Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

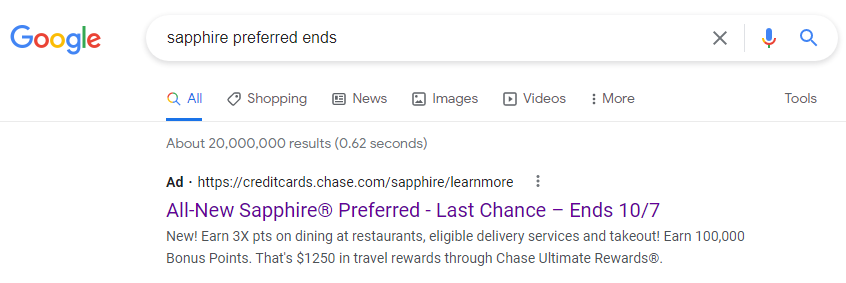

Update, 10/5: While Chase told me yesterday this offer would end sometime on October 6, Google is now showing an updated end date of sometime on Thursday, 10/7.

If you have a Sapphire card now and still want to make yourself eligible for this card offer, be sure to follow the instructions in this post and in these FAQs.

Update, 10/4: With the Chase Chase Sapphire Preferred® Card® Card 100,000 point offer ending on Wednesday, now is the last chance to convert any existing Sapphire cards that you have to a Freedom card to become eligible for this bonus. After converting to a Freedom card, you can wait 2 days and then try applying for a Chase Sapphire Preferred® Card !

Note that as long as you apply with the 100K offer, you will still get the 100,000 point bonus even if you aren’t approved on before the offer expires.

Originally posted on 6/9:

Many people opened a Chase Sapphire Reserve® card between August 2016-March 2017 when it launched with a 100,000 point signup bonus.

The Sapphire cards have a unique family rule in that you can only get a signup bonus once on any of them every 48 months. But that means many people are now eligible, or are about to be eligible, for another Sapphire bonus.

Chase currently has the deal of the year, offering 100,000 points if you open a Chase Sapphire Preferred® Card and spend $4,000 in 3 months. Read more about that offer here.

But waiting 48 months from your last bonus isn’t enough, Chase also won’t approve you for a Sapphire card if you currently have a Sapphire card.

That means you either have to close your current Sapphire card or downgrade it to a non-Sapphire card in order to apply for the 100K offer.

By downgrading you will get a pro-rated refund of any annual fee paid on your Sapphire card.

After downgrading you should wait about 2 days before applying for a new Sapphire card.

The 3 downgrade options are:

- Chase Freedom Visa

- Chase Freedom Flex Mastercard

- Chase Freedom Unlimited® Visa

None of those cards have an annual fee. So which should you get?

The Freedom Visa is no longer available for new applicants, but you can convert other cards to it. It earns 5 points per dollar on up to $1,500 of spending in quarterly rotating categories such as gas stations, restaurants, home improvement stores, wholesale clubs, internet, streaming, Amazon, Walmart, Paypal, grocery stores, and more.

The Freedom Flex Mastercard is very similar to the Freedom Visa, but you’ll also get cell phone insurance and you’ll earn 3 points per dollar on drugstore and dining purchases and 5 points per dollar on all travel purchased through the Chase Ultimate Rewards portal. The only downside is that Costco and Costco gas stations don’t accept Mastercard. However there is a workaround, you can buy Costco gift cards online with a Mastercard to take advantage of quarterly bonuses like wholesale clubs and gas stations at Costco.

The Freedom Unlimited card earns 1.5 points per dollar everywhere with no limit, making it an excellent card for everyday use. It also earns 3 points per dollar on drugstore and dining purchases and 5 points per dollar on all travel purchased through the Chase Ultimate Rewards portal.

Freedom, Freedom Flex, and Freedom Unlimited alone can’t transfer points into much more lucrative airline or hotel miles, but if you or your spouse has an Ink Business Preferred® Credit Card, Sapphire Reserve, or Chase Sapphire Preferred® Card, then you can transfer points from Freedom to one of those cards and from there to your favorite travel currency. Those cards also allow you to redeem your points for paid travel or other select consumer categories and business categories at a value of 1.25 or 1.5 cents per point. The Freedom, Freedom Unlimited, or Ink Unlimited card can also keep your points alive for free if you do close one of those premium cards.

