round-trip first class flight in First Class from the US to Tel Aviv on Lufthansa with access to their amazing first class terminal during your connection with a Porsche transfer to your plane.

- Turkish Airlines has an incredibly generous award chart, with bargains on United like domestic awards, including Hawaii, costing just 7.5K miles in coach or 12.5K miles in business class! Tickets to Israel cost just 32K miles in coach or 47K miles in business class!

- 7.5K Virgin Atlantic miles is enough for a Delta short-haul flight and 35K is enough to fly nonstop on Delta between North America and Israel.

- 7.5K British Airways Avios are enough for short-haul flights worldwide.

- 37K Flying Blue miles is enough to fly nonstop on Delta between North America and Israel.

- 120K Aeroplan miles is enough for a round-trip business class award between North America and 2 European cities.

- With 90K Cathay Pacific Asia Miles miles you can book a round-trip business class award between North America and Europe.

- With 180K Qantas points you can fly round-trip in El Al business class between NYC and Tel Aviv with no fuel surcharges.

- With 135K Emirates miles you can fly round-trip in A380 Shower Class from JFK to Milan.

- With 217.5K Emirates miles you can fly round-trip in A380 Shower Class from JFK to Dubai.

- You can book Vacasa private homes for just 15K Wyndham points.

- And endless other possibilities!

Dan’s Quick Thoughts:

This card seems like a no-brainer thanks to the annual credits that more than cover the annual fee.

It some ways though, it falls short of the consumer Venture X card. It doesn’t offer additional users free lounge access or some with perks like Hertz status. However, that may be outweighed by the enhanced Priority Pass which allows non-lounge credits, plus spending won’t be reported on your personal credit report and the card won’t count against your 5/24 count.

Assuming you take advantage of the annual credits, there is essentially a net-negative cost for all of the card’s benefits, like Capital One lounge access, enhanced Priority Pass lounge access, and more.

With the ability to reimburse yourself for any travel purchase and the option to transfer points to valuable airline partners such as Turkish, where you can fly anywhere in the US50 for just 7.5K miles in coach or 12.5K miles in first class, spending on the card is valuable and doesn’t require jumping through hoops with multiple cards as with other banks to earn 2 transferrable miles per dollar everywhere.

The signup bonus is just gravy on top of those benefits!

Will you signup for the Capital One Venture Rewards Credit Card X Business Card?

![[Citi-Emirates Transfers Will Be Devalued] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Citi-Emirates Transfers Will Be Devalued] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

105 Comments On "Earn 150,000 Miles, $300 Travel Credit, 10K Bonus, Enhanced Priority Pass+More From The Capital One Venture Rewards Credit Card X Business Card!"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Dan, what are signup rules for Cap1, do they limit you to 2 cards per account (does this include biz) ?

They don’t have a limit of 2, but they can be picky. YMMV!

Is it possible to downgrade after the first year?

Potentially, but beware that Capital One downgrade rules are different than every other bank and you need to downgrade before the fee hits, otherwise the only option is to close it if you want the fee back:

https://www.dansdeals.com/credit-cards/capitalone/dont-forget-finish-spending-capital-one-venture-x-travel-vacation-rental-credit-aware-capital-one-downgrade-quirks/

But with a $300 travel credit and 10K bonus miles, the anniversary bonus is worth more than the annual fee.

Is I’m looking to spend 100k on a new card, should I use it in the AA Card or this capital one card?

Diversify and split it?

Why get the AA card?

Miles, status, free bags, open locked doors… I mean why open any card?

do you need a business or SP is good enough

SP is fine.

Do you think it’s a matter of time before they cut lounge access for AUs on the consumer Venture X?

Hopefully not.

I will have a bit of difficulty hitting that spend. Does Capital One Crack down on gift card purchases? How about PayPal venmo payments? Thanks!

i opened the capital one spark plus it was very difficult to spend the amount as they only gave me 10k credit line until i pay back. is there a way to get a larger credit line?

