Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

Related:

-Building Credit And Credit Card FAQs: Your Questions Answered

-On The Topic Of Chase 5/24: Here’s What You Need To Know About Additional User Cards

You can view credit card offers by hovering over the “Credit Cards” tab. You can then click on “Credit Cards From All Banks“ to find card offers via the logo of the bank you’re looking for.

For a limited time only you can earn 50,000 bonus miles for opening a Chase United Explorer card and spending $3,000 within 3 months. The normal bonus is 30,000 miles. Plus you’ll earn an additional 5,000 miles for adding a free additional user card and making a purchase within 3 months. There is a $95 annual fee.

This offer is available on the consumer and business card. For the business card just click on the consumer link and then click on the link under “Are you a business owner?”

It can be difficult to get approved if you have been approved for 5 or more consumer cards in the past 24 months.

Spend $3,000 on a new card and add an additional user and you’ll have at least 58,000 miles.

A short-haul United domestic award under 700 miles in distance is just 10,000 miles. That’s more than the BA 7.5K short-haul, but availability is much better, it allows for a longer flight distance, and you are allowed to have connections for the same rate, something that BA doesn’t allow.

Best of all United never charges any fuel surcharges. Other airlines like American collect massive fuel surcharges to fly on British Airways. Delta charges fuel surcharges to fly on some partners and if you originate in Europe and other regions. United will never collect a fuel surcharge and they have access to awards on 36 partner airlines which means better availability on more awards.

The United card is easily my favorite of all of the airline cards. Here’s why:

View all the reasons why after the jump:

-It is the only card that gives expanded award ticket availability.

Cardholders have access to expanded saver coach award availability (XN class), last seat standard coach award availability (YN class), and last seat standard business/first class award availability (JN class).

It’s not just slightly expanded. There is a world of difference between the availability that cardholders can access and the availability for non-cardholders.

When a non-cardholder searches for a flight from Newark to Tel Aviv on 2/26 for example (or for many other dates) they’ll be quoted the price for a standard award, 85K miles:

But when a logged-in cardholder searches they’ll be quoted just 42.5K miles for the same flight:

You can view the underlying data explaining this concept by using United’s expert mode.You can learn more about searching for those classes in expert mode in this post.

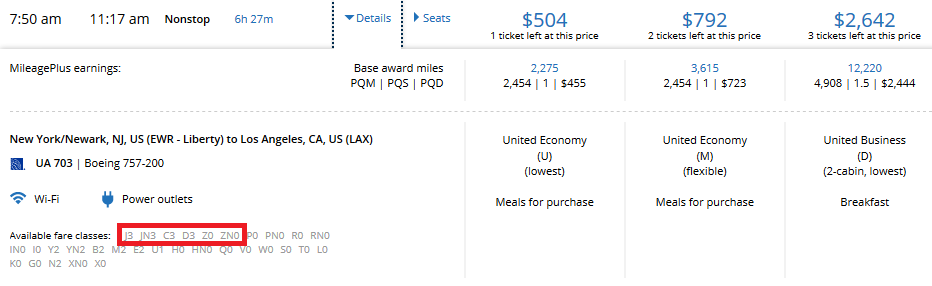

In this case United is selling one-way flights for $1,738. But if you look under “available fare classes” you’ll notice that it says XN9 X0:

XN9 means that United is willing to sell at least 9 seats as saver awards if you have a United credit card or elite status. X0 means that United is not willing to sell any saver award seats to non-cardholders.

This availability differential applies to all domestic and international routes and makes it crucial to be a United cardholders.

United is also the only major US carrier that caps the mileage rate for standard awards at a reasonable rate.