The value of the points will be based on where you use them, but if you use those points for a trip worth where they are worth 2 cents each then you’ll have effectively earned 10% back on 5 point categories or 3% on 1.5 point spending. The sky is the limit of the value of airline miles as they aren’t tied to the cost of a ticket. That’s good for people in the know and bad for those who are not. 1 mile can be worth 0.25 cents or it can be worth 25 cents, it all just depends on how you use them!

So which card option is best? It’s certainly valuable to have a Freedom Unlimited card for everyday purchases. On the other hand if you max out $6K/year in quarterly spending you’ll earn 30K points on Freedom or Freedom Flex, while you would have to spend $20K/year on Freedom Unlimited to earn that many points.

In short, if you just want to focus on quarterly bonus categories, you’ll want Freedom Flex. If you want bonus earning everywhere you’ll want Freedom Unlimited.

Personally, between my wife and me, we have 1 Freedom Unlimited, and 6 Freedom/Freedom Flex cards. There’s no benefit to having multiple Freedom Unlimited cards, but with multiple Freedom/Freedom Flex cards you can earn the $1,500 quarterly bonus on each card.

Which Freedom card is your favorite?

![[Full Details With Video And Pictures] Is This United’s Next Generation Polaris Business Class Seat?](https://i.dansdeals.com/wp-content/uploads/2025/05/07110420/United-Airlines1-768x432-1-267x150.jpg)

![[Air Canada Won’t Resume Flights Until September, Emirates Until April 2026] Here Are The Current And Next Available Flights To Israel On More Than 40 Airlines!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Arkia Will Add Additional Service With A Neos Air Dreamliner!] Arkia Now Selling Nonstop Flights Between JFK And Tel Aviv!](https://i.dansdeals.com/wp-content/uploads/2025/01/13093827/Hamburg_Airport_Iberojet_Airbus_A330-941_CS-TKH_DSC08679-267x150.jpg)

![[AMEX Explains Upcoming Points Transfer Pause To Emirates] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

201 Comments On "Last Chance To Become Eligible For Chase Sapphire Preferred® Card’s Mega Bonus Of The Year: Convert To Freedom, Freedom Flex, Or Freedom Unlimited?"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

If I am an authorized user on my spouse’s reserve, can I get the preferred bonus?

i have the same question

Yes

What happens to the points in the sapphire account when changing it to a cash back card?

Chase cash back cards are actually Ultimate Rewards points which can always be turned into cash, so they remain points.

Can I transfer my points to my wife’s card, downgrade my card and apply fir a new sapphire?

Will they claw back any benefits like the travel credit or door dash if you downgrade?

No

Hey Dan!

After downgrading do I need to wait 30 days before applying for a new CSR?

No, 2 days.

If you downgrade the reserve card to apply for this bonus, can you later upgrade the card back to reserve so you can take advantage of the 1.5 cents per point on travel?

Yes, anytime after approval.

Even while u get the preferred u can upgrade the other card back to a reserve and have both at same time?

Yes

This could still make sense, but you should note that Chase has been discounting the CSR annual fee for renewals only – so by doing this you may pay $550 and not $450.

Are they still?

I think Dan has mentioned it in the past few weeks

@dan any data points on this?

Wont it look a bit funny to Chase to downgrade from CSR, then a week later switch right back??

Is there rlno downside to downgrading my Sapphire? Does Chase target offers based on how long I’ve had my card?

No

I downgraded my CSR to freedom, chase says it can take 2 billing cycles to get the prorated refund. But now after being approved for the CSP I want to immediately upgrade back to the CSR in order to get 1.5 per point etc. do I have to wait for the prorated refund to hit my account!?

No, just wait 2 days.

Hi Dan,

I canceled my CSP about a week ago due to general lack of use (I opened it in 2015). Just so I understand your post correctly, am I now eligible for the 100K bonus if I reapply?

Thanks!

Yes

Can I still downgrade my csp and reapply today before the deadline or I need to wait the 2 days before I reapply

Nothing to lose by trying!

if i downgrade my Reserve and get the Preferred and in 2 months want to upgrade back to reserve will i get another $300 for travel?

Doubt it, but let us know.

So no travel credit, but you will have to pay the full AF of $550?

I’d think probably yes if you upgrade the new Preferred and no if you “re”-upgrade the old Reserve.

Probably not, if you’re upgrading back the same card you downgraded from. But if you have a second Freedom anyways, try upgrading THAT one to CSR instead, and you’ll probably get a new travel credit right away, which means you’ll be able to get 2 travel credits (the second one a year from now) for the same annual fee.