I love the Venture X card. That being said, the $300 travel credit is not nearly as valuable as the Sapphire Reserve $300 credit. The Sapphire credit works as a statement credit against anything even somewhat travel related (including gas, public transportation etc). The Venture X credit is only when purchasing travel through the Capital One travel portal, which I’ve found to be quite non competitive with what you can find on other sites. That’s my only gripe against the card and I wish they would make it more like the Sapphire annual credit.

On the other hand the ability to pay yourself back for all travel expenses on the Venture X is a valuable option that the Reserve is lacking.

Neither Chase nor Capital One penalize you if you have to cancel said refundable travel…

Credit would apply if I cancel 24 hours later?

Lol looks like they sew this comment as they changed it to a coupon instead of a statment credit

You can always redeem UR at 1cpp for a statement credit/cashback, so please explain why the reserve card is lacking, earn 3 points per $ on said travel anywhere and redeem those points at 1cpp just like the VX to offset those expenses

how in the world are you spending 30K?

this is a full stop for a lot of us

+1

Paying taxes will be profitable.

This is a business credit card. It may be a full stop for you. However its a business card. Businesses may spend alot of money. I could meet the spend in a day.

Travel portal requirement is a real downside. Costco travel has much better deals on car rentals and hotels.

No penalty if you need to cancel refundable Capital One travel plans…

are you implying cap1 doesn’t claw back the credit? but you would still lose the value of the credit or your paid hotel reservation? can u pls explain.

Is this true even now that it’s a $300 coupon not a statement credit?

Hey, I am very “chase” heavy with my cc’s. I like the value of the travel with the preferred and the reserve. I get 3x for digital spend and 1.5x for regular business spend. Is there any reason to go Capital1 and get the 2x… Is there anything worth it that Cap1 has that Chase doesn’t?

They have transfer partners like Lifemiles, Turkish, Qantas, and Wyndham that Chase doesn’t have.

You can also pay yourself back for travel purchases made anywhere.

Plus, no Forex while earning 2x points is valuable.

You can also pay yourself back for travel purchases made anywhere.

You can always redeem UR at 1cpp for a statement credit/cashback, earn 3 points per $ on said travel anywhere and redeem those points at 1cpp just like the VX to offset those expenses , why is this a capital one benefit over chase?

Yeah, not sure why Cap1 benefits in this area. Pretty much any cc allows you to do that…

Because you earn at least 2 points per dollar everywhere.

What does pay yourself back for travel mean?

hi dan, I have a very specific question. I have a very large purchase I want to put on this card. what does that mean that there’s no apr? what happens if you carry a balance? do they freeze your account so you can’t spend more? how does that work? I saw somewhere that even though it’s a spend card, they do charge 2.99% fee if you’re overdue. do they then freeze your account? why wouldn’t anyone just keep racking up a bill on there and it’s a very low apr forever. Thanks, I’m a big fan of your work

It’s 2.99% of the balance that month, not a 2.99% APR.

that is correct. my question is, after the 2.99% is assesed to the account, do they lock your card? what’s stopping someone from racking up thousnads of dollars in debt and paying only 2.99% per month?

Comes out a little over 40% APR. But my experience was after the second biling cycle they simply freeze the card. Also on a new account they do limit you on the first 6 months to maximum 10k spending. Unless you are an older customer with heavy spending. Their algorithm recalculate your unlimited spending every six month based on your past six months behavior. Last year I spent an average of 30k monthly. Since February my average was 8k (I had to secure AA platinum pro and do other Amex stuff) last week my balance was only $2,769.67 not due. My card was declined for $7,9k. I called surprised, spoke to a senior account manager and was given a full explanation. She offered that I should pay my actual balance that was not due yet and they they would approve the new purchase. Needless to say I just used a different card. The venture X consumer.

I literally just got approved for the other business card that has the $30,000 spend on it. This card’s definitely better you think they’ll let me switch it

Try it and let everyone know?

i called and they couldnt do it.. told me to apply for the new card.. but i wasn’t approved…

Plaza Premium no longer has access to the SFO lounge. It was great for the few months it lasted.

Last I checked, Capital One granted access to Virgin lounges in the US with an agreement outside of Plaza Premium/Priority Pass. Is that no longer the case?

How quickly can Start making purchases= how long typically for the card to arrive?

Do the 3 start from approval or card arrival?

