Never miss a deal: Follow us on the DansDeals App, WhatsApp, X, Telegram, Instagram, Facebook, SMS, or our Daily Email Digest.

Links may pay us a commission. We appreciate your support! View our advertiser and editorial disclosure here. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Update: DEAD! Don’t miss it if this becomes alive again. Sign up for deal notification alerts here!

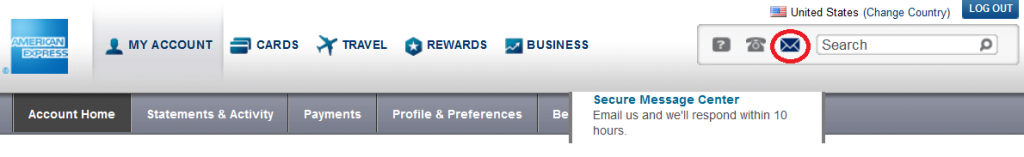

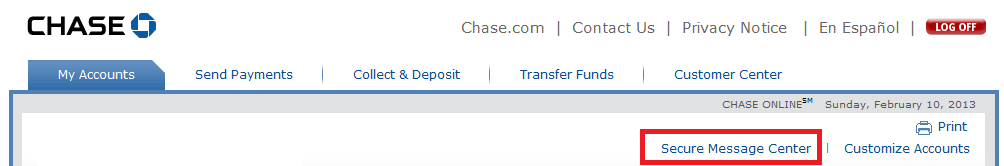

Secure messaging (or SM for short) is incredible. It’s a time saver and it works miracles.

Some examples of what you can do:

-Have an application reconsidered.

This was a new one for me, but a DDF member related that they sent a SM to Chase and got a Chase Sapphire Preferred® Card approved by offering to move over part of the credit line from their United Explorer card.

You can also employ the strategies I wrote about in this Reconsideration post when writing a SM to be reconsidered. Explain why you want the card for its benefits (for United to get free bags and primary car rental insurance, etc) and if you are willing to move over part or all of the credit from another card to get the new card approved.

-Cancel a card.

First of all you really shouldn’t do this via SM. Rather than cancelling a card unilaterally you should apply for a new card (or multiple new cards) and work to get them approved by moving over part of or all of the credit line of the card you want to close anyway.

Also if you call to cancel a card you may be offered (or you can ask for) a retention bonus to keep the card open.

But if you are sure you just want to close down the card and don’t want to waste time fighting to close it you can just send a SM to ask that it be closed. Add that you simply don’t have the time to call in and would appreciate it if they can close it for you.

-Get credit for a promotion.

A few of my $25 Costco Link Like Love credits didn’t post automatically. I sent a SM and they manually posted them. Strangely enough a few months later they showed up automatically.

Many DDF’ers posted similar stories with Small Business Saturday as well.

-Request a waiver for a late fee and interest.

If you miss a payment once and get hit with a late fee and interest you can ask via SM that it be waived as a courtesy. Don’t forget to also request that interest on the next bill be suppressed as well.

-Have pending points posted.

Most cards post the points together with the statement. On AMEX cards they’re only posted after you have paid your bill. Once you pay your bill you can SM to have your points posted right away instead of having to wait for them.

You can also ask AMEX to allow you to borrow Membership Rewards or Starpoints which you will have 12 months to pay back through purchases or signup bonuses.

-Match a bonus.

While this no longer works with AMEX, people have been able to match some bonus offers with Chase and Citi. Can’t hurt to ask!

-Receive a refund of a credit balance.

Pretty straightforward. Just SM to get a check sent out to you for a credit balance left on your account. You can even request that the credit balance be sent to your checking account via ACH.

What else do you SM for?