For example if you want to fly nonstop from NYC to LA on this Wednesday in business class there are 5 airlines to choose from:

American would charge 97.5K miles with their variable standard award pricing:

Delta would charge 120K miles with their variable standard award pricing:

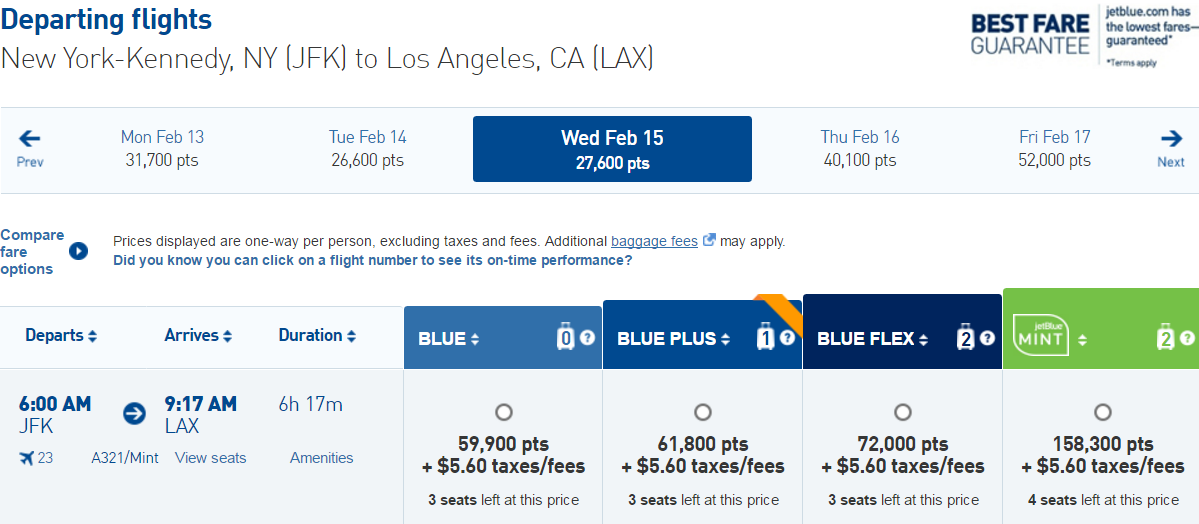

All JetBlue award pricing is variable and they want 158K miles:

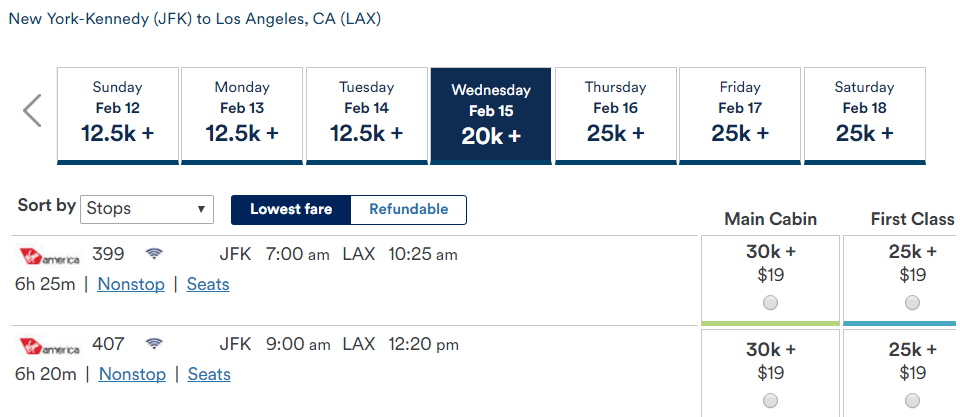

All Virgin America award pricing is variable as well. They charge 67.5K miles:

That would be incredibly foolish though as Alaska can book the same Virgin flights for just 25K miles. And you can transfer 20K Virgin America miles into 26K Alaska miles! Great deal, but the caveat is that Virgin America is the only airline flying nonstop between NYC and LAX without lie-flat seating in business class. But yes you’re reading that correctly, the cost for Virgin business class is less than coach:

If a non-cardholder searches for a United award they won’t see any availability. That’s because United has a fixed 50K rate for domestic business class, but they restrict availability on their standard awards for non-cardholders.

However cardholders get access to last seat availability and can book a lie-flat seat for 50K miles, even if it’s the last business class seat on the plane:

Once again, you can view the underlying data explaining this concept by using United’s expert mode.You can learn more about searching for those classes in expert mode in this post.

JN3 means that United is willing to sell 3 seats as business standard awards if you have a United credit card or elite status. ZN0 means that United is not willing to sell any business standard award seats to non-cardholders.

