Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

21 years ago legendary Continental CEO Gordon Bethune wrote “From Worst to First” about how he turned Continental from the worst US airline into the best US airline. He took flak for calling United “HIV positive” when asked about merging with them and his hand picked successor, Larry Kellner, was forced out when he refused to merge with United. Jeff Smisek took over and merged Continental with United while preserving the worst aspects of both carriers.

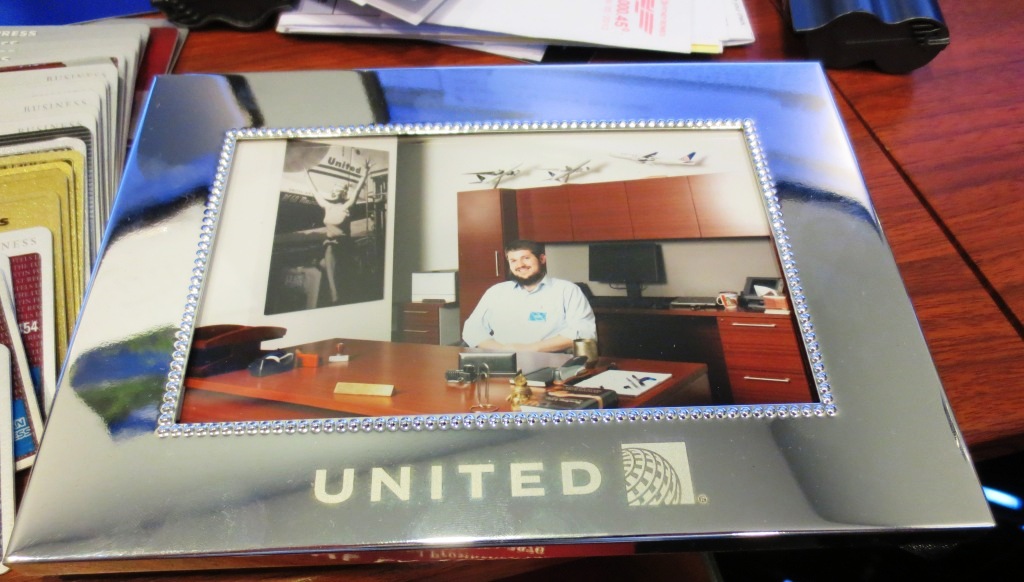

Sitting at then United CEO Jeff Smisek’s desk:

Smisek was eventually forced out due the federal government investigating him and due to poor performance and new CEO Oscar Munoz went on an apology tour, promising to make United great again.

Meeting Oscar before United’s final 747 flight:

The honeymoon period didn’t last long after Munoz bungled the Dr. Dao incident.

United hired infamous USAirways bean counter Scott Kirby as their new President after he had a falling out with American. Jeff Smisek and Scott Kirby could write the sequel “From First to Worst,” but nowadays former USAirways CEO Doug Parker has the rightful claim on worst as far as airline operations go. Delta has the worst mileage program, though the other airlines are trying so hard to catch up with them.

The ability to not have to compete for customers was all made possible by the mergers that eliminated Airtran, America West, Continental, Northwest, and USAirways.

The rise and fall of the United Club card benefits mirrors the industry’s.

When the card launched it cost $395/year and had some pretty sweet benefits as can be seen from my April 2012 post on it. But looking back at that post, I’m just amazed about how many of those benefits have been killed!

- It offered 1.5 miles per dollar everywhere, which was very innovative at the time.

- However, in April 2016 Chase launched the no annual fee Freedom Unlimited Card, which also earns 1.5 points per dollar and those points are Hybrid Chase points which can be used for paid travel, cashback, or mileage transfers.

- In May 2017 AMEX struck back with The Blue Business℠ Plus Credit Card from American Express that earns 2 points per dollar everywhere, has no annual fee, and can transfer points into miles.