![[Policy Change: United Will Ban Foreign Flag Pins!] Which Airlines Allow Crewmembers To Wear Palestinian Flag Pins?](https://i.dansdeals.com/wp-content/uploads/2024/05/29110034/WhatsApp-Image-2024-05-29-at-10.56.03-AM-190x150.jpeg)

![[AMEX Explains Upcoming Points Transfer Pause To Emirates] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-286x150.jpg)

![[AMEX Explains Upcoming Points Transfer Pause To Emirates] Ultimate Guide To Bank Points Transfers; Including All Current Bonuses And Transfer Times!](https://i.dansdeals.com/wp-content/uploads/2020/08/16160333/dansdeals-glitch-fare-1024x538-1-133x70.jpg)

Leave a Reply

22 Comments On "What Do You SM For?"

All opinions expressed below are user generated and the opinions aren’t provided, reviewed or endorsed by any advertiser or DansDeals.

Which cards have bonuses that can be matched?

@Sue:

http://www.dansdeals.com/archives/26128

If i give the SS# of the additional card holder for my AMEX account, will that result in a credit pull for her? If not, why do they ask for it? If not,is there any reason not to provide this information?

@Me:

No pull.

It will show up on her report which will either help her (like if it has a low utilization, etc) or hurt her (if it’s maxed out, etc).

You can add an AU without an SSN, just say you don’t have it handy.

Dan,

Is blue cash preffered still have signup of 150 I’ve had the card since dec and havnt got it and they told me it wasn’t my offer what is best way to get them to honor it? Sm??

Thanks.

Reply

@Mike:

Showing $150 for me: http://www.dansdeals.com/go/bluecashpre/

You can SM them.

Send a screenshot of the $150. You may have to browse incognito to see it: http://www.dansdeals.com/credit-cards

@Dan: I did get it with a DOB only, but now they’re bombarding me with letter, emails for the SS#. Can I ignore that, or will that result in a FR which i would rather avoid at this point. Also, if I’m planning on a 3BM in her name soon, should I avoid giving her SS#?

@Me:

You can ignore it.

If she has never had an AMEX before it can be beneficial to first be added as an AU. It will backdate her credit file until when you first had an AMEX, which can greatly help someone;s score.

dan,

how can i send a screen shot in a sm?

@mike:

There should be an option to attach a file.

on amex secure message? where?

thanks

Hi Dan,

Great site with wonderful updates. I get your twitter updates too. Highly recommended!

I did the 4BM a few weeks ago. 2 Consumer and 2 Business. Got the Business approved right away. THey denied both consumers saying my income to debt ratio was too low. Tried reconsideration and HUCA a few times, trying to move debt from one card to another. 5 different agents said no can do. Finally increased my income level and an agent called me back saying they can only issue a max of 4 cards and that was the problem. That includes business cards. I had to close one Starwoods (the one that was generating a fee this month for the first time). Can you weigh in on this? Ever heard of it? How did you get around it?

Thanks!!

PS I’m also in Ohio

well, first, move out of Ohio.

“On AMEX charge cards they’re only posted after you have paid your bill”

My bonus points just posted before I even paid my bill

Did SM for reconsideration and worked for me. got united. United bussiness and sapphire got denied. Called a few times,nothing, after that I tried Sm worked with no hitch.

That’s with having others before….

Has anyone changed a chase sapphire visa into mastercard? if yes, how long after they got approved for the card.

I may have seen Dan mention he did that. however when I called to request that (during a pending app) the rep said I would have to wait a year.

how can i send or receive a SM from chase on my phone browser?

i cannot get the chase desktop version.

If I got charged $175 for my AMEX Gold annual fee, is there anything I can do thorugh SM or is it better to talk on the phone?

citi aadvantage card allow to sm only to order a card agreement, doesnt allow anything else.

any way to contact them in writing?

Check this e-mail thread out Dan, like you say never give up and you never know. I ended up getting 50 dollar credit for an erroneous e-mail citi sent me saying they are charging me an annual fee

Message

From: me***********************om

Subject: email error

Date: November 27, 2013 9:15 EST

I understand you may feel frustrated by this. We certainly do value you as a customer.

Your account has been reviewed by an escalations representative.