I believe Cap1 lets you create virtual cards as soon as you are approved so you can start spending immediately.

I was approved on Tuesday. Called Wednesday to have the card expedited. Received it on Friday. I also have the Venture X with a $30k limit. Got the card to pay $30k I’m estimated taxes. It is touted as not having a spending limit but I was denied for the $30k. I tried for $15k, denied. $10k, denied. It finally allowed me to do $5k. Seriously. The whole reason I got the card was for the September estimated taxes and thought I’d meet the minimum in one purchase. Frustrated to say the least.

You can login and request approval for larger purchases.

Is there any car rental protection?

The car rental protection benefits are the same as the ones offered by the personal Venture X card (75K limit; Excluded countries include Israel, Ireland, Northern Ireland, and Jamaica). Chase Sapphire/Reserve has NO country exclusions for car rentals.

My Amex blue sent me a letter saying they cover cdw in Israel. Not primary coverage

Wow! So instead of paying for 3 insurances that cost $25 per day, you only have to pay for the 1 only-exists-in-Israel insurance that cost $24 per day.

When traveling overseas, Amex secondary auto insurance coverage acts as a primary since you have no other primary auto insurance (same applies in the U.S. if you don’t own a car and don’t have auto insurance – for example, you live in a major city and rent a car when traveling to other states).

I have used this benefit with Amex Platinum in the past (you have to explain to the CSR that you have no other primary auto insurance and talk to a supervisor as needed).

the regular venture x if i want to downgrade to avoid the annual fee what should I downgrade to?

QuickSilver or VentureOne. But you essentially have no annual fee with the $300 credit & 10,000 anniversary bonus.

Hi Dan,

Can you elaborate more on Priority Pass retail airport offers. Do they have this in EWR?

Had this card for over a year. Didn’t realize it had the “enhanced” priority pass

How have you had this card for over a year if it just came out yesterday? Did you mean you have the consumer Venture X? (Which did away with the enhanced PP.)

Just picked it up through your link — thank you, Dan!

Ketiva chatima tovah and lshana tovah umetukah to you and yours.

Thanks and congrats!

Shana tova to you and yours!

Unrelated, but it looks like Breeze Airlines is now starting services from Plattsburghl Airport to Orlando. (Starting Nov 28.)

I already have the personal venture X and a Spark card. Do I gain anything by adding a business version? Even if its essentially free, I am already getting 2 miles per dollar on business purchases that can transfer to Venture X. I don’t need 2 priority pass lounge memberships obviously. Any reason to sign up (other than the signup bonus)?

In addition to the signup bonus, Venture X Business has enhanced Priority Pass, as described in the post.

How do you know how much credit you get at the eat locations? You mentioned $28 in Bar Symon. Is that the standard amount at all places?

The 2% Spark card costs $150 per year which is only forgiven if you spend $150K or more per year. The Venture X costs $395 but has a $300 travel credit and 10K annual bonus points, making it essentially free. Unless you are spending over $150K per year, the Venture X is a better value proposition. (Without figuring for benefits, e.g. PP.)

can i open 2 capital one cards and it be one pull only ?

lets say open a personal and a business on same day.

I have the Spark cash (my wife has the Venture X consumer), Besides the bonus is there any reason I should be aware of to get this card?

Enhanced Priority Pass, as described in the post.

The exact same question was literally asked 2 posts up by Yitz and answered.

@dan the plan cancellation loophole for $300 credit has been closed today….

please elaborate?

What do you mean

If choosing between Venture Rewards ($95) and Venture X Rewards ($395), considering the cost isn’t as big a difference after the 300 travel credit only with the X, is there a big difference. The bargain version only gives 2 visits a year to the airport lounges. What else should one consider? Do these provide rental car coverage?

I have the Spark Cash. Is there any reason to keep that card once getting the Venture X?

If you want cash back or want less expensive MLB redemptions.

CapitalOne lounge access is a joke. How many do they have?

Currently 2, soon to be 6.

Applied. Rejected. I just finished spending the $30 on the spark cash. Any reconsideration with Cap1?

Hey Dan, which has more value in points? Chase reserve or capital one venture z bussiness?

