Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Last week I wrote about how AMEX added new language to their credit card applications stating that they reserve the right to deny a signup bonus based on your history of opening and closing AMEX cards.

Today AMEX has added a popup system that will tell you if you will not get the signup bonus. Unfortunately the only way to check on your eligibility is by submitting a credit card application.

I wanted to see how it works firsthand, so I tried applying for an AMEX Platinum card, despite having one. After clicking submit this popup came up:

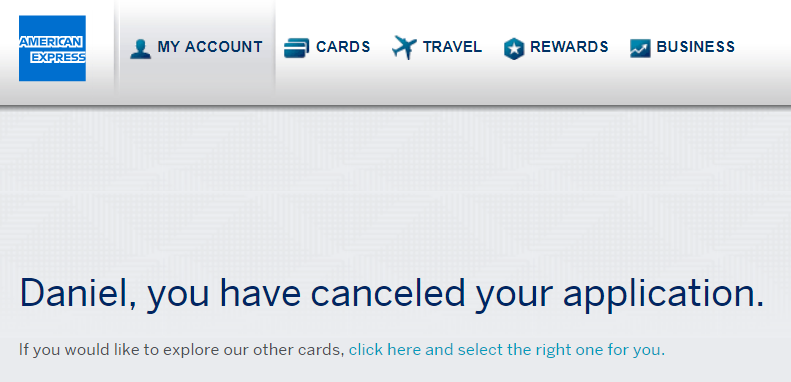

I clicked cancel application and got this page:

There is another version of the popup that says that you won’t get the signup bonus “Based on your history with American Express welcome offers, introductory APR offers, or the number of cards you have opened and closed.”

Lots of questions remain.

If you don’t get the popup, will that guarantee a signup bonus, or will your history with AMEX still play a factor?

Many people have reported that after about 6 or 7 years you can get an AMEX signup bonus, despite the once in a lifetime language. Will the popup check back if you have ever had the card, or will it also look back 6-7 years?

Overall though, it’s a good thing that AMEX is adding some clarity to a vague policy.

![[Now Live] Fiji Airways Will Adopt AAdvantage As Mileage Currency, Join OneWorld](https://i.dansdeals.com/wp-content/uploads/2020/01/06161338/FJ-default-image-optimized-449x150.jpg)

Leave a Reply

34 Comments On "AMEX Responds To Vague Signup Bonus Eligibility Rules With An Eligibility Popup"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

at least they won’t pull your credit report if you received the popup….so it seems

So, is there a credit pull if you cancel?

Read the popup.

Oops I missed that. thanx

Yeah, that’s great news. Thanks.

Absolutely agree for the clarity part!

There being vague and strict

But at the very least there letting you know what the deal it is before you complete the application process.

If you don’t get the popup, will that guarantee a signup bonus, or will your history with AMEX still play a factor?

there is a chance that it wont popup ?

I didn’t get the signup bonus because i had it 12 years ago

Which card?

When did you close it and when did you apply for it?

SPG, closed it 12 years ago, reapplied a few months back when it had the 35k signup bonus

Hey Dan,

If i have a Chase sapphire reserve with a credit line of $1500, would it hurt me if I would add an authorized user?

(Main Q is – would the $75 AU fee add to the $450 AF and i would therefore suddenly be charged a AF of $525? or is the $75 AU fee separate from the AF?)

any help appriciated

thanks!

Separate.

Doesn’t reserve require 10k minimum limit?

You can lower it after approval.

You risked a hard pull on your report?

Took one for the team

Define 6 or 7 years please.

From the opening of the card? How much before the application do you need to close the card?

Does this mean applications with “no language” are now worthless?

+1 please answer

What happens if I applied and didnt get the popup?

i got the american express gold business card a little over 2 yrs ago, and just signed up for the card again today and nothing popped up and got approved…will i still get the 50k bonus?

I’d guess that you won’t, but let us know.

so why didn’t i get a pop up?

Did you cancel right away after getting the bonus? How much time passed between cancelation and your new application?

right before the annual fee came in….11 months later

I wonder if they have file cabinets from the 1970’s and check there to see if you had the card 40 years ago.

“Steve, it looks like you have had this card with us in 1971. We don’t want you abusing and taking advantage of our rewards program and so we must decline you at this time”.

Dan the man, When you mentioned that the closing of cards can affect being approved for a amex card, would that mean the closing of this specific card previously, or do you mean even the closing of other amex cards may affect your approval of a different amex card?

I opened the Gold Card for a 50k bonus 4 years ago and closed it probably a year later. And I opened 3 months ago a new Gold card and I did get the 50k bonus again

Hi, does it also apply to the introductory 0 APR or only the bonus points? thank you.

I had the same thing with a Platinum that I had previously opened & I did get the bonus, however after a few months they took the 100K points out of my account. it might be a good idea to get rid of the points ASAP

is that working for business cards as well?

Hi Dan, I’ve just come out of the 5/24 freezer and looking for a couple of good card offers. I didn’t see any posts about the AMEX Delta 60K offer, ends Tuesday,any advice? I have Ink business plus and freedom cards, thinking of going for the 80K preferred as my first chase addition, as I have a family member with the CSR and was in the freeezer for the 75k reward offer. Is it worth getting anyeway at 50k or does your crystal ball show a higher offer repeating later this year?

Thansk

So I just applied for the Amex Business Platinum which I did have before, but no pop-up came on. Does that mean I will get the bonus?

you wont get it i tried that already

i got now the msg even i didnt have the card before what doe that mean?