How much time after it’s downgraded will I be able to apply for the sapphire?

2 days.

Can you first apply for this card and then downgrade the Reserve? What if I downgrade the Reserve and I am not approved for for the preferred?

No.

You can always switch back.

Though, as I mentioned above, he would lose his $100 discounted renewal rate.

Seems like this would just be ‘a cost of doing business’ to get the 100K bonus on CSP card. kinda like paying the points/fees on Plastiq to do the MS for bonus points. Sound right? If not, what am I missing?

My CSR anniv is august 29 but i didn’t want to take a chance this CSP bonus offer would be gone so I downgraded today and will apply in 3 days for CSP and then move the downgrade back to CSR, as per Dan’s notes here. I hope it’s all correct…

Well, starting August 1st, they’re reportedly charging the full $550 anyway (https://www.cnbc.com/select/chase-sapphire-reserve-annual-fee/).

Ya, seems you did the right move.

so i have the reserve when it first came out and what i did is lowereD my sapphire PREFFERRED to regular sapphire with zero fees am i eligible now for sapphire preferred? or do i need to take the regular sapphire and downgrade to one of those?

I don’t think you’ll be approved for a new sapphire if you still have a sapphire, even the free one.

Correct, you need to change to Freedom.

@dan if i change my saphire only and keep reserved i can apply for preferred? also when i downgrade do they do a credit pull?

No.

No.

Does downgrading to a Freedom card make me loose any future signup bonus for the Freedom card if I currently don’t have a Freedom card

No.

@dan, I just came below 5/24. I have 10 open cards with chase. Do I need to close any existing accounts to increase chances of approval for sapphire preferred?

No, if you’re denied you can call and offer to close a card to get approved for the new card.

How do I get 5% back at Costco gas with Mastercard? If I buy online gift card won’t it code as Costco wholesale?

You need to do it when there’s a wholesale club bonus category.

Hoping you can help:

I have the Reserve and unlimited. (I think regular sapphire too but I don’t use it)

I’m thinking to just have my husband apply for the preferred.

Thoughts?

Why not both get the 100K preferred offer?

Or maybe ‘downgrade’ or change the sapphire to a freedom /flex?

Thank you

Sure

How do i find out when i had my saphire reserve card ? How do i know if its 48 months yet?

If it’s still open or downgraded, just look back at your old statements to see when you last got the bonus.

i closed it a while ago & its not showing on my chase profile.

No way to know then, just have to apply and see.

If you’re rejected there won’t be a pull.

Since when is there no hard pull for rejected applications? That’s great.

I’d recommend they try contracting Chase and/or search your phone/email for any communications you may have made regarding the card (in about 20 seconds, I found a whatsapp message I had sent to a friend when I signed up).

For rejections due to multiple Sapphire cards or received Sapphire bonus within 48 months.

Helpful nonetheless.

Similar to Amex’s popup, just not quite as intuitive.

Any advantage of downgrading to Freedom Unlimited if I have the Ink Unlimited already?

3x/5x categories.

If I downgrade the preferred to freedom what happens to all my UR POINTS? if I get approved for a new sapphire or upgrade back to the sapphire will my existing UR POINTS become transferable again?

They remain UR points.

Yes.

@dan If I downgrade to a freedom and don’t get approved for the reserve again, would I be able to reinstate my old card back to a reserve??

Yes

I already have all three…

Me too, start working on multiple Freedoms

If I downgrade to a freedom would I have to switch it back to a sapphire to apply for a new freedom or will I be approved for another one?

You can switch between Freedom versions for that.

Can you downgrade online or do you need to call?

Call

I assume if I downgrade then upgrade my Reserve I will no longer be grandfathered in to getting my travel credit by the calendar year. Any downsides to that?

Not that I can think of.

wCan you downgrade your new preferred card after the bonuses point hit? Will you get a prorated refund on the 95? IS there a clawback

Not advisable to close or downgrade within 12 months.

I didn’t realize I needed to switch my regular sapphire too, I only downgraded my reserve. Is that true?

Is there any benefits of a plain sapphire over the freedom cards?

Yes.

No.

I didn’t see the part about waiting 2 days and got declined can I apply again or I am done and won’t get approved?

Sure, you can apply in 2 days.

Thank you so much for all the info.