This same concept applies to coach, business, and first class standard awards on all domestic and international routes. And United’s standard last seat pricing for cardholders is downright reasonable compared to their competition.

-As you have better access to saver coach awards you’ll also have better ability to do Plan B awards. Plan B allows you to redeem for saver business and first class awards when there’s only saver coach available. Read more about Plan B in this post.

No airline besides United offers a Plan B redemption.

-United is launching basic economy fares that won’t allow you to bring large carry-ons aboard and will only allow boarding in the final boarding group. However if you have a United credit card you’ll be able to board in the priority boarding group for cardholders and you’ll still be able to bring a carry-on bag for free, even on a basic economy fare!

-United cardholders and their companions can check a free bag on domestic routes when using their card to pay for the flight. The card also offers double miles for United flights.

-The United card offers primary rental car CDW insurance in every country. Many other cards only have secondary coverage when you rent a car in your home country. This means that if you damage your rental vehicle you must file the claim with your own personal insurance policy first, and only if they won’t cover the damage will the credit card cover the damage. Even additional cardholders get primary coverage when they rent.

With primary rental car CDW insurance you will not have to file anything with your own insurance company. Chase will cover the entire bill for any damage to your rental car. Just be sure to decline the rental agency’s CDW coverage. This primary coverage applies in every country in the world.

-The United Explorer card gives 2 free United Club passes every year for being a cardmember.

-Your miles will never expire as long as you are a United cardholder, even if you don’t have any activity.

-There are no foreign exchange fees on the card.

-United cardholders get exclusive access to auctions that allow you to use your miles for once-in-a-lifetime experiences. A few years ago I used 25K miles for 4 field box seats to an Indians game along with the right to run onto the field before the top of the 7th inning and swipe 2nd base right off the field. Nobody could believe it as I walked around the ballpark with 2nd base. I even got it signed after the game by the Indians wining pitcher that night, Justin Masterson, who was equally shocked that I actually had 2nd base.

-The United Explorer card gives a 10K mileage bonus every year in which you spend $25K. That means you’ll earn at least 1.4 miles per dollar spent everywhere if you spend $25K in a year. That’s not as good as you can do with the Freedom Unlimited’s 1.5 points per dollar, but that card requires a premium Ultimate Rewards card to transfer points into miles.

-A massive benefit for United elite members is that they can get free upgrades on coach award tickets on upgrade eligible routes if they have a United card.

-Another benefit for United Elite members is that if they spend $25K in a year on the card it will waive the requirement to spend $2.5K on United flights to get Silver status, $5K on United flights to get Gold status, and $7.5K on United flights to get Platinum status. You only need to fly the 25K, 50K, or 75K miles like in the good old days.

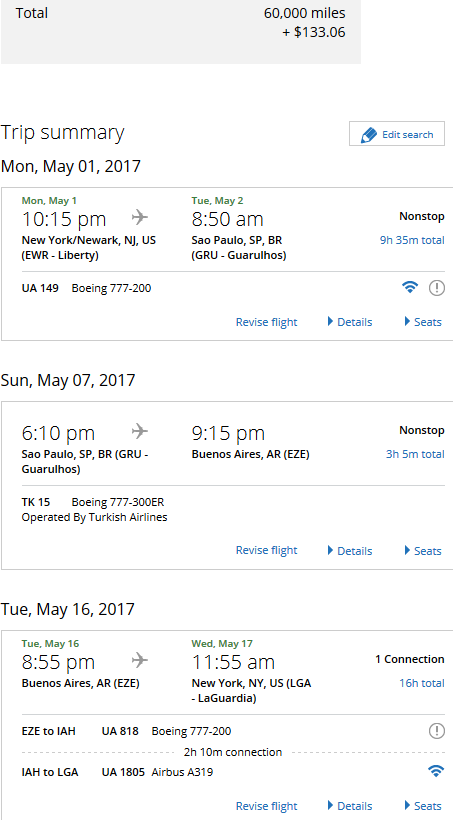

While American and Delta have eliminated free stopovers, United continues to offer a free excursionist perk as described in this post. Just use the multi-city award search on United.com to piece it together.