I think most websites value Chase points slightly higher than Cap 1, but it all depends on your ability to use them. For example, Chase can be converted to United miles – Cap 1 to Turkish. Both can get you United award space. United theoretically has better availability – Turkish has cheaper rates.

That being said, your best bet is to build up balances in all 4 major programs (Chase, AMEX, Citi, Cap1), and never pay more than 1.0¢ per point.

Does Cap1 have a travel portal with flights for cheaper with an equivalent of a reserve or preferred like chase does? or is the only benefit of Cap1 over Chase the 2x and travel partners that Chase doesn’t have?

The Venture X is an essentially free card (after travel credit + annual bonus) that earns a flat 2% plus benefits (PP, etc.) vs. the equivalent card at Chase (Ink Unlimited) which would be a free card that earns a flat 1.5% and no benefits. The other Chase business cards are not equivalent. (Ink Cash is way better for telephone/office supplies but worse for general spending, Ink Premier costs $195 and earns 2% – 2.5% for purchases over $5K – but it is not a points card, etc.)

Is there a car rental insurance on this card?

Was told that they are only allowing one charge card per member

HI

Question

1. Does the business card have the virtual card feature?

2. Does the business card allow you to overpay your balance?

(I like to always to make sure to have a negative balance on my credit card. That way I don’t spend what I don’t have. Unlike Chase, Capital One don’t allow payments more than what is owed.)

Thanks

Dan, can the miles be redeemed for a statement credit?

https://www.dansdeals.com/points-travel/milespoints/earn-150000-bonus-miles-300-annual-travel-credit-10k-anniversary-bonus-enhanced-priority-pass-capital-one-lounge-access-new-capital-one-venture-x-business-card/#Use_points_for_paid_travel_reimbursement

signed up as sole proprietorship, got instant approval, and now got this in the email?

To finish processing your recent request, we need some supporting documents:

Business Bank Statements

Bank Statements

Articles of Incorporation

Organization

LLC/LLP/LP

Government Issued business license

IRS EIN Assignment Letter

Ugh. Thanks for that data point. I wonder how common this is…wouldn’t bother if I had to put up with that degree of scrutiny.

If your corp is registered to a PO box, they won’t allow you to apply for the card

If I have the spark cash for another business, does that still disqualify me from this card?

If I applied already and was declined, does it make sense to close my spark cash plus? Will they do reconsideration, or a whole new application/credit pull?

Sure.

There is a reconsideration line, just let them know you closed your spark cash.

Ive never seen a post about Rideshare protection for items lost in a rideshare car. Is that a benefit with any other card?

What is the recon number for this? I was denied?

800-625-7866

If I already have venture X biz, am I eligible for spark cash plus?

Has anyone ever used the word elite mc protections? Are they easy to deal with like Amex? Or is it a pain in the neck

FYI: Capital One transfers to BA Avios has been “down for maintenance” for a while

Im considering closing the Spark Plus and getting the venture x, What would happen to my points if I close the account?

Do you or anyone you know have a Capital One card you can transfer them to?

Just got an email with this for the consumer card, not sure if it applies for the business card as well:

Your Venture X card has a new hotel offering—the Lifestyle Collection. The perfect complement to our Premier Collection, the new Lifestyle Collection offers vibrant, inviting hotels set in iconic locales. Plus, enjoy a $50 experience credit and other benefits on every stay.

is this card a hard credit pull?

For 30K in spend, couldn’t you sign up for 5 no fee Ink cards and get about a half million chase points?

I know that it would mean either 2 player mode or different Ink cards on the same business or separate accounts for “employees” or even also including the $95 Ink preferred.

But nonetheless, if you can use the benefits here then they do justify and nullify the annual fee. But you would end up with a few hundred thousand less points.

But I may still go for it after I maximize the free Ink cards on every business and side-hustle.

They don’t have a limit of 2, but they can be picky. YMMV

How can I book domestic flights as well as international flights with points through Turkish Air. It either tells me full, or doesn’t have a flying option. Thanks!

@dan “You are expected to pay your balance, in full, at the end of each billing cycle”

does that mean by the end of the statement? as in 30 days or is there another 30 days after the statement? (as in 60 days)

Thank you