- Chase responded in May 2018 with a business version of their 1.5 points per dollar no annual fee card, the Ink Business Unlimited® Credit Card.

- Chase is currently offering 3 points per dollar on a new Freedom Unlimited card signup.

- Earning “hybrid” bank points is far superior to earning miles locked into one carrier that are subject to painful devaluations. You can transfer them on demand when you need them without leaving yourself exposed to devaluations. Or you can redeem them for a myriad of other uses.

- All of these changes mean that the United Club card’s once innovative everyday benefit is not worth much unless you’re outside of the US as the card has no foreign transaction fees, while these other everyday cards do have foreign transaction fees.

- It offered Avis President’s Club elite status.

- This benefit was killed in 2013 for new cardholders. Cardholders now get Hertz President’s Circle status, which is much easier to obtain from other cards.

- It offered a full unrestricted United Club membership.

- At the time this offered United Club access for you and your family even if you weren’t flying. United would issue you a gate pass to get past TSA and access the club, which was very useful.

- In September 2013 United started charging for previously free premium liquors and beers.

- In August 2016 they started requiring that you had a same day boarding pass on any airline to access the club, the gate pass benefit was killed.

- In December 2016 United removed showers from United Clubs and shifted them to their new Polaris lounges that require an international business class ticket. This devalued the usefulness of the clubs when flying coach or even when flying in first class across the country or to Hawaii when it’s nice to freshen up in the lounge before or after a flight.

- Effective 11/1/19 United will only allow you to access the club if you have a same day United or Star Alliance boarding pass. This severely limits the usefulness of the club membership.

- It offered to waive the $75 close-in fee for booking award tickets within 3 weeks.

- Effective 11/15/19 United will eliminate close-in fees on awards. No, that’s not a good thing, it’s actually devastating news as mileage rates will likely skyrocket when tickets are expensive. This takes away a major benefit of this card.

- It offered priority boarding in a group before cardholders from less expensive United cards.

- In January 2019 United changed boarding group 2 to include all United cardholders and Silver elites. There is no longer any priority boarding benefit over less expensive United cards. You do still retain the ability to use priority checkin where available.

- It offered 2 free bags for the cardholder and one companion, even when you didn’t purchase your ticket with the card.

- United now requires that you purchase the ticket on the card in order to get free bags. Other cards offer more miles per dollar spent on airfare and more travel benefits, so you lose out on those benefits. This is still a valuable benefit, but it comes with an opportunity cost.

- It used to offer Hyatt Platinum status.

- This benefit was eliminated on 1/1/19.

- It used to have better perks than the $95/year United Explorer card.

- The United Explorer card now has a limited time increased signup bonus with the annual fee waived.

- The United Explorer card now offers more points per dollar spent on dining and hotels than the Club card.

- The United Explorer card now offers free Global Entry/Pre-Check, which the Club card does not.

- The United Explorer card now offers a 25% rebate on food, beverages and onboard Wi-Fi, which the Club card does not.

- The United Explorer card offers 2 free annual Club passes that you can give to anyone to use. The Club card comes with Club membership, but that’s only good if the cardholder is traveling.

- The United Club card’s annual fee has gone up from $375 to $395 to $450.

Brutal! I don’t think I’ve seen another card get devalued quite like this one. Citi Prestige could possibly give it a run for its money, though at least it got some new benefits to replace the more valuable ones that were killed.

Ironically, I think the United Explorer card is still the best co-branded airline card and is a must have for United flyers. The Club card can still make sense if you need the club membership and don’t care about the new restrictions or if you need the extra free checked bags a few times per year, but the case for keeping the United Club card is worse than ever.

Do you have a United Club card? Will you keep it active after the November elimination of club access when not flying United/Star Alliance and the end of the close-in award fee waiver?