I just downgraded my CSR to Freedom Flex.

Does the Sapphire Preferred allow me to book travel directly like the Reserve? I have used that several times.

Sure

But you’ll get only 1.25 cents/point as opposed to 1.5.

Is it worth it to get the card to switch the 100,000 to my Hyatt account or is it more valuable in other ways?

Why transfer before you have a use for them?

Currently abroad when downgrading and upgrading do u get new digits and or new card?

If paid for travel with reserve then downgrade will beninfits and protection regarding the travel be affected? And if yes when reupgraded back does the coverage on the previously paid travel come back into affect? Thanks

Same card number.

When you reupgrade you’ll get them back.

Chase Benefits says the benefits are assigned based the card at the time of purchase regardless of whether the card changed or even exists at time of claim

In the most recent billing cycle, will all my 3x purchases on restaurants and travel be converted to 1x point purchases if I downgrade before billing cycle closes?

No.

So you are able to have 2 sapphires at once (by downgrading reserve to a freedom and then upgrading back to reserve once approved for preferred) but you can’t apply for a a Sapphire of you currently have one?

Correct.

How soon after opening the CSP can we upgrade to. The reserve?

2 days.

I had downgraded my CSP yesterday and I tried applying today because they told me the product change was completed and I was declined. I did call them and they said it’s because I had a sapphire card recently. Whet could I do now?

I said wait 2 days, not 1 day.

Try applying tomorrow.

Does chase have a limit on how many cards you can have with them?

Currently 1 business and 6 consumer

No.

Hey, I want to apply for this card and the United quest. If I do 2 tabs will it be one pull?

Yes, 2 Chase cards on the same day will typically be just one pull.

Unfortunately I’m in the wrong part of this 4 year cycle. Got a CSP in 2018.

So the freedom unlimited is in a way better than for example the Citi double because those 1.5 points could be worth more than the 2 cents?

Sure, though Citi double cash also be worth more than 2 with a Premier card.

interesting, this game is complicated.

Thanks for all the info i just applied for the prefered through your link, its under review!

Why is there a hard pull if chase know my credit info as they provide me a report?

Also if someone has the amex platinum is it worth it to get the prefered (besides from the initial bonus)?

I had A sapphire Preferred and downgraded to a regular sapphire was that a dumb move? (we both recently opened preferred) Between me and my wife we have preferred/Unlimited and freedom in addition to airline and hotel cards

Regular Sapphire is pointless. Change it to another Freedom?

Does Getting another freedom prevent me from getting an opening bonus in the future on this card?

Can you do a product change twice?

No.

Yes.

Any of these 3 cards have no Foreign Transaction Fees?

Thanks

No.

I tried to apply and was declined right away – how do I find out why i was declined and can i reapply a different way to get approved?

Call Chase.

Do you have a current Sapphire card or did you get a Sapphire bonus within 48 months?

dont have a sapphire currently – last time i got the bonus was in 2016…

Did you close it? Downgrade it to?

Either way, HUCA

I did a product change yesterday. Online it’s already showing as freedom. Can I apply now (were you saying 2 days to be safe?)

No. You need 2 days or you’ll get rejected.

Ok thanks

Question:

I downgraded my SR to a freedom.

I’m assuming that the new card will have a new expiration and CVV, correct?

For how long the old car remains active?

Will it stay active as long as I don’t Activate/ use the new card?

Thank you

Old card will continue working until expiration.

I’ve seen others say best not to purchase gc’s at SM for initial spend requirements. Dan, is that true? What about other gc’s like OD when they run their specials?

No issues with Chase.

i plan on downgrading my reserve card to a freedom card and applying for a sapphire preferred.

how long after I’m approved can i switch my freedom card back to a reserve card?

Any time

I went for the freedom card, already have a freedom unlimited. Was going to do FLEX, BUT ITS A MASTERCARD SO YOUR CARD NUMBER WILL CHANGE.

Once I get approved for the sapphire preferred. (after down grading my current reserve to a freedom unlimited )

Is there any reason or advantage to upgrade the same account that I initially downgraded back to sapphire reserve or should I keep the freedom unlimited and apply for a new sapphire card ?

You won’t be able to get approved for a new Sapphire Reserve for 48 months, so upgrade will the only option until then.

ok…but if I want to get a a freedom unlimited card to create my chase trifecta…can apply again for a freedom unlimited after upgrading the freedom unlimited back to sapphire reserve?? or must I wait again ??