A round-trip ticket to 2 European or South American cities is just 60,000 miles round-trip thanks to the free excursionist perk:

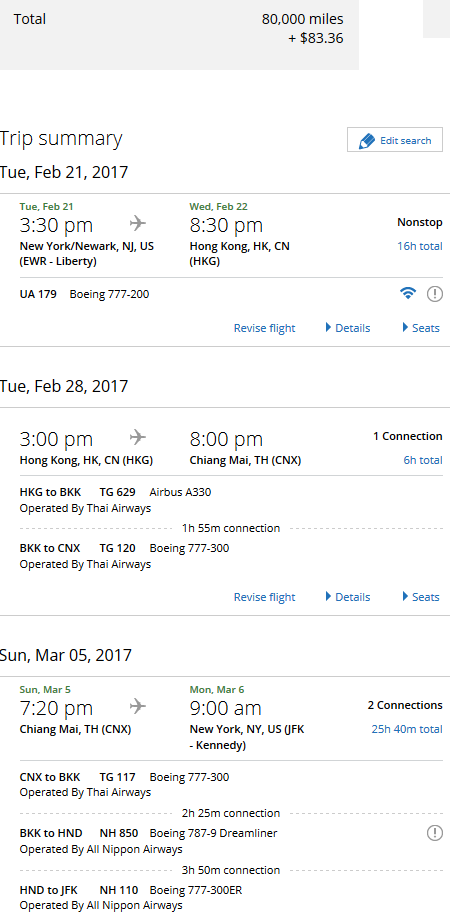

A flight to 2 of my favorite cities in Asia, Hong Kong and Chiang Mai, Thailand is 80K thanks to the perk:

You’re even allowed a free open jaw in addition to the perk to really maximize your travel. For example this itinerary includes travel to London, Paris, and Zurich. You can take a train or use 4.5K BA Avios to get from London to Paris to fill the hole in the open jaw:

Of course the free stopover isn’t just useful from the US.

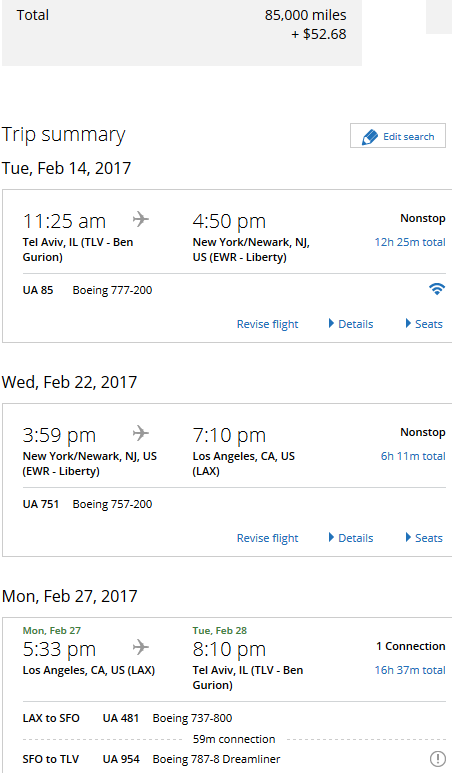

You can stopover in NYC and LA when flying from Tel Aviv to the US:

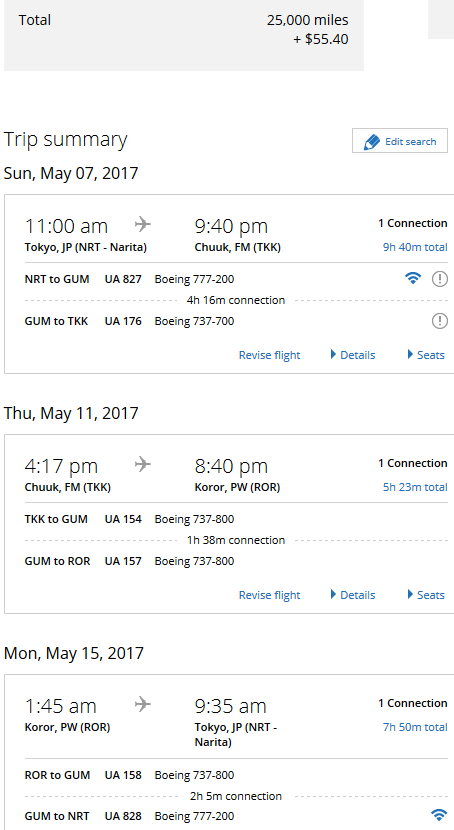

If you find yourself in Japan you can fly to 2 cities in Micronesia (I’ve been hankering to get back to Palau since the moment I left) for 25K miles:

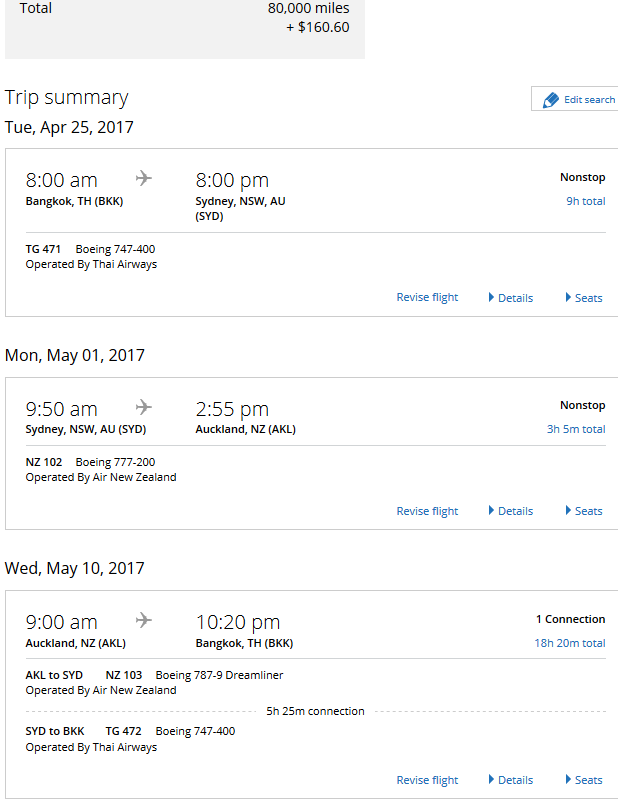

Or you can fly from Bangkok to Sydney and Auckland in Thai first class (with a free 1 hour massage in the Bangkok first class lounge) and Air New Zealand business class for 80K miles round-trip:

United has dozens of partner airlines which means lots of great award opportunities. However not all of them are currently bookable online, you’ll have to call (or use the Aeroplan or ANA sites) to get the full picture:

United partners that currently must be booked over the phone:

-Cape Air

-Edelweiss

-Great Lakes Airlines

-Jet Airways (Ends 3/25/17)

-Singapore

And here’s the list of partners currently bookable on United.com:

-ANA

-Adria Airlines

-Aegean Airlines

-Aer Lingus

-Air Canada

-Air China

-Air Dolomiti

-Air India

-Air New Zealand

-Aeromar

-Asiana Airlines

-Austrian Airlines

-Avianca Airlines

-Azul Brazilian Airlines

-Brussels Airlines

-Copa Airlines

-Croatia Airlines

-EVA Air

-Egyptair

-Ethiopian Airlines

-Eurowings

-Germanwings

-Hawaiian Airlines

-Island Air

-LOT Polish

-Lufthansa

-Scandinavian Airlines

-Shenzhen Airlines

-Silver Airways

-South African Airways

-Swiss International Airlines

-TAP Portugal

-THAI

-Turkish Airlines

Are you a United cardholder?

![[Citi-Emirates Transfers Will Be Devalued] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Global Entry Reimbursement Information Corrected] WOW! United Massively Overhauls Credit Card Program And Lounge Access; The Good, The Bad, And The Ugly](https://i.dansdeals.com/wp-content/uploads/2017/09/03174721/United-Airlines1-768x432-267x150.jpg)

![[Citi-Emirates Transfers Will Be Devalued] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

63 Comments On "55K Miles For Signing Up For A United Explorer Card; On Expanded Awards, Excursionist Perks, And Why The United Card Is My Favorite Airline Mileage Card"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

What is the yearly fee?

Does 5/24 apply for this. Or its just tough to get approved!?

@Dave:

$95.

@Point lover:

It does, but that doesn’t mean it’s impossible to get around it.

What is the link to the post where you wrote about avoiding the close-in fee?

Annual fee? Free for 1st year? And then?

Thank You

Hi Dan,

My eyes roll every time because I have excellent credit but I live in Canada.

I am unable to get USA credit cards and there bonuses because I have no social or USA credit history

Any work around or advise ?

If I have this card as a personal card, can I apply for the business card and get the bonus?

If I had the personal card in the last two years and got the signup bonus. Can I still get the business card? Or will they not let me collect the signup bonus?

5/24 ?

@Anonymous:

Read up on the seminar posts

@Jackson strong:

Read the post.

@Arieh:

Are you a US citizen?

@Broussard:

Yes.

@Meir:

You can.

There are even ways to get the personal bonus again, but that requires some DDF sleuthing or seminar attending first.

@Anonymous:

Read the post.

I can’t see the link to the card – can you please post it?

My co-worker was targeted on his United mileage account for a 70k sign-up bonus. He was approved despite being 5/24.

@Anonymous:

Click on the instruction links in this post please.

@Mikey:

Nice!

Dan,

I want to get this card for our shul as we have at least 150K we could use to charge annually. I have real bad credit personally so I don’t think I could be approved. How do we go about applying successfully and yet not put anyone’s credit in jeopardy?

Can you apply for it even if you’ve already had it?

Canadian Citizen with USA vacation home

-The United Explorer card gives a 10K mileage bonus every year in which you spend $25K. That means you’ll earn at least 1.4 miles per dollar spent everywhere if you spend $25K in a year.

The Freedom unlimited gives you 1.5 for every dollar spent.

Your better of doing your spend on the freedom Ulimited which gives 1.5 per dollar spent.

Dan, I currently have the United mileageplus club card. Other than the 50k sign up bonus, is there a benefit of this card vs the club card? Thanks

Does the 5 within 2 years apply to the business card S well?

@Dan: please explain how thx

Does the card give you free checked bags?

I have bad credit and cant get card – any way as an additional card holder that i can get these benefits?

Any difference if it’s the Visa Or Master card?

I have an old United milage

Plus Explorer master card still from continental days

Is the 50,000 bonus the best sign on bonus typically available or would it pay to wait for a better one?

@Bonnie:

There are better cards for that kind of spend. Most of the benefits for this card are not for the spending.

@Peretz770:

As long as you haven’t gotten a bonus in the past 24 months then you’re good.

@Arieh:

I think you’re out of luck then.

@Moe:

Indeed. But this card’s benefits are what makes it shine.

@Eli:

No.

@Jp:

When applying for one, yes.

@Anonymous:

You’re going to have to search on DDF for that one.

@Savage:

Read the post please.

@Reb Dave:

No.

@Eli:

Same benefits.

@Risa:

50K is the highest public bonus.

Sometimes people get targeted for 70K though.

But there is still no way to get around close in fees being a card holder is there?

@aaron:

There is, see comment 10 and dig for a bit.

I was not targeted but am seeing the 70K offer on united.com after i lookup flights. On one of the pages before booking the offer is appearing.

It was there multiple times.

Hi Dan

could you be a bit more specific as far as united not charging any fuel charges from Europe , the are indeed charging (Lhr- Jfk or Cdg-jfk)$85.00 or so.

@AJ:

That’s called being targeted.

Most accounts don’t have that.

@izzy:

$85 is tax, not fuel surcharges.

BA charges fuel surcharges to London for example and they can set you back $1,000/ticket.

I am US citizen – living in Canada – can I apply?

@Dan: I was targeted for 70k on my mileage plus account. Any way to sign up through your referral link so you get the credit?

Oh@Dan:

Oh. Thanks for clarifying.

(BTW – it didn’t work for the business card. Business was 50K)

Thanks for everything!

@MJ:

You should be able to, but you may need to provide a US address.

@Yelped:

Nope, but thanks and enjoy!

If I have united credit card any way to get free checked bag on united flight if booking with CSR points?

I used to have a United Credit Card. I canceled it and sent it back. United is my least favorite airline. Their big innovation of past years was to compress all the rows in the back 2/3 of each flight to the point that even short people like my wife and me were in pain after an hour or two.

Then they’d charge $70 for each _segment_ of a flight to have the seats with more legroom.

No way will we ever fly United if there’s a choice. We have found we get much better deals on Alaska for our miles. Feel free to fly United if you want–we won’t.

Dan – what status level at united gets you access to the same increased saver award flight options as the CC? Thanks

Didn’t they used to waive the annual fee for the first year? Any way to get it waived?

If the 5/24 affects me can i upgrade (or downgrade) the sapphire or freedom to United and still get the bonus?

Expert mode showing on International as well?

You suggest there are ways to avoid close in fees- and to search on the “seminar posts”? How does one access those?

thank you.

@James:

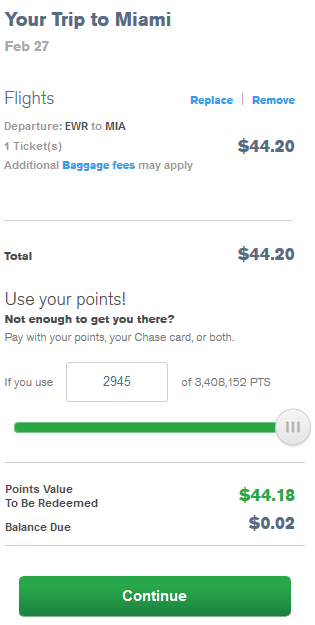

Try charging $0.02 to your United card and the rest with points and let us know how it goes.

For example:

@Charles Kuttner:

Same as AA and Delta have done.

@Zach:

Any status.

@Michael:

Not with the increased offer.

@chulent:

No.

@hvaces42:

Sure.

@ben:

There’s a search function on this website.

Is there a way I can get noticed by United to get them to target me with one of there cc with a bonus?

@Bochur:

No.

If I downgraded my united explorer card to a no annual fee United card would I still get the benefits of United award availability and discounted mileage fares that you described in the post?

@Sammy:

No.

They used to waive the AF first year even for 50K offer why do you think they changed that? do you think sm or calling them to waive first year will help with his card?

Dan you mentioned basic economy fare rolling out soon. Will that affect saver miles award tickets?

I currently have a united explorer card and my wife is a secondary on the card.

she received by mail a targeted promotion for 70k if she opens a untied explorer card.

I am planning to cancel my united explorer if she can get the card and the entire bonus.

My question is, do they require SSN for opening a secondary card (i dont remember) and will i be able to be a secondary and her to get the full bonus if i already have/had the card?

thanks!

@Anonymous:

You can try.

@Anonymous:

No.

@ilan:

No SSN needed and you can be secondary.

However you won’t get any of the United benefits mentioned in this post.

@Dan:

Thank you Dan much appreciated!

@Dan:

Thank you! She flies without me more than i fly without her lately, so the benefits are better off with her anyway.

I am planning to sign up for this card. Any difference or benefit if I sign up as an individual vs. business? I am planning to pay my bill in full before the statement comes out, so the benefit of the balance not showing up in my credit report doesn’t apply to me.

@Baruch:

Get both

Dan, I read your old post about “expert mode” on UA’s website. I enabled expert mode and yet can’t see the Fare class link to see all available classes. Is this still relevant?

@David B:

Still works.

You need to perform a revenue search, not an award search to see it.

Can I product switch a chase card like the preferred to united chase. Even if I won’t get the sign up bonus?

@Ari:

No.

Wife has been targeted for 70k for the United explorer as well as 75k for the United Club. Which do u think would be the better option? Or do u think it is worth it to get both solely for the miles.. Thanks Dan

Dan can you please explain more about this Benefit

-A massive benefit for United elite members is that they can get free upgrades on coach award tickets on upgrade eligible routes if they have a United card.

Thanks,

Explain this to me pls When XN9 class isn’t showing in my dates does that mean that business saver award will never open for this dates or just it’s not available nnow and could open up, (If it’s just showing that it’s only now not available whats the point of this export mode i can also see that it’s not available on the dates without export mode..)

Hi Dan! I’m interested in the United Explorer Business card because it looks like the $95 annual fee is waived for the first year. Does the business card still have expanded award availability?