![[Air France, LOT, AirBaltic, Eurowings, And Vueling Push Back Return] Here Are The Current And Next Available Flights To Israel On More Than 40 Airlines!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[Now Open For Bookings] Hyatt’s Confidante Miami Beach Will Become Andaz Miami Beach!](https://i.dansdeals.com/wp-content/uploads/2022/05/14090208/Entry-Lobby-199x150.jpg)

Leave a Reply

91 Comments On "Here’s How United Transformed Their Premium Club Card From Hero To Zero; The Worst Credit Card Devaluation Of All Time?"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Citi prestige got hit badly too

Yup, but at least there were some key additions to make up for the massive losses.

dan can i match my current hertz president to avis president and do you have a link to your post that shows where you can email avis? and how was it able to offer 2 free bags for you and a companion if you adn the companion had different frequent flier numbers and you had the card linked to your ffn and not him ?thank you

I don’t believe that Avis does matches to PC/CHM.

You would have to be booked on the same record locator.

thanks for that clarity much appreciated

Avis would only match to preferred plus.

You hit the nail on the head. Good post

Thanks.

@dan would you still say the old Presidential Plus cars is worth to hold on to?

That card has a very different value proposition. It too got a lot worse when they added an expiration policy on the FEQMs. But if you close it you will never be able to get it back.

If you enjoy the elite status you get from it then it can be worth keeping. Just realize what it’s costing you by using that card to earn elite status instead of other cards to earn more valuable rewards.

@dan the only thing I really use it is I get the waiver for the FQD’s toward my elite status. I really leave the card in my drawer but I feel for $450 to get platinum status without worrying about FQD’s is my only advantage.

If you have an address abroad you can also waive the PQD requirement, but you’ll need to prove it to switch.

Otherwise you can spend $25K on a UA card to waive the PQD requirement. But it is nice to not have to worry about it.

As a million miler from the Continental days, i have status… a) would it be fair to say the only benefit of the Presidential Plus card is the club access b) what to do with all the miles accumulated?

No interest in trying to hit Platinum via spending?

You don’t lose your miles if you close the card.

With all these devaluations maybe you can make a nice cashback thread. With the case for cash back and all the best cash back cards.

Here’s why I’m not switching: https://www.dansdeals.com/credit-cards/airline-hotel-program-devaluations-prove-transferable-point-currencies-critical/

Other options: https://www.dansdeals.com/credit-cards/2019-worth-paying-taxes-credit-card-earn-miles-breakdown-card-benefits/

Dan, curios your thoughts on this overall. Long time Continental (Cleveland guy and it was the hub)/United flyer…most miles are from business flights, so racked up quote a bit. It’s just getting harder and harder to stick with them. The 1K and possible GS invite soon are what’s holding me, but with Delta willing to status match to Diamond M, is there a major downside to finally making the jump? United MP miles used to be the most valuable but with this downgrade coming is there really a plus to the MP over SM? Delta’s Asia routes aren’t as good (nothing like flying up front on ANA with star alliance), but i’m sure with the alliance i would find a good airline.

If you’re still in CLE, United still has a much bigger presence than Delta does, though Delta is growing. I wouldn’t take more connections to switch over.

How much do you spend annually on UA metal that you think you’ll get a GS invite?

I think UA miles will still be more valuable than DL miles, but the delta between the 2 programs will definitely shrink. And Skyteam isn’t nearly as strong as Star Alliance.

In the 15-18K annually range.

I thought Star Alliance was the stronger one. Thanks for confirming

Buy all tickets now on the Sapphire card for the 3 pts now vs. the Club card 2.

The value of the miles will be a big difference in this race to the bottom. The Skypesos are really hurting Delta I think more than they realize.

Not going to get GS with those numbers.

good to know….was wishful thinking though

I’ll be canceling before my next renewal.

I cancelled mine yesterday

Do you think that there will no longer be expanded availability from the credit card after they lose their award charts?

I think there still will be.