As a courtesy, I will apply a $50.00 credit to your account for the confusion and inconvenience this has caused you. The credit will post to your account in 2 business days.

Thank you for choosing Citi, we appreciate your business.

From: do*****13

Subject: email error

Date: November 27, 2013 9:14 EST

Please put me in touch with second tier supervisor Thanks

From: me***********************om

Subject: email error

Date: November 26, 2013 5:28 EST

Unfortunately, we are unable to add bonus Thank You points to your account.

We apologize for any inconvenience.

If there is any way we can be of further assistance, please feel free to contact us.

From: do*****13

Subject: email error

Date: November 26, 2013 5:25 EST

I dont see any response in body of text?

From: me***********************om

Subject: email error

Date: November 26, 2013 1:42 EST

From: do*****13

Subject: email error

Date: November 26, 2013 12:49 EST

would you consider a lower amount of points? Also as previously requested I would like to be in touch with a second lever supervisor

From: me***********************om

Subject: email error

Date: November 26, 2013 10:28 EST

As previously advised, we are unable to comply with your request to add 50,000 ThankYou Points to your account.

If there is any way we can be of further assistance, please feel free to contact us.

From: do*****13

Subject: email error

Date: November 26, 2013 9:25 EST

Very disappointed with such a response. Although no annual fee was charged I was perturbed that now I have to deal with possible fighting off an annual fee. I am asking for 50,000 points not because of annual fee or lack of but because of erroneous e-mail. I would like for you to reconsider or in the alternative I would like to be in touch with second level supervisor. As stated this response is particularly surprising given my many credit cards and checking account with Citi, my many years with Citi and my on-time payment history. Responses such as these make me think of switching all my spending and checking accounts to other cards or banks such as AMEX or Chase. Happy Holidays and hope to hear a more favorable response.

From: me***********************om

Subject: Re: email error

Date: November 25, 2013 5:37 EST

We will not be providing ThankYou Points for the annual fee notification error. No annual fee was applied to your account and as you have provided in your message, a corrected email was dispatched explaining the error.

If there is any way we can be of further assistance, please feel free to contact us.

From: do*****13

Subject: email error

Date: November 25, 2013 5:07 EST

I am pasting the e-mail below I got from you in which an erroneous e-mail was sent to me telling me I will be charged an annual fee even though this card does not have annual fee. I was quite perturbed when I received the initial e-mail telling me I will be charged an annual fee and therefore because of this error I am asking to be awarded 50,000 thank you points. As you know I have multiple credit cards and a checking account and have been a loyal, long time and on time payer of all citi cards. Thank you for understanding On Sunday, November 24, 2013 6:59 PM, Citi Cards citicards@info.citibank.com wrote: Cardmember:Account Ending In: 4042 Member Since: 2012 Add citicards@info.citibank.com to your address book to ensure delivery. ACCOUNT NUMBER: XXXX-XXXX-XXXX-4042 Why were writing you As part of your conversion to the Citi ThankYou(R) Preferred account, we sent you an email explaining that we were charging an annual membership fee on your account. This email was sent to you in error, and we sincerely apologize for our mistake. We want to assure you that your Citi ThankYou Preferred account does not have an annual membership fee. Again, please accept our apology for any inconvenience that we may have caused. How to contact us If you have any questions, please call us at 1-800-THANKYOU (1-800-842-6596). Our telecommunication number for our hearing impaired customers is 1-800-325-2865. Sincerely, Your Customer Service Team

Reply

Return to Message Center

View all offers

ACCOUNT HOMEABOUT CITIGROUPSECURITY & PRIVACYHELP & CONTACT USTERMS & CONDITIONSPRIVACYCITICARDS.COM

My Citi gives you access to accounts and services provided by Citi

Can a CSR read both SMs if you SM one account on Chase and then SM another account on chase ? I want to request a fee waived on two different chase accounts and wonder if the CSR can read my SM history and deny one fee if the other fee is waived.

How do you actually send the am to chase?