I would like to have a total of 3 cards sapphire reserve , sapphire preferred an freedom unlimited..

Yes, that would work.

This is a bit off topic but I just transferred 265,000 ultimate rewards points to Southwest instead of 26,500. Both Southwest and Chase say there is nothing that can be done. Has anyone ever been in this situation and got them back?

Ouch. Have you reached out to a manager at Chase to see if they can open up a case?

I just tried. Nothing they can do. I told them I was going to have to downgrade because of it which works out great anyways so I can get the preferred on a few days.

I see the transfer of points on my sapphire reserve statement dated April 20, 2017 showing that my wife’s bonus points transferred that month to my acct. That’s the date that matters right (when she earned her bonus, which would have been prior to April 20, 2017)? So she should be eligible now to apply for the preferred and get the new bonus? Just wanted confirmation before she applies. Thanks!

Correct.

Hey Dan, I downgraded my reserve to freedom, and got approved for the preferred.

Since I have multiple Freedom cards do I NEED to upgrade from that specific freedom back to CSR or can I just upgrade from any of my Freedom cards to a reserve?

Any.

Firstly, love the amount of times you replied ‘2 days’.

Secondly, do you know how much longer this offer will be around for? (Currently in a new mortgage process)

No idea, sorry.

Thank you for the idea. I have had the Reserve card since day one and I will keep it as long as I can. That said, if I request to downgrade it, wait the two days or so, apply for this deal and then get the reserve back, do you think that I would be able to transfer the 100k bonus points over to the reserve to make them effectively 150k points?

Thanks again and best of luck.

Yes you can.

Hi Dan, thanks for all your guidance. If I downgrade my Sapphire reserve to get a Preferred and then reinstate the Reserve, will I have to pay the $550 again?

If you downgrade you’ll get a pro-rated refund of the annual fee, when you upgrade you get charged. No loss.

thanks

My CSR 48 months was up in Sept so in Dec I applied at 60k fort he CSP. Man I feel shorted. I tried to get the 80k on a recon call but they didnt do it. Man this hurts!!

I waited 48 hours after downgrading my CSR to to Freedom Visa but was denied. How long do I need to wait before the system lets me reapply?

What should a non-working spouse in a high income household put down for income when applying? Can I put down the household income? My husband was already approved and now I want to apply for one as well.

Household income

So if I have a sapphire reserve and a sapphire preferred do I have to downgrade both? my most recent bonus was 100k in march of 2017 with sapphire reserve…

i noticed that you don’t have any post on the freedom visa

is that because you don’t recommend it?

is there anywhere besides for Costco that I will have issues with a MasterCard?

Hi Dan dose chase Count Authorised used cards for the 5/25 rule?

https://www.dansdeals.com/credit-cards/5-24-day-whats-chase-5-24-strategy/

If I downgrade my csr to the freedom and then apply for the csp then upgrade that for the csr what will happen with my original points from my original csr that I downgraded to freedom am I able to move it bake and if yes how?

If I downgrade my sapphire to a freedom and reapply for the sapphire a few days later and I’m denied, will i be able to upgrade my freedom back to the sapphire? and how long after?

Yes, anytime

Just downgraded by Reserve. Hope I can get the 100K on Wednesday

Does Chase do a credit check if they don’t approve because I recently received the bonus?

They do not.

Thank you

Hope this wasn’t already covered, but looking for some advice. I cancelled my reserve card last week and tried applying for the preferred two days later. I was denied, so I tried again two more times and was denied. I called today and they told me that my reserve card has not yet cleared from the system. They could not override that and push my application through. Anyone else have this problem and found a workaround?

You are supposed to downgrade, not cancel.

Try reopening it and downgrading it.

Thank you for the reply! Problem is, I already have the freedom, freedom flex, and unlimited. So I figured my only option was to cancel and reapply

Nope, as the FAQ post says, there is no limit to Freedom cards and the more you have the better.

I downgraded on 10/4 to my second freedom flex and reapplied today. It did go through and Chase says that they are going to deliberate on my application further instead of immediately denying it like before. This is the usual pattern for my credit card applications so I’m pretty hopeful. Thanks for the guidance and posting these updates, Dan!

I just came across this post so I’m short on time….downgraded my reserve to a freedom flex at 10:15pm MST today (Monday). Am I eligible to apply for the preferred anytime on Wednesday or do I have to wait until after 10:15pm? (assuming they haven’t changed the sign up bonus at that time). Thanks!