Dan, thanks again for the helpful post. I have the United Club Card and a standard United Premier card, but have never had the Explorer card. Would I be eligible for the Explorer card? I assume I would need to apply for the Explorer card to get the promo miles, and would I then cancel the Club card, and move the credit line over to the Explorer card? I assume that asking Chase to downgrade the Club card will mean I wouldn’t get the promo miles. Thanks!

Not familiar with a United Premier credit card, but as long as you don’t have an Explorer card you are eligible for the bonus:

https://www.dansdeals.com/credit-cards/earn-60000-miles-united-explorer-card-take-advantage-uniteds-generous-awards/

You would need to signup for a new account to get the bonus and you can move over the credit line. You wouldn’t get miles for downgrading.

And yet UAL stock seems to have outperformed S&P, AA, and DAL. Isn’t that what matters to the company?

Exactly, what they have been doing is working. This is greed. And I think it will cost them in the long run.

No doubt! Short sighted. Good job in calling them out for their shortcomings.

The United Club card used to be my favorite airline card primarily because of the waived close-in booking fee coupled with expanded award availability and of course Club access for my family. But, for the reasons you outline above, I couldn’t justify keeping it any more. Sad!

It used to offer Hyatt Platinum status.

This benefit was eliminated on 1/1/19. I had upgraded last year a some point my united explorer card to the club card & i got Discoverist | status with hyatt, which is their lowest level

Valid through Feb 29, 2020

You had to enroll in that before 1/1/19. It won’t be renewed.

Does the club card however still offer complimentary discoverist status with hyatt going foward?

No.

My main reason for having the card, and collecting points with United for that matter, was close-in awards without fees.

I assume that will likely be irrelevant moving forward.

I will very likely cancel after an upcoming flight on which I will get 4 free bags.

Thanks, Dan, for such well written and informative posts.

Yes, that will be irrelevant as of 11/15.

the one benefit the card has it earns 1.5 miles per dollar

As I wrote in the post, that is worthless compared to better options.

i have the card, and managed to get 2 bags for 4 of us on a trip EWR- LHR a $600 saving

Wait… has something changed? Aren’t two bags free on international routes anyway? Am I missing something?

that has finished a long time ago, now you barely get one!

Looks like it is dependent on the destination. I’ve got no status, and flew to China on United in December, with no charge for two bags per person.

I use the club card for the 1.5 miles for my business spending about $200,000 a year on it. The Amex blue is capped at 50,000. Other than the Amex platinum and the

Capital one spark where can i get at leadt 1.5 points per dollar? Thanks.

$200K on the Club card? Why?!?!?!?

The better options are right in this post in the 1.5 miles per dollar section.

Also:

https://www.dansdeals.com/credit-cards/ultimate-comparison-chart-chase-ultimate-rewards-cards-supercharge-earnings-creating-killer-quinfecta/

https://www.dansdeals.com/credit-cards/reader-question-chase-ink-card-apply/

Thank you.

If someone is over 5/24, it’s hard to get new cards.

You can convert cards or go on a low-card diet.

I believe the only biz card on that list that would give 1.5 is the ink Unlimited. I use the chase quinfecta and have already applied for that. Are there any others other than the ones I already use as i like to spread my purchases around to ease my payments throughout the month ? Thanks.

You can have more than one Ink Unlimited.

Thanks for that, I didn’t know that. That really helps me more than you know. Also Dan, I just want to thank you for making it possible for my family and myself to go on trips and vacations, that I couldn’t have done without your amazing guidance!

I will be canceling also before next renewal. Thanks for the detailed analysis.

You’re getting too worked up about this. Credit cards come and credit cards go. If you don’t like one, cancel it, and get a different one. As far as complaining about Munoz, Kirby and Parker, you desperately need PERSPECTIVE. Your blog (in large part) exists to EXPLOIT frequent flyer programs. To get your readers more than they deserve. Munoz, Kirby and Parker work for their shareholders. And their employees ultimately report to these leaders. These employees need to take steps to avoid people like you and their readers from exploiting their company. They’re nothing wrong with these CEOs or their employees. Their goals are simply different from your own. As I said, you need to think harder about this and try not to be negative to people who are only doing their jobs (pretty well, I’d say: like if you invested $1000 in any airline managed by Scott Kirby, you’d now have $20,000).