Probably better to wait for later on Wednesday.

Hi Dan

Today is Tuesday

I believe you said we need to apply by Wednesday

I have a Reserve (which renewed October 1st, they charged me 550) so I wont have time to downgrade it today (which in theory would get me the 550 reimbursed) and apply to the Preferred because that would only be possible Thursday

Correct?

Nothing to lose by trying.

If I downgraded yesterday 11pm, when should I try applying?

Wednesday evening.

I have the Sapphire preferred card for over 4 years.

Is it to late to downgrade today and still get in on this offer?

Thanks

You can still try to do that.

How many days do you need to wait after cancelling a CSR before applying for the CSP? Is it also two days?

About 2 days, yes.

Waht will happen if I apply less than 2 days after downgrading.

Chase CSR is telling me we have to wait THREE months to upgrade back to the Sapphire preferred. Is it only to the CSReserve that it is immediate?

Nope, fake news.

I applied for me and my wife. I got declined and my wife’s said they need more time. I called in yesterday for a second review and they said I should hear back soon. I never heard back but I see the card on my online account. Does that mean I’m for sure approved?

It does, congrats!

Awesome thanks!

Love to hear news is fake sometimes! Thank you. Have a problem with downgrading. My account only has $500 credit line so when I want to get the new Sapphire I will need a credit increase since it is a minimum of $1k to open the account. Since they will be doing a hard pull anyway for a new card that shouldn’t stop me from downgrading, right?

Dan

I downgraded my CSR on 10/4 at 4:45 pm. When do you suggest I apply for the CSP?

Thanks

Tough call. I think you are OK to wait for tomorrow morning.

Do I lose by trying today at 4:45?

You can certainly give that a shot. Worst case you can reapply tomorrow if you have to and if the offer is still around.

Let us know how it goes!

If we reapply the next day, does that count as a second hard pull?

There’s no pull if you’re not eligible due to the signup rules.

Just applied and approved!

Got declined on the spot. Im 18 with no other Chase cards. My other card is an additional on Amex. Any suggestion?

Go to a branch and open a checking account and then reapply.

I switched a card from a regular Sapphire to a Freedom on 10/5 in the afternoon. Should I apply after 10PM tonight (10/6), or wait until 10/7 in the morning based on the new information? Is the new info reliable? The rep I spoke to yesterday afternoon was told 10/6 is the end date. Or does the 2 day wait only needed when applying for the SAME card (Sapphire *preferred* downgrade, new Sapphire Preferred application) as opposed to a regular Sapphire to something else and new Preferred application?

besides your image in this post, I can’t find anywhere online indication about the offer ending Thursday. Is it still worth waiting till Thursday to apply? I downgraded my reserve card yesterday. Even though hasn’t been two days, do I have anything to lose by applying today already? What move would you make to most securely grab the 100k offer?

Did you search for “sapphire preferred ends”?

Yes. Exactly as you had in screenshot. I’m in Israel, if that’d make the difference. Either way, not finding Thursday date anywhere else and unsure what the wisest move would be.

Thanks Dan! Downgraded on Monday afternoon and was just approved.

Thanks! I have also downgraded on Monday at about 4:30 PM and was just approved.

I downgraded my reserve to freedom on Tuesday. Applied just now for preferred and was declined. Any sense in calling reconsideration line now or better to apply again later today?

I downgraded end of September and applied On October 6 I got a generic email from Chase that they were reviewing my application and I see they pulled a credit report I haven’t heard anything from them cents and when I called them they said they have no record of an application. What is there to do?

For a reference point I downgraded 7 days ago and am attempting to apply in-branch for the 100k, I’ve gone daily starting at day 4 and they consistently say you have to wait 30 days. It’s not showing up as an option on their screen, same story at a few different branches. When they call in it’s the same answer every time, not enough time has passed and it could take up to 60 days.

The online wait time is 3 days.

The branch wait time is 30 days.

I want to downgrade my sapphire preferred so that in the future I can qualify for the sign up bonus again. In the meantime, I use chase visa until i am ready to apply for a new sapphire preferred. Do I keep all my points? what happens to annual bonus points? can I still get 25% bonus through travel portal?

Does this strategy even make sense – or should I only downgrade if 2 days later im ready to sign up again for the chase sapphire preffered?