Spoken like a true anti-consumerist.

Exploit? Certainly not.

Maximize the value, sure.

If there was nothing wrong with Smisek then he wouldn’t have been fired. United lost big time under his leadership.

Munoz did a decent job righting the ship, but Kirby is trying to kill it just like Smisek. Delta will eat United’s lunch if United manages to suck all of the value out of MileagePlus as Delta is the better airline. People stick with United for the more valuable mileage program, but United doesn’t seem to get that.

And I think you missed the boat on this post. I analyze credit cards and mileage programs on this blog. I’m not getting worked up over anything, I showed how they managed to take a valuable card and turn it into a dumpster fire. I’m looking out for my readers by pointing out the evolution of how that happened. Those readers can now make an educated decision and decide if its worth paying for the remaining benefits rather than believe the cool aid that the airlines serve up.

Touché! A bit off topic but nonetheless related, I’m sitting on 2.8M Marriott points and was planning on converting to United MR, I’m having 2nd thoughts after this. Any suggestions for a family that isn’t into hotels? Thanks

I’d sit on them for now.

Thanks Dan for being reachable!

corporate greed has no end.

It’s not “greed” — it’s business. The profit margins of airlines is way below the S&P 500 average. It amazes me how human beings can have a complete lack of perspective. As I told Dan, when you’re mooching off somebody or something, and they try to limit your mooching, it’s bad manners to complain how horrible they are. There’s nothing wrong with looking for a deal, but when the deal ends, look for another one instead of complaining (especially about the people who ended your deal).

Of course it’s greed. Airlines are profitable due to mileage sales, so they try to make it even more profitable.

Maybe it will work. Maybe it will backfire if the program devalues too much and people bail. It’s arrogant to claim to know how this will play out in the long run. Maybe in 10 years from now we’ll all be focused on cash back cards and airlines will be begging for us to come back and earn miles once again by adding value back to their programs. Or maybe nothing will change at all.

Bad manners? Is this a joke? We’re talking about Fortune 500 corporations, not your neighbor! They want to make another buck off us, not do us favors.

If you’re looking for a blog that blatantly flaunts your corporate shill attitude, I recommend switching over to TPG…

not to mention that maybe generally their profit margins are small relative to the s&p 500 ,but with individual people specifically they can rip the avg person off ,especially someone old fashioned that is not up to date with the whole miles game, such as last minute expensive tickets or baggage fees upgrade fees. that my parents and grandparents uncles aunts and cousin wouldn’t think 2x about swiping

The money you spend is an asset you have. Just look how much credit card companies pay for opening bonuses not counting the amount they pay for affiliate advertising.Flying for free in exchange for that is not mooching its business.And to say that people who spent money on united cards and flew united flights to get miles and/or elite benefits dont have a right to complain is ridiculous

People who say that maximizing value from miles in mooching have an inherent misunderstanding of how miles work.

Sorry, Dan, but I know exactly how miles “work.” You do, too. Your objective is to get as many miles as you can at lowest cost, and get the most value from those miles when you spend them. Obviously, that’s not the objective of the for-profit companies that issue and redeem these miles. Your complete failure to understand and appreciate their motivations is not flattering to you.

Do you even read what you’re saying?!?

The miles I earn from buying VGCs gives United the exact same revenue that as buying anything else. So what in the world does lowest cost mean? UA makes the exact same thing off me as they do off anyone else.

I often spend my miles on last-minute seats such as CLE-NYC. UA charges $1,000 for these tickets as businesses will pay it. I just wouldn’t go, so that’s not lost revenue. Instead I pay 20K miles and occupy a seat that would have otherwise gone out empty. UA gets to fill the last minute seat without cannibalizing revenue that businesses would pay for that route on a last minute ticket. In other words it’s just about as pure profit as you can get in business. Near zero marginal cost selling me a product that would otherwise be spoiled and that I would never pay retail for.

When they don’t think there will be extra seats they don’t release the flight for saver award seats. Pretty straightforward system.

This has always been the win-win-win. It has made airlines billions of dollars in annual profits. They can change it, but I posit that they may just kill the golden goose in the process.

Your complete failure to understand and appreciate how the mileage system works while proclaiming to be an expert is not flattering to you.

I am a million miler, and I will never see the inside of the new polaris lounge, just the pop-up lounge in Newark which is a joke. There is an expectation of treating frequent flyers with some dignity that is long gone.

Another important thing to mention is that when you pay with miles, the airline gets paid from an escrow account (where the miles were kept, it’s an actual account that the airlines can’t touch unless you use the miles). They’re not giving away a seat for free.

And as mentioned on the other posts, what United did is to devalue their miles to be like Delta’s miles, charging about 100 for every $1 ticket cost, essentially devaluing their miles.

@iahphx

Can you stop being the expert around here, maybe you should start your own blog.

I pretty much keep it for acces to UA and SA lounges as it’s cheaper than buying access. I’d happily give it up if there was an alternative, any recommendations?

i know this is off topic but can you tell me after your whole saga with tesla and the free home charger and referral credit repair issues bug bounty etc etc do you mind telling me how much you paid for the tesla model 3?factoring in the bug bounty and not factoring in the bug bounty? and did you get the standard or midrange one? thank you for sharing

There is an entire forum for off-topic posts:

https://forums.dansdeals.com/

I have the Club card, and I’ll cancel if the fee goes away unless they introduce FREE changes. Or maybe partner awards will still incur a close-in fee?

No close-in fees on partners either.

Dan, thanks for the United Club Card timeline of devaluation. I’ve had the card for less than a year and was planning on using it in my retirement years. I didn’t realize there was a long history of devaluations. What’s the next one? Not a good way to treat a long time loyal customer , I’m out.

I used to fly United all the time out of Newark. I have had too many bad experiences with them now I avoid them at all costs.

Hi where can I get president circle status without this card shanks

No. The $75 close in booking fee waiver was a major motivator.

I think the card still makes sense for non-Premiers near a United hub, as it offers a lot of the benefits you’d get by being a Silver (and some better than that).

But I agree with all of the above.

Can you downgrade the club card or does it need to be cancel entirely?

You can downgrade, but then you would lose out on the signup bonus for that card. May as well get 60K for signing up for a new Explorer card.

Wouldnt that hurt my credit?

I will defiantly be getting rid of it was great for the close in fees while it lasted…

Do these changes give reason to suspect that there will be changes in the ability to transfer points from other programs to United or the rate at which they are transferred?

No.

Dan, if I have the President Plus card and have flex miles- if I close it do I lose the flex miles, or do they stay in the account until I use them? Thanks.

They stay in your account.

Thanks. BTW, my wife “lives” overseas in order to not have to worry about her qualifying dollars for United status. Thanks, Dan!

Had it, was going to close it eventually, now the deal is sealed, I am shutting it down when the next annual fee comes around, disgrace, scam and rip-off!!!!!

the upgrade with status on united awards tickets NEVER got me one complimentary upgrade on even a short domestic flight, with seats available same day at the gate and with my status!! SCAM! UNITED mileage MINUS!

lousy service, screamed at my pregnant wife for vomiting during turbulence, I’m done with them, enough benefit of the doubt and attempted opportunities that always failed.

I was switching to flying only united, though that’s now over, I’ll be giving up status opportunities, but I will either go after the cheaper fare even if it’s insignificant over a status with any US airlines these days.

I’ll work on swiss or ba status over any US airline!

Dan lounge in tel aviv stopped